Report Overview

Global Dairy Protein Hydrolysate Highlights

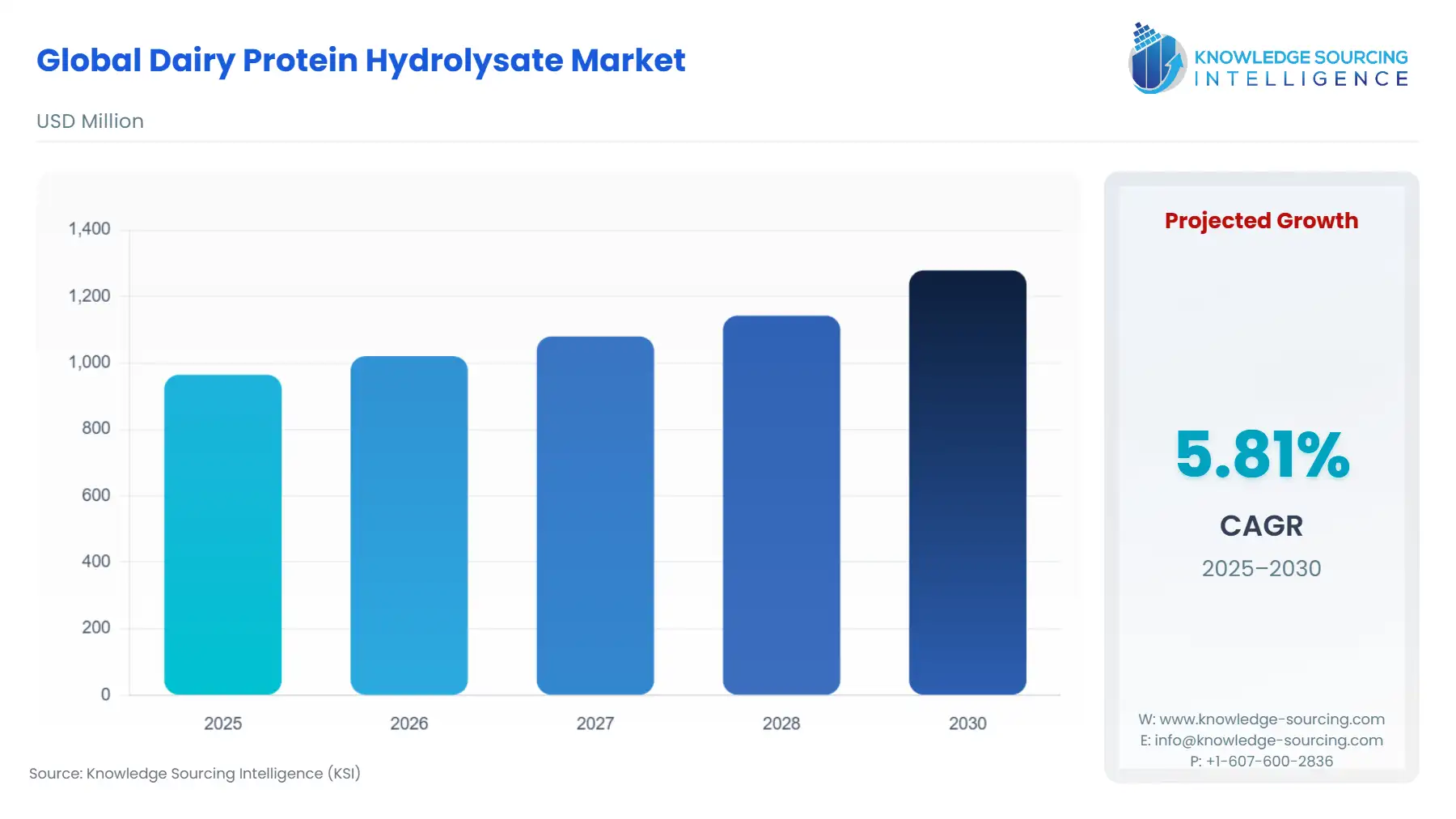

Dairy Protein Hydrolysate Market Size

The Global Dairy Protein Hydrolysate Market is expected to grow at a CAGR of 5.81%, reaching a market size of US$1278.97 million in 2030 from US$964.552 million in 2025.

