Report Overview

OTC Sleep Aids Medication Highlights

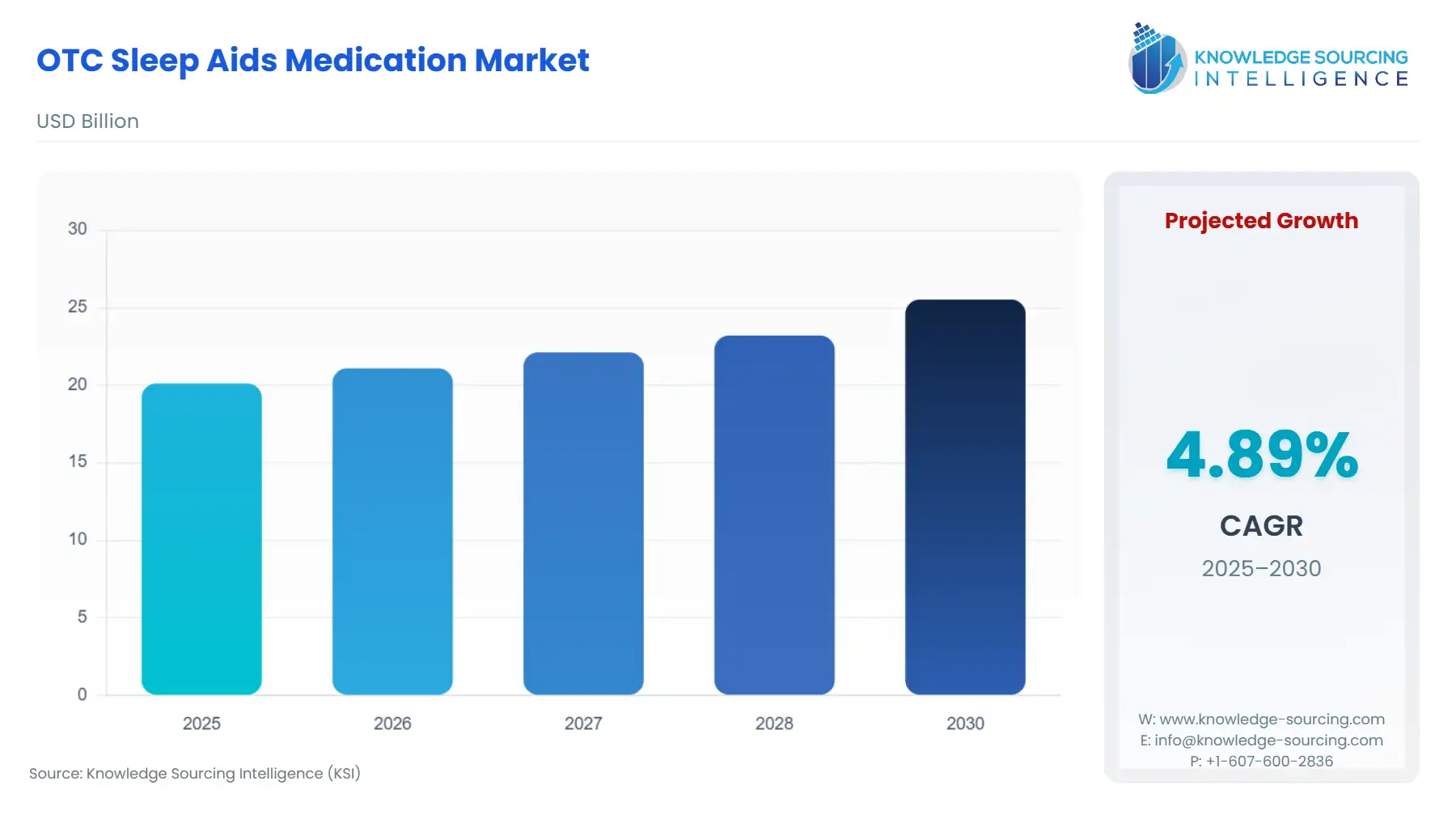

The OTC Sleep Aids Medication Market is expected to grow at a CAGR of 4.89%, reaching a market size of US$25.526 billion in 2030 from US$20.105 billion in 2025

Over-the-counter (OTC) sleep aid medication refers to drugs that can be purchased without a prescription for treating or helping with occasional sleeplessness or insomnia. These sleep aid medications are thus prescribed ideally for treating occasional sleepless nights. The commonly used medications are diphenhydramine, Doxylamine, Melatonin, and valerian. The market selling OTC sleep aid medications includes Unison SleepTabs, ZzzQuil, Tylenol, Nytol, and Sominex, among others.

