Report Overview

Celiac Disease Treatment Market Highlights

Celiac Disease Treatment Market Size:

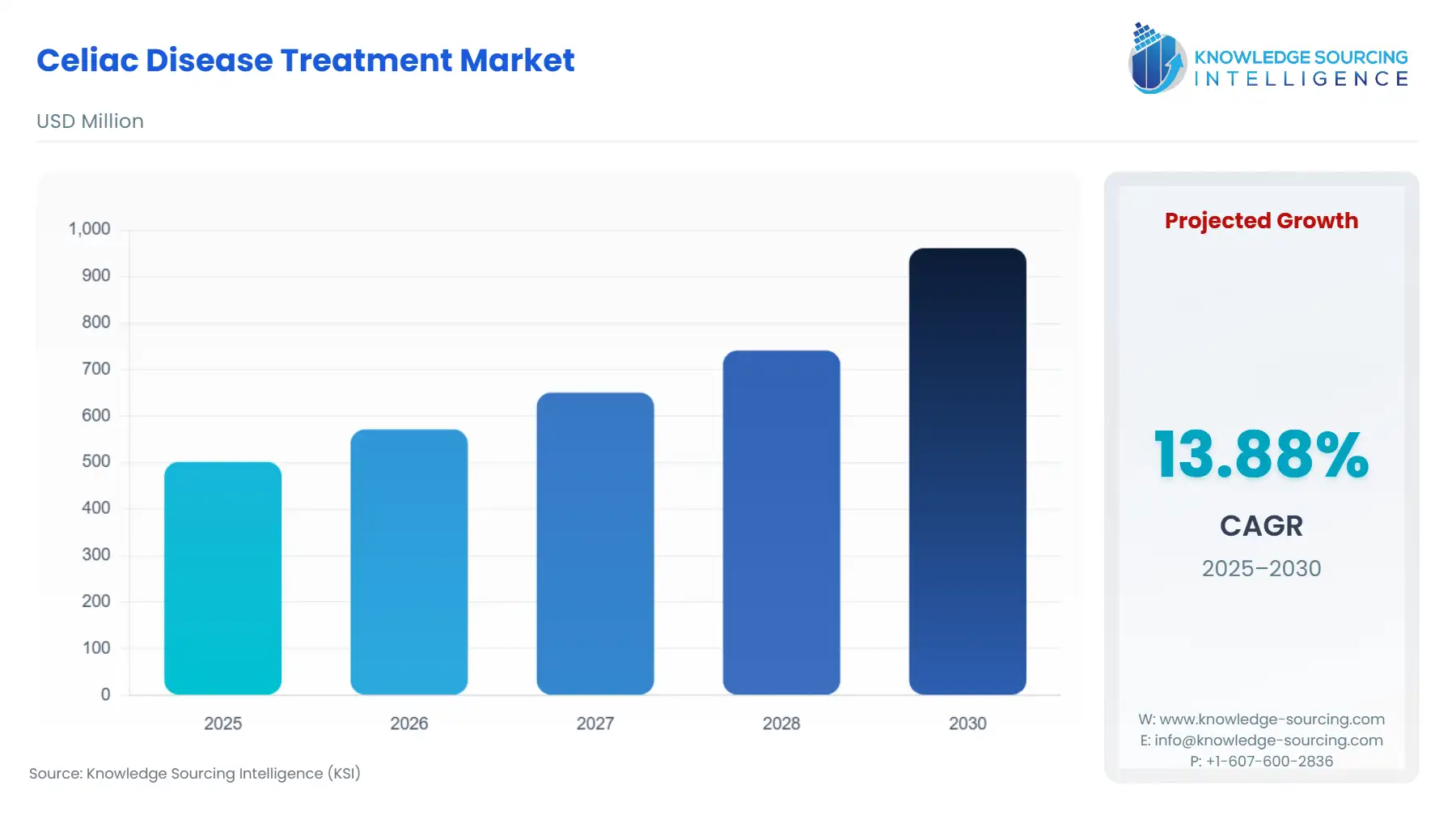

The Celiac Disease Treatment Market is expected to grow from USD 501.820 million in 2025 to USD 961.137 million in 2030, at a CAGR of 13.88%.

