Report Overview

Force Sensors Market - Highlights

Force Sensors Market Size:

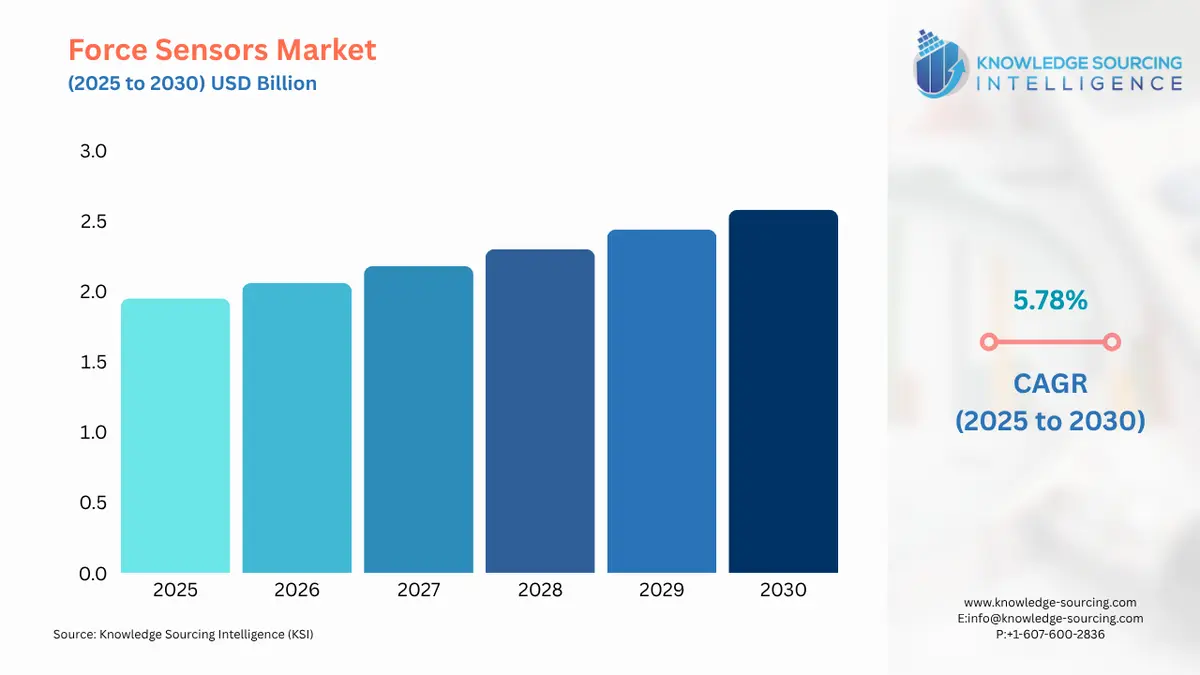

The force sensors market is projected to expand at a 5.61% CAGR, attaining USD 2.7 billion in 2031 from USD 1.946 billion in 2025.

Force Sensors Market Trends:

Force sensors are tools that transform applied mechanical forces, such as compressive and tensile forces, into digital signals whose magnitude can be used to calculate the force's magnitude. The signals are utilized as inputs to control equipment and processes. Force sensors are used in heavy automotive vehicles like construction trucks and extraction vehicles to track the overloading force of vehicle components to avoid fatigue failure. Growing applicability in automotive coupled with industrial automation are majorly driving the force sensors industry growth.

Force Sensors Market Growth Drivers:

Increasing industrial automation to raise demand for force sensors.

Automation and robots are essential to revive and modernize the manufacturing sector. Industry 4.0 is significantly speeding up and boosting the use of automation and robotics technologies across several industrial sectors. Force and torque sensors allow robotic processes like deburring, sanding, and polishing to be carried out. Applications for packing, manufacturing lines, and inspection processes can all benefit from force sensing. The incorporation of mechanics, robotics, and control systems on the manufacturing floor has become commonplace with the push toward Industry 4.0 breakthroughs to maximize productivity, efficiency, and cost.

