Report Overview

Global Algae Protein Market Highlights

Algae Protein Market Size:

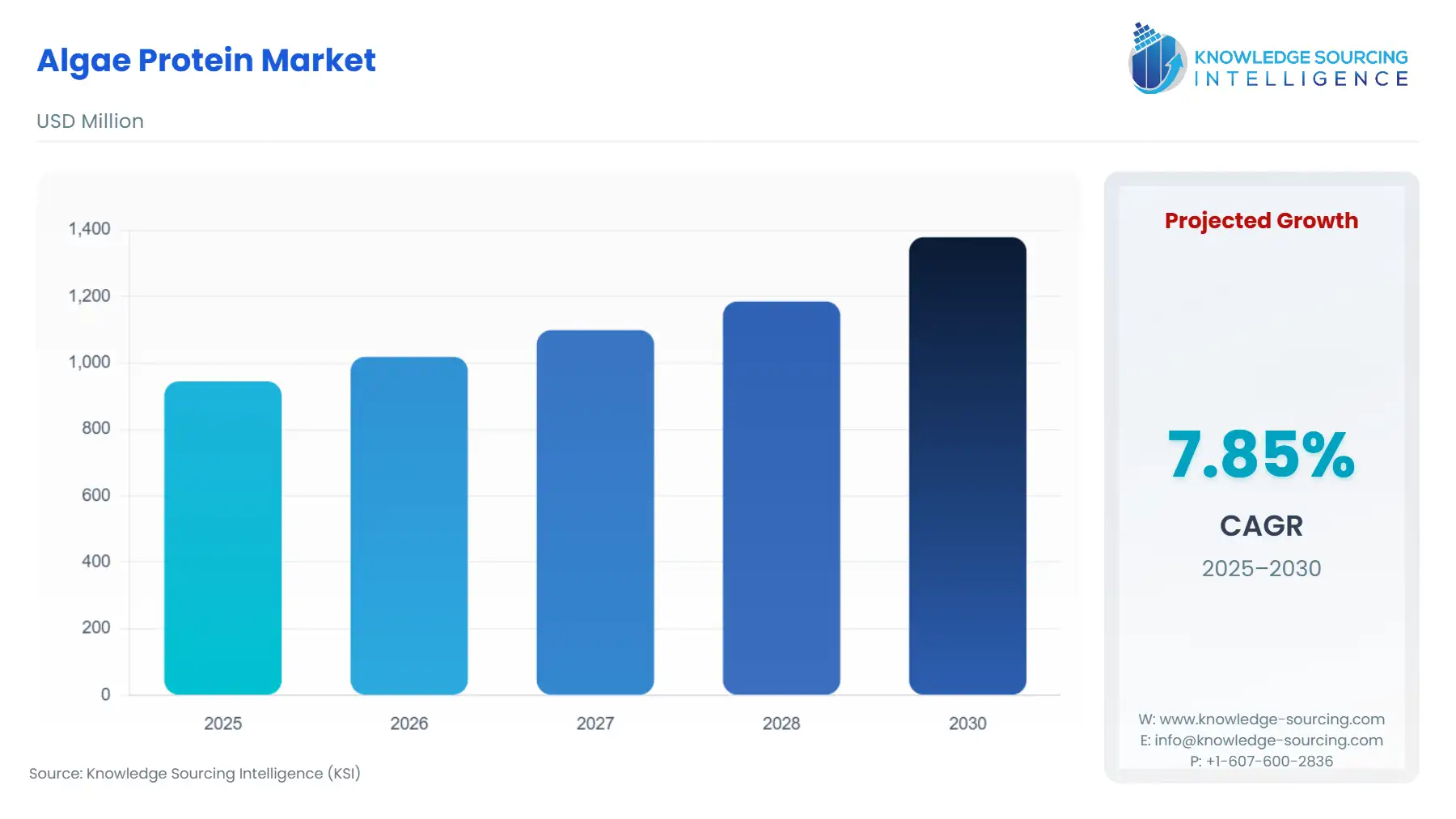

The global algae protein market is expected to grow at a CAGR of 7.85%, reaching a market size of US$1,378.756 million in 2030 from US$944.724 million in 2025.

