Report Overview

Fracking Chemicals and Fluids Highlights

Fracking Chemicals Fluids Market Size

The Fracking Chemicals and Fluids market is forecast to grow at a CAGR of 6.7%, reaching USD 61.9 billion in 2031 from USD 44.8 billion in 2026.

The fracking chemicals fluids market is a specialized sector within the oil and gas industry, mainly focused on fracking or hydraulic fracturing chemical additives production and application. Hydraulic fracturing is a production technique for natural gas and oil from deep underground formations by injecting high-pressure fluid into rocks to create fractures. This method has gained wide momentum because it has proved effective for accessing unconventional resources, particularly from shale formations.

The fracking fluids comprise as much as 90% water and 9.5% sand or proppants, leaving only a percentage of chemical additives at 0.5%. These chemicals fulfill several important functions, such as property enhancements of the fluid, prevention of corrosion, control of the pH level, and decreased friction while pumping. Some common additives are biocides to inhibit bacterial growth, friction reducers to increase fluid flow, and stabilizers to prevent clay swelling in the wellbore. The actual composition of fracking fluids is highly customized depending on various geological characteristics of the target formation and operation requirements.

Fracking Chemicals Fluids Market Growth Drivers:

Rising demand for fracking chemicals

The market for fracking chemicals depends on several variables, such as global demand for energy, regulatory policies, and technological progress. Recently, greater attention has been given to developing more eco-friendly and less harmful chemical formulations in light of increased concerns over environmental implications. For instance, companies now use food-grade additives due to pressure from the public over the safety of regular fracking chemicals.

Regarding low water consumption and the carrying capacity of proppants, foam-based fracturing fluids are relatively new alternatives to water-based fluids. However, these alternatives also pose the challenge of maintaining stability within harsh reservoir conditions. Studies in nanotechnology and special surfactants are in progress to enhance performances and safety standards, which influences the market dynamics.

Fracking Chemicals Fluids Market Segmentation Analysis:

