Report Overview

Global Metal Packaging Market Highlights

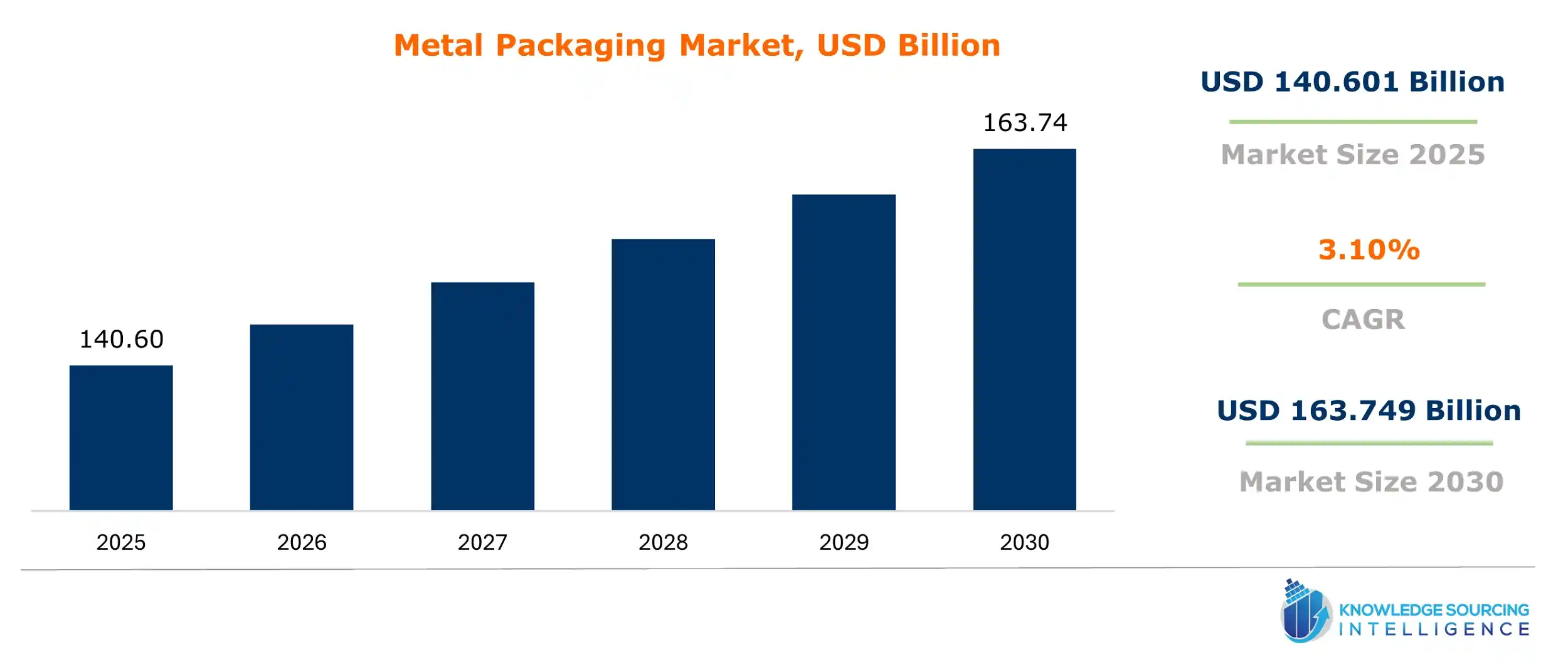

Metal Packaging Market Size:

The global metal packaging market is expected to grow at a CAGR of 3.10%, reaching a market size of US$163.749 billion in 2030 from US$140.601 billion in 2025.

