Report Overview

Pinch Valves Market - Highlights

Pinch Valves Market Size:

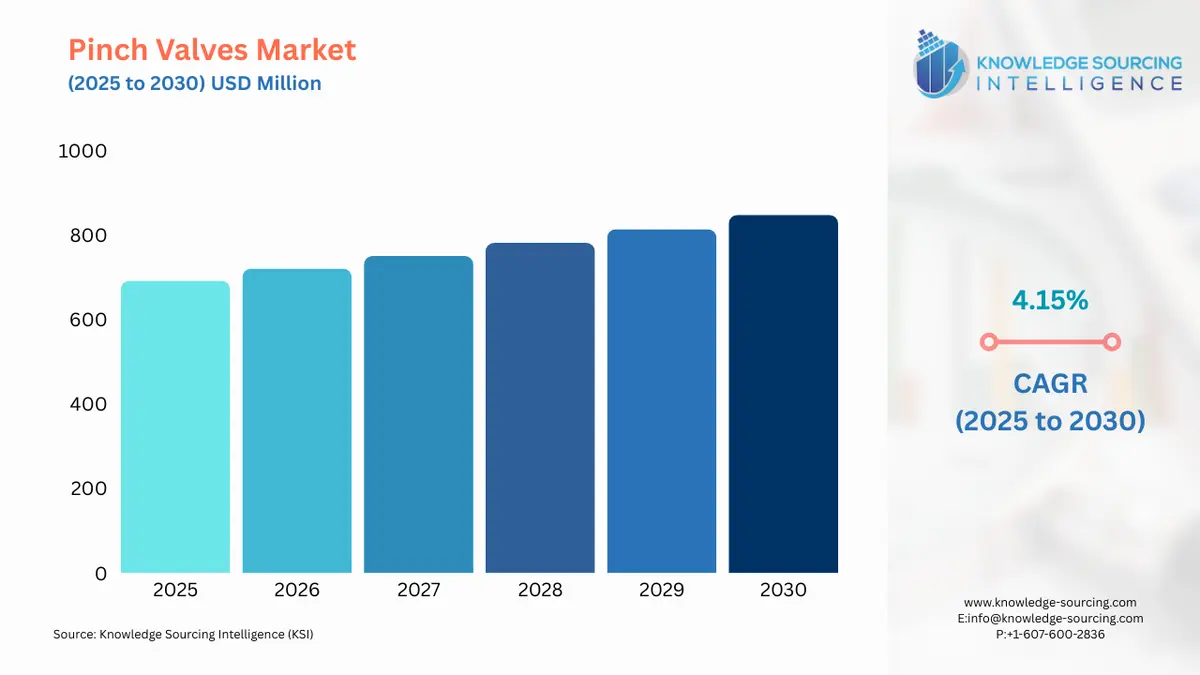

The pinch valves market, with a 4.03% CAGR, is expected to grow to USD 876.531 million in 2031 from USD 691.717 million in 2025.

Pinch Valves Market Trends:

A pinch valve is a type of control valve that employs a pinching mechanism to effectively obstruct the flow of fluid. It is designed with a full bore or fully ported configuration, allowing for efficient control over the fluid flow. The pinch valves market caters to various end-user industries, including automotive, chemical, mining, food & beverage, and others. The booming demand from major end-users such as automotive and food and beverage is prominently driving the pinch valve industry growth, thereby further expanding the overall market size.

Pinch Valves Market Segmentation Analysis:

High demand from automotive bolsters the pinch valves market growth.

Pinch valves are utilized for controlling and regulating fluid flow in coolant systems, fuel systems, pneumatic systems, and brake systems in the automotive. The automotive industry is experiencing significant growth driven by the rising demand for vehicles having improved safety and performance coupled with favourable investment inflows and policies. According to the International Organization of Motor Vehicle Manufacturers, In 2022, commercial vehicle production in Canada reached 939,364 units, reflecting a 10% growth compared to the previous year. Such growth expands the need for reliable control solutions like pinch valves leading to the growth of the pinch valve market.

Emerging food & beverage drives the pinch valves market expansion.

Pinch valves are extensively used in the food & beverage industry due to their hygienic design, easy cleanability, and compatibility with food-grade materials. These valves play a vital role in controlling the flow of liquids and semi-solid substances, ensuring precise portioning, filling, and dispensing in food processing and packaging applications. Owing to the growing global population the demand for processed and packaged food & beverage products is increasing. Thus fuelling the growth of the pinch valve industry. According to the Ministry of Industry and Information Technology, major beverage producers in China experienced a significant year-on-year increase of 12% in their output, surpassing 183 million tons in 2021.

