Report Overview

Global Cryostat Market - Highlights

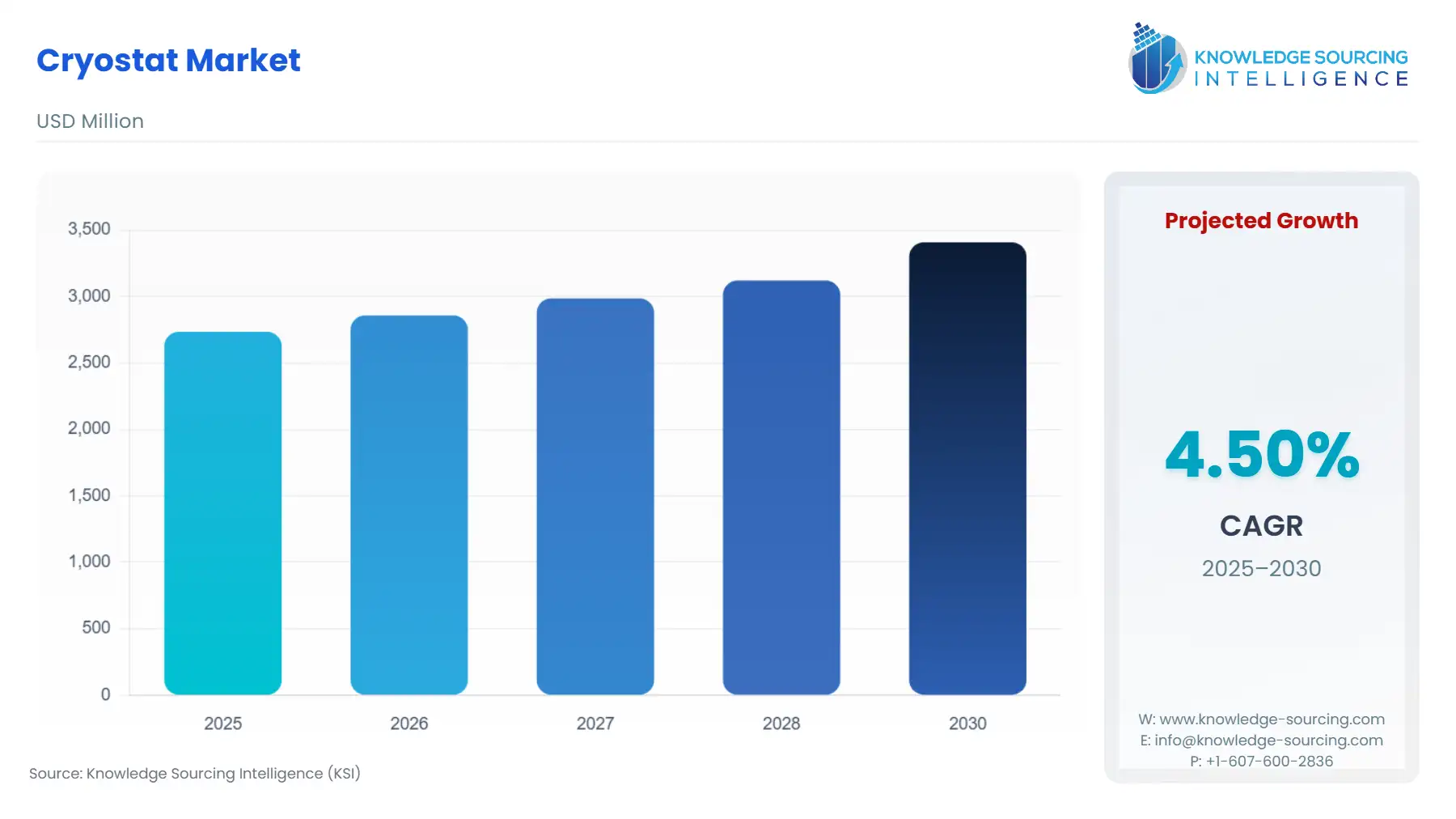

Cryostat Market Size:

The Cryostat Market will reach US$3.408 billion in 2030 from US$2.735 billion in 2025 at a CAGR of 4.50% during the forecast period.

The Global Cryostat Market comprises equipment designed to maintain extremely low, precisely controlled temperatures for samples and devices, ranging from $-40^\circ\text{C}$ to millikelvin regimes. These instruments are essential across diverse high-technology sectors, including materials science, fundamental physics research, medical diagnostics, and advanced electronics fabrication. The market is broadly bifurcated between analytical/research cryostats (typically low-temperature, high-precision systems like Closed-cycle Cryostats) and clinical cryostats (higher-temperature, high-throughput systems used for frozen sectioning in pathology). The operational demand is non-cyclical, driven by sustained global investment in scientific discovery and the mandatory clinical need for rapid diagnostic procedures. The structural trajectory of the market favours technological systems that enhance operational efficiency and minimise reliance on increasingly scarce and costly Helium-based Cryostats.