Dairy protein hydrolysate is a protein extracted from milk that has been hydrolyzed, i.e., a protein consisting of highly organized chains of amino acids broken down into simpler and smaller chains called peptides. So, it is a milk-derived protein formed through hydrolysis, and it is tailored to specific applications, functions, and different markets.

Numerous factors are driving the market growth of dairy protein hydrolysate. Consumers are becoming more health-conscious, demanding various nutritional products that can help them in bridging the nutritional deficiency. This increase in demand for dairy protein hydrolysate is also positively impacted by the growth of consumers' disposable income. At the same time, the rising demand for infant nutrition is leading the market growth of dairy protein hydrolysate. Moreover, the benefits offered by dairy protein through the process of hydrolysis, like a faster absorption rate than intact protein as it is tailored to specific requirements, is leveraging dairy protein hydrolysate demand in infants, athletes, elderly people, and fitness enthusiasts’ consumers.

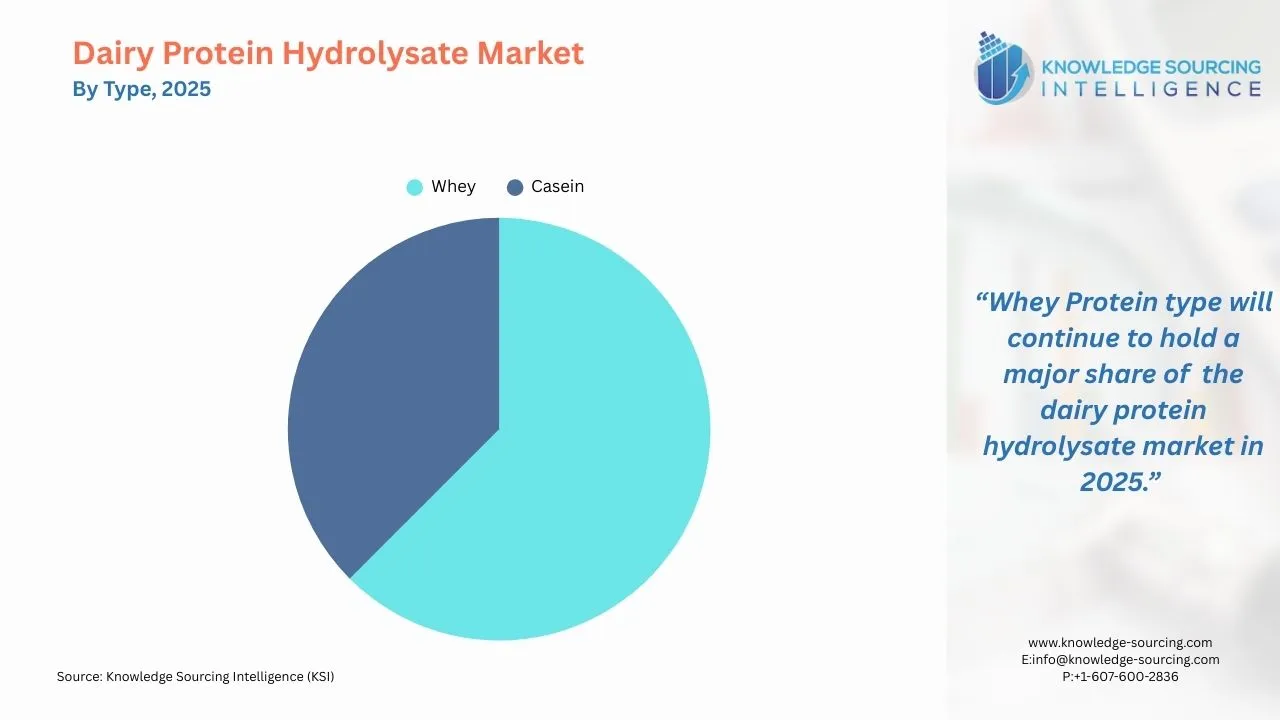

The global dairy protein hydrolysate market has been classified based on product, form, technology, application, and geography. Based on the product, the market has been segmented into whey protein and casein, with whey protein having the largest share in the global dairy protein hydrolysate market. Based on form, the global dairy protein hydrolysate market has been segmented into powder and paste, dominated by powder form due to its convenience and other reasons. The global dairy protein hydrolysate market has been bifurcated by technology into acid hydrolysis and enzymatic hydrolysis. By application, the global market has been classified as sports nutrition, infant nutrition, clinical nutrition, and animal feed. The market is segmented into five key regions of the world- Asia-Pacific, North America, South America, Europe, and the Middle East.

