Report Overview

Onshore Drilling Fluids Market Highlights

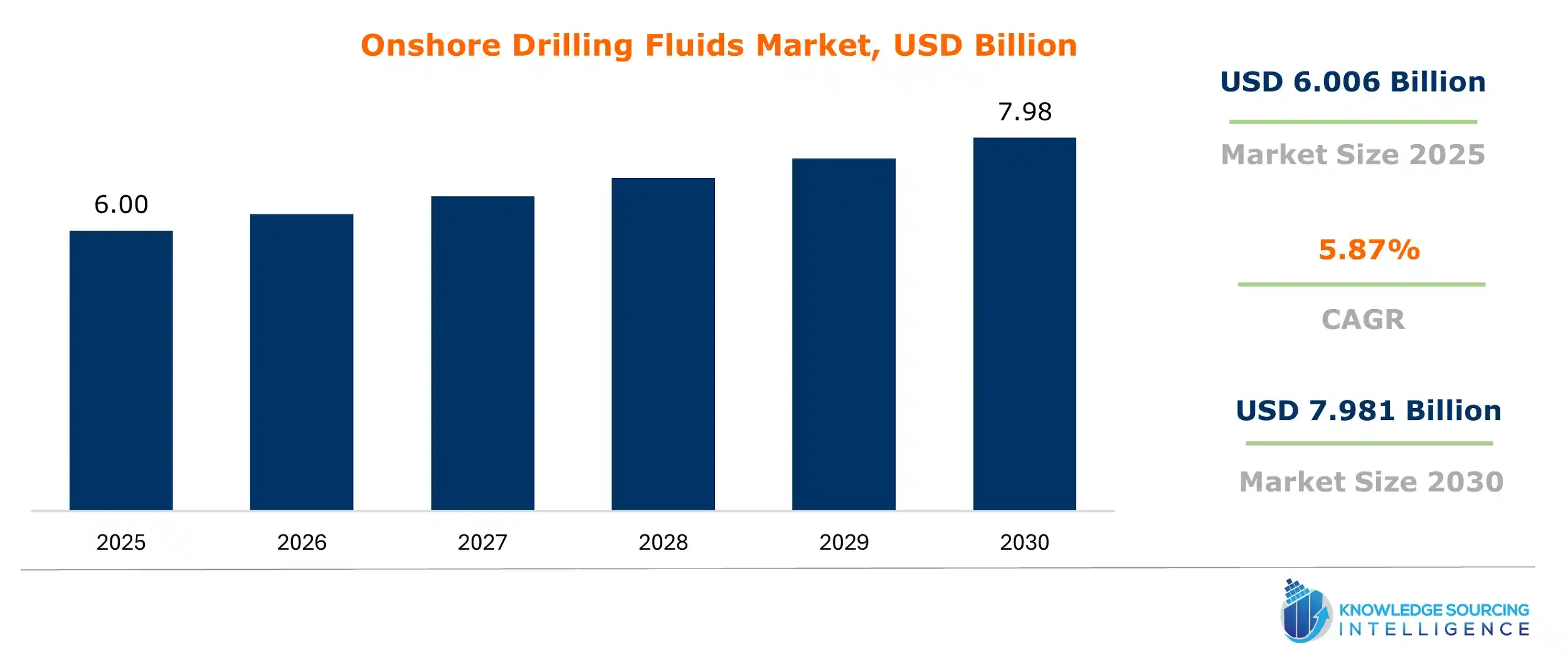

Onshore Drilling Fluids Market Size:

The onshore drilling fluids market is expected to grow at a CAGR of 5.87%, reaching a market size of US$7.981 billion in 2030 from US$6.006 billion in 2025.

Onshore Drilling Fluids Market Key Highlights:

The onshore drilling fluids market is significantly driven by the increasing number of onshore drilling operations across various sectors, particularly in oil and gas. Additionally, the market for onshore drilling fluids is expanding due to urbanization, industrialization, a spike in government investments, and rising consumer expenditure.

With the growing demand for energy worldwide, the need for oil exploration has also expanded. In fiscal year 2022, the United States onshore oil and gas program accounted for nearly 14 percent of total U.S. onshore oil production. Despite growing demand, onshore drilling operations may face challenges related to environmental disturbances and impacts on local communities.

According to the U.S. Energy Information Administration, crude oil and natural gas drilling activity onshore had 464 in 2021, 708 in 2022, and 669 in 2023 in the country.

Baker Hughes International's active Rig Count has expanded in the last few years, averaging 1361 in 2021, 1747 in 2022, and 1814 in 2023.

Onshore Drilling Fluids Market Growth Drivers:

- Increasing global consumption of oil

The onshore drilling fluids market is expected to expand as the demand surges for oil and petroleum in many developing countries worldwide. These demands would increase in the market of Asia Pacific and Africa. Rapid industrialization and demand for large shipments and logistics have created the need for crude oil. The global crude oil production has risen which was 37.30 (mb/d) in 2020, moved to 38.02 (mb/d) in 2021, and reached 39.69 (mb/d) in 2022, according to Organization of the Petroleum Exporting Countries data. Due to these developments, the demand for onshore drilling fluids would rise.

