Report Overview

Safety Valves Market - Highlights

Safety Valves Market Size:

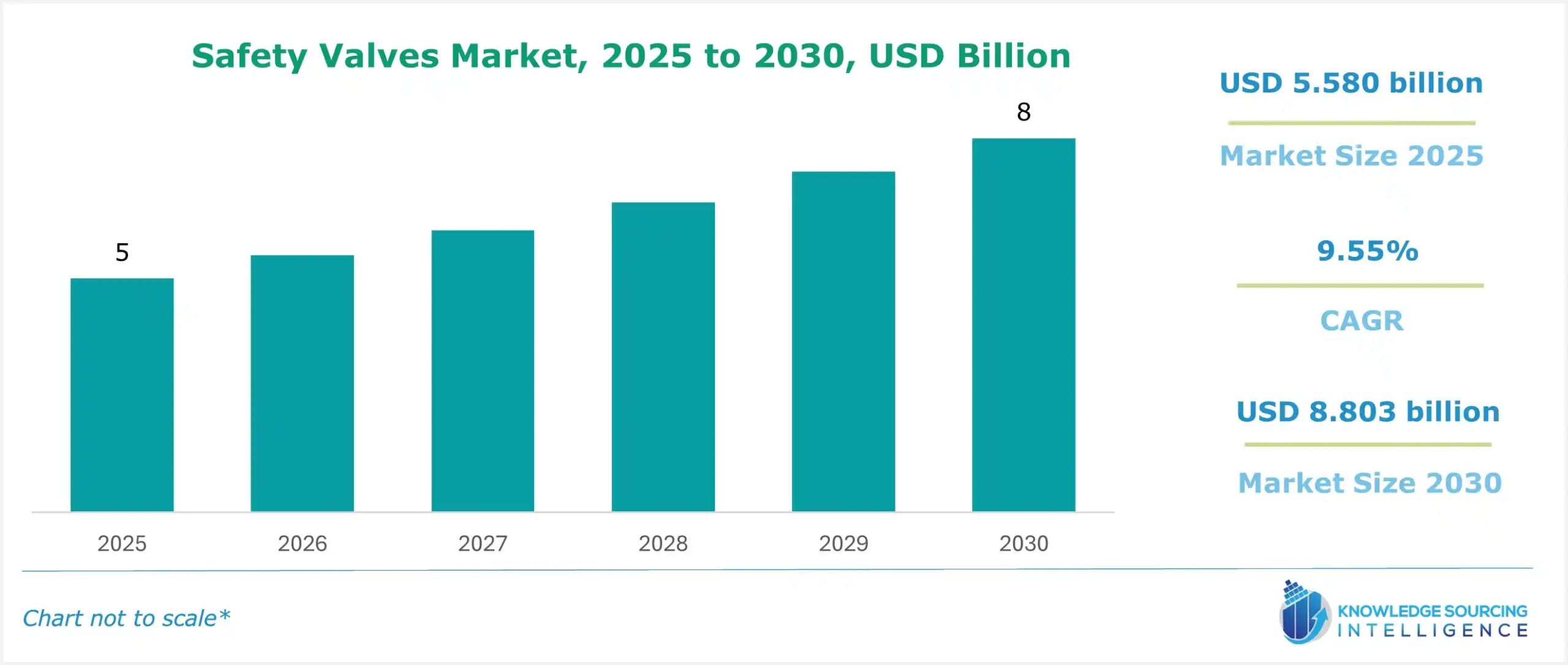

The safety valve market is projected to grow at a CAGR of 9.55% over the forecast period, increasing from US$5.580 billion in 2025 to US$8.803 billion by 2030.

A safety valve is a device, which is used across multiple industries, like oil & gas, petrochemicals, power & energy, and chemicals, among others, to ensure the industry’s safety. of the industry. These valves allow a controlled release of steam or gas when a higher pressure is built, and maintain an optimum pressure in the pipelines and containers. The main purpose of the safety valve is to release excess pressure from vessels and to prevent the excessive release of gases into the atmosphere.