Global Cryostat Market Analysis

- Growth Drivers

The key factor propelling demand is the global research and development imperative across material science and fundamental physics. Exponential growth in fields like quantum computing and spintronics directly creates non-negotiable demand for ultra-stable, low-vibration Closed-cycle Cryostats capable of operating in the sub-4 Kelvin regime to house qubits and superconducting components. Furthermore, the rising global incidence of cancer and the subsequent requirement for rapid intraoperative diagnostics in oncology directly compels demand from Healthcare & Medical facilities for reliable, automated Cryocooler-based frozen sectioning units. US tariffs on complex, high-precision electronic components sourced from Asia-Pacific, such as those used in sophisticated Temperature Control Systems, subtly inflate the final system cost globally, though the inelastic nature of research funding dampens the full impact on overall demand volume.

- Challenges and Opportunities

The primary challenge facing the market is the critical dependency on liquid helium, which faces perpetual supply volatility and escalating costs due to limited global reserves and complex extraction logistics. This scarcity acts as a significant headwind, compelling academic institutions to delay non-essential experiments and directly increasing demand for expensive, but operationally autonomous, Closed-cycle Cryostats. A major opportunity exists in the development of highly integrated, miniaturised cryocooling technology for industrial quality control (QC) and advanced sensor applications. Smaller, more robust Cryocoolers could enable the integration of cryogenic measurement into semiconductor fabrication and aerospace systems outside of a dedicated laboratory environment, thereby creating a new, high-volume industrial demand segment for compact, ruggedised cryostats.

- Raw Material and Pricing Analysis

The Global Cryostat Market deals with a physical product heavily reliant on specialised materials. The most critical raw material is high-purity copper (oxygen-free high thermal conductivity, or OFHC copper) and specialised stainless steels and aluminium alloys used for the cryostat chambers and vacuum vessels. Pricing for the finished cryostat is highly sensitive to the global market price of these base metals, particularly copper, which is critical for thermal anchoring and heat exchange elements. For high-end Multistage Cryostats and dilution refrigerators, the supply of $^{3}\text{He}$ (Helium-3) and $^{4}\text{He}$ (Helium-4) remains a fundamental, price-volatile input. The global supply of high-precision, low-vibration Cryocoolers (Gifford-McMahon or Pulse Tube coolers) from a few specialised manufacturers also introduces a bottleneck, where procurement lead times and pricing power are concentrated, significantly influencing the final equipment cost and delivery timeline.

- Supply Chain Analysis

The cryostat supply chain is structured around a global, two-tiered model: high-volume production of standard medical cryostats and low-volume, highly specialised production of research cryostats. The high-volume segment (histopathology) often centralises final assembly in Europe and Asia-Pacific (e.g., China, Germany), where labour and access to precision machining are optimised. Conversely, the high-end research sector (e.g., quantum, superconductivity) relies on sophisticated OEMs primarily located in North America and Western Europe (e.g., the US, UK, the Netherlands). Key logistical complexities involve the safe and efficient transport of high-vacuum components and the dependency on a small number of global suppliers for critical subcomponents like high-precision Cryocoolers and specialised superconducting wire. This geographic concentration of technology suppliers creates a fragile dependency, where regional manufacturing or trade disruptions immediately constrain the supply of high-performance research cryostats globally.

Cryostat Market Government Regulations

The regulation of cryostat equipment spans both clinical safety/efficacy and environmental/energy efficiency, depending on the application segment.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FDA (Food and Drug Administration) Class I/II Medical Devices |

Cryostats used for medical frozen sectioning (histology) are regulated as Class I or Class II devices. This classification mandates adherence to Quality System Regulation (QSR) and often requires 510(k) Pre-market Notification. This rigorous process elevates R&D and compliance costs, acting as an entry barrier and driving demand toward established, FDA-approved manufacturers like Thermo Fisher Scientific and Leica Biosystems. |

|

European Union |

F-Gas Regulation (EU 517/2014) and Medical Device Regulation (MDR) 2017/745 |

The F-Gas regulation restricts the use of fluorinated greenhouse gases, compelling cryostat manufacturers to adopt refrigerants with lower Global Warming Potential (GWP) in integrated Cryocoolers and cooling systems. This directly drives development and demand for next-generation, environmentally compliant Closed-cycle Cryostats. The MDR further imposes stringent clinical evidence requirements on medical cryostats, increasing verification demand for histopathology devices. |

|

Global/International |

Export Control Regulations (e.g., Wassenaar Arrangement) |

High-precision, ultra-low temperature cryostats, especially those integrated with superconducting magnets used for scientific, military, and nuclear applications, are subject to strict dual-use export controls. This regulation constrains international trade flow for the most advanced systems in the Aerospace & Defense and Energy & Power segments, limiting market demand to nations with bilateral research agreements or domestic manufacturing capability. |

