Report Overview

Wind Turbine Generator Market Highlights

Wind Turbine Generator Market Size:

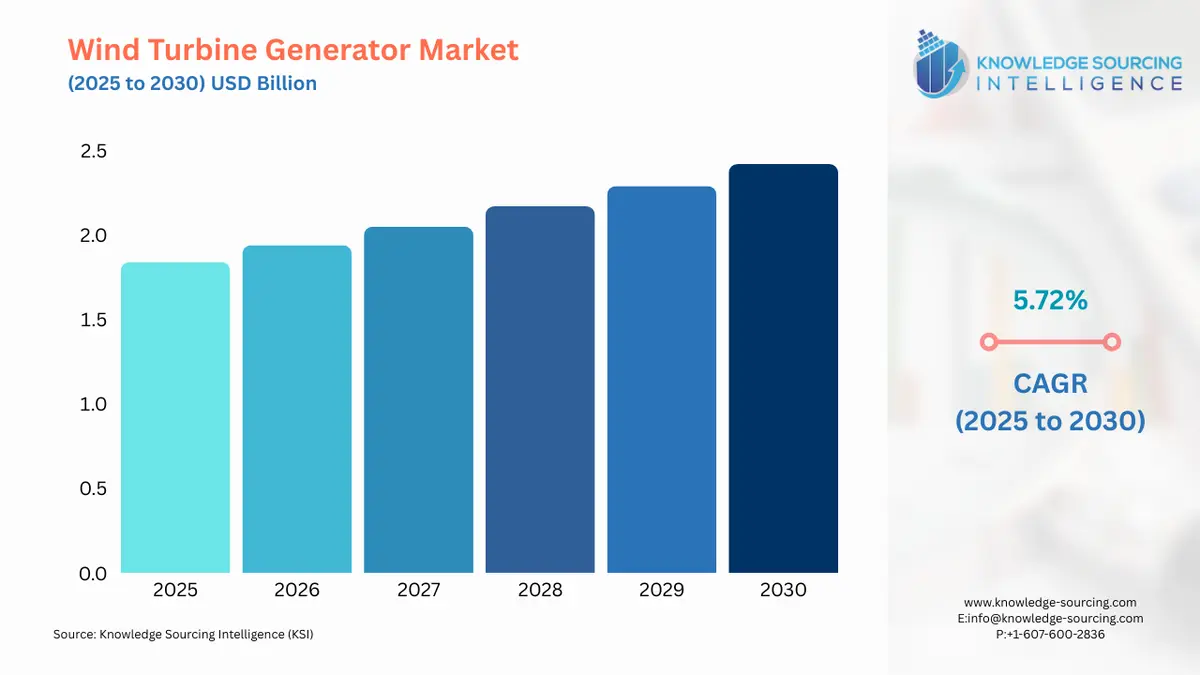

Wind Turbine Generator Market, with a 5.72% CAGR, is expected to grow to USD 2.424 billion in 2030 from USD 1.836 billion in 2025.

Mechanical energy is converted to electrical energy by the wind turbine generator. Wind turbine generators are unique in comparison to conventional producing units that are typically connected to the electrical grid. As wind turbine generators are equipped with simple technology that makes operation simple and lowers maintenance and operation costs, the electrical sectors have benefited from their introduction. Wind production has expanded as a consequence of the creation of very efficient wind turbines, yielding profitability and a comprehensive solution that ensures a sustainable future. According to (IRENA) International Renewable Energy Agency, the installed wind energy capacity globally has increased dramatically, from 180,846 MW in 2010 to 622,408 MW in 2019 which shows a trend in the potential growth of the wind turbine generator market. Additionally, the market is being driven by the growing awareness of the use of renewable energy, as wind power generators are one of the quickly deploying sources due to their advantages over other energy sources, such as the cost-effectiveness of wind power and land-based utility-scale wind, which is one of the least expensive energy sources.