Safety Valves Market Trends:

One of the major driving factors propelling the safety valves market is the increasing demand for chemicals and petrochemicals across multiple industries. With the rising demand for chemicals across the globe, the production of chemicals and petrochemicals grew significantly, creating an optimum opportunity for the safety valve growth in the industry. In the chemical industry, safety valves are used to control and release excessive pressure, which can damage the vessel or the system.

The production of chemicals in India has grown significantly over the past few years. The India Brand Equity Foundation, in its chemical report, stated that in April 2024, a total of 934.3 thousand MT of chemicals were produced in the nation, and 1,697 thousand MT of petrochemicals were produced. The total chemical production grew to about 949.5 thousand MT in May 2024, whereas the petrochemical production expanded to 1,820 thousand MT in the same period.

Safety Valve Market Growth Drivers:

- The rising production of crude oil is anticipated to fuel the safety valve market expansion.

Safety valves play a critical role in maintaining the safety and efficiency of the oil and gas industry. In this industry, the safety valves are used to prevent uncontrolled flow, which can further lead to major accidents. The growth of global oil and gas production across the globe is forecasted to increase the market share of safety valves worldwide.

Enerdata, in its report, stated that in 2023, global crude oil production expanded by 1%. The organization further stated that in 2022, 756 million tons of crude oil were produced by the USA, whereas about 598 million tons in Saudi Arabia and 544 million tons in Russia were produced in the same year. The total production increased in 2023 when about 820 million tons of crude oil were produced by the USA, whereas about 542 million tons and 535 million tons of crude oil were produced by Saudi Arabia and Russia, respectively.

- The increasing demand from the power generation industry is anticipated to fuel the safety valve market expansion.

Over time, the need for safety valves for power generation will grow quickly. The energy and power generation facilities' increasing emphasis on safety as they handle various pressured liquids and materials is anticipated to support the safety valve market growth in the coming years, which has also increased energy production. For instance, the electricity generation target (including renewable energy) for 2023-2024 was established at 1750 billion units (BU), which essentially translates into a rise of roughly 7.2% above the generated quantity of 1624.158 BU during the previous year (2022-2023). On the other hand, there was a generation figure of 1624.158 in 2022-2023, with an increase from the past year, circumstances being such that from 1,491.859 in the year before that (2021-2022) there had been an 8.87% rise.

Moreover, safety valves are used in machinery to prevent overpressure from exploding. However, safety valves in nuclear power plants also prevent radioactive materials from dispersing outside. As new nuclear power plants are constructed in future years, there will be a demand for isolation and safety valves used within them. For instance, the USA’s share of nuclear power generation was 779.19 TWh in 2023.

