Report Overview

Proximity Sensor Market Size, Highlights

Proximity Sensor Market Size:

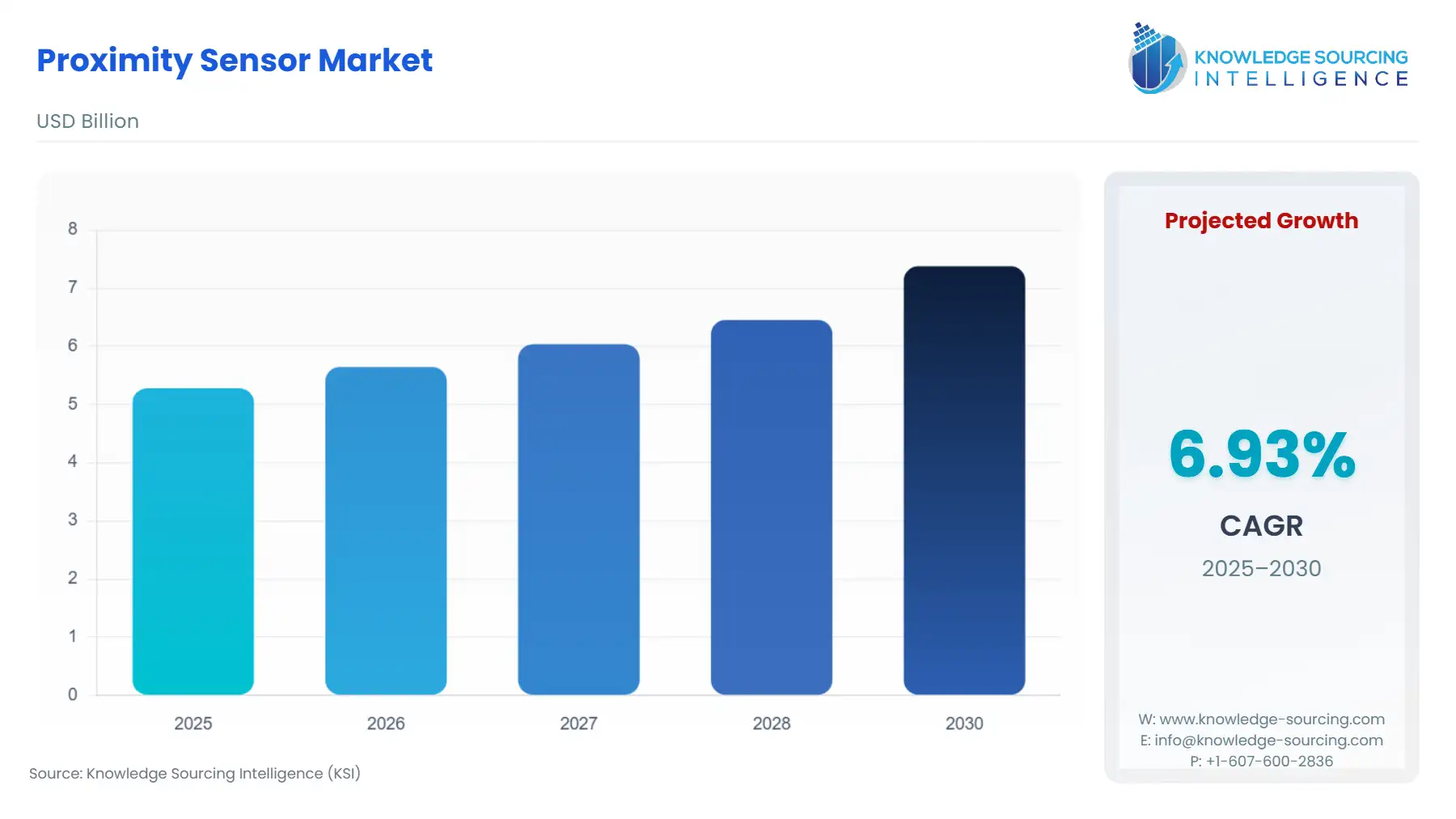

The proximity sensor market is expected to grow at a CAGR of 6.93% from US$5.28 billion in 2025 to US$7.38 billion in 2030.