Diary Protein Hydrolysate Market Growth Drivers:

- The growing demand by the infant segment will be driving the market growth

There is an increasing demand for nutritional food by the infant segment of the market. The rising number of women in the working population is increasing the dependence on ready-made nutritional food for infants. This is leading to an increase in demand for dairy protein hydrolysate of milk formula.

- Rising health awareness among the population is increasing the demand for nutritional supplements

Growing awareness among people regarding the consumption of nutritional products is significantly driving the demand for dairy protein hydrolysates globally.

The rising prevalence of chronic diseases such as obesity and diabetes is encouraging people to focus on their lifestyle choices and dietary patterns. At the same time, to fulfill their protein requirement, people are using hydrolysate protein formula, leading to an increase in demand for dairy protein hydrolysate.

Diary Protein Hydrolysate Market Segmentation Analysis:

- Whey Protein type will continue to hold a major market share

The dairy protein hydrolysate market is segmented into Whey protein and Casein protein. During the forecast period, whey protein will continue to dominate the market share based on type.

Whey protein is a form of high-quality protein derived from that part of milk. Whey is the remaining liquid left after milk has been strained. It is a by-product of the cheese manufacturing process. Whey protein is dominating the market share of dairy protein hydrolysate for many reasons. It has wide applications as it has a faster absorption rate than casein. The constituent profile of whey protein contains all the nine essential amino acids the body requires. It is more widely available than the Casein protein, which has a very limited market share. Hence, in the forecast period, whey protein will continue to dominate the market share.

