Report Overview

Biorational Pesticide Market Report, Highlights

Biorational Pesticide Market Size:

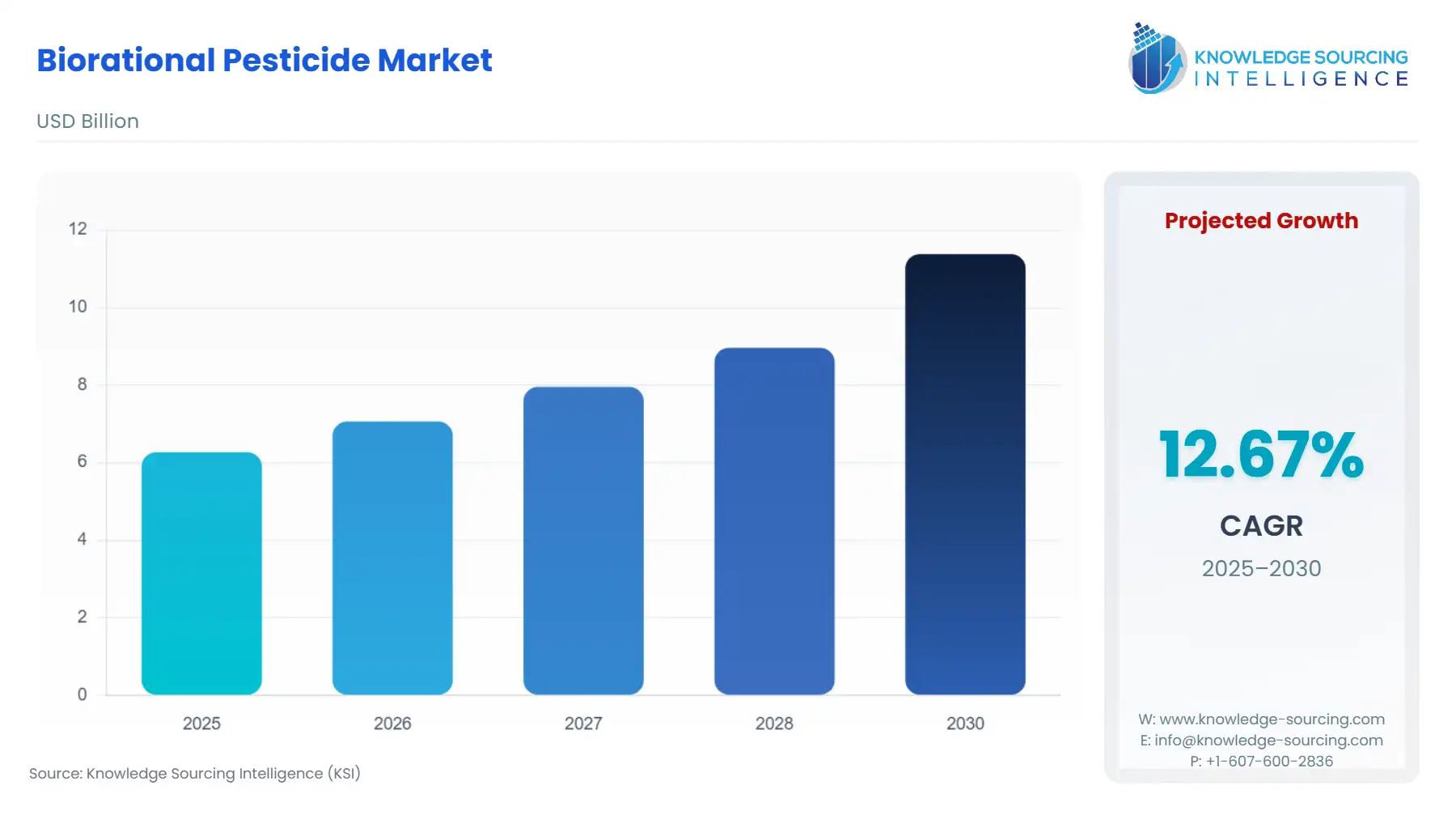

The Biorational Pesticide Market is expected to grow from US$6.268 billion in 2025 to US$11.381 billion in 2030, at a CAGR of 12.67%.