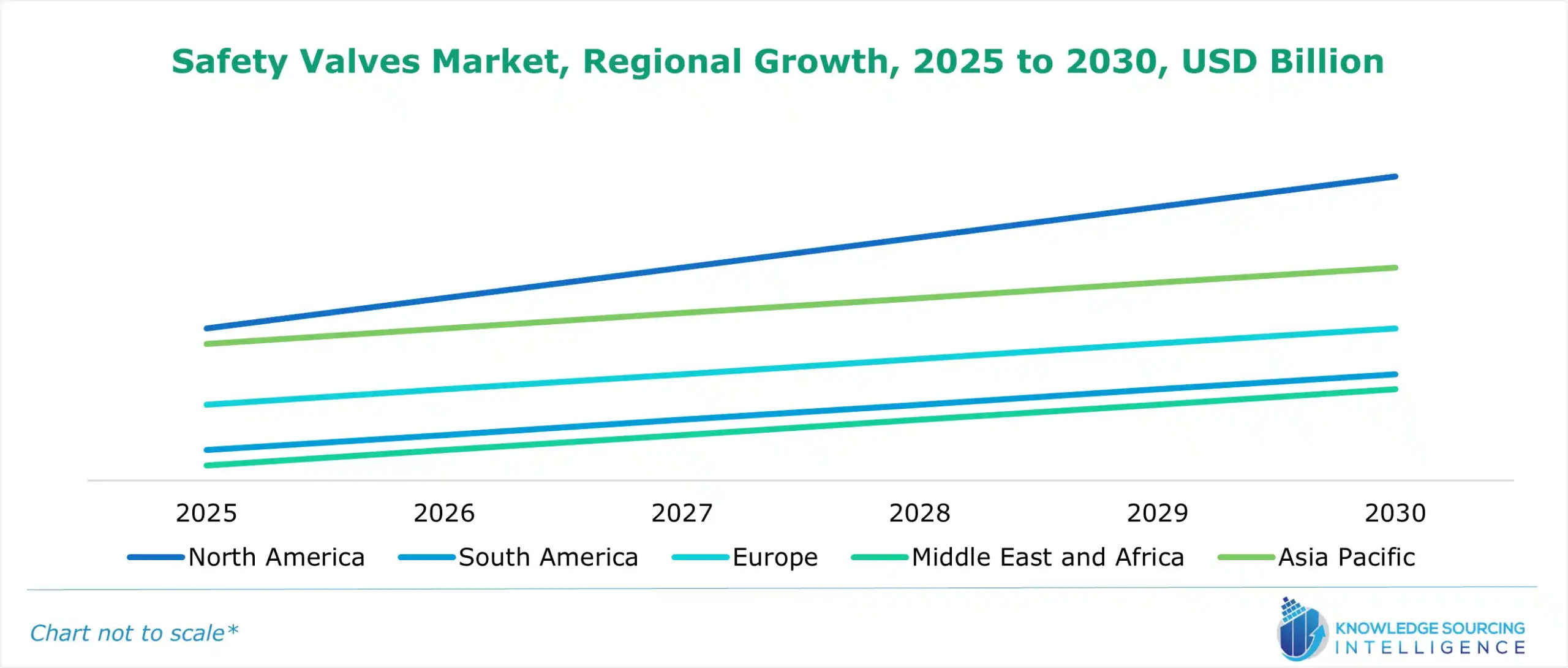

Safety Valve Market Geographical Outlook:

Based on geography, the safety valve market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The USA held the largest market share in the North American region. Safety valves can protect people and property from the dangers of over-pressuring. The market for safety valves in the United States is expected to grow moderately in the projected period, owing to the increasing demand for safety valves in various industries such as power generation, mining, and oil and gas. Additionally, the extensive use of these safety valves in chemical reactors, nuclear power plants, and steam boilers is anticipated to propel the market growth for safety valves in the forecasted period.

The growing power generation industry in the United States will positively impact the safety valves market in the coming years. For instance, in 2023, about 4,178 billion kilowatt-hours (kWh) or about 4.18 trillion kWh of electricity was generated at utility-scale electricity generation facilities in the United States. About 60% of this electricity came from fossil fuels, nuclear energy contributed to about 18.6%, and the remaining energy was generated from renewables. Hence, the growing power generation sector is anticipated to boost the market growth for safety valves.

Additionally, the growing adoption of safety valves in industries such as food and beverages and pharmaceuticals, among others, is expected to fuel the market in the coming years. For instance, in February 2022, GEA, one of the major companies operating in the United States, launched a new generation of valves for improved safety and hygiene production. These valves will provide safety in industries like food and beverages, dairy, and the pharmaceutical industries. Hence, multiple applications of safety valves in various industries are fueling the market growth.

According to the U.S. Energy Information Administration (EIA), in the United States in 2022, 4.07 trillion kWh of electricity was consumed. The electricity generated from nuclear power sources in 2022 was 772 billion kilowatt-hours, which grew to 775 billion kilowatt-hours in 2023. Similarly, the electricity generated from natural gas in 2022 was 1,687 billion kilowatt-hours, which grew to 1,802 billion kilowatt-hours in 2023. Hence, the rising electricity generation and the growing application of safety valves in these end-use sectors are anticipated to propel market growth in the coming years.

Safety Valve Market Recent Developments:

- October 2024- Danfoss announced new safety valves concerning the EVR and NRV lines in compliance with tight UL 60335-2-40 and 60335-2-89 standards. They are perfect for sealing off flammable refrigerant charges in case of leaks, thus minimizing the total releasable charge for higher-capacity systems.

