Report Overview

Healthcare Payer Services Market Highlights

Healthcare Payer Services Market Size:

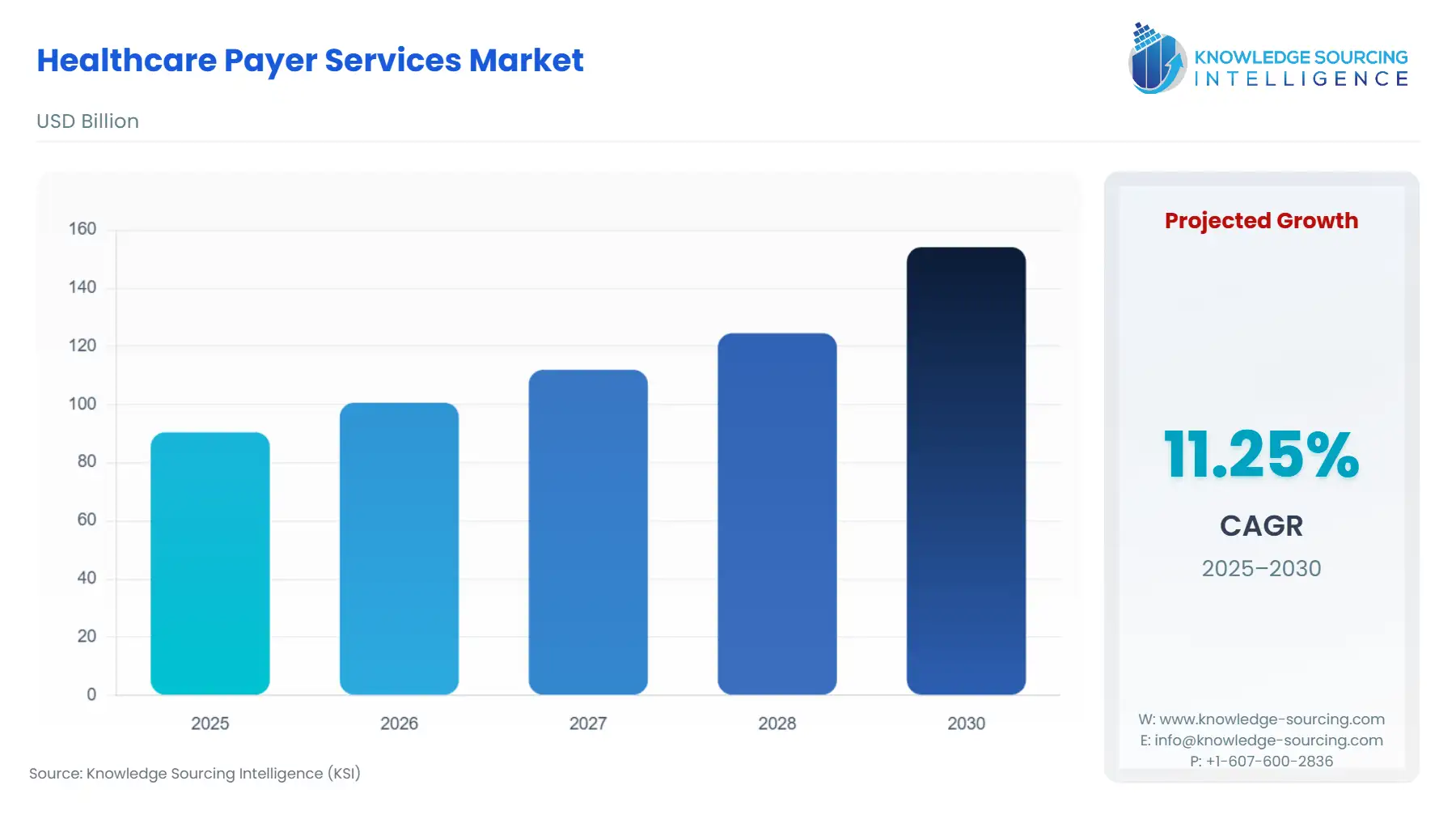

Healthcare Payer Services Market, with a 10.91% CAGR, is forecasted to rise from USD 90.453 billion in 2025 to USD 168.386 billion in 2031.

Healthcare Payer Services Market Trends:

Healthcare payer services are the administrative and support functions that are necessary to manage the financial aspects of healthcare These services handle tasks like claims processing, member enrolment, benefit management, customer service, utilization review, provider network management, payment processing, data analytics, and regulatory compliance. They ensure smooth insurance operations, manage costs and facilitate quality care for members. The rising healthcare cost coupled with the increased prevalence of chronic diseases and the ageing population has emerged as a significant driving force behind the substantial growth of the healthcare payer services industry.

Healthcare Payer Services Market Growth Drivers:

Increased prevalence of chronic diseases bolsters the healthcare payer services market growth.