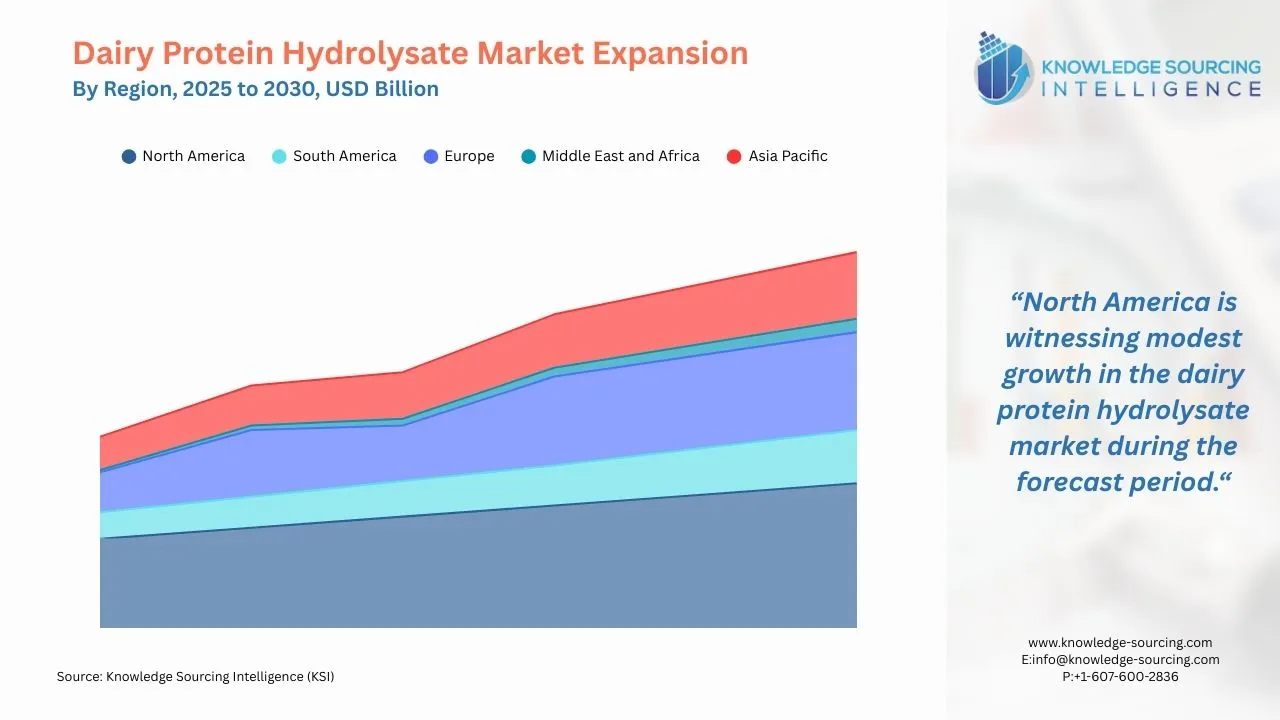

Dairy Protein Hydrolysate Market Geographical Outlook:

- North America will continue to hold the largest share in the forecast period.

Geographically, the global dairy protein hydrolysate market is classified into five major regional markets- North America, South America, Europe, the Middle East and Africa (MEA), and Asia Pacific (APAC).

North America accounted for a significant global dairy protein hydrolysate market share. The growth of this regional market is attributed to rising demand across the United States and Canada. Increasing health awareness among people in this region and shifting consumer preference towards nutritional products to maintain overall health and well-being is boosting the North American dairy protein hydrolysates market. High demand for energy bars and energy shakes across restaurants and homes to promote fat loss and weight management is further contributing to the regional market expansion. Asia Pacific is projected to experience a significant growth rate (CAGR) during the forecast period.

Diary Protein Hydrolysate Market Restraints:

- Regulatory and compliance policies can hinder market growth

Though the demand for dairy protein hydrolysate is showing an increasing trend, the regulatory and compliance challenges put forth by different governments to meet the health and safety standards will be acting as key restraints in the market expansion as it will increase the cost of product development, affecting the price-sensitive customers.

Diary Protein Hydrolysate Market Key Developments:

- In November 2024, Arla Foods Ingredients, a global company in premium nutrition, acquired Volac’s Whey Nutrition Business. Arla Foods Ingredients is building a processing facility at Felinfach in Wales to produce whey protein.

- In November 2024, Valio, a leading Finnish dairy company, launched a new product segment- milk protein concentrate Valio Elis MPC® 65 in the protein products market.

- In October 2024, FrieslandCampina Ingredients, a global protein and probiotic specialist, announced that its new protein hydrolysate ingredient “Hyvital Whey HA 300” has been approved by the EU for its use across European Union countries for infants and follow-on formulas.

List of Top Dairy Protein Hydrolysate Companies:

- AMCO Proteins

- Milk Specialties Global

- Agropur Inc.

- Glanbia Nutritionals Inc.

- Hilmar Cheese Company

Dairy Protein Hydrolysate Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Dairy Protein Hydrolysate Market Size in 2025 | US$964.552 million |

| Dairy Protein Hydrolysate Market Size in 2030 | US$1278.97 million |

| Growth Rate | CAGR of 5.81% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Dairy Protein Hydrolysate Market |

|

| Customization Scope | Free report customization with purchase |

The Global Diary Protein Hydrolysate market is segmented and analyzed as follows:

- By Type

- Whey

- Casein

- By Form

- Powder

- Paste

- By Application

- Sports Nutrition

- Infant Nutrition

- Clinical Nutrition

- Animal Feed

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America