Safety Valves Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Safety Valves Market Size in 2025 | US$5.580 billion |

| Safety Valves Market Size in 2030 | US$8.803 billion |

| Growth Rate | CAGR of 9.55% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Safety Valves Market |

|

| Customization Scope | Free report customization with purchase |

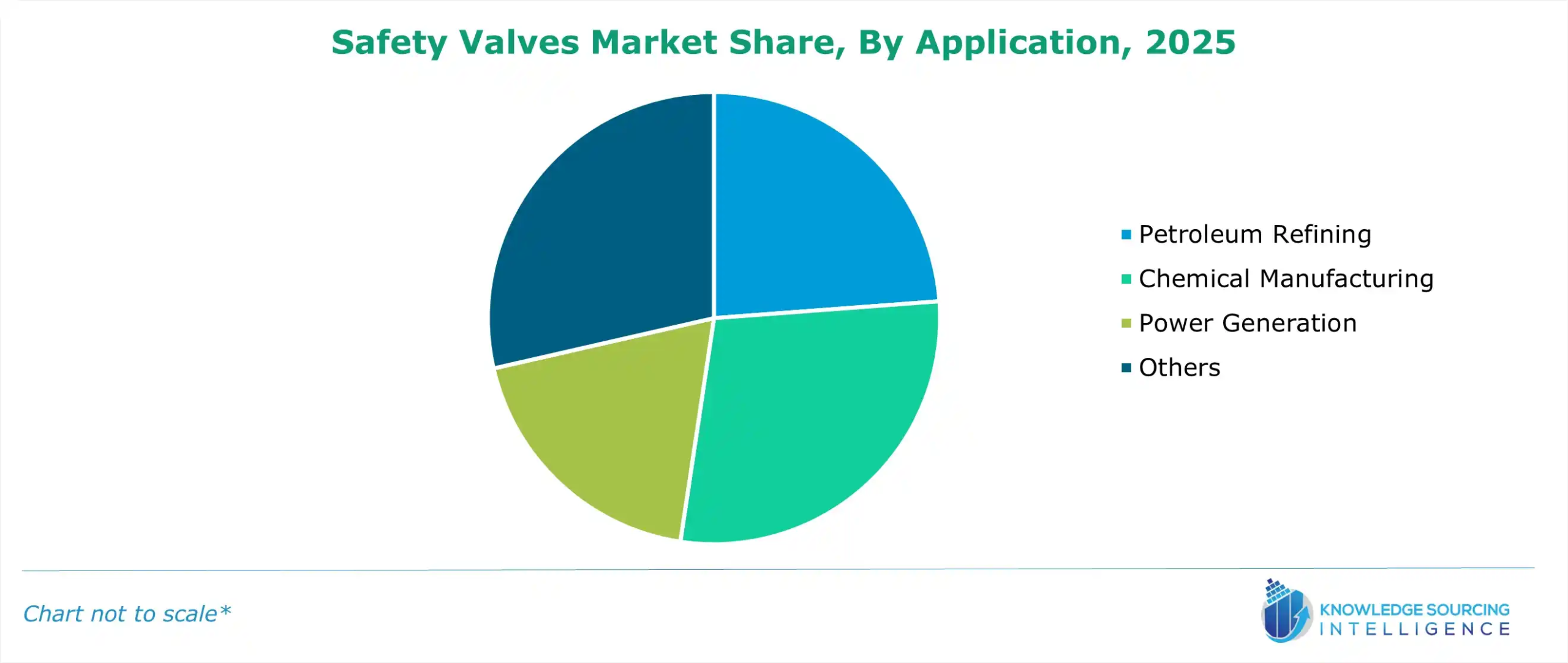

The safety valve market is analyzed into the following segments:

- By Valve Type

- Spring Loaded Safety Valves

- Pilot Operated Safety Valves

- Dead Weight Pressure Relief Valves

- By Material Type

- Cast Steel

- Cast Iron

- Bronze

- By Application

- Petroleum Refining

- Chemical Manufacturing

- Power Generation

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- United Kingdom

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Others

- North America