Algae Protein Market Trends:

Algae protein is a prevalent choice for protein sources due to its nutritional value and sustainability advantages. Produced from aquatic plants, algae incorporate all nine required amino acids, are rich in iron and vitamins, and are low in calories, which makes them reasonable for weight management. Algae generation needs negligible land and less water consumption, and helps in carbon sequestration, benefiting climate change mitigation. It can be utilized in food products such as protein powders, nutritional supplements, and plant-based meat alternatives, as well as in pharmaceutical items and for animal feed.

Besides, the nutritional composition and well-being impacts could be different depending on the type of algae.

The algae protein market is witnessing substantial expansion due to growing consumer demand for plant-based proteins, more knowledge about dietary benefits of algae, and technological advancements in the cultivation and extraction of algae to make it cost-effective.

Further, the market is extending to developing regions, with rising markets developing products to increase the attraction of consumers to this sustainable protein source. Companies are doing strategic collaborations to create attractive and economical algae protein items.

Further, a few challenges for algae protein incorporate cost reduction as its production could be costlier, and some people could develop allergies to algae, which could restrain the market growth. However, growing consumer acknowledgment of algae protein as a reasonable food source and raising clear regulatory standards for plant-based food products, including algae protein production and labeling, could lead to the continuous expansion of the market in the future.

Algae Protein Market Growth Drivers:

- Rising consumer preference for plant-based nutritional supplements is predicted to boost the global algae protein demand.

The increasing worldwide population is expanding the demand for protein around the world as a result of which sustainable plant-based protein sources are picking up popularity to fulfill the rising global necessity for protein-rich food products. According to a report from the Natural Resources Institute (NRI) of January 2024, it is stated that by 2050, the world will be required to deliver twice as much protein compared to the current amount, requiring an extra 25,000 KM2 of feeding land for the production of traditional animal protein.

Moreover, consumer inclination for plant-based items is developing due to well-being concerns, environmental concerns, and ethical considerations. It is additionally sustainable, as it originates from aquatic plants requiring less land and water compared to conventional agriculture. Algae protein can be consolidated into different food items, including protein powders, energy bars, and plant-based meat alternatives. As the request for plant-based proteins increases, companies are investing in research and development to improve taste, texture, and affordability. The market is additionally growing past conventional protein powders to incorporate plant-based meat options and dietary supplements.

Additionally, the demand for algae protein is predicted to increase on account of the high protein content in algae as compared to that in other plant-based protein sources, including soy and green vegetables. There is a rise in people adopting veganism, which can result in greater requirements for plant-based protein sources like algae protein, which cater to diverse requirements and can become a practical alternative for vegans to fulfill their nutritional needs.

According to the Vegan Society report, the sign-up of people for the Veganuary campaign in January 2022 shows a rise of more than 700,000 sign-ups from every country across the globe. Further, there was an increase in participants from 582,000 people in 2021 to 692,000 individuals in 2022, leading to fuelling the market growth.

Furthermore, according to the Environmental Working Group (EWG), the production, handling, and distribution of meat cause the high utilization of pesticides, fertilizer, feed, fuel, and water while also impacting the environment by releasing greenhouse gases. As a result of the negative impact of meat consumption on the environment, there's an increasing shift towards alternative sources of protein, subsequently emphatically impacting the development of the global algae protein market.

- Increasing the utilization of algae health benefits and reducing the risk of certain diseases will bolster the algae protein market globally.

