Report Overview

Mental Well-Being Supplements Market Highlights

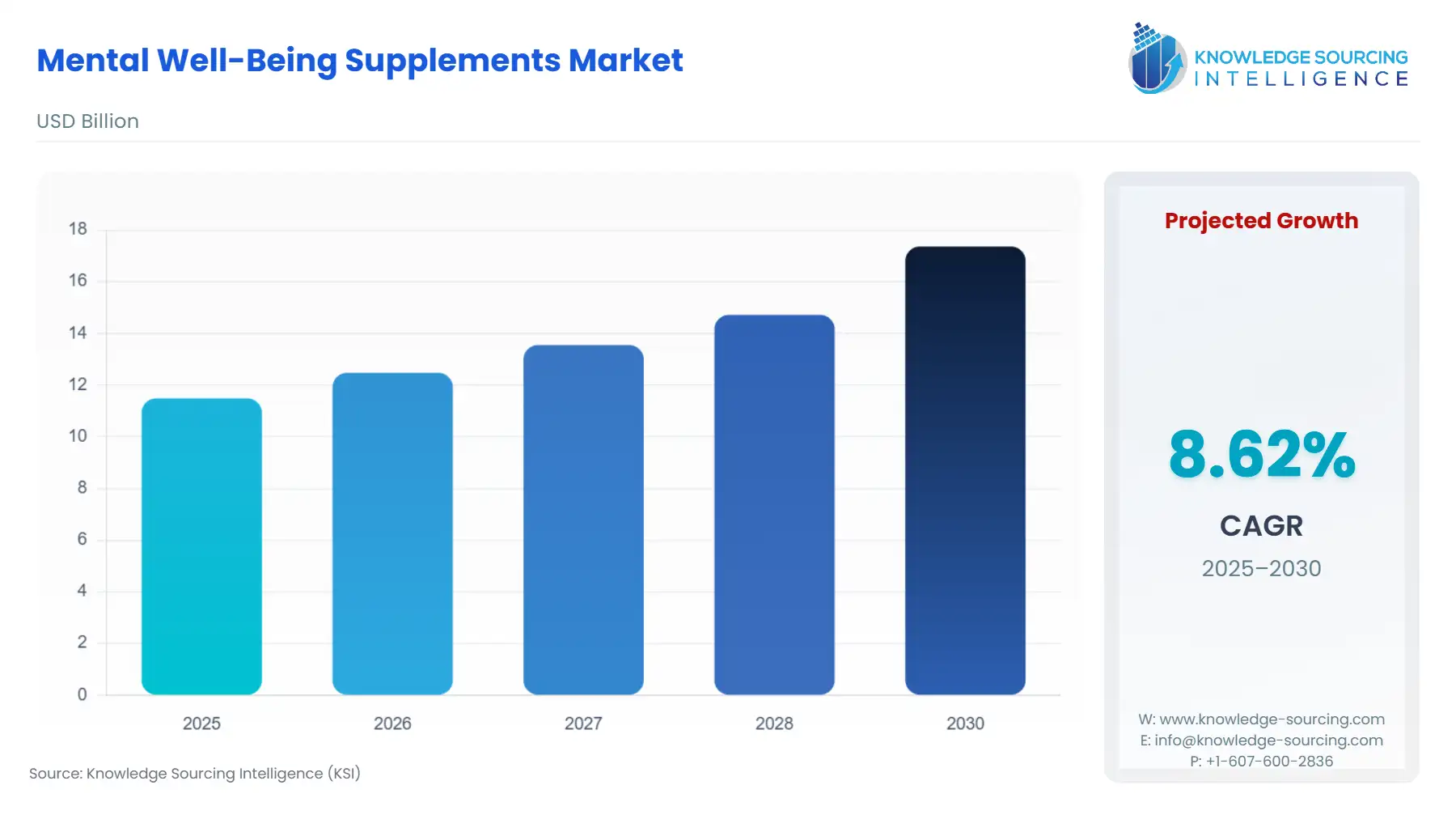

Mental Well-Being Supplements Market Size:

The Mental Well-Being Supplements Market, valued at $11.488 billion in 2025, is projected to grow at a CAGR of 8.62% to reach a market value of $17.366 billion in 2030.

Rising stress levels, sleep disorders, memory enhancement, and mood support like postpartum blues drive the market. The growth in mental well-being supplements is gaining popularity among youths by maintaining normal memory and concentration and reducing fatigue. Further, supplements address a critical need by supporting the central nervous system and restoring balance and restfulness in the body.

Mental Well-Being Supplements Market Overview & Scope:

The Mental Well-Being Supplements Market is segmented by:

- Product Type: By product type, the market is segmented into natural molecules, herbal extracts, and vitamins & minerals. The herbal extracts, such as ashwagandha extracts, may help to reduce stress and anxiety. The herbal extracts will witness a significant surge in growth.

