Report Overview

Cognition Supplements Market Size, Highlights

Cognition Supplements Market Size

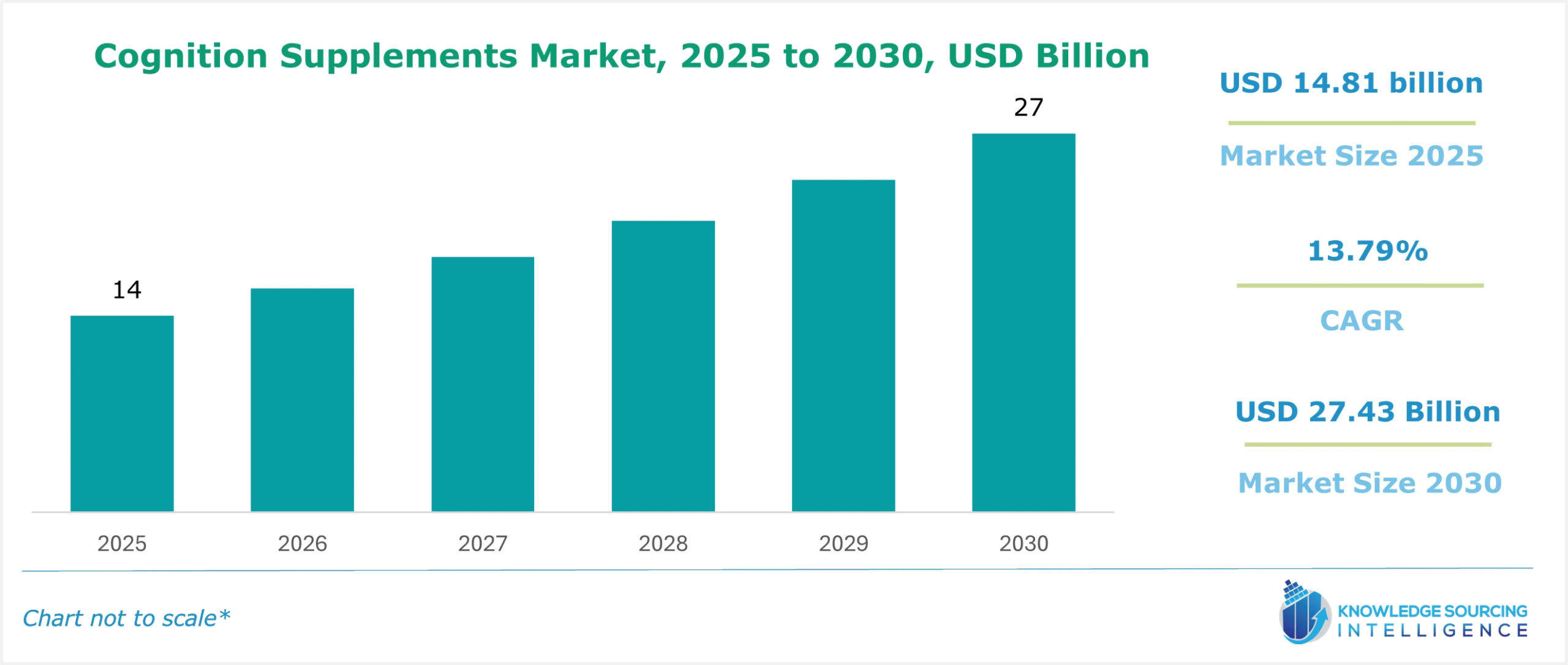

The Global cognition supplements market is predicted to expand at a CAGR of 13.79% to account for US$27.43 billion by 2030 from US$14.81 billion in 2025.

These Nootropics, or cognitive supplements, claim to improve memory, attention, and brain function in general. Caffeine, Ginkgo biloba, Bacopa monnieri, and omega-3 fatty acids are common components.

Cognition Supplements Market Trends:

The need for cognitive health solutions among ageing populations hoping to preserve mental sharpness is driving the cognition supplements market. The market's growth is further aided by rising stress levels, hectic lifestyles, and the incidence of cognitive illnesses like Alzheimer's disease. Research demonstrating the effectiveness of certain substances and technological developments also contributes to market expansion. Furthermore, as individuals place a higher priority on general brain health and cognitive ability, the trend towards preventative healthcare and self-care is rising demand for cognition supplements.

As per the World Health Organization, the population worldwide is rapidly ageing. One billion people worldwide were sixty years of age or older in 2020. By 2030, that number will have increased to 1.4 billion, or one in six persons on the planet. Furthermore, the population of those 60 and over will have doubled to 2.1 billion by 2050. It is anticipated that between 2020 and 2050, the number of people 80 years of age or older will triple, reaching 426 million.

