Report Overview

Global Mobile Water Treatment Highlights

Mobile Water Treatment Market Size:

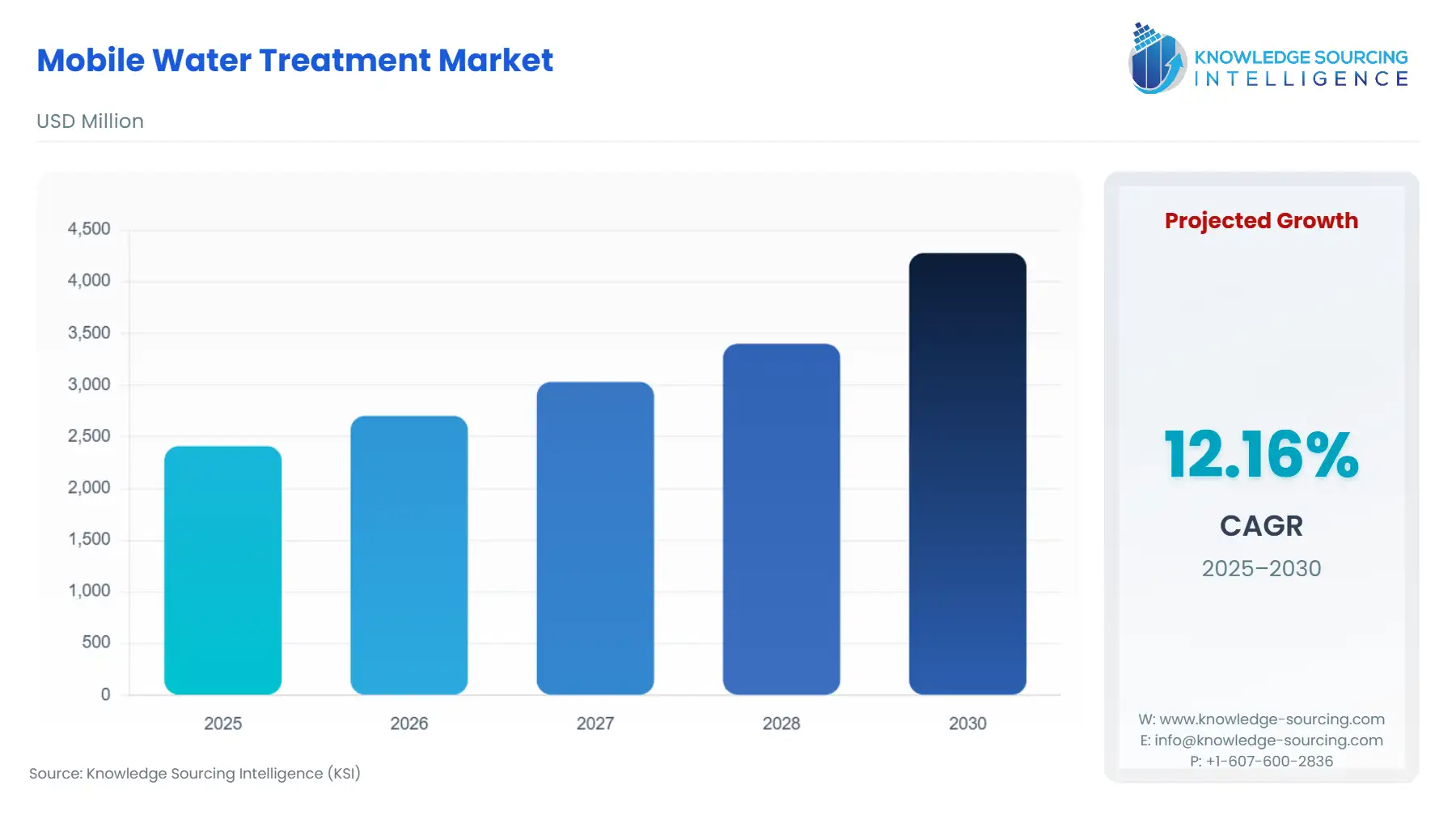

The mobile water treatment market is predicted to grow at a CAGR of 12.16% from US$2.410 billion in 2025 to US$4.278 billion by 2030.

Mobile water treatment systems are used when water delivery services are temporarily disrupted to provide a regular supply of safe drinking water. From any natural water source, including saltwater, surface water, seawater, ponds, and rivers, mobile treatment solutions can create purified water. Water contamination incidents are on the rise all over the world, which is the main driver of the worldwide mobile water treatment market. Additionally, the shrinkage of freshwater resources and the lack of water in arid regions have a significant impact on the expansion of the global market. However, the development of the market could be hampered by the manufacturing and implementation costs of mobile water treatment solutions.

What are the drivers of the Mobile Water Treatment Market?

- Increasing reservoir and treatment plant construction

The rapid expansion of reservoirs and wastewater and water treatment plants worldwide is one of the main factors fueling the growth of the global mobile water treatment market. Water scarcity has become a severe problem in many countries which increases the demand for clean water. Freshwater resources are being depleted quickly. By 2025, the U.S. Food and Agriculture Organisation projects that 1.9 billion people will reside in regions with a complete water shortage. Additionally, by 2025, about two-thirds of the world's population may be experiencing water stress. The World Data Lab estimates that 2.36 billion people live in locations with limited access to clean water.

