Report Overview

Green Logistics Market Size, Highlights

Green Logistics Market Size:

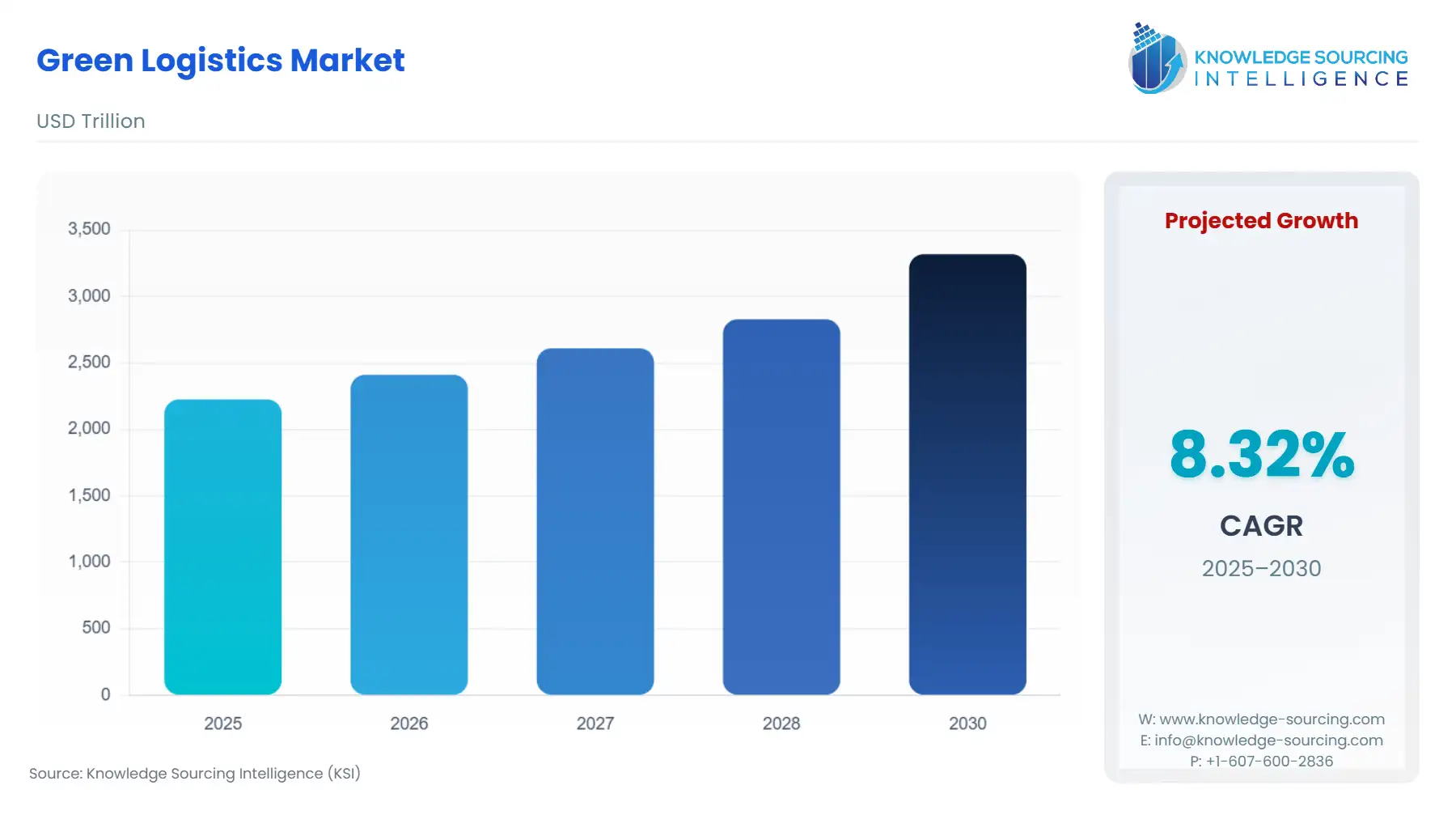

The Green Logistics Market is set to witness robust growth at a CAGR of 8.32% during the forecast period to be worth US$ 3.319 trillion in 2030 from US$ 2.226 trillion in 2025.