Different types of algae are rich in fundamental nutrients like proteins, vitamins, and minerals, which are significant for maintaining overall health and preventing different diseases. Additionally, with the increasing health consciousness among consumers, algae protein-based items are becoming prevalent choices. For instance, the University of Exeter study published in December 2023 in the Journal of Nutrition discovered that ingestion of commercially accessible algal species, which are rich in protein and high in micronutrients, bolsters muscle remodelling in young healthy adults, proposing algae as a sustainable alternative to animal-derived protein for muscle maintenance and building.

Further, some algae species contain compounds with disease-fighting properties, such as antioxidants, anti-inflammatory agents, and antiviral substances, which can protect against chronic illness.. According to the WebMD LLC article, Spirulina contains cancer prevention agents that have anti-inflammatory impacts, which contribute to chronic inflammation and cancer. Phycocyanin, a major pigment protein in spirulina, decreases inflammation, blocks tumor development, and kills cancer cells. Further, there is ongoing research on understanding and developing the immune-enhancing potential of Spirulina in the treatment of cancer. Moreover, a research article in MDPI from 2022 states that seaweed compounds have the potential to treat chronic diseases such as obesity, different cancers, diabetes, osteoporosis, arthritis, and neurodegenerative diseases. There is research going on to study and develop algae protein products to treat different conditions, which can contribute to fuelling the market growth in the future.

Algae Protein Market Restraints:

- High production cost that increases the final price of the finished product could hinder the global algae protein market growth.

The high cost of extracting and processing protein from algae into usable form results in an increase in the price of algae protein products for end-user consumers compared to the cost of plant-based protein alternatives and meat-based protein products. The high price of algae protein products will lead to less adoption by consumers, as they could move towards the less expensive substitutes available in abundance in the market, which will hamstring the expansion of the global algae protein market. Further, the producer companies will limit investing in scaling up production and R&D due to low acceptance, which could impact the overall market growth.

Algae Protein Market Geographical Outlook:

- Europe region is predicted to hold a considerable market share.

The rising population in Europe is increasingly conscious of their health and well-being and is opting for plant-based foods which will contribute to the market growth in the region.

Further, countries in Europe are emphasizing on development of eco-friendly products and the adoption of sustainability practices through policies and grants. For instance, the University of Gothenburg published news in May 2024 about their researcher, Kristof Stedt granted a royal grant from King Carl XVI Gustaf's 50th Anniversary Fund for Science, Technology, and Environment for his research on modern strategies for increasing algae as a future protein source.

Moreover, in January 2024, NRI published that it was part of a two-year project to develop a new innovative technology for producing protein with an enhanced flavor from microalgae. The venture is part of the 'novel low-emission food production systems competition' financed by the Biotechnology and Biological Sciences Research Council and Innovate UK. It will be conveyed in association with London-based biotechnology start-up Arborea Ltd and Imperial College London. These initiatives will promote the algae protein market growth in the European region.

Algae Protein Market Key Developments:

- June 2024 - Brevel, Ltd. started its first commercial plant, measuring 27,000 square feet, adequate for hundreds of tons of production of microalgae protein powder. The clean, non-GMO, and planet-friendly protein is a market-viable arrangement within the elective protein market and is anticipated to begin rolling out its first products in Q1 2025.

- March 2023 - Nestlé R&D and UC Chile announced a research collaboration to investigate the potential of marine plants and algae in Latin America. The partnership objective is to fortify joint business enterprise capabilities and investigate alternative vegetable protein sources within the region.

Algae Protein Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

|

Algae Protein Market Size in 2025 |

US$944.724 million |

|

Algae Protein Market Size in 2030 |

US$1,378.756 million |

| Growth Rate | CAGR of 7.85% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

|

List of Major Companies in Algae Protein Market |

|

| Customization Scope | Free report customization with purchase |

Algae Protein Market Segmentation:

- By Type

- Spirulina

- Chlorella

- Seaweed

- Others

- By End-User

- Dietary Supplements

- Food Items

- Animal Feed

- Pharmaceutical

- Cosmetics and Personal Care

- By Geography

-

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America