Report Overview

Waste to Energy Market Highlights

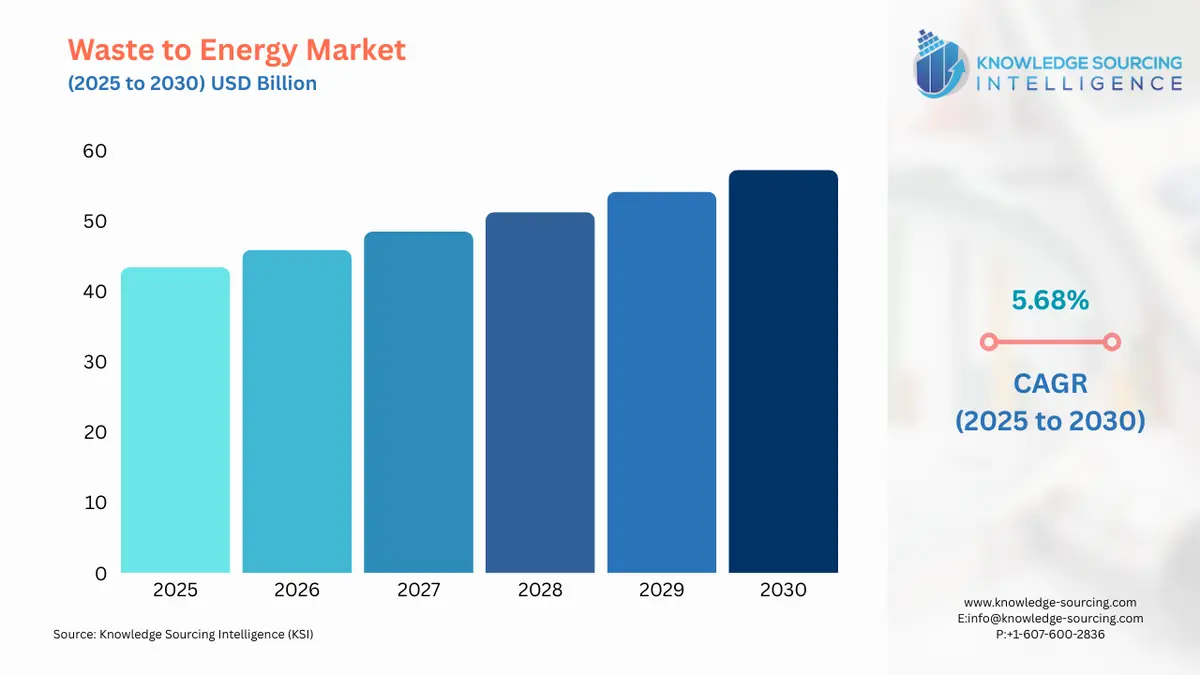

Waste to Energy Market Size

The waste-to-energy market is evaluated at US$43.415 billion in 2025, growing at a CAGR of 5.68%, reaching a market size of US$57.239 billion by 2030.

Waste to energy refers to a process in which energy is generated in the form of electricity or heat, which is done by processing or treating waste. In other words, waste-to-energy refers to the technology that converts waste into a fuel source. It is also known as the recovery of energy. Most of the electricity or heat is produced through direct combustion. However, a combustible fuel commodity is often generated through the treatment of waste such as ethanol and methane, among others.

The waste-to-energy market is expected to grow significantly over the next five years, owing to growing concerns about waste disposal and a growing focus on the generation of clean energy in many parts of the world. This advanced technology helps in reducing the waste disposed of in landfills, thereby reducing greenhouse gases. Furthermore, it helps in the recycling of waste, which also reduces the harmful impact of waste on the environment. Waste-to-energy facilities are often considered the only facilities that help mitigate adverse climate changes as they reduce the burning of fossil fuels and can further reduce the harmful emissions being produced to the environment. Various governments worldwide are taking the necessary steps to protect the environment. That has also led to an upsurge in the investments being made in waste-to-energy facilities in both developed and underdeveloped economies, which, in turn, is significantly shaping the market growth throughout the forecast period. Furthermore, the increased focus on waste management is further positively impacting the market growth. Numerous regulations are being implemented in many countries for the proper disposal and treatment of waste for energy generation purposes because of limited land areas in many parts of the world.

Governments are taking the necessary steps to implement numerous sustainable and effective waste management solutions, and waste to energy is considered an integral part. With a growing emphasis on renewable energy, rising fossil fuel prices, and a desire to reduce reliance on fossil fuels, many countries are investing in alternative energy sources. Several regional governments are investing in waste-to-energy facilities to benefit from it.

What are the Waste-to-Energy Market drivers?

- Rapid urbanization and industrialization are playing a significant role in the global waste-to-energy market.

One of the key factors anticipated to propel the business growth opportunities for manufacturers is the rapid urbanization and industrialization in both the developed and developing economies of the world. With growing industrialization and urbanization, commercial and residential waste generation has also increased significantly. Additionally, the continuously rising demand for energy globally due to a rising population, rapid industrialization, and urbanization is one of the key drivers for market growth throughout the forecast period. The burgeoning demand for strong heating and cooling needs in some of the regions is also projected to be one of the factors responsible for boosting the energy demand. The movement toward sustainable development is also projected to boost investments in clean energy projects in many countries, increasing the demand for waste-to-energy systems and thus positively impacting the market growth for the next five years.