The green logistics market is experiencing emerging trends like adding multi-modal connectivity across highways, railways, ports, airports, logistics infrastructure, and inland waterways to facilitate sustainable economic activities.

Various government plans and initiatives for a cost-efficient, resilient, and sustainable logistics ecosystem. This coherent application is aimed at reducing carbon dioxide emissions.

Green Logistics Market Overview & Scope:

The Green Logistics Market is segmented by:

- Service Type: The value-added services included inventory management, supply chain optimization, and freight forwarding. The key driver of the segment is the use of artificial intelligence to enhance productivity. The building certifications are boosting sustainable warehouse design, energy-efficient warehouse operations, and automated warehousing systems. The growing demand for the electric and hybrid vehicle fleet and sustainable maritime and aviation fuel are the major market drivers for the transportation segment.

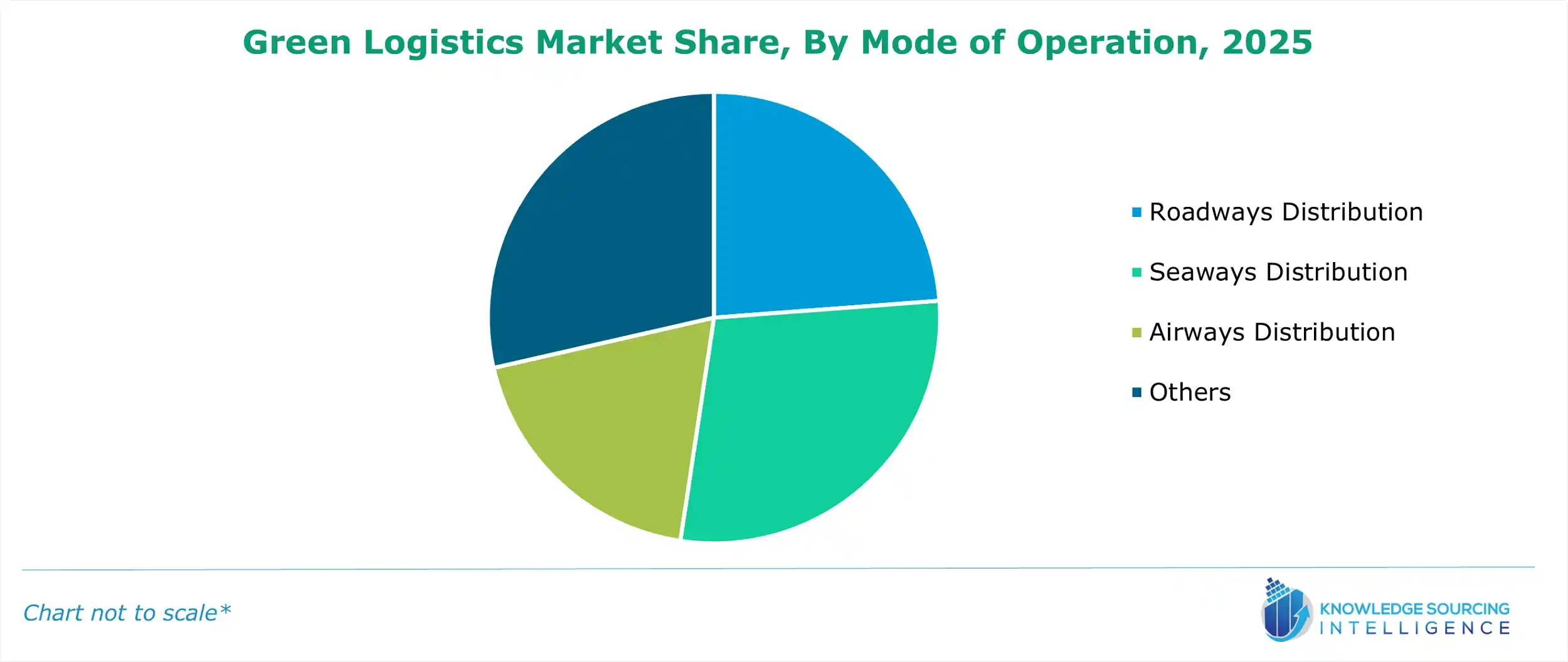

- Mode Of Operation: A growing emphasis on alternative fuel vehicles, and the use of advanced route optimization systems is aiding the roadways distribution’s expansion. Sustainable practices in maritime logistics and sustainable maritime fuel are the focus of this segment. The growing use of sustainable aviation fuel, adoption of green technologies, are crucial for the airway distribution segment.

- Industry: Based on industry, the green logistics market is segmented into retail, electrical and electronics, chemical, automotive, energy, agriculture, BFSI, and others.

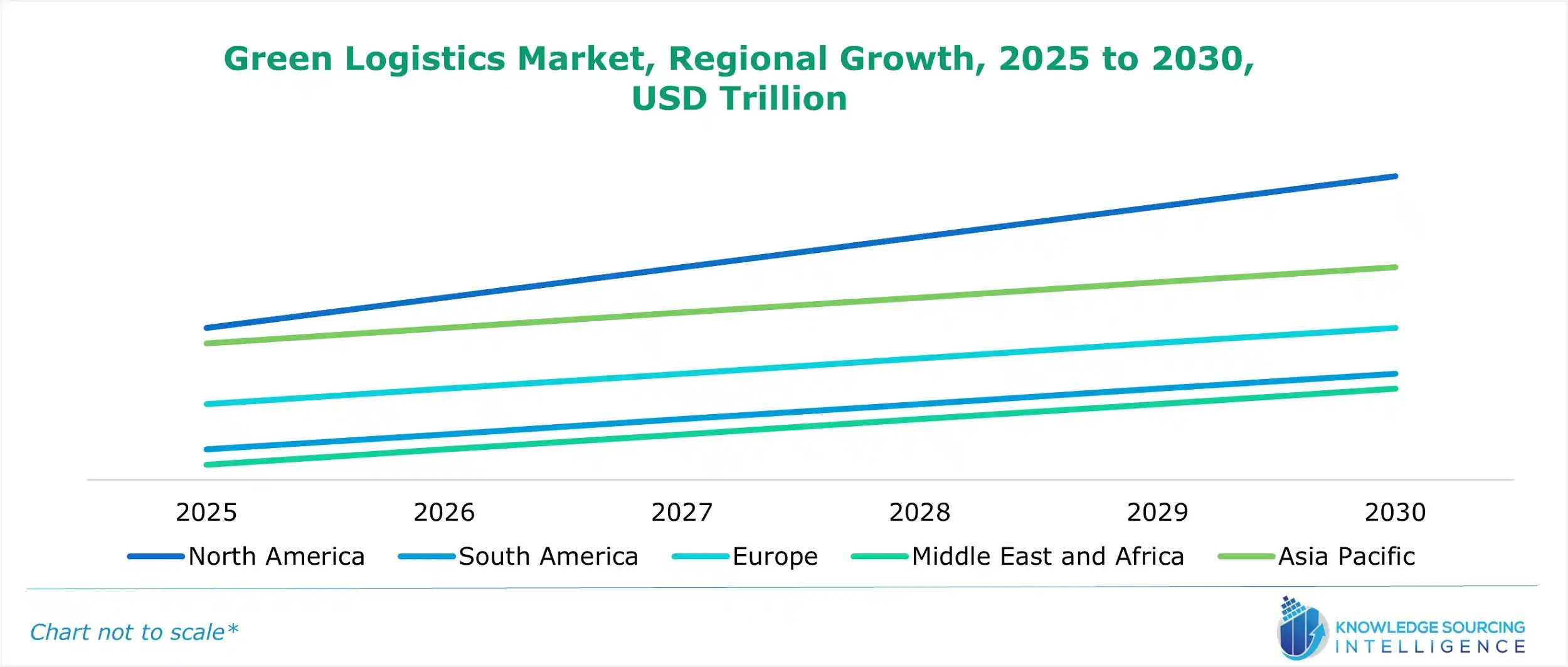

- Region: By geography, the green logistics market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific.