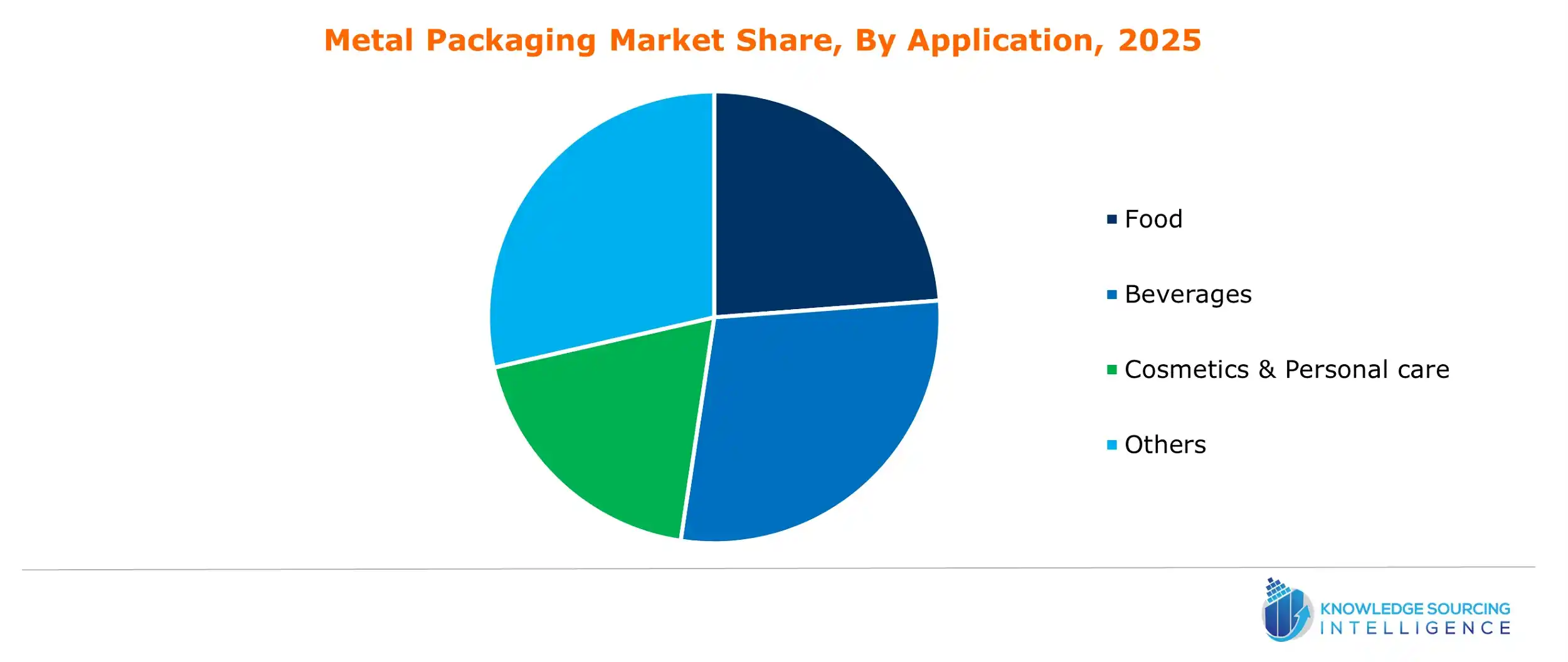

The rising market is predominantly due to the food and beverage (F&B) industry’s expansion. Furthermore, growth can also be attributed to the increasing need for metal packaging solutions for drinks, especially beer, sparkling wines, sodas, iced teas, energy drinks, caffeinated sodas, and coffee beverages.

In addition, the introduction of resealable and adjustable cans has enhanced the utility and storage space, which is another critical level factor. Similarly, companies have also focused on attractive designs for personal care products to broaden their consumer base and encourage market growth. On the other hand, the market is growing faster due to consumers' increasing level of understanding of the health benefits of storing organic foods in metal containers.

Metal Packaging Market Growth Drivers:

- Increased demand for attractive packaging is contributing to the global metal packaging market growth

One of the main trends driving market expansion is the increasing use of different coatings and printing on metal packaging products. Numerous businesses provide paints and protective coatings for metal goods that draw customers. In addition to being simple to use and coming in various sizes and shapes, the introduction of eye-catching printing on metal cans, aerosols, and tins increases demand for this kind of packaging, which in turn fuels market expansion. During market development, one important aspect to consider is the creativity of printing inks utilized by manufacturers in branding to attract and retain consumers.