Celiac disease (CeD) is a chronic, autoimmune disorder of the small intestine triggered by the ingestion of gluten in genetically predisposed individuals. The market for Celiac Disease Treatment remains uniquely positioned, centered on the lifelong adherence to a strict Gluten-Free Diet (GFD) as the sole approved treatment globally. This dietary cornerstone creates a demand matrix where the largest volume of current market value resides in gluten-free food products and associated compliance/monitoring tools. However, the true market imperative is driven by the significant unmet need represented by patients who experience persistent symptoms or intestinal damage despite strict adherence to the GFD. This clinical gap fuels substantial investment in pharmaceutical research, focusing on pharmacological agents designed to reduce immune response, modify gluten peptides, or restore intestinal barrier function. The market’s evolution is therefore characterized by a duality: the mature GFD product segment catering to the current patient base and the high-growth, high-risk biopharmaceutical pipeline aiming to revolutionize care through novel immune modulators and antigen-specific immunotherapies.

Celiac Disease Treatment Market Analysis

- Growth Drivers

The rising global prevalence of celiac disease, estimated at approximately 1% and increasing due to improved awareness, acts as a foundational growth driver, significantly enlarging the pool of diagnosed patients requiring lifelong management solutions. Advances in non-invasive serological diagnostics, such as anti-tissue transglutaminase (anti-tTG) and anti-deamidated gliadin antibodies (DGP) tests, accelerate verified diagnoses, moving previously undiagnosed individuals into the active treatment market for GFD products and monitoring tools. Concurrently, the proliferation of specialized Gluten-Free Diet Products—including certified, widely available packaged foods—improves adherence and quality of life for diagnosed patients, sustaining demand for the largest market component while validating the GFD as the core treatment modality.

- Challenges and Opportunities

A primary challenge is the slow and often unsuccessful progression of drug candidates through late-stage clinical trials, which historically dampens investor confidence and delays the introduction of pharmacological alternatives. The high cost and difficulty of maintaining a truly strict GFD represent both a patient challenge and a market opportunity; cross-contamination in prepared foods is common. This failure point creates immense demand for novel Enzyme Therapy drugs and immune modulators designed as "safety nets" for inadvertent gluten exposure. The key opportunity, therefore, lies in developing and commercializing these adjunctive therapies, providing a breakthrough solution for the estimated 30% of patients who do not fully heal on the GFD alone.

- Supply Chain Analysis

The supply chain for the Celiac Disease Treatment market is bifurcated between the pharmaceutical pipeline and the established gluten-free food segment. Pharmaceutical supply chains for emerging assets—such as therapeutic peptides and biologics in late-stage trials—follow standard biotech pathways, requiring specialized manufacturing for active pharmaceutical ingredients (APIs), which are often outsourced to Contract Manufacturing Organizations (CMOs) in North America and Europe. The Gluten-Free Diet Products segment relies on a complex, decentralized food manufacturing supply chain that demands rigorous segregation and testing protocols to prevent gluten cross-contamination, often sourcing specialized ingredients like rice and tapioca flour from Asia-Pacific, increasing logistical complexity and certified production cost.

Celiac Disease Treatment Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FDA Draft Guidance for Celiac Disease Drug Development (2025) / Gluten-Free Labeling Rule |

The FDA's guidance emphasizes drug development for patients with persistent symptoms despite a GFD, formally channeling the biopharma pipeline toward adjunctive, not curative, therapies, focusing on histological and symptom endpoints. The Gluten-Free Labeling Rule (<20 ppm) bolsters consumer trust and directly drives demand for certified GFD products. |

|

European Union |

Regulation (EU) No 828/2014 (Gluten-Free Information to Consumers) / European Medicines Agency (EMA) |

This regulation establishes two labeling tiers (<20 ppm and <100 ppm), providing a clear framework that supports the proliferation of labeled GFD products across the continent, thus enabling safer dietary management. EMA oversight dictates the clinical trial requirements and subsequent market authorization for all pharmaceutical treatments. |

|

Canada |

Food and Drug Regulations (Gluten-Free Labeling) / Health Canada |

Health Canada's enforcement of the <20 ppm threshold for "gluten-free" claims provides robust consumer protection, increasing patient confidence in packaged food safety. This regulatory consistency helps to consolidate demand toward verified GFD food companies. |