The OTC sleep aids medication market refers to producing, distributing, and selling over-the-counter sleep aids drugs. It constitutes nonprescription sleeping pills as well as natural supplements that are targeted at managing occasional sleeplessness, mild insomnia, temporary sleep disturbance, jet lag, and general restlessness. The market includes antihistamine-based medications, melatonin supplements, herbal and natural remedies such as valerian root, chamomile, and other products.

The market for OTC sleep aid medications is rising due to various factors. The increase in the prevalence of sleep disorders is mainly driven by modern lifestyle changes such as stress, anxiety, irregular work schedules, and excessive screen time. This has led to an increase in cases of sleep disorders, or, say, sleep disorders have become very common nowadays. People have increased awareness of the importance of sleep and their sleep health, driving the demand for sleeping pills or natural supplements for treating their sleep disorders and boosting their sleep health. Further, the accessibility offered by OTC drugs has been a reason for its continued market growth. Moreover, the coming years will be dominated by the trend toward natural and herbal sleep aid medications, boosting the market.

What are the OTC Sleep Aids Medication Market drivers?

- Rising prevalence of sleep disorders is propelling the market growth

The current modern lifestyle is driven by stress, anxiety, work pressure, and excessive screen time. This is causing an increase in the number of people with sleep disorders such as insomnia and parasomnia, leading to a rise in demand for OTC sleep aid medications. As per the data from the National Heart, Lung, and Blood Institute, about 50 to 70 million Americans have sleep or wakefulness disorders, highlighting the high prevalence of sleep disorders. Additionally, the Clinical guideline for the evaluation and management of chronic insomnia in adults estimates that about 33% to 505 of the adult population is facing the issue of situational stress. These data highlight the growing number of sleep disorders, and thus, it can be anticipated that there is an increasing trend of sleeplessness. Therefore, the OTC sleep aid medication market will grow significantly during the forecast period.

Segment analysis of the OTC Sleep Aids Medication Market:

- By Application, hospitals and clinics will continue to hold the largest segment

By type, the OTC sleep aids medication market is segmented into Antihistamines, Melatonin Supplements, Herbal supplements, and magnesium supplements. During the forecast period, Antihistamines will continue to dominate the market share of OTC sleep aids medication.

Antihistamines are the most common type of medication used in OTC sleep aids. Diphenhydramine, an antihistamine, is the most often used in sleep aid medications. It helps in treating short-term insomnia. Doxylamine is also a sedating antihistamine that is found in many OTC sleep aids. Some other commonly used antihistamines in OTC drugs are chlorpheniramine, cinnarizine, hydroxyzine, etc. Thus, antihistamines are the most widely as well as traditionally used in the OTC sleep aids medication market. Though other segments, such as melatonin or herbal, are rising, antihistamines will continue to dominate the market.

Geographical outlook of the OTC Sleep Aids Medication Market:

- Asia-Pacific will be the fastest-growing region during the forecast period

The OTC sleep aids medication market is segmented by geography into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. During the forecast period, Asia-Pacific will be the fastest-growing region. Meanwhile, North America will continue dominating the market in the coming years.

The Asia Pacific region will be the fastest-growing market during the forecast period. This growth is attributed to the growing cases of sleep disorders in the region due to adopting modern lifestyles. The growing economy is providing people with the affordability to purchase drugs. Further, the increasing awareness of people for sleep-related disorders and to treat them is driving the market.

Meanwhile, the North American market is estimated to hold a significant share. The advanced healthcare infrastructure in countries like the United States drives this dominance. The high prevalence of sleep disorders and the increasing infrastructure supporting its medication are driving its market growth.

Recent developments in the OTC Sleep Aids Medication Market:

- In December 2024, Eli Lilly and Company announced that the U.S. Food and Drug Administration approved Zepbound. It is a medicine for adults with moderate to severe sleep apnea and obesity. It will help improve sleep disorders. However, Zepbound contains tripeptide and thus has some side effects.

- In February 2024, Nestle developed a bioactive blend for improving sleep quality. It was done in Switzerland with the National University of Singapore Sleep Center. This innovation is a nutritional solution containing bioactive ingredients such as vitamin B, magnesium, and Zinc for sleep.

OTC Sleep Aids Medication Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| OTC Sleep Aids Medication Market Size in 2025 | US$20.105 billion |

| OTC Sleep Aids Medication Market Size in 2030 | US$25.526 billion |

| Growth Rate | CAGR of 4.89% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the OTC Sleep Aids Medication Market | |

| Customization Scope | Free report customization with purchase |

The OTC Sleep Aids Medication Market is analyzed into the following segments:

- By Type

- Antihistamine

- Melatonin Supplements

- Herbal Supplement

- Others

- By Application

- Insomnia Treatment

- Anxiety Relief

- Others

- By Distribution Channel

- Online

- Supermarkets/Hypermarkets

- Pharmacies and Drugstores

- Specialty Stores

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- India

- Indonesia

- Thailand

- Others

- North America