Report Overview

Signal Generator Market - Highlights

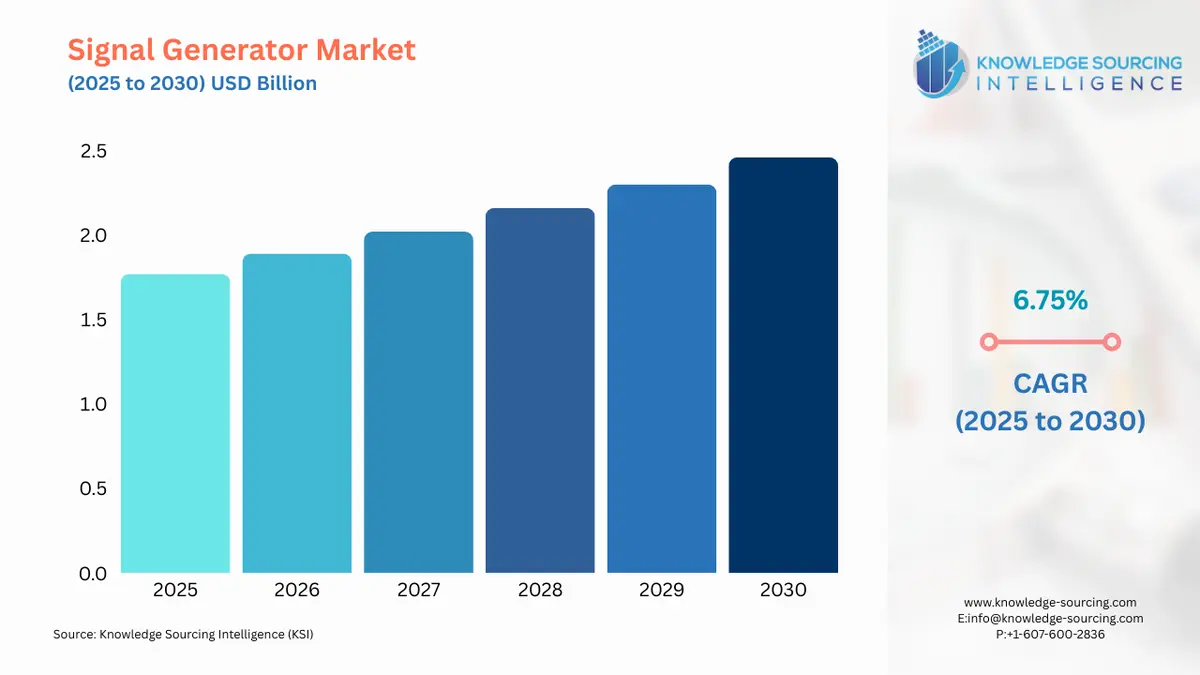

Signal Generator Market Size:

Signal Generator Market is forecasted to rise at a 6.75% CAGR, reaching USD 2.456 billion by 2030 from USD 1.772 billion in 2025.

A signal generator is an electronic device that generates electrical signals of different types and frequencies for testing and measurement purposes and the signals generated can be used to test and verify the performance of electronic components, circuits, and systems. Signal generators are used in research and development, production testing, quality control, and troubleshooting applications across a variety of industries, including electronics, telecommunications, aerospace, and defense. The market for signal generators is expected to grow due to the increasing demand for advanced signal generators with new features and capabilities and also due to increasing electronic testing and measurement equipment.

Signal Generator Market Growth Drivers:

- Growing consumer electronics usage and developments in telecommunication will boost the signal generator market.

The signal generator is used in applications like telecommunications, aerospace, defence, automotive, and electronics manufacturing as these require the generation of precise and controlled electrical signals for testing and calibration purposes. Signal generators are used for testing and calibration of communication systems, such as cellular networks, satellite systems, and radio and television broadcasting systems. The increasing adoption of new communication technologies, such as 5G, has created new opportunities for the signal generator market. According to Groupe Speciale Mobile Association (GSMA), 5G connections worldwide reached 310 million in 2021, up from 17 million in 2019. According to International Telecommunication Union (ITU), the number of fixed broadband subscriptions worldwide reached 1.2 billion in 2021, up from 720 million in 2010, and as the demand for 5G and high-speed broadband connections increases, the demand for signal generators is also expected to increase. The increasing usage of consumer electronics such as smartphones, tablets, and wearables and also the increasing adoption of wireless technologies such as Wi-Fi, Bluetooth, and NFC in electronic devices which has created a need for signal generators. According to the Consumer Technology Association (CTA), the total sales of consumer electronics in the United States reached $442 billion in 2020, a 7.5% increase from the previous year, and predicted that global spending on consumer electronics will reach $1.1 trillion in 2021, a 3.9% increase from 2020. This demonstrates that demand for the signal generator will increase due to the increased development of new electronics and telecommunication technologies.

Signal Generator Market Geographical Outlook:

- During the forecast period, the Asia Pacific region is expected to hold a significant market share

Asia-Pacific is expected to hold significant market shares in the signal generator market due to increasing demand for electronic devices and the adoption of new technologies such as 5G, IoT, and AI in China, India, and South Korea. In 2020, the Chinese government announced a new five-year plan that includes investments of over $1.4 trillion in various industries, including the electronics industry and the plan includes measures to support the development of 5G technology, artificial intelligence, and other advanced technologies. The Chinese government has been investing heavily in the infrastructure needed to support 5G networks and the government planned to build over 600,000 5G base stations by the end of 2021. Also, in 2019, the Indian government launched the National Policy on Electronics (NPE) to create a conducive environment for the development of the electronics industry in India. These factors all add to the market growth of signal generators in the Asia Pacific region.

List of Top Signal Generator Companies:

- Tektronix Inc.

- Tabor Electronics Ltd.

- Keysight Technologies Inc.

- SHF Communications Technologies AG

- Good Will Instruments Co. Ltd

Segmentation:

- SIGNAL GENERATOR MARKET BY TYPE

- Function Generator

- Arbitrary Function Generator

- Radio Frequency (RF) Signal Generator

- Others

- SIGNAL GENERATOR MARKET BY WAVE

- Sine

- Square

- Triangular

- Arbitrary Waves

- Others

- SIGNAL GENERATOR MARKET BY END-USER

- Electronics

- Communications

- GLOBAL MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America