Biorational Pesticide Market Analysis

- Growth Drivers

Three demand catalysts directly expand biorational pesticide uptake. First, regulatory facilitation for low-risk products—such as the U.S. EPAs dedicated biopesticide registration programs and data guidance—shortens approval friction for biochemical and microbial products, increasing supplier investment and farmer availability (Environmental Protection Agency). Second, grower economics in high-value and row crops, notably Brazil’s large row-crop sector, create a commercial incentive to adopt bioinputs that align with export residue limits and IPM programs. This yields higher unit demand for biorational insecticides, nematicides and fungicides (Brazil Ministry of Agriculture). Third, large agribusiness players expanding integrated biological portfolios reduce distribution barriers through seed and spray channels, immediately increasing market reach and farmer trial rates (Syngenta).

- Challenges and Opportunities

The United States maintains a relatively favorable tariff environment for biorational pesticides, reflecting their classification under specialized harmonized tariff codes for microbial, biochemical, and other low-risk biological crop protection inputs. Most finished biorational actives and formulated products imported into the U.S. enter under low to zero MFN duty rates, reducing landed-cost inflation for distributors and enabling competitive price positioning relative to synthetic pesticides. However, tariff exposure increases when biological ingredients, fermentation inputs, or formulation intermediates originate from countries subject to Section 301 or other trade-remedy measures, which can raise component-level costs for certain suppliers.

Headwinds that suppress demand include inconsistent regional regulatory timelines—such as complex EU approval processes under Regulation 1107/2009—variable shelf-life and storage requirements for microbial products, and perceived variability in field efficacy relative to synthetics. These factors raise buyer switching costs and slow adoption (European Commission / EUR-Lex). Opportunities include strategic partnerships that accelerate strain optimization and fermentation scale-up, reducing production cost; formulation advances that improve foliar, seed and soil application ease; and public-policy incentives promoting reduced-residue inputs. Collectively, these opportunities reduce cost, handling and label constraints, increasing purchased volumes and repeat usage (Syngenta).

- Raw Material and Pricing Analysis

Primary cost drivers include biological feedstock inputs and fermentation capacity availability. Key production expenses involve strain development, master/working seed-lot maintenance, fermenter throughput, downstream concentration, stabilization systems and cold-chain requirements. Market evidence shows companies investing in internal strain optimization and partnerships that reduce cost per unit and improve scale, lowering farmer price barriers. The supply landscape is characterized by concentrated specialized contract manufacturers, occasionally creating capacity bottlenecks and short-term pricing volatility. When firms invest in in-house pilot and scale fermentation, unit costs decline and reliability improves, enabling steady distributor pricing and strengthening market demand (Syngenta).

- Supply Chain Analysis

The supply chain spans R&D and strain banks; pilot and full-scale fermentation; downstream formulation and stabilization; distribution networks (retail, seed channels); and growers. Key hubs include North America, Brazil, Europe and India, reflecting the availability of fermentation and formulation infrastructure. Logistical complexities include cold-chain requirements for some microbial actives, reduced shelf stability relative to chemical pesticides, and regulatory documentation for cross-border biological shipping. Dependence on contract fermenters or single-region production poses risk. Companies investing in vertical integration or establishing multi-regional supply partnerships reduce bottlenecks and advance steady adoption (MDPI).

Biorational Pesticide Market Government Regulations

|

Jurisdiction |

Agency / Regulation |

Market Impact |

|

United States |

EPA — Biopesticide Registration (Biopesticides & Pollution Prevention Division) |

Dedicated biopesticide pathways and data guidance reduce registration friction for microbial/biochemical products, accelerating launches and expanding availability (Environmental Protection Agency). |

|

European Union |

Regulation (EC) No 1107/2009 |

Heavier data and risk-based assessment lengthens approval cycles, delaying market entry and limiting near-term demand relative to the U.S. and Brazil (European Commission / EUR-Lex). |

|

Brazil |

Ministry of Agriculture (MAPA) — bio-input policies |

Advanced registration throughput and supportive policies have driven rapid uptake in row crops, creating a powerful demand