Chronic conditions like diabetes, heart disease, and cancer are increasingly becoming more prevalent. These diseases require ongoing care, which is expensive. Healthcare payer services can help to manage the costs of chronic diseases by developing and implementing disease management programs. For instance, In 2020, the World Health Organization reported nearly 10 million global deaths attributed to cancer, marking it as a significant global health issue. Lung cancer led the tally in cancer-related fatalities, followed by colon and rectum, liver, stomach, and breast cancers. As chronic illnesses rise among global populations, healthcare service demand grows, driving substantial growth within the healthcare payer sector.

The ageing population drives the healthcare payer services market growth.

With the growing ageing population, the need for effective healthcare services is on the rise. This is driving up the cost of healthcare, which is putting pressure on payers to find ways to control costs. Healthcare payer services can help payers to manage costs by negotiating lower rates with providers, implementing utilization review programs, and preventing fraud and abuse. For instance, according to a 2021 report by the World Health Organization (WHO), the projection for 2030 indicates that 1 in every 6 individuals globally will be aged 60 years or older. Furthermore, the anticipated growth from 2020 to 2050 suggests a tripling in the number of individuals aged 80 years or more, reaching 426 million.

Rising healthcare cost drives the healthcare payer services market expansion.

As healthcare expenses continue to rise globally, the demand for efficient management and cost containment becomes paramount. Payer services play a pivotal role in addressing this challenge by streamlining administrative processes, optimizing resource utilization, and negotiating favourable terms with healthcare providers. The increased complexity and scale of healthcare expenditure necessitate robust systems for managing claims, processing payments, and verifying coverage details which are all integral functions provided by payer services. The surge in demand for insurance plans to mitigate the financial burden also fuels the growth of payer services, prompting innovation in coverage options and the development of cost-effective care models.

Healthcare Payer Services Market Geographical Outlook:

North America is anticipated to dominate the market.

North America is projected to account for a major share of the healthcare payer services market owing to the region’s large ageing population, high prevalence of chronic diseases and increasing healthcare costs, particularly in countries like the United States and Canada. For instance, according to the National Center for Chronic Disease Prevention and Health Promotion, six in ten Americans experience at least one chronic illness, while four in ten adults face a minimum of two chronic conditions, such as heart disease, stroke, cancer, or diabetes, underscoring the high prevalence of chronic disease and the need for robust healthcare payer services in the region.

Healthcare Payer Services Market Challenges:

Data breaches will restrain the healthcare payer services market growth.

The growth of the healthcare payer services industry may be restrained by Data breaches and loss of confidentiality. The healthcare industry handles a vast amount of sensitive patient data, including names, addresses, dates of birth, medical histories, and financial information. This sensitive data is highly sought after by cybercriminals who can use it for financial gain, identity theft, and other malicious purposes. Outsourcing payer services can introduce additional risk to this sensitive data, as it is often stored and managed by third-party vendors. For instance, according to the HIPAA In 2022, there was an average daily report of 1.94 healthcare data breaches involving 500 or more records. This poses a challenge to the market's expansion and may require Robust encryption and secure data storage methods to help safeguard sensitive information.

Healthcare Payer Services Market Company Products:

TCS User Engagement Platform: TCS’ User Engagement Platform, operates on a 'mobile first' approach, fostering 'patient-centric' care through a mobile solution. It serves as a central hub for patient inquiries concerning wellness, claim reimbursements, health plan options, and test results. This platform offers immediate access to current healthcare data gathered from various channels. Patients can conveniently retrieve digital prescriptions and access a range of medical services via their dedicated portal.

Healthcare payer solutions: EXL Healthcare payer solution leads in value-based transformation, elevating cost, quality, and member/provider experience. Their profound industry knowledge and broad healthcare capabilities uniquely enable them to surpass the needs of providers, members, and stakeholders. Leveraging vast data, advanced analytics, and digital skills alongside domain expertise, they enhance care quality and patient outcomes.

Medical Bill Review: WNS medical bill review (MBR) services streamline front-end tasks, bill and code reviews, and medical management to enhance accuracy, process efficiency, regulatory compliance, and customer satisfaction while cutting costs. They utilize top-notch technology and in-house expertise to ensure efficient MBR operations and exceptional results.

List of Top Healthcare Payer Services Companies:

Vee Technologies

WNS

Hexaware Technologies

Change Healthcare

Conduent

Healthcare Payer Services Market Scope:

Report Metric | Details |

Healthcare Payer Services Market Size in 2025 | USD 90.453 billion |

Healthcare Payer Services Market Size in 2030 | USD 154.154 billion |

Growth Rate | CAGR of 11.25% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Healthcare Payer Services Market |

|

Customization Scope | Free report customization with purchase |

Healthcare Payer Services Market Segmentation

By Payer Type

Public

Private

Commercial

By Service Type

Business Process Outsourcing (BPO)

Information Technology Outsourcing (ITO)

By Application

Patient Claim Management

Billings & Revenue Management

Member Enrollment Service

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others