Furthermore, to meet changing consumer preferences, market players in the cognition supplements industry use a variety of strategies, including investing in research for innovative formulations, forming strategic partnerships for wider distribution, and utilising branding and marketing techniques to differentiate their products and win over customers.

Additionally, based on clinical and scientific evidence, Probi® Sensia is a novel probiotic idea that enhances mood and sleep quality, improves working memory and learning, and promotes enhanced cognition. These brain processes are crucial for improving people's general mental well-being. The new probiotic solution is tailored with local assistance, available to suit a range of consumer demands, and backed by claims relevant to global health.

Comprehensively, the cognitive supplements market is expanding significantly due to reasons such as an ageing population, growing awareness of cognitive health, and a rise in demand for performance-enhancing products. Market participants are using a variety of tactics, including branding campaigns, strategic alliances, and research and development, to remain competitive in this ever-changing environment. Furthermore, the cognitive supplements market is expected to grow in the future due to shifting consumer preferences and the ability to create more potent formulations made possible by technological advancements.

Cognition Supplements Market Growth Drivers:

- Growth in mental health diseases.

The cognitive supplements market is predicted to be significantly driven by the projected increase in mental health disorders. Complementary and alternative methods to enhance mental well-being are in greater demand due to the rising global prevalence of illnesses, including anxiety, depression, and ADHD. Supplements claiming to elevate mood, lessen stress, and increase cognitive function are called cognition supplements, and they are positioned to meet this need. The cognitive supplements market is expected to increase significantly in the upcoming years as people look for ways to prevent and treat mental health concerns. This presents potential for innovation and growth in the industry.

An estimated 57.8 million people in the US who were 18 years of age or older had AMI in 2021. This figure accounted for 22.8% of all adult Americans. Women had a greater frequency of AMI (27.2%) than did men (18.1%). The frequency of AMI was highest in young people (18–25 years old) (33.7%), followed by adults (26–49 years old; 28.1%) and older individuals (15.0%).

Adults reporting two or more racial identities had the highest frequency of AMI (34.9%), followed by those who identified as American Indian or Alaskan Native (AI/AN) (26.6%). Asian adults had the lowest frequency of AMI (16.4%).

Additionally, the National Mental Health Programme (NMHP) is being implemented in India by the government to provide accessible and reasonably priced mental healthcare facilities. The National Health Mission offers support to States and UTs for the District Mental Health Programme (DMHP), a component of the NMHP, which has been approved for implementation in 704 districts. The DMHP provides outpatient services, assessment, counselling, psycho-social interventions, ongoing care and support for individuals with severe mental disorders, medication, outreach services, ambulance services, and other services at the Community Health Centre (CHC) and Primary Health Centre (PHC) levels.

Furthermore, self-reported mental and behavioural disorders are among the many health problems covered by the Australian Bureau of Statistics (ABS) 2020–21 National Health Survey. Only when an individual states that a mental or behavioural condition has lasted, or was anticipated to last, six months or more does the NHS record the individual as having a mental or behavioural condition during the collection period. A mental or behavioural disorder was estimated to have affected 1 in 5 (20%) Australians aged 15 and older during the collecting period (August 2020 to June 2021), according to the 2020–21 NHS (ABS 2022b).