Increasing need for piezoelectric force sensors in different industries to boost the market growth.

Advanced sensing technologies are becoming necessary as the world gets more automated and linked. Piezoelectric force sensors have become a top choice across numerous industries such as chemical, healthcare, and oil & gas due to their unmatched sensitivity and precision. In the medical & healthcare sector piezoelectric sensors are used in blood pressure monitors, infusion devices, and ultrasound imaging systems. Moreover, devices made for prosthetic use can electrically control the movement of the prosthetic device while using piezoelectric sensors to detect muscle movements.

High demand in the automotive sector to increase the market size.

Force sensors are also frequently used in the automotive industry to monitor centripetal force during maneuvers thereby improving driver safety. Rising automobile sales and manufacturing to cater to the growing demand are likely to generate growth opportunities for the force sensors industry. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle sales, including passenger cars and commercial vehicles, increased from 78787566 in 2020 to 81,628,533 in 2022. Moreover, as per the same source automotive production at the country level has witnessed a significant increase.

Rising use in the oil & gas industry.

Force sensors find extensive application in the oil & gas industry due to their ability to accurately measure and monitor forces involved in various operations such as drilling, wellbore stability, pipeline monitoring, and equipment performance. These sensors enable real-time data acquisition and analysis, facilitating better decision-making, improving operational efficiency, and ensuring safety. The oil & gas industry is growing due to increasing energy demand, exploration of new oil and gas reserves, and investments to boost the refining sector. For instance, in December 2022, Aramco and TotalEnergies jointly approved the final investment decision to construct a large-scale petrochemical facility in Saudi Arabia called the ‘Amiral' complex. The project would be fully owned, operated, and integrated with the existing SATORP refinery situated in Jubail, along Saudi Arabia's eastern coast.

Force Sensors Market Geographical Outlook:

North America is projected to dominate the force sensors market.

During the projected period, the North American region is anticipated to account for a significant market share due to its significant presence of leading automotive manufacturers coupled with technological advancements which are driving the demand for force sensors in vehicle design, safety systems, and performance optimization. According to the International Organization of Motor Vehicle Manufacturers, in 2022, the three leading economies of the North America region namely the USA, Canada, and Mexico all experienced a noteworthy 10% increase in commercial vehicle production compared to 2021.

Force Sensors Market Restraints:

High cost and low precision.

Due to technical and budgetary challenges, it is expensive to incorporate multiple functionalities onto a compact sensor. The creation of tiny sensors requires significant research and development work from all parties to meet shifting market expectations. Further, their precision and repeatability, where frequent readings may deviate by a minimum of 10% or more, are also impeding the force sensor market growth.

List of Top Force Sensors Companies:

HSFPAR Series: The HSFPAR Series, offered by ALPS ALPINE CO., LTD, is a range of compact and highly sensitive load detection sensors. These sensors are designed for various applications, including load detection and depth of water detection. With their surface mount and connector connection capabilities, they can be easily integrated into different systems or devices. The HSFPAR Series provides reliable and accurate load detection in a small package, making it a versatile solution for a wide range of applications.

1865 Series: Honeywell International Inc's 1865 Series is a cutting-edge transducer tailored to meet the demands of medical and specialized OEM applications. These high-performance devices incorporate laser-trimmed compensation and can be configured to work with a constant current or voltage supply. Enclosed in a plastic package, these transducers utilize a solid-state piezoresistive pressure sensor. They are specifically designed for applications that involve the application of force through a flexible membrane onto the sensor.

Force Sensors Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Force Sensors Market Size in 2025 | USD 1.946 billion |

Force Sensors Market Size in 2030 | USD 2.577 billion |

Growth Rate | CAGR of 5.78% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Force Sensors Market |

|

Customization Scope | Free report customization with purchase |

Force Sensors Market Segmentation

By Type

Inductive Force Sensors

Capacitive Force Sensors

Piezoelectric Force Sensors

Others

By Input Type

Weight

Torque

Tension

Others

By End-User

Chemical

Oil & Gas

Power & Energy

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others