- Rising demand for metal print packaging is anticipated to boost this market’s expansion.

The introduction of metal print packaging primarily drove the global metal packaging market. Its eye-catching designs, sizes, and shapes drew customers and significantly increased brand exposure. Moreover, the energy consumed to recycle metal packaging is about 90% less than the energy used to make primary aluminium, and aluminium can be recycled repeatedly without the loss of any quality. In addition, metal packaging has the highest recycling rates in general. Another factor fueling the metal packaging market share worldwide is the year-round availability of seasonal fruits and vegetables in the form of canned foods to satiate consumers' cravings. The enormous demand for beverage packaging made of metal has also increased the consumption of print packaging.

- The high use of beverage cans will increase the market growth.

Metal cans, especially those designed for almost any alcoholic beverage, have gained widespread acceptance owing to their practicality as well as the preference of consumers. The fact that such cans deliver information in standard portion sizes makes it easier to keep track of alcohol consumption, particularly in high-proof drinks. Further, due to its lightweight nature, aluminium is ideal for beverage containers, enhancing mobility and reducing carbon footprint as well as transportation costs.

Moreover, the rising demand for metal cans is also observed due to the innovations introduced in the market in the non-alcoholic beverages segment. In this regard, PepsiCo, in January 2023, introduced Starry, a lemon-lime flavored carbonated soft drink featuring stylish can designs. Likewise, new products launched by Monster Energy Ltd, which were sugar-free beverages in aluminum cans, also contributed to the increased use of metal packaging. In terms of design, aluminum cans are lightweight, have thermal conductivity, and have the ability to recycle features. Thus, they are growing in popularity.

Metal Packaging Market Restraints:

- High cost is anticipated to hamper the market growth

Although metal packaging has the most important qualities, some reasons limit the market's growth. Most notably, steel has a high rate of corrosion, is chemically very unstable, and has low resistance to acidic and alkaline substances. Further, the market growth has also been affected by the fact that acidic substances like food products packaged in metal containers cause precipitation of metal ions. Moreover, poor inner coating protection also causes a degradation in the quality of metal products, which, conversely, restrains market growth for several applications. Furthermore, the expense involved in manufacturing such packaging is greater than other packaging materials, which discourages the market. Finally, since the metal recycles back to its source state, for instance, steel becomes iron ore, corrosion inflicts a similar effect on the market.