- High usage of petroleum products

OPEC Members witnessed an increased demand for petroleum products in recent years. The exports of petroleum products were 3.48 (mb/d) in 2020, grew to 4.03 (mb/d) in 2021, and expanded to 4.46 (mb/d) in 2022. The largest exporters of petroleum products are Saudi Arabia, UAE, and Algeria, which are part of the Organization of the Petroleum Exporting Countries. Petroleum products are used in multiple chemical industries, such as in paints, beauty products, and dry cleaning. Apart from these, fuels such as gasoline, aviation turbine fuel, jet fuel, propane, and butane, among other petroleum products, are utilized in aviation, aeronautical, and space travel.

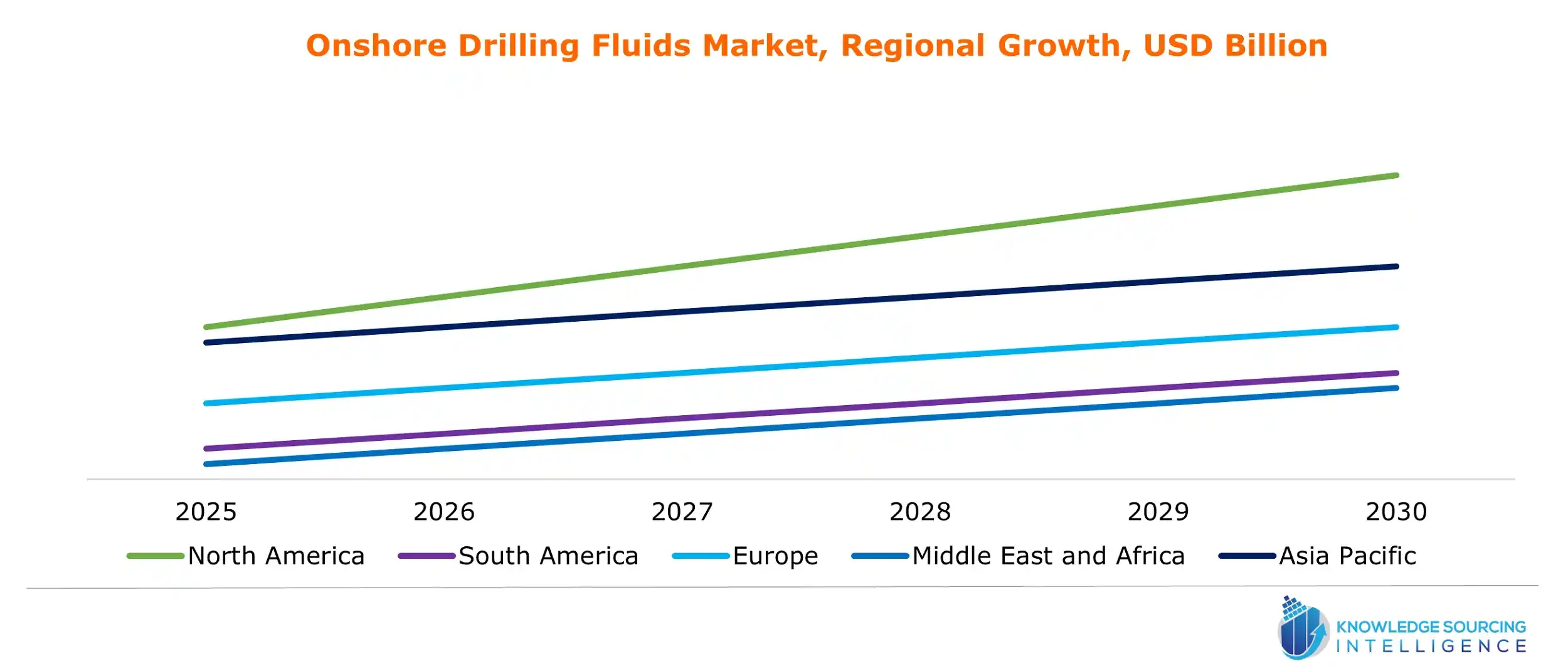

Onshore Drilling Fluids Market Geographical Outlook:

- The Onshore drilling fluids market is segmented into five regions worldwide

By geography, the market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.

The Asia Pacific region is expected to see the fastest growth in the onshore drilling fluids market due to increasing investment in the oil exploration industry. North America is expected to have a significant market share in the onshore drilling fluids market. As the new-well oil production per rig has expanded in the United States from around 500 barrels/day to 670 barrels/day from 2023 to 2024, the number of rig counts has expanded from around 100 to 150 from 2023 to 2024.

Onshore Drilling Fluids Market Restraints:

- The onshore drilling fluids market could be hampered by environmental challenges such as accidental spills and improper disposal, leading to water and soil contamination. Further, the residue has several compounds containing potential pollutants, which could adversely impact terrestrial life, including reducing soil fertility.