Top Trends Shaping the Green Logistics Market:

1. Use of alternate fuel

- The use of alternate fuel in the logistics and supply chain industry is crucial, which makes sustainability and carbon neutrality completely essential for this sector. These fuels included biodiesel, methanol, and hydrogen to natural gas, P-series, solar-based fuels, and more.

2. AI innovations

- Artificial intelligence is playing an important role in transforming the sustainability of logistics. AI has been utilized in demand forecasting, route optimization, and identifying areas of energy wastage and optimization.

Green Logistics Market: Growth Drivers vs. Challenges:

Drivers:

- Growing awareness about sustainability and green economy: With growing pressures about the near-and long-term decarbonization and sustainability commitments. The logistics is taking the next step in its journey to net zero. The green logistics is focused on reducing the environmental impact of operations.

Several companies are taking steps to reaffirm their commitment to climate goals. For instance, in July 2024, Maruti Suzuki India Limited surpassed a landmark of 2 million cumulative vehicle dispatches using railways, showing its commitment to green logistics. This offsets cumulative CO2 emissions of about 10,000 metric tonnes and achieved cumulative fuel savings of 270 million liters in the last decade.

- Expanding demand for sustainable transport: Companies can easily avoid tons of emissions using alternative sustainable transport. This also includes comprehensive transport networks. In 2024, CEVA Logistics announced that they avoided more than 26,000 tons of emissions by using about 10 million liters of sustainable maritime and aviation fuel. The company currently operates more than 1,000 electric and low-carbon fuel vehicles.

Challenges:

- Lack of infrastructure: The lack of infrastructure in several local authorities has made it challenging to build new green facilities that meet the wants of those involved in logistics activities.

Green Logistics Market Regional Analysis:

Green Logistics Market: Competitive Landscape:

The market is fragmented, with many notable players including Agility Public Warehousing Company K.S.C.P. and Subsidiaries, Bolloré SE, CEVA Logistics, Deutsche Post DHL Group., DSV, FedEx Corporation, GEODIS, United Parcel Service of America, Inc., XPO Logistics, Inc., and YUSEN LOGISTICS CO., LTD., among others:

Few Strategic Developments Related to the Market:

- New Launch: In November 2024, CEVA Logistics launched the FORPLANET sub-brand for low-carbon, sustainable logistics solutions. FORPLANET confirms CEVA's commitment to sustainable logistics and developing new solutions for the supply chains.

- New Partnership: In July 2024, DHL and Envision teamed up for sustainable innovations in logistics and energy. Their partnership covers four main areas: logistics solutions, Sustainable Aviation Fuel, green energy, and the joint development of a “Net Zero Industrial & Logistic Park”.

- Expansion: In June 2024, ITC enhanced its mid-mile and last-mile deliveries with eco-friendly solutions. As the ITC's green logistics strategy, the company increased the number of EV trips by 2.7 times compared to 2023.

Green Logistics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Green Logistics Market Size in 2025 | US$2.226 trillion |

| Green Logistics Market Size in 2030 | US$3.319 trillion |

| Growth Rate | CAGR of 8.32% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Tillion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Green Logistics Market |

|

| Customization Scope | Free report customization with purchase |

Green Logistics Market is analyzed into the following segments:

By Service Type

- Value-added Services

- Warehousing

- Distribution

- Transportation

- Reverse Logistics

- Packaging

By Mode Of Operation

- Roadways Distribution

- Seaways Distribution

- Airways Distribution

- Others

By Industry

- Retail

- Electrical And Electronics

- Chemical

- Automotive

- Energy

- Agriculture

- BFSI

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others