Cryostat Market Segment Analysis

- By Type: Closed-cycle Cryostat

The Closed-cycle Cryostat segment is the most structurally favoured market category, owing to its operational independence. The primary demand driver is the escalating cost and logistical complexity of liquid cryogens, especially liquid helium. Closed-cycle systems, utilising internal Cryocoolers (e.g., Gifford-McMahon or Pulse Tube) to re-circulate helium gas within a sealed system, eliminate the recurrent expense and logistical risk associated with cryogen resupply. This feature creates a powerful financial incentive and an environmental imperative for research institutions, which directly propels demand away from traditional Bath Cryostat and Continuous-flow Cryostat models towards cryogen-free technology. This demand is particularly pronounced in remote research facilities and for continuous-operation experiments in fields like advanced spectroscopy and quantum materials research, where system uptime and stability are paramount and the continuous flow of liquid cryogen is disruptive and costly. The advancement of pulse-tube technology, achieving lower base temperatures and ultra-low vibration levels, further solidifies demand from highly sensitive quantum research applications.

- By Application: Healthcare & Medical

The Healthcare & Medical application represents the largest volume segment, anchored by the mandatory requirement for quick diagnostic procedures in surgical oncology. The specific demand driver is the surgical imperative for rapid intraoperative frozen section diagnosis to determine tumour margins and ensure complete resection during live surgery. The cryostat, acting as an essential tool for rapid freezing and sectioning of tissue samples, provides pathologists with results in minutes, which is non-negotiable for surgical workflow efficiency and patient outcomes. This clinical need is further compounded by the global rise in the number of surgical procedures for cancer and chronic diseases. Consequently, every new hospital, diagnostic centre, or pathology laboratory established globally immediately creates baseline demand for automated, high-throughput cryostats and matching Microtome Cryosat Blades. The shift toward decentralising diagnostic capabilities to regional or satellite hospitals also contributes, driving the need for reliable, easy-to-use systems.

Cryostat Market Geographical Analysis

- US Market Analysis (North America)

The US market is characterised by extensive, federally funded research initiatives (e.g., NIH, NSF) and robust private sector investment in quantum technology. Local factors significantly impacting demand include the high density of leading academic research institutions and commercial quantum labs. This environment generates substantial, high-value demand for advanced, ultra-low temperature Closed-cycle Cryostats and specialised Multistage Cryostats. Furthermore, the dominance of large Integrated Delivery Networks (IDNs) in healthcare procurement drives standardised volume demand for high-throughput histopathology cryostats, often prioritising models from key global suppliers like Thermo Fisher Scientific and Leica Biosystems, which offer integrated workflow solutions and national service contracts.

- Brazil Market Analysis (South America)

The Brazilian cryostat market is primarily driven by the modernisation of public university research facilities and emerging private healthcare investment. The key local factor impacting demand is the variable public funding cycles for scientific infrastructure. This leads to a strong preference and demand for operationally simple and cost-efficient Continuous-flow Cryostat models and Nitrogen-based Cryostats, as the high capital cost and logistical complexity of sourcing liquid helium and servicing advanced Closed-cycle Cryocoolers often present a prohibitive financial barrier for many institutions. Demand in the Healthcare & Medical segment is concentrated in major state capitals and private hospital systems.

- Germany Market Analysis (Europe)

The German market benefits from a strong tradition of government-funded physics research (e.g., Max Planck Institutes) and a highly regulated medical device environment. The local factor driving demand is the strict adherence to clinical and quality standards in the Healthcare & Medical sector, compelling hospitals to invest in premium, high-precision histopathology cryostats from established European manufacturers. In the research domain, the emphasis on sustainability and energy efficiency, influenced by EU regulations, directly drives demand for the latest generation of low-power, high-efficiency Closed-cycle Cryostats for materials science and advanced sensor development.

- United Arab Emirates Market Analysis (Middle East & Africa)

The UAE cryostat market is significantly influenced by large-scale government strategic initiatives aimed at diversifying the economy through advanced technology and healthcare specialisation. The local factor driving demand is the aggressive capital expenditure in new "mega-project" research centres and specialised hospitals. These new institutions typically mandate the purchase of the latest, state-of-the-art systems, creating high-value, concentrated demand for advanced Cryocooler technology and high-end, helium-free research cryostats, often sourced directly from US and European OEMs to meet world-class facility specifications.