- Application: By application, the market is segmented into memory enhancement, attention & focus, depression & mood support, sleep & recovery, anti-aging & longevity, and stress & anxiety relief. The annual prevalence of sleep disorders in patients over 10 years increased from 7.6% person-years in 2011 to 14.4% in 2020, according to the National Library of Medicine. This increase in sleep disorders is noticeable worldwide.

- Distribution Channel: By distribution channel, the market is segmented into online, offline, and wholesale distributors. The online segment is growing significantly.

- Region: By geography, the mental well-being supplements market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

Top Trends Shaping the Mental Well-being Supplements Market:

1. Demand from the online segment

- E-commerce sales worldwide have steadily risen year over year for the last decade. Social media marketing and influencer marketing of these products drive the demand for mental well-being supplements online.

Further, OECD countries having a notable share of internet users purchasing online were the Netherlands, Norway, Denmark, and South Korea, with 92.3%, 92.2%, 90%, and 76.3% in 2022, respectively.

- Major factors driving growth are the expanding number of internet users with purchasing power, the maturity of e-banking, and changing habits and preferences for online transactions.

2. Growing propensity toward herbal products

- There has been a growing surge towards herbal products. This is propelled by the increasing awareness of natural products and increasing memory power in the challenging environment.

- In May 2024, Numi Organic TeaTM launched its new relax and regenerate Herbal Supplement Tea Line featuring Damiana. It positively affects mood, hormone balance, and mental health.

Mental Well-Being Supplements Market Growth Drivers vs. Challenges:

Opportunities:

Challenges:

- Challenges for regulation: There has been a growing demand for mental well-being supplements, but the tough regulatory compliances and policies often cause difficulty in the entry of new players.

Mental Well-Being Supplements Market Regional Analysis:

- Asia-Pacific: The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries. This propels the demand for mental well-being supplements.

- North America: Nutrition Adoption is growing in North America. The US has serious problems like sleep deprivation and growing anxiety. According to the CDC's Behavioral Risk Factor Surveillance System (BRFSS) report in the United States, the percentage of adults not getting enough sleep varies by State. In 2022, the number of people with insufficient sleep was high in states like Louisiana and Tennessee, reaching the highest, 46% of adults in Hawaii.

- Europe: The European market for mental well-being supplements is very promising. This is due to the rising stress levels and growing consumer awareness of stress-related health issues. Germany, France, the UK, and Spain are a few of the largest markets.

Mental Well-Being Supplements Market Competitive Landscape:

Some of the major companies include Natural Factors Nutritional Products Ltd., Nutricia, Onnit Labs, Inc., Intelligent Labs, Accelerated Intelligence Inc., and NOW Foods Strategies:

- Product Approval: In January 2025, SPRAVATO (esketamine) was approved in the U.S. as the first and only monotherapy for adults with treatment-resistant depression. Following the U.S. FDA Priority Review, approval is based on data demonstrating that SPRAVATO met its primary endpoint at 4 weeks. SPRAVATO CIII nasal spray is an innovative treatment for adults living with major depressive disorder (MDD).

- Launch: Nordic launched Probi Sense. It is a dietary supplement for the mental capacity. Probi Sense contains Probi's lactic acid bacteria strain Lactiplantibacillus plantarum HEAL9 (HEAL9), with zinc, iodine, and magnesium minerals. The product had the backing of four clinical studies demonstrating its positive effects and is designed to support mental well-being.

- Innovation: In April 2024, the Centre for Addiction and Mental Health (CAMH) developed the first-ever clinically validated natural supplement to prevent postpartum blues. The study was published in the Lancet Discovery Science journal eClinicalMedicine. CAMH's new supplement was confirmed to prevent postpartum blues and reduce symptoms of postpartum depression over six months after giving birth.

Mental Well-Being Supplements Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Mental Well-Being Supplements Market Size in 2025 | US$11.488 billion |

| Mental Well-Being Supplements Market Size in 2030 | US$17.366 billion |

| Growth Rate | CAGR of 8.62% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Mental Well-Being Supplements Market |

|

| Customization Scope | Free report customization with purchase |

Mental Well-Being Supplements Market is analyzed into the following segments:

By Product Type

- Natural Molecules

- Herbal Extracts

- Vitamins & Minerals

By Application

- Memory Enhancement

- Attention & Focus

- Depression & Mood Support

- Sleep & Recovery

- Anti-aging & Longevity

- Stress & Anxiety Relief

By Distribution Channel

- Online

- Offline

- Wholesale distributors

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- UK

- France

- Spain

- Others

- Middle East and Africa

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Taiwan

- Thailand

- Others