Drilling Fluids Market Products:

- BaraHib by Halliburton– BaraHib is a water-based fluid system that carries the conveniences of water and the performance of oil. Halliburton has engineered high-performance water-based fluids and additives that can be customized to meet specific challenges.

- Total Energies- Total Energies developed EDC Synthetic Base Fluids. Total Energies EDC Synthetic Base Oils products cover the full range of drilling needs for both onshore and offshore operations for product safety specifications.

Onshore Drilling Fluids Market Key Developments

The market leaders for the onshore drilling fluids market are Baker Hughes, Castle Harlan Inc., AMC Drilling Fluids & Products (Imdex Ltd.), Secure Energy Services, Global Drilling and Chemicals, Sagemines, Halliburton Company, and Schlumberger. These key players implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage. For instance,

List of Top Onshore Drilling Fluids Companies:

- Baker Hughes

- Castle Harlan Inc.

- Secure Energy Services

- Global Drilling and Chemicals

- Sagemines

Onshore Drilling Fluids Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Onshore Drilling Fluids Market Size in 2025 | US$6.006 billion |

| Onshore Drilling Fluids Market Size in 2030 | US$7.981 billion |

| Growth Rate | CAGR of 5.87% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Onshore Drilling Fluids Market |

|

| Customization Scope | Free report customization with purchase |

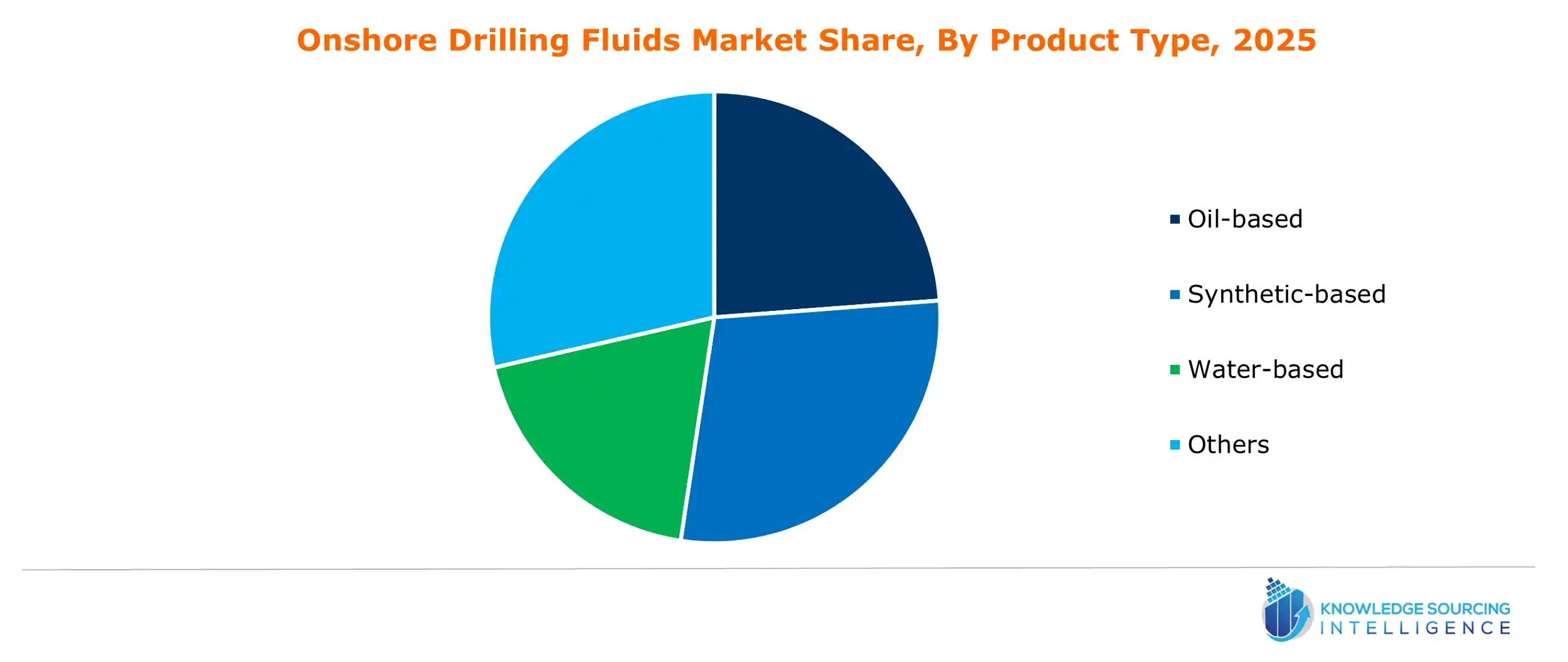

The onshore drilling fluids market is segmented and analyzed as follows:

- By Product Type

- Oil-based

- Synthetic-based

- Water-based

- Others

- By Well Type

- HPHT

- Conventional

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America