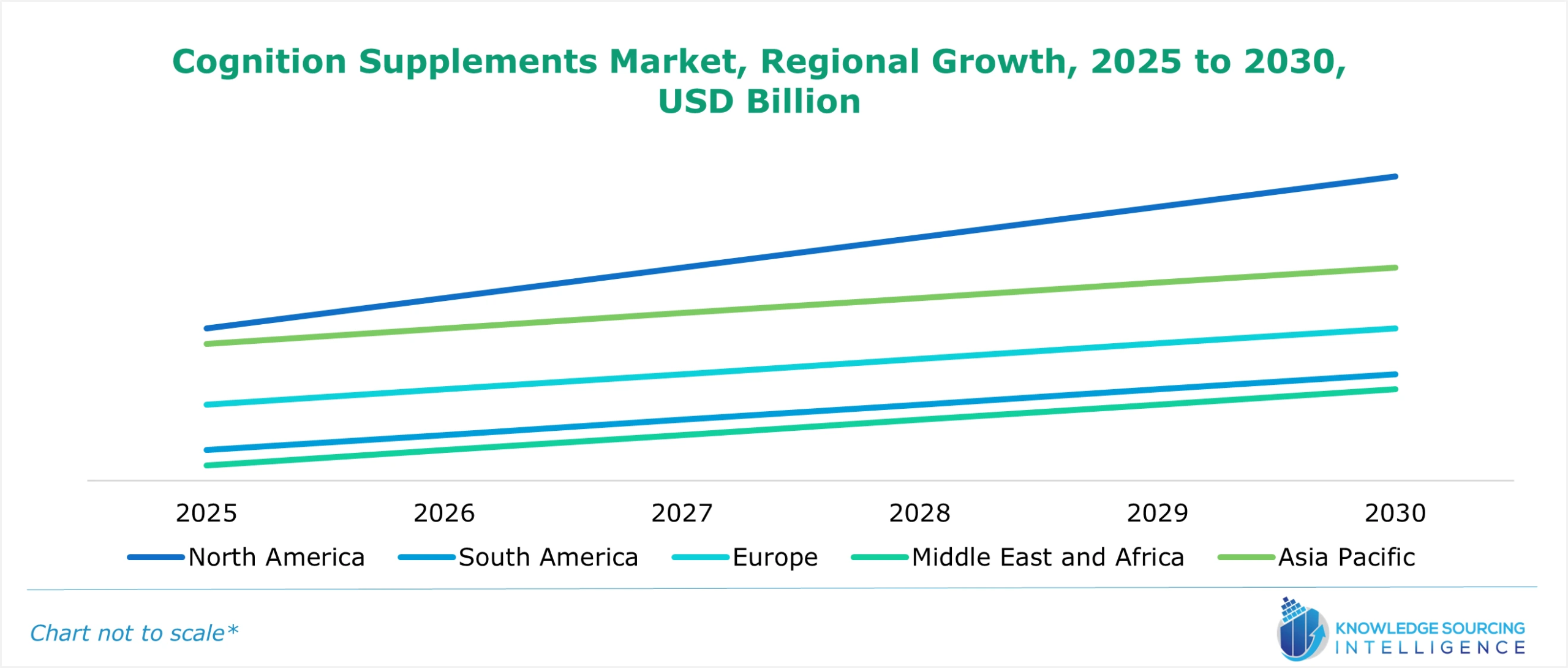

Cognition Supplements Market Geographical Outlook:

- The United States in the North American region is expected to hold significant shares of the Global cognition supplements market.

The ageing population is one of the primary causes of dementia and cognitive impairment. The number of elderly people in the United States has been steadily increasing, which has led to an increase in the prevalence of mental health conditions like dementia. Throughout the forecast period, this is expected to expand the product's application scope and boost overall market growth. For instance, the prevalence of Alzheimer's dementia rises with age: 5.0% of those 65 to 74, 13.1% of those 75 to 84, and 33.3% of those 85 years of age and above have the disease in the United States.

Further, consumer preferences have shifted in favour of herbal health products that contain ingredients like matcha tea, caffeine, beets, spinach, Brahmi, Arctic root, turmeric, ginseng, and pine bark in the last few years. Furthermore, it is anticipated that the growing vegan population in the United States will increase demand for herbal products.

Moreover, the dietary and natural supplement industries in this region are well-established, which will contribute to their high growth during the forecast period. For instance, it was projected that the total sales of dietary supplements in the United States in 2020 would be $55.7 billion, $21.2 billion were attributed to supplements that contain vitamins, minerals, or both, with $8.0 billion going toward multivitamins/minerals (MVM) and multivitamins (MVs).

Furthermore, the growing prevalence of mental health issues like anxiety, stress, and depression is supporting the industry's growth. For instance, the Anxiety and Depression Association of America estimates that 6.8 million adult Americans have general anxiety disorder, or GAD.

Further, social media platforms are becoming increasingly influential in consumer decision-making. In addition, the market is expanding as more people become aware of how simple it is to get cognitive supplements through online pharmacy websites and applications that offer home delivery, cashback, discounts, and a plethora of payment options. Typically, they involve generic supplements that are easily obtained by prescription or over-the-counter (OTC) to relieve pain related to cognitive disorders. Positive market trends are also being produced by athletes' increasing use of cognitive supplements for a variety of competitive sports.

Cognition Supplements Market Company Profiling:

- Accelerated Intelligence is strategically positioned in the cognition supplements market, leveraging its commitment to improving lives through supplements, nutrition, and research. At the core of its strategy lies a dedication to applying science and global resources to enhance health and well-being across all life stages. The company boasts a leading portfolio of products designed to support brain health, wellness, and prevention. This portfolio serves as a cornerstone for its market presence, catering to the needs of consumers seeking safe, effective, and affordable supplements and medicines. One key aspect of Accelerated Intelligence's strategy is its relentless focus on innovation. The company maintains an industry-leading pipeline of promising new products, with a clear intention to disrupt the market with novel offerings. By continually investing in research and development, Accelerated Intelligence ensures that it remains at the forefront of cognitive health solutions.

Cognition Supplements Market Key Developments:

- February 2024, Neuriva, a well-known brain health supplement manufactured by Reckitt, introduced the first-ever 30-Day Brain Health Challenge in the category, which is a daily dedication to cognitive health. The challenge, an exciting new addition to the well-known Neuriva Brain Gym programme, consists of several easy, everyday exercises and games that add interest and education to creating a routine for brain health.