The booming chemical sector drives pinch valves market growth.

Pinch valves are widely used in the chemical industry due to their suitability for handling corrosive chemicals and abrasive fluids. The chemical industry is experiencing growth due to increasing demand for speciality chemicals, expanding manufacturing capabilities, and stringent safety and regulatory standards. Owing to such growth the need for reliable, efficient, and safe flow control solutions intensifies, leading to an increased demand for pinch valves. According to the Department of Chemicals and Petrochemicals, the production of major chemicals in India witnessed notable growth in 2021, reaching a total of 1,05,12,189 metric tons (MT). This represents a significant increase of 14.83% compared to the previous year.

Pinch Valves Market Geographical Outlook:

Asia-Pacific region is anticipated to dominate the pinch valves market.

Asia-Pacific is expected to account for a significant share of the pinch valves market due to proactive government initiatives and investments aimed at expanding the food and beverage as well as chemical production capabilities. Moreover, the increasing focus on enhancing infrastructure is further encouraging industrial development. For instance, in the Union Budget 2022-23, the Department of Chemicals and Petrochemicals received an allocation of Rs. 209 crores from the Indian government. Also, in October 2022, through targeted grants, the government of Australia allocated $111.3 million to stimulate regional manufacturing, with a specific focus on expanding food manufacturing capability and capacity across Australia.

Pinch Valves Market Growth Drivers:

Alternative technologies availability restrains the pinch valve market growth.

Pinch valves encounter competition from a diverse range of alternative valve technologies existing in the market, including ball valves, gate valves, and butterfly valves. These alternative options present a variety of features, performance characteristics, and price points, thereby posing a challenge for the pinch valves industry. The availability of alternative valve types with varying functionalities and price considerations adds complexity to the decision-making process for end-users. For instance, in July 2022, Valworx recently launched stainless air-actuated sanitary butterfly valves which are designed with Tri-Clamp ends and are manufactured using materials that adhere to FDA, USDA, and 3-A standards.

Pinch Valves Market Company Products:

VMP Plastic Air Pinch Valves: Armaturen & Separationstechnik GmbH offers VMP Plastic Air Pinch Valves that provide lightweight and cost-effective solutions. These valves ensure a tight seal when closed and offer a full bore opening when opened, allowing unobstructed product flow. The valves are equipped with sleeves available in various options to handle abrasive materials, strong acids, and bases, as well as high-temperature applications. With their versatile capabilities, the VMP Plastic Air Pinch Valves cater to a wide range of industries and fluid handling needs efficiently and reliably.

VM-VMM: WAMGROUP S.p.A offers the VM and VMM valves that are specifically designed for intercepting material flow in pneumatic conveying systems and pipelines. These valves can also be utilized as locking devices for silo-filling pipes. With a working temperature range of -20 to 80 °C (-4 to 176 °F), they are suitable for various operating conditions. Notably, the VM valves boast exceptionally low air consumption, making them highly efficient. The VM and VMM valves provide reliable and versatile solutions for material flow control.

Series 70: Red Valve Company Inc. offers Series 70 manual pinch valves that feature a robust fabricated steel body, eliminating the need for heavy cast iron housing. These valves are designed with lightweight open-frame construction, providing easy visibility of the valve position. Additionally, they have the flexibility to accommodate special face-to-face dimensions, allowing for customized installations. The Series 70 manual pinch valves provide a durable and versatile solution for fluid control applications with their reliable construction and adaptability to various requirements.

Pinch Valves Companies:

Armaturen & Seperationstechnik GmbH

WAMGROUP S.p.A

Red Valve Company Inc.

Emerson Electric Co.

Onyx Valve Company

Pinch Valves Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Pinch Valves Market Size in 2025 | USD 691.717 million |

Pinch Valves Market Size in 2030 | USD 847.541 million |

Growth Rate | CAGR of 4.15% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Pinch Valves Market |

|

Customization Scope | Free report customization with purchase |

Pinch Valves Market Segmentation

By Type

Open Pinch Valves

Enclosed Pinch Valves

By Sleeve Type

Standard Sleeves

Double Wall Sleeves

Cone Sleeves

By End-User

Automotive

Chemical

Mining

Food & Beverage

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation

Page last updated on: September 26, 2025