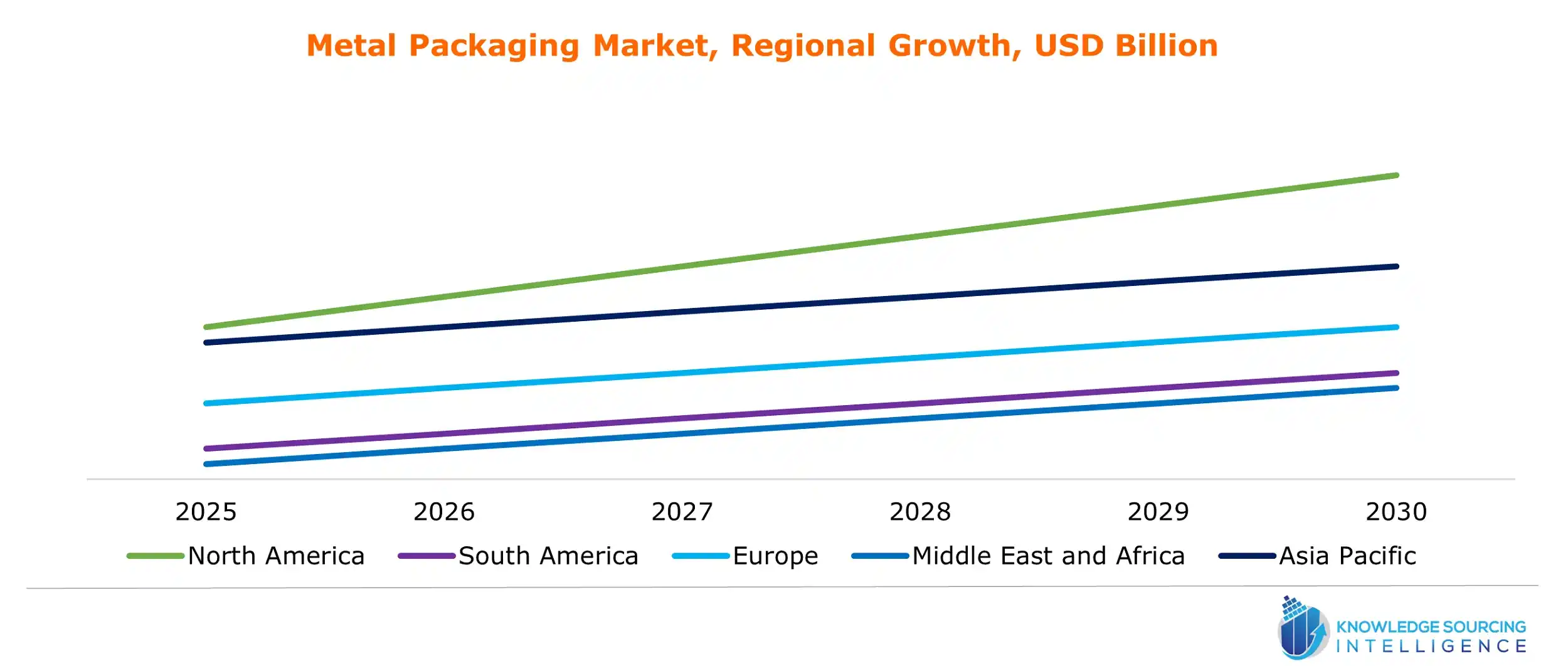

Metal Packaging Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period.

The demand and importance of the metal packaging market in China can easily be attributed to the country's large manufacturing and consumer goods industry. The food, beverage, pharmaceutical, cosmetic, and consumer products sectors are among the strongest influences fueling the growth of metal packaging.

In China, the growing concern for the environment and government interventions have increased the need for environment-friendly packaging options. Recyclable metal and green can coatings are among the eco-friendly alternatives being explored by these producers. Hence, it is expected that the consumers’ appreciation of green packing will push for the invention of greener processes and recyclable materials to comply with even more stringent restrictions on good manufacturing practices.

Metal Packaging Market Key Launches:

- In July 2024, AkzoNobel introduced Securshield 500 for the Metal Packaging Sector. AkzoNobel ensures a more sustainable future for the metal packaging industry. Manufacturers of food cans can take advantage of a next-generation line of metal packaging coatings created by the company that is PVC and bisphenol (BPXni*) free.

- In June 2024, Sonoco Products Company, a multinational producer of environment-friendly packaging, agreed to pay USD 3.9 billion to KPS Capital Partners to purchase Eviosys, a European supplier of food cans, ends, and closures. In addition to investing in high-return opportunities through internal growth and external acquisitions, Sonoco said this acquisition will further its strategy to focus on and grow its core businesses.

List of Top Metal Packaging Companies:

- Ball Corporation

- Crown Holdings Incorporated

- Silgan Holdings Incorporated

- Can-Pack SA

- CCL Container Inc

Metal Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Metal Packaging Market Size in 2025 | US$140.601 billion |

| Metal Packaging Market Size in 2030 | US$163.749 billion |

| Growth Rate | CAGR of 3.10% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Metal Packaging Market |

|

| Customization Scope | Free report customization with purchase |

The Global metal packaging market is segmented and analyzed as follows:

- By Type

- Cans

- Caps & Closures

- Others

- By Raw Material

- Steel

- Aluminum

- Others

- By Application

- Food

- Beverages

- Cosmetics & Personal care

- Industrial

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America