Celiac Disease Treatment Market Segment Analysis

- By Type: Therapeutic Vaccines

The Therapeutic Vaccines segment represents the high-potential, high-risk frontier of the Celiac Disease Treatment Market, operating with a fundamental growth driver: the complete elimination of dietary restrictions and the lifelong burden of the GFD. These treatments are not traditional vaccines but are antigen-specific immunotherapies, such as those in the clinical pipeline by Barinthus Biotherapeutics (VTP-1000), designed to reprogram the immune system to tolerate gluten peptides. Growth is therefore highly inelastic and is driven by the promise of a cure or a substantial freedom from dietary vigilance. This segment directly targets the most significant constraint on patient quality of life, and its market penetration will be instantaneous and deep upon regulatory approval. Success here would fundamentally shift the treatment paradigm, decreasing long-term demand for diagnostic monitoring and GFD products, while creating substantial revenue in the high-cost, high-value pharmaceutical domain.

- By Distribution Channel: Hospital Pharmacies

The Hospital Pharmacies channel focuses on the highly specialized and acute care required for celiac disease complications, primarily non-responsive celiac disease (NRCD) and refractory celiac disease (RCD). The need for injectable or complex oral therapies managed in a controlled clinical setting drives this growth. This channel constitutes the primary point of dispensing for Steroids (e.g., budesonide) and Immunosuppressive Drugs used to treat severe, persistent intestinal inflammation, as well as Biologics that are currently being investigated for RCD. Crucially, the channel represents the initial point of access for any successfully launched injectable therapeutic vaccines or new enzyme therapies requiring initial patient education and monitored administration. The market's growth through this channel is concentrated on high-value, low-volume pharmaceutical products, directly linked to physician prescribing habits for complicated cases.

Celiac Disease Treatment Market Geographical Analysis

- US Market Analysis

The US market is the leading global revenue generator, propelled by high disposable income, a sophisticated healthcare reimbursement structure, and high diagnosis rates driven by family and at-risk screening efforts. The local demand factor is the robust and competitive Gluten-Free Diet Products industry, which provides wide availability and choice, facilitating patient adherence to the GFD. The US market is also the primary driver of pharmaceutical innovation, hosting the majority of pivotal Phase 2 and Phase 3 clinical trials for novel drug candidates like enzyme therapies and immune modulators, channeling immediate future demand into this geographical region upon successful FDA approval.

- Brazil Market Analysis

The Brazilian market is driven by the increasing urbanization and adoption of Westernized diets, which correlates with higher CeD incidence. A major local factor is the prevalence of undiagnosed cases, suggesting a significant latent market. Current treatment demand is primarily centered on over-the-counter Vitamins and Dietary Supplements to manage nutrient deficiencies (iron, folate, B12) resulting from malabsorption, representing a large, accessible segment of the market. The pharmaceutical segment is constrained by comparatively slower regulatory processes and price sensitivity, limiting immediate patient access to newer, high-cost therapies.

- United Kingdom Market Analysis

The UK market is significantly shaped by the National Health Service (NHS) and the co-existence of patient advocacy groups like Coeliac UK, which drive awareness and diagnosis. Its growth is highly influenced by reimbursement policies for staple GFD foods, which are often provided through prescription in various regions, maintaining a high and stable demand for specialty gluten-free baked goods and mixes. The UK's participation in major European clinical trials also positions it as an early adopter market for new pharmaceutical treatments entering the European Medicines Agency (EMA) review process.

- Saudi Arabia Market Analysis

The Saudi Arabian market is emerging, driven by increased awareness and diagnostic capabilities in major private health centers. The local factor influencing growth is the reliance on imported Gluten-Free Diet Products, which are often subject to premium pricing and complex logistical pathways, leading to higher consumer costs. Treatment demand focuses on essential Steroids and supportive care for complicated cases, with the specialized Immunosuppressive Drugs and novel pipeline treatments being imported for limited use in specialized tertiary care facilities.