The proximity sensor market encompasses a range of technologies, including inductive, capacitive, photoelectric, and magnetic sensors, all designed to detect the presence or absence of nearby objects without physical contact. These non-contact solutions serve as foundational components across virtually all industrial and consumer electronic applications, translating physical parameters into electrical signals for machine control and human-device interaction. The current market is defined by a dichotomy: the high-volume demand from mature, cost-sensitive consumer electronics sectors versus the high-specification, high-reliability demand originating from industrial and medical applications.

Proximity Sensor Market Analysis

- Growth Drivers

The global mandate for operational efficiency and safety in automated environments is the critical growth driver, directly increasing the Bill of Materials (BOM) requirement for proximity sensing in new capital equipment. Industrial manufacturing's pivot to Industry 4.0 technologies necessitates the deployment of thousands of new sensors to monitor real-time machine status and part positioning on assembly lines. This digital transformation creates a non-negotiable demand for inductive sensors that offer high switching frequencies and environmental ruggedness. Simultaneously, the proliferation of consumer wearable devices in health and wellness, like smartwatches and continuous health monitors, increases demand for ultra-small, low-power capacitive sensors for human interface detection and non-invasive vital sign monitoring.

- Challenges and Opportunities

A primary challenge involves the supply chain volatility of key electronic components, such as rare-earth elements in magnetic sensors and silicon wafers, leading to longer lead times and upward pricing pressure that constrain mass-market product margins. This complexity acts as a headwind, particularly for high-volume consumer electronics producers. Conversely, a significant opportunity lies in the burgeoning Hospital Automation segment. The move towards contactless patient interaction, automated drug dispensing, and surgical robotics, driven by hygienic imperatives, creates a high-margin opportunity for specialized photoelectric and capacitive sensors that meet stringent medical device standards. These applications command superior specifications for cleanliness and reliability, justifying higher component costs and fueling revenue growth.

- Raw Material and Pricing Analysis

Proximity sensors, as physical hardware, are inextricably linked to the supply chain dynamics of specific materials. Inductive and magnetic sensor cores rely on specialized ferrites and other magnetic materials, the pricing of which is dictated by the extraction and processing of raw elements. Photoelectric sensors, based on optical principles, require high-purity silicon for the photo-detector and emitter components, linking their cost directly to the global semiconductor fab capacity and pricing structure. Furthermore, the specialized plastics and resins used for housing and encapsulation, essential for achieving the high ingress protection (IP) ratings required in industrial and automotive applications, contribute significantly to the final sensor unit cost. The current inflationary environment for commodities and energy creates sustained upward pressure on manufacturing costs across all sensor types.

- Supply Chain Analysis

The global supply chain for proximity sensors is highly tiered and complex, anchored by key production hubs in Asia-Pacific, particularly China, Taiwan, and South Korea, which dominate the fabrication of the underlying semiconductor components and the final sensor assembly. The logistical complexity is defined by a reliance on highly specialized component suppliers (e.g., for ASIC chips, lenses, and magnetic cores) and the need for rapid, high-volume shipping to major end-user manufacturing centers, such as automotive assembly plants in North America and industrial machinery producers in Europe. Any disruption in East-West shipping routes or trade-related tariff changes creates immediate constraints on the entire supply chain, impacting inventory levels and forcing manufacturers to implement dual-sourcing strategies.