- Reducing fossil fuel dependency.

Governments worldwide are implementing numerous strategies that are further aimed at reducing fossil fuel dependency due to the high environmental impacts and costs. The growing prices of fossil fuels and their adverse effects on the environment have led to an upsurge in the dependence on clean energy, which is further expected to boost the waste-to-energy market growth in the coming years. Fossil fuels have continued to play an important role in the global energy system. Fossil fuel energy is considered the fundamental driver of the industrial revolution.

However, using fossil fuels negatively impacts the environment and the economy. In addition, the growing need for electricity further increases the use of fossil fuels for power generation, which is costlier in comparison with renewable sources of energy. Due to the high price of fossil fuels, many regions worldwide are moving towards alternative sources of electricity generation, positively impacting the market growth in the coming five years.

Segment analysis of the Waste-to-Energy Market:

- Thermal technology is estimated to hold a significant market share.

By technology, the waste-to-energy market has been segmented into thermal and biological. Thermal waste-to-energy technology is expected to hold a substantial market share primarily due to its simple process and being environment-friendly, which is widely adopted. Furthermore, this technology allows the complete combustion of gases that are released from the waste, making it more efficient and suitable.

Biological technology is also anticipated to show substantial growth during the coming years owing to growing investments in R&D under this segment. The growing focus on the adoption of organic approaches for the disposal of waste due to their less adverse effects on the environment is also one of the key factors supplementing this segment’s expansion throughout the forecast period.

- Europe and Asia Pacific regions are expected to witness promising growth over the forecast period.

Based on geography, the waste-to-energy market has been segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The European region is projected to hold a considerable market share throughout the next five years, majorly due to the favorable government policies that further support investments in waste-to-energy plants, such as landfill taxes and carbon taxes, among others.

The APAC region is also anticipated to show promising growth opportunities for manufacturers over the next five years due to the inclination of the government toward waste management and increasing investments in waste-to-energy projects in major emerging countries like India, China, and Indonesia, among others.

Key developments in the Waste-to-Energy Market:

The waste-to-energy industry has seen significant developments in the last few years, owing to the rapid adoption of environment-friendly alternatives for fuel production and government initiatives to decrease pollution and environmental degradation.

According to a news release by Patriot Hydrogen in January 2022, the company is hard at work on the first Patriot unit, which was installed at Kimberley Clean Energy's Kilto Station project near Broome in mid-2022. Kimberley Clean Energy's fossil fuel replacement approach will include the modular hydrogen production unit, with plans to add a hydrogen system in the years ahead. Patriot Hydrogen raised AUS$1 million (US$720,000 approx) in oversubscribed capital. This funding will be used to support Patriot's anticipated IPO in the third quarter of 2022 and supply further Patriot modules to Kimberley Clean Energy, which has signed a memorandum of understanding for 75 units.

According to a tweet by Capstone Green Energy on May 26th, 2022, the company received an order for Two Waste-to-Energy Cogeneration Projects in Italy, which are in the works. Acciona Agua SA will operate three C65 microturbines at its wastewater treatment plants in Alghero and Cagliari, Italy.

According to a news release on 24th May 2022 by the Emirates News Agency (WAM), the Sharjah Waste to Energy facility, the first of its type in the Middle East, was unveiled by Dr Sheikh Sultan bin Muhammad Al Qasimi, the Ruler of Sharjah. Emirates Waste to Energy, a joint venture between BEEAH Energy, BEEAH Group's renewable energy division, and Masdar, one of the world's top renewable energy firms, has completed its first project. The plant, unveiled in 2018, would divert up to 300,000 tonnes of garbage from landfills each year, helping the UAE meet its waste diversion and management targets. The project will help the country accomplish its goal of achieving climate neutrality by 2050 by preventing up to 450,000 tonnes of carbon dioxide from being released into the atmosphere each year.

Waste to Energy Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Waste to Energy Market Size in 2025 | US$43.415 billion |

| Waste to Energy Market Size in 2030 | US$57.239 billion |

| Growth Rate | CAGR of 5.68% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Waste to Energy Market |

|

| Customization Scope | Free report customization with purchase |

The Waste-to-Energy Market is analyzed into the following segments:

- By Technology

- Thermal

- Biological

- By Offering

- Solutions

- Services

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- UK

- Italy

- Others

- Middle East and Africa

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America

Our Best-Performing Industry Reports:

- Distributed Energy Resource Management System Market

- Wave Energy Market

- Residential Energy Storage Market

Navigation:

- Waste to Energy Market Size

- Waste to Energy Market Key Highlights:

- What are the Waste-to-Energy Market drivers?

- Segment analysis of the Waste-to-Energy Market:

- Key developments in the Waste-to-Energy Market:

- Waste to Energy Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 23, 2025