- China Market Analysis (Asia-Pacific)

The Chinese market is characterised by massive, centralised government investment in fundamental science (e.g., quantum communication, high-field magnet research) and rapid expansion of medical infrastructure. The local factor driving demand is the strategic national focus on technological self-sufficiency and the sheer volume of new university and public hospital construction. This dual focus creates huge volume demand for medical cryostats, often fulfilled by strong domestic manufacturers like Jinhua Yidi Medical Appliance, while simultaneously generating intense premium demand for cutting-edge, imported Multistage Cryostats necessary for the national quantum computing and particle physics research projects.

Cryostat Market Competitive Environment and Analysis

The Global Cryostat Market's competitive landscape is divided between major conglomerates dominating the high-volume clinical pathology segment and highly specialised, niche engineering firms focusing on ultra-low-temperature physics applications. Competition hinges on temperature stability, cryogen independence, automation, and service reliability.

- Leica Biosystems Nussloch GmbH

Leica Biosystems is a dominant force in the high-volume Healthcare & Medical segment, strategically positioning itself as a comprehensive provider of anatomical pathology solutions. The company's core advantage is its deep integration into the global pathology workflow, with products like the CM series of cryostats being the industry standard for frozen sectioning. Leica Biosystems actively captures the majority of demand from hospitals and diagnostic centres by offering high-throughput, reliable, and ergonomic systems, coupled with a full suite of consumables like Microtome Cryosat Blades and embedding media. Their focus is on workflow efficiency and accuracy, essential for time-sensitive intraoperative procedures.

- Oxford Instruments Plc

Oxford Instruments is strategically positioned as a leading supplier for the high-end research and quantum technology segments. The company specialises in manufacturing sophisticated cryogenic systems, particularly magnet systems and Cryocooler-based solutions. Oxford Instruments leverages its expertise in superconducting magnet technology and dilution refrigeration to drive demand for its systems in national laboratories and university physics departments working on quantum computing, superconductivity, and nanotechnology. The company’s competitive edge lies in its ability to deliver ultra-low temperatures (often sub-1 Kelvin) and highly stable magnetic environments, features that are indispensable to its core customer base.

- Cryomech Inc.

Cryomech Inc., recently acquired by Blue Origin, positions itself as a specialised leader in Cryocooler and cryostat manufacturing, particularly for the scientific research community. Their key product lines, including Gifford-McMahon and Pulse Tube Cryocoolers, are widely used as the cooling engines within Closed-cycle Cryostats sold by system integrators and directly to end-users. Cryomech's strategic focus on the core cooling technology fuels OEM demand from numerous cryostat manufacturers who integrate Cryomech's highly reliable and efficient coolers into their final systems, thereby influencing a large portion of the cryogen-free market. The company’s reputation for technical performance and reliability is critical in the demanding environments of large-scale scientific facilities.

Cryostat Market Developments

- October 2025: Leica Biosystems Launches CM1950 Cryostat with DualEcoTec Cooling System

Leica Biosystems launched the CM1950 cryostat featuring the new DualEcoTec cooling system, which utilises a refrigerant with a near-zero Global Warming Potential (GWP). The new system also offers enhanced temperature stability and up to a 50% reduction in power consumption compared to the previous model. This launch directly drives demand from Healthcare & Medical customers who are increasingly prioritising sustainable and energy-efficient equipment purchases to meet corporate responsibility goals and comply with environmental regulations like the EU's F-Gas rules.

Consumer Oxygen Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 2.735 billion |

| Total Market Size in 2030 | USD 3.408 billion |

| Forecast Unit | Billion |

| Growth Rate | 4.50% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Component, Cryogen Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Consumer Oxygen Equipment Market Segmentation:

Global Cryostat Market Segmentation by Type

- Closed-cycle Cryostat

- Continuous-flow Cryostat

- Bath Cryostat

- Multistage Cryostat

Global Cryostat Market Segmentation by Component:

- Cryocoolers

- Cryogen Storage & Supply Systems

- Vacuum Systems

- Temperature Control Systems

- Heat Exchangers

- Cryostat Chambers & Sample Holders

- Safety & Insulation Components

- Microtome Cryosat Blades

Global Cryostat Market Segmentation by Cryogen Type:

- Helium-based Cryostats

- Nitrogen-based Cryostats

- Other

Global Cryostat Market Segmentation by Application:

- Healthcare & Medical

- Aerospace & Defense

- Energy & Power

- Electronics & Semiconductor

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- The Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others