- Japan Market Analysis

The Japanese market for Celiac Disease Treatment is small but characterized by exceptionally high standards for food safety and product quality. A unique local factor is the naturally low gluten content in the traditional diet, which consists largely of rice, resulting in a lower estimated prevalence. However, demand for treatment, predominantly Gluten-Free Diet Products, is highly concentrated on certified imports and meticulously developed local rice-based alternatives, catering to an increasingly globalized dietary pattern while prioritizing the highest standard of allergen control.

Celiac Disease Treatment Market Competitive Environment and Analysis

The Celiac Disease Treatment Market features a unique competitive structure, with no pharmaceutical products yet approved for the disease itself, creating an opportunity-rich pipeline landscape. The primary competition exists in the Gluten-Free Diet Products segment and the Diagnostic/Compliance Monitoring space. Biopharmaceutical competition centers on clinical trial progression, patent exclusivity, and demonstrated safety/efficacy in Phase 2 and 3 studies to capture the market for non-responsive patients.

- Innovate Biopharmaceuticals Inc.

Innovate Biopharmaceuticals is a clinical-stage biotech company focused on autoimmune and inflammatory diseases. Its lead drug candidate is Larazotide Acetate (INN-202), an oral peptide designed to normalize the dysfunctional intestinal barrier by decreasing permeability. Innovate's strategic positioning is pioneering the first-ever Phase 3 clinical trial for a drug candidate in celiac disease, directly targeting the unmet need of patients suffering from persistent symptoms despite the GFD. The company's focus on intestinal barrier integrity provides a mechanism distinct from immune suppression or gluten degradation, potentially offering an adjunctive approach to existing or pipeline therapies.

- Takeda Pharmaceutical Company Ltd.

Takeda is a major multinational pharmaceutical company leveraging its expertise in gastrointestinal disease research. Takeda's involvement in the Celiac Disease Treatment market is anchored by TAK-062, an investigational agent being studied in Phase 2 clinical trials. This drug is an oral enzyme therapy designed to digest residual gluten peptides in the stomach and small intestine, preventing the formation of immunogenic fragments. Takeda's strategic advantage is its robust clinical development infrastructure and global reach, allowing for large-scale, multi-center trials focused on improving both symptoms and small intestinal damage from inadvertent gluten exposure, positioning it as a significant potential competitor in the enzyme therapy space.

- Glutenostics LLC

Glutenostics LLC operates in the diagnostics and management tools segment of the market. The company focuses on licensing, developing, and commercializing novel technologies to improve lifelong management of celiac disease. Their key product, Gluten Detective, is an at-home rapid urine and stool test designed to monitor compliance with the GFD by detecting residual gluten exposure. This strategic positioning addresses the high rate of non-adherence and cross-contamination, directly driving demand for better compliance tools. By providing patients with a real-time feedback mechanism, Glutenostics supports better management and highlights the continued clinical need for pharmacological protection against gluten exposure.

Celiac Disease Treatment Market Developments

- October 2024: Topas Therapeutics announced positive topline results from its Phase IIa trial of TPM502 in celiac disease patients. The findings provided a clinical proof of concept for the company's proprietary nanoparticle platform, demonstrating its potential to induce targeted, antigen-specific tolerogenic effects.

- September 2024: Barinthus Biotherapeutics initiated its Phase 1 trial for VTP-1000, an antigen-specific immunotherapy utilizing its SNAP Tolerance Platform. The trial assesses the safety and tolerability of this investigational T-cell immunotherapeutic designed to promote immune tolerance to gluten in celiac patients.

- February 2024: Base Culture launched its Simply Bread line, a shelf-stable, clean-ingredient, and Certified Gluten-Free bread. The launch provided consumers with a convenient and compliant new option in the large and competitive Gluten-Free Diet Products segment.

Celiac Disease Treatment Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 501.820 million |

| Total Market Size in 2031 | USD 961.137 million |

| Growth Rate | 13.88% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Route of Administration, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Celiac Disease Treatment Market Segmentation:

- By Type

- Vitamins and Dietary Supplements

- Steroids

- Immunosuppressive Drugs

- Therapeutic Vaccines

- Enzyme Therapy

- Gluten-Free Diet Products

- Biologics

- By Route of Administration

- Oral

- Injectable

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Others