The majority of the Middle Eastern and African nations, including Saudi Arabia and Egypt, are among the locations with extreme water shortages and water stress. In these areas, the average amount of water per person is less than 500 m3, and the area where the average amount of water per person is less than 1000 m3 is known as a water-scarce area. Reusing treated water is therefore the greatest option in these areas. As a quick, affordable, and dependable solution to the water crisis problem, mobile water treatment may be a good option in this situation. Any location can receive clean drinking water thanks to a mobile water treatment system that is mounted on a trailer.

Further, there has been a lot of investment in the wastewater treatment sector, there will likely be a significant increase in demand for mobile water treatment technology. The Winnipeg Sewer Treatment plant was built with a US$212.8 million investment from the Canadian government in July 2021. It is anticipated that further construction projects offer promising growth prospects.

- Investment in the wastewater treatment sector is aiding in mobile water treatment technology adoption

India is predicted to experience acute water scarcity by 2030 when water demand will be twice more than availability. It was also estimated that Swachh Bharat Mission-Urban 2.0 would cost INR 1,41,600 crores (about USD 18.998 billion) to implement its various components in the fiscal year 2021–2022. The Government of India contributed INR 36,465 crores (about USD 4.892 billion) of that total, with the remaining monies coming from other sources like CSR from the public and private sectors, outside aid, etc. It contains the budgetary allotment for national water and wastewater treatment.

- Increasing global population

Due to population growth, urbanization, and climate change, competition for water resources is expected to increase, with a particular impact on agriculture. The world’s population will continue to increase every year, adding approximately 1.4 billion people to reach an estimated 9.2 billion by 2040. This expansion in population will demand more water resources while quality water levels from natural sources continue to dip further.

What are the key geographical trends shaping the Mobile Water Treatment Market?

By geography, the mobile water treatment market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region such as ASEAN countries.

The Asia Pacific region is estimated to have a notable growth rate, attributed to the rising demand for clean water due to rapid urbanization and industrialization and diminishing freshwater resources around the globe. Additionally, with an increasing population and growing awareness regarding the health hazards of consuming contaminated water, especially in developing economies like China and India, the demand for mobile water treatment solutions is expected to grow significantly in the upcoming years.

The North American mobile water treatment market is segmented into USA, Canada, and Mexico. The ongoing and rising clean drinking water crisis is estimated to be the major factor propelling the region's mobile water treatment market growth. Due to the plunging water levels in the Colorado River, Mexico and American states such as Arizona and Nevada are estimated to be some of the worst affected regions, with Arizona expected to lose significant of its supply.

- The agricultural sector is projected to hold a significant share of the mobile water treatment market.

By end-users, the mobile water treatment market is divided into the municipality, construction, chemical, agriculture, and others. Agricultural activities and irrigation facilities are intertwined activities for increasing crop yield. Water is a critical input for agricultural production and is important to food security. Irrigated agriculture is, on average, at least twice as productive per unit of land as rain-fed agriculture, thereby allowing for more production intensification and crop diversification. Increasing productivity and the ability to feed the growing population calls for better irrigation facilities. The mobile water treatment facilities can produce purified water from any natural and contaminated water sources, which can irrigate the crop field, thereby reducing water wastage.

Key developments in the Mobile Water Treatment Market:

The market leaders for the Mobile Water Treatment Market are Veolia Water Technologies, GE Water, Evoqua Water Technologies LLC, SUEZ Water, Pall Corporation, Organo Corporation, Degremount, Ramky Enviro Engineers Limited, and Ecolutia Service. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc. to gain a competitive advantage over their competitors. For Instance,

- In April 2024, Xylem introduced new mobile technology that would help the water utilities meet compliance requirements for emerging drinking water contaminants such as PFAS. The MitiGATOR Mobile System can be quickly deployed to allow utilities to immediately begin reducing PFAS. It can also be used to provide important technology data.

- In March 2024, Gradiant announced a mobile turnkey water treatment system designed to supply demineralized water essential for power generation at a major integrated petrochemical and refining complex located in Malaysia. The end-user is a global energy company.

- In September 2023, NSI Mobile Water Solutions announced the acquisition of a notable segment of Pall Water's European mobile water fleet, which includes Pall Aria Containerized units.

Global Mobile Water Treatment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Mobile Water Treatment Market Size in 2025 | US$2.410 billion |

| Mobile Water Treatment Market Size in 2030 | US$4.278 billion |

| Growth Rate | CAGR of 12.16% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Mobile Water Treatment Market |

|

| Customization Scope | Free report customization with purchase |

Mobile Water Treatment Market Segmentation:

- By Product Type

- Resin Mobile Water Treatment

- Membrane Mobile Water Treatment

- Filtration Mobile Water Treatment

- Others

- By End-user

- Municipal

- Construction

- Chemical

- Agriculture

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America