Proximity Sensor Market Government Regulations

Government regulations are an increasingly influential determinant of sensor design specifications and market expansion, particularly in safety-critical applications.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union (EU) |

Machinery Directive (2006/42/EC) |

Mandates strict machine safety standards, compelling manufacturers to integrate redundant, certified safety-rated proximity sensors (e.g., photoelectric light curtains, safety switches) to ensure operator protection, thereby increasing demand for specific, compliant sensor models. |

|

United States |

Food and Drug Administration (FDA) & Medical Device Regulation |

Imposes rigorous quality, reliability, and material standards for sensors used in medical devices and surgical robotics, creating a barrier to entry but accelerating demand for certified, high-end sensors in the Medical Devices end-user segment. |

|

International |

International Electrotechnical Commission (IEC) Standards (e.g., IEC 60947-5-2) |

Establishes uniform technical specifications and testing procedures for proximity sensors, standardizing performance and encouraging global trade, which streamlines the integration process for multi-national equipment manufacturers. |

Proximity Sensor Market Segment Analysis

- By Type: Inductive

The need for Inductive Proximity Sensors is critically tied to the increasing deployment of automated machinery within the Industrial Manufacturing and Automotive sectors. Inductive sensors function by generating an electromagnetic field and detecting the signal loss when a metal object enters that field, providing reliable, non-contact detection of metallic components. The core growth driver is the industry's imperative for high-speed, repeatable, and non-marring position feedback. In a typical automated factory, hundreds of these sensors are deployed per assembly line to monitor the precise position of tooling, clamp status, and the presence of metal parts passing through a production station. The ongoing global transition to smart factories, or Industry 4.0, requires high-frequency switching capabilities and superior noise immunity, which directly drives demand for premium, integrated circuit (IC)-based inductive sensors capable of communicating via protocols like IO-Link. This market profile prioritizes operational reliability over unit cost, creating a steady revenue stream for manufacturers.

- By End-User: Medical Devices

The Medical Devices end-user segment is a high-value consumer of proximity sensing technology, primarily propelled by the need for enhanced patient safety and non-invasive monitoring. The adoption of proximity sensors in this sector is driven by the regulatory and clinical shift toward precise, non-contact measurements and sterile operating environments. For example, highly sensitive capacitive sensors are now mandated in fluid management and dosage systems to detect liquid levels without compromising sterility, eliminating the risk of cross-contamination. Furthermore, the rise of home-based Patient Monitoring Systems increases the demand for compact, low-power photoelectric and capacitive sensors for non-contact fall detection, movement monitoring, and heart rate measurement in wearable patches and remote bedside devices. This segment's growth is characterized by a non-price-elasticity; functionality, certification, and long-term reliability are the core purchasing criteria, commanding premium pricing.

Proximity Sensor Market Geographical Analysis

- US Market Analysis (North America)

The US market is defined by high-specification demand from two key sectors: Aerospace/Defense and advanced Medical Devices. The regulatory environment, particularly FDA certification for medical technology, creates a strong demand pull for domestic or certified international sensors. Local factors, including significant private and government investment in advanced manufacturing and the reshoring of critical production, prioritize high-precision, networked sensors that comply with strict cybersecurity and data integrity protocols. This focus on premium, integrated solutions elevates the average selling price (ASP) of proximity sensors in the US compared to volume-driven markets.

- Brazil Market Analysis (South America)

The Brazilian market is largely concentrated in the Automotive and Mining/Raw Material Processing sectors. The domestic automotive industry, driven by local production and export requirements, mandates the integration of standardized magnetic and photoelectric sensors for powertrain and vehicle control systems. The substantial mining sector drives demand for rugged, heavy-duty inductive sensors with high IP ratings, necessary for reliable object detection and machinery positioning in harsh, corrosive environments. Market growth is sensitive to macroeconomic stability and foreign direct investment in core manufacturing infrastructure.

- Germany Market Analysis (Europe)

Germany stands as a central European hub for proximity sensor demand, driven by its world-leading position in Industrial Automation and Machinery (Industrie 4.0). German-based manufacturers of machine tools and high-precision automation equipment embed sophisticated, safety-certified inductive and photoelectric sensors into their export-oriented products, creating sustained demand for premium, performance-optimized components. Strict adherence to EU Machinery Directives further increases the need for safety-rated sensors. Local R&D intensity pushes continuous demand for sensors with higher resolution and integrated processing capabilities.