Wind Turbine Generator Market Growth Drivers:

- The increasing demand for wind energy will boost the market growth

Wind energy reduces the price volatility that fuel contributes to traditional energy sources since its power is provided at a set price over a lengthy period of time. Its fuel is free for a long time (20 years). A combination of production tax incentives and advancements in wind power technology efficiency have fuelled the increase of wind energy demand, resulting in very cheap wind energy. As the installation of wind energy has increased which has increased wind energy production due to the above benefits the demand for wind turbine generators will also increase at a rapid pace. For instance, in 2021 according to IEA, the energy production from wind grew by a record 273 TWh (up 17%). Its growth rate was the greatest of all renewable energy technologies and was 55% greater than that of 2020. Wind energy continues to be the most popular non-hydro renewable energy source, producing 1870 TWh in 2021. Because wind is free, operational costs are lower than with competing technologies due to which turbines and generators run in an automated mode with minimum maintenance required during their lifetime, driving demand for wind energy and boosting the wind turbine generator market.

- The horizontal axis wind turbine segment will boost the market growth.

The horizontal axis wind turbine's (HAWT) primary rotor shaft and electrical generator are positioned at the top of the tower and can be rotated either toward or away from the prevalent wind direction using a simple wind vane. The horizontal axis wind turbine is crucial in the renewable energy market in terms of wind energy because it has been produced for over three decades, in contrast to the previous 10 years, when the bulk of vertical axis wind turbines (VAWT) were produced. The HAWT's technological and economic benefits with the capacity of energy it produces propel it forward. According to EIA, horizontal axis wind turbines are often manufactured to have a capacity between 2 and 8 MW more than vertical axis wind turbines, and the Horse Hollow Wind Energy Center in Texas, one of the biggest wind farms in the US, featured 422 horizontal axis wind turbines on over 47,000 acres as of the end of 2021. The project's total ability to produce power is around 735 megawatts. These high-speed winds benefit from the low cost, ease of maintenance, high power generation and absence of a professional staff of the horizontal axis wind turbine is driving this type of turbine forward which will boost the wind turbine generator market during the forecasted period.

Wind Turbine Generator Market Geographical Outlook:

- During the forecast period, the Asia Pacific region will dominate the wind turbine generator market

Asia-Pacific is expected to lead the wind turbine generator market in the years to come. The market for wind turbine generators, particularly industrial and residential-scale models, has enormous potential to grow in this area. As this region holds a huge amount of wind energy capacity in different countries the demand for wind turbine generators is anticipated to increase. For instance, according to IEA, China has the most wind power producing capacity in the world, with 288.3 GW installed capacity as of 2020, and was responsible for around 70% of the growth in wind generation in 2021. The country added 25.65 MW of SWTs in 2020, increasing its total installed capacity to 610.6 MW. The nation first provided FiT from onshore wind in 2009; it is presently available for wind turbines with FiT prices ranging from EUR 13.4 to 20.1 ct/kWh. As per the same source, the fourth-largest installed wind power capacity in the world is in India. The nation's installed wind power capacity was 38.6 GW as of 2020. 1,02,788 MW has been calculated as the maximum amount of wind power that might be generated for grid interaction at sites with wind power densities greater than 200 W/sq. m at 80 m hub height and just 2% land availability. In October 2022, according to the Union Minister of State for Renewable Energy, Chemicals, and Fertilizers, India's first 4.20 MW wind turbine generator, a single unit with the biggest generation capacity, was erected at Vadalivilai near Valliyoor in the Tirunelveli district. This shows the potential of the Asia-Pacific region in the sector of wind energy, and due to the increase in wind energy production, the requirement for wind turbine generators will rise in this region, which is expected to boost the market's growth during the forecasted period.

Segmentation

- WIND TURBINE GENERATOR MARKET BY GENERATOR TYPE

- PMSG (Permanent-Magnet Synchronous)

- WRSG/EESG (wound/electrically-excited synchronous)

- DFIG (doubly-fed induction)

- SCIG (squirrel-cage induction)

- WIND TURBINE GENERATOR MARKET BY TURBINE TYPE

- Horizontal-Axis

- Vertical-Axis

- WIND TURBINE GENERATOR MARKET BY DEPLOYMENT

- On-Shore

- Off-Shore

- WIND TURBINE GENERATOR MARKET BY END-USER

- WIND TURBINE GENERATOR MARKET BY GEOGRAPHY

-

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America