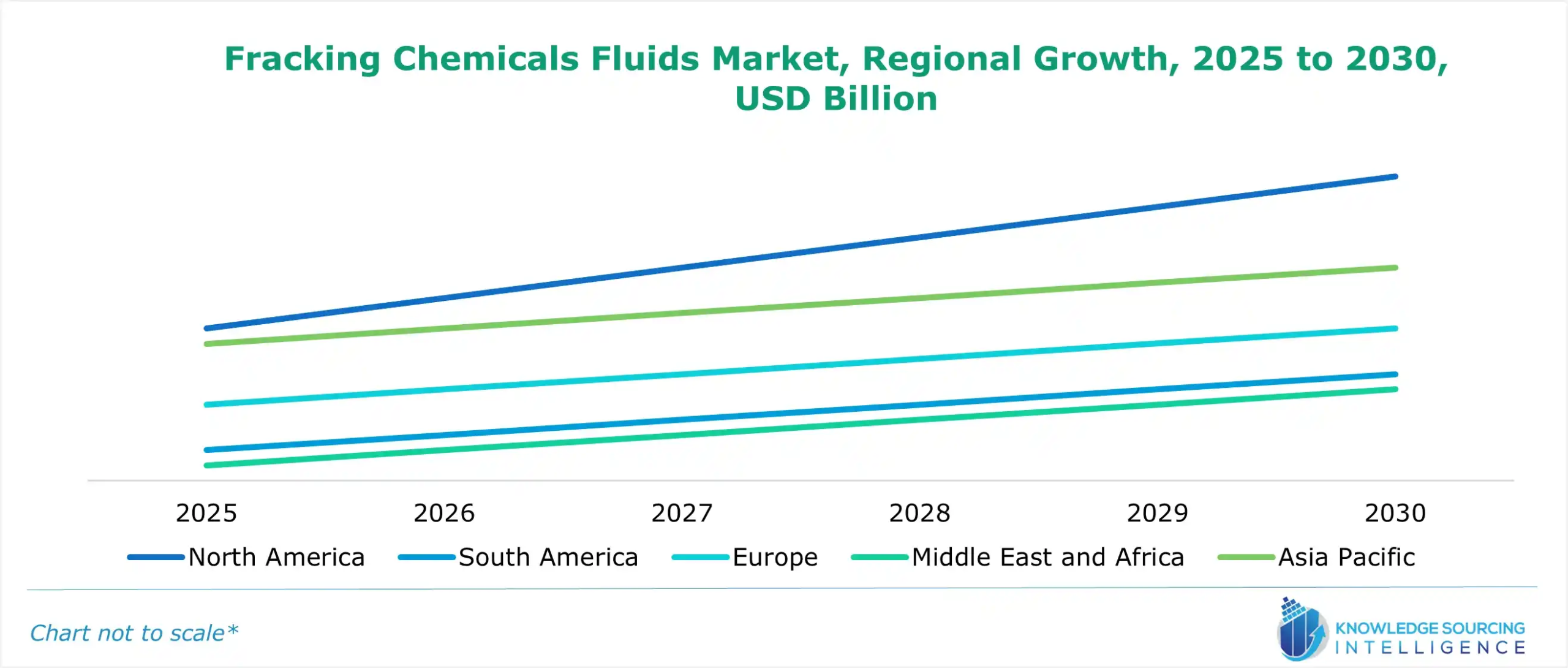

The North American region will dominate the fracking chemicals fluids market during the forecast period.

The North American fracking chemicals fluids market is experiencing significant growth, driven primarily by the region's abundant shale gas and tight oil reserves.

The U.S. is expected to lead the North American market share with other states like Texas, New Mexico, and North Dakota, which are pivotal in expanding crude oil reserves through advanced fracking techniques. Substantial discovery and extension of proved reserves by the U.S. Energy Information Administration also contribute to market growth. The same is true for the Canadian market, as its contribution is also positively recorded with an increase in fracking activities in the Western Canadian Sedimentary Basin.

In addition, the industry is expanding with technological evolution. More operators are incorporating waterless fracking and eco-friendly chemicals into their work to drive recovery rates while taking care of the environment. The application of super-advanced fracking chemicals will rise to a certain extent by 2024, enabling companies to drive efficiency and minimize their operation costs.

The fracking chemicals fluids market by function is segmented into surfactant, scale inhibitor, friction reducer, corrosion Inhibitor, biocide, crosslinker, gelling agent, and others.

Fracking chemical fluids are broadly applied to surfactants, scale inhibitors, friction reducers, and biocides. With the growing economies of Asia and Africa, the demand for fracking chemical fluids, such as corrosion inhibitors, crosslinkers, and gelling agents, is also growing.

Fracking Chemicals Fluids Market Restraints:

One of the significant restraints influencing the market for fracking chemicals fluids is the rising levels of regulation surveillance concerning hydraulic fracturing operations. Additionally, with increased re-evaluations of ground contamination by fracking chemicals and the possibility of triggering seismic activities, state and federal governments have placed additional regulatory measures on fracking operations. In many cases, such measures include stricter environmental assessments, increased transparency over chemical uses, and more critical inspection of water sources. Compliance with these regulations may result in increased operational expenses, delaying project approval, and reducing drilling activities. Public opposition to fracking based on environmental advocacy groups may result in time delays in allowing permits and higher litigation cases. This will further restrain market growth.