- UAE Market Analysis (Middle East & Africa)

The UAE market exhibits demand primarily driven by large-scale Infrastructure and Building Automation projects, alongside significant, specialized requirements from the Oil & Gas sector. Smart city initiatives and the rapid construction of modern commercial and residential facilities create a strong pull for photoelectric and capacitive sensors used in access control, elevator systems, and utility monitoring. The oil and gas industry requires explosion-proof (Ex-rated) proximity sensors for hazardous area applications, a niche segment characterized by extremely high safety requirements and minimal price sensitivity, specifically driving demand for certified, robust inductive solutions.

- China Market Analysis (Asia-Pacific)

China is the world's most significant market for proximity sensors, acting as both a colossal manufacturing base and a massive end-user consumer. The core growth driver is a dual-engine phenomenon: high-volume, cost-competitive demand from the domestic Consumer Electronics assembly industry and an escalating, high-specification requirement from the state-led shift toward advanced industrial automation. The sheer scale of domestic production for smartphones, appliances, and industrial machinery guarantees high demand across all sensor types, although price pressure for low-end components remains intensely competitive. The government's focus on national technological self-sufficiency further fuels localized supply chain development.

Proximity Sensor Market Competitive Environment and Analysis

The competitive landscape is fragmented yet dominated at the high-end by a few multinational conglomerates that leverage their extensive patent portfolios, global distribution networks, and deep integration with major industrial automation platforms. These leaders focus on developing integrated, intelligent sensors with embedded microprocessors and communication capabilities. The mid-to-low end is characterized by intense price competition, largely from Asia-Pacific manufacturers, specializing in high-volume, standard-specification components.

- Honeywell International

Honeywell is strategically positioned as a high-reliability supplier, primarily focusing on advanced and specialized sensing technologies for the Aerospace, Industrial, and Medical sectors. The company leverages its proprietary sensing technology and global regulatory compliance expertise to deliver high-precision, application-specific proximity sensors, particularly in arduous, mission-critical environments. Its strategy emphasizes a solutions-based approach, integrating sensors with broader control and automation platforms rather than competing on volume or unit cost. Key product areas include specialized high-temperature magnetic sensors and explosion-proof (Ex-rated) inductive sensors for hazardous environments.

- Omron

Omron focuses on the Industrial Automation segment, where it maintains a dominant market share in numerous regions through a comprehensive portfolio of photoelectric, inductive, and fiber optic sensors. The company's strategic positioning revolves around providing complete factory automation solutions, ensuring seamless integration of its proximity sensors with its programmable logic controllers (PLCs) and other control components. Omron emphasizes robustness, ease of integration (via IO-Link technology), and reliability, targeting high-volume discrete and process manufacturing users.

Proximity Sensor Market Developments

- July 2024: STMicroelectronics launched a Single-Zone Direct Time-of-Flight (ToF) sensor. This new sensor is designed to enhance proximity sensing under high ambient light conditions. It's targeted for use in demanding environments like smart factories, advanced robotics, and various security systems, providing reliable, high-performance distance measurement.

- July 2024: Elliptic Labs started shipping its AI Virtual Proximity Sensor™ INNER BEAUTY on the HONOR X60i smartphone. This is a software-only virtual sensor that uses AI to turn existing hardware (like the speaker and microphone) into a proximity sensor, eliminating the need for a dedicated physical hardware component in the device.

Proximity Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Proximity Sensor Market Size in 2025 | US$5.28 billion |

| Proximity Sensor Market Size in 2030 | US$7.38 billion |

| Growth Rate | CAGR of 6.93% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Proximity Sensor Market |

|

| Customization Scope | Free report customization with purchase |

Proximity Sensor Market Segmentation:

BY TYPE

- Capacitive

- Photoelectric

- Inductive

- Magnetic

BY APPLICATION

- Automotive

- Consumer Electronics

- Industrial Manufacturing

- Home and Building Automation

- Others

BY END-USER

- Medical Devices

- Patient Monitoring Systems

- Surgical Robotics

- Hospital Automation

- Prosthetics and Rehabilitation

BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others