- February 2024, Neuriva, a well-known brain health supplement manufactured by Reckitt, introduced the first-ever 30-Day Brain Health Challenge in the category, which is a daily dedication to cognitive health. The challenge, an exciting new addition to the well-known Neuriva Brain Gym app, consists of several easy, everyday activities and games that add interest and education to creating a routine for brain health.

- Additionally, BrainPromise, a new product developed by EyePromise in February 2024, for brain protection, function, and health, was introduced. With a host of other benefits, BrainPromise provides complete brain nutrition by supplying vital vitamins and minerals, such as the antioxidants lutein and zeaxanthin, which have been shown in numerous published studies to be effective in combating oxidative stress.

Cognition Supplements Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Cognition Supplements Market Size in 2025 | US$14.81 billion |

| Cognition Supplements Market Size in 2030 | US$27.43 billion |

| Growth Rate | CAGR of 13.79% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Cognition Supplements Market | |

| Customization Scope | Free report customization with purchase |

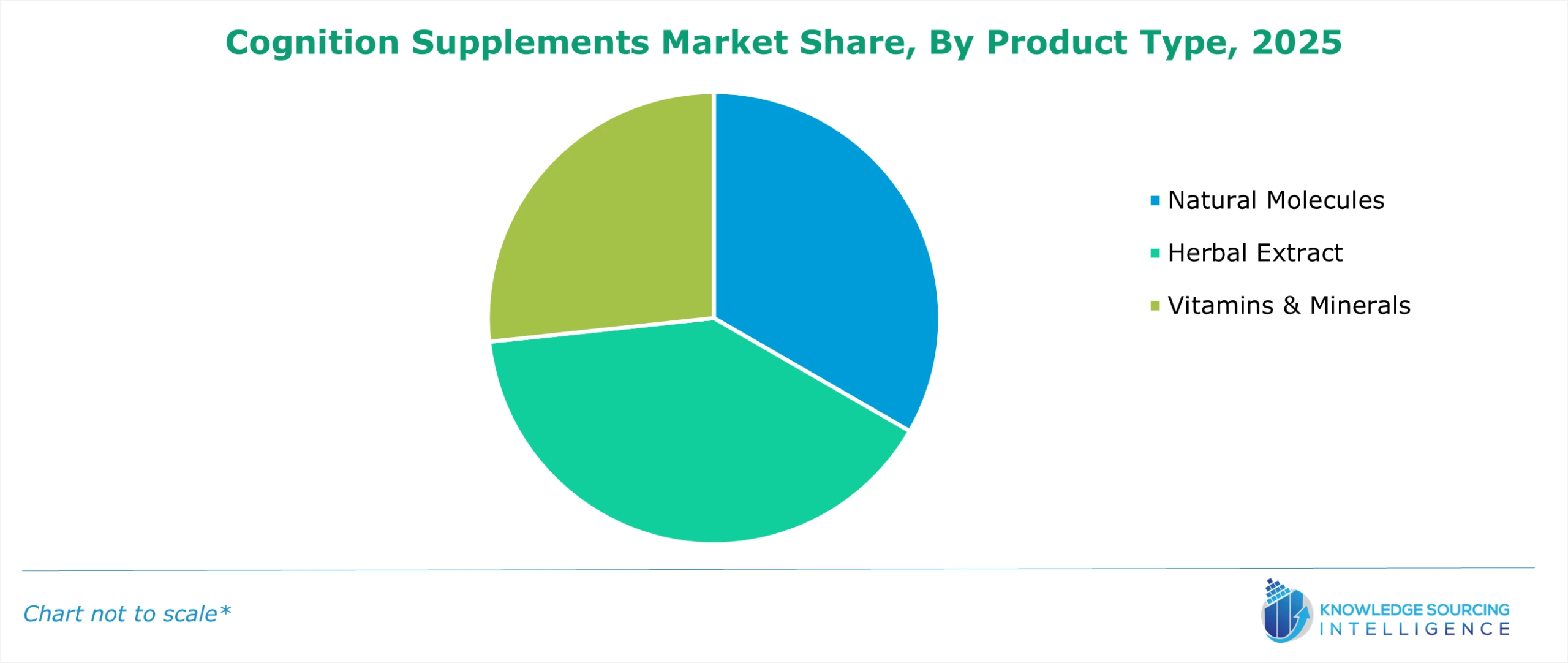

The cognition supplements market is segmented and analyzed as below:

- By Product Type

- Natural Molecules

- Herbal Extract

- Vitamins & Minerals

- By Form

- Chewable

- Capsules

- By Distribution Channel

- Supermarkets/Hypermarkets

- Medical Stores

- Online Retail Stores

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America