List of Top Fracking Chemicals Fluid Companies:

BASF SE

Baker Hughes, a GE Company LLC

Schlumberger Limited

Halliburton

DuPont

Fracking Chemicals Fluids Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

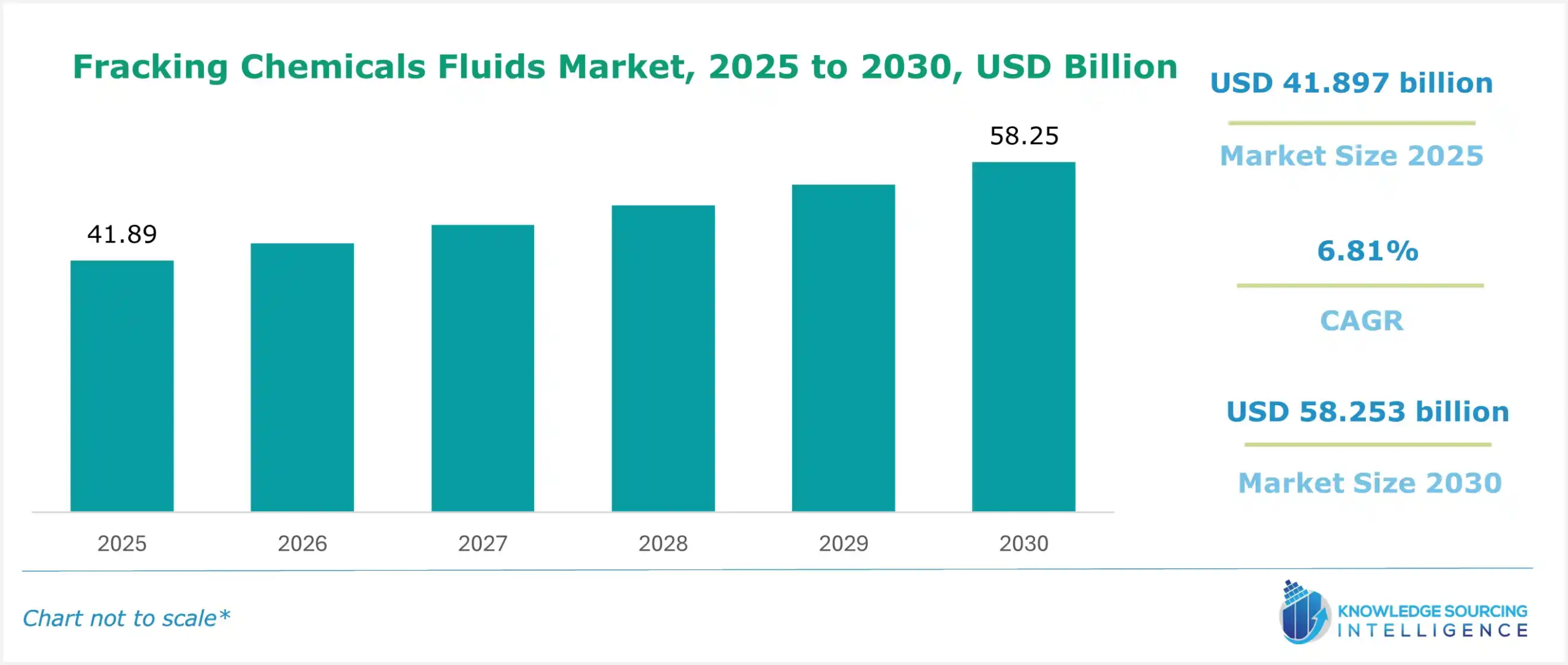

Fracking Chemicals Fluids Market Size in 2025 | US$41.897 billion |

Fracking Chemicals Fluids Market Size in 2030 | US$58.253 billion |

Growth Rate | CAGR of 6.81% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Fracking Chemicals Fluids Market |

|

Customization Scope | Free report customization with purchase |

The fracking chemicals fluids market is segmented and analyzed as follows:

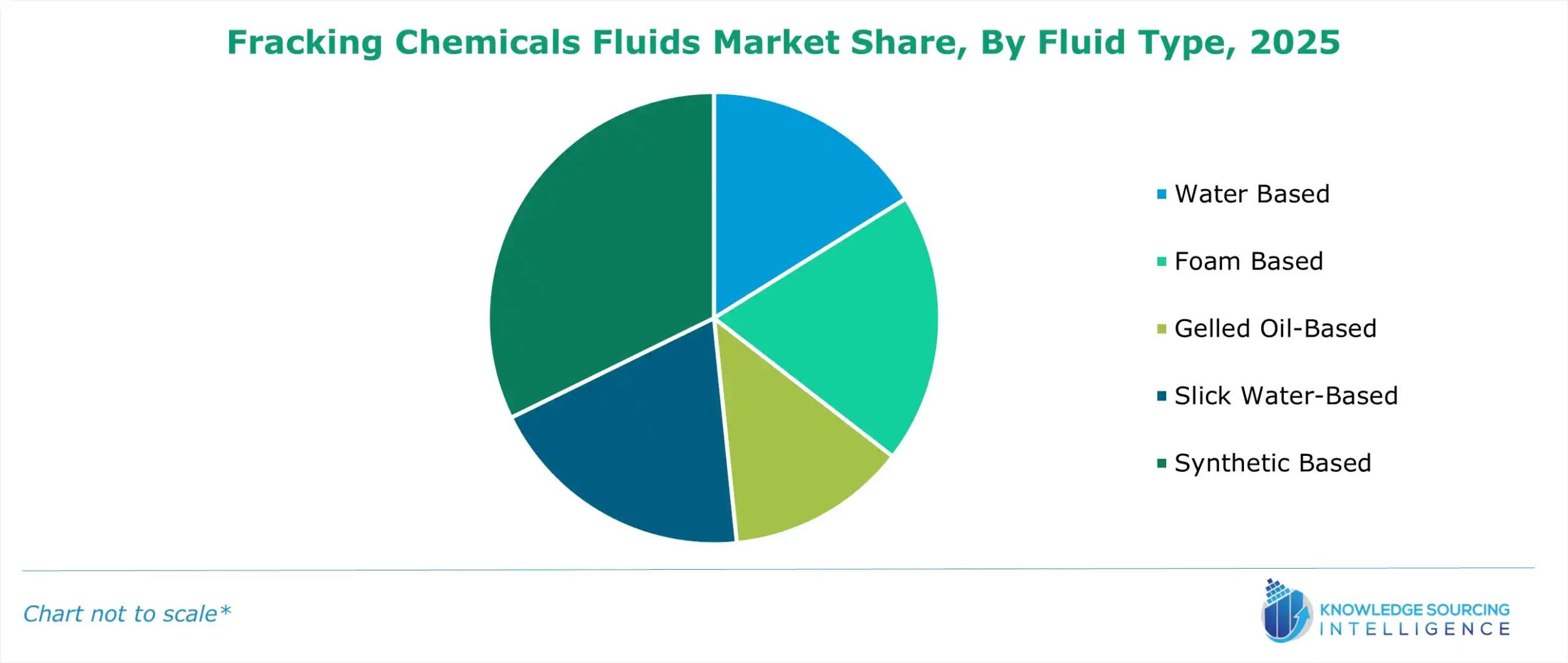

By Fluid Type

Water Based

Foam Based

Gelled Oil-Based

Slick Water-Based

Synthetic Based

Others

By Product Type

Borate Cross-Linked Fluids

Organometallic Cross-Linked Fluids

Aluminium Phosphate Ester Oil Gels

By Function

Surfactant

Scale Inhibitor

Friction Reducer

Corrosion Inhibitor

Biocide

Crosslinker

Gelling Agent

Others

By Application

Oil and Gas

Oil Well

Shale Gas Well

Horizontal Well

Mining

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Rest of South America

Europe

United Kingdom

Germany

France

Italy

Spain

Rest of Europe

Middle East and Africa

Saudi Arabia

UAE

Rest of the Middle East and Africa

Asia Pacific

China

India

Japan

South Korea

Taiwan

Thailand

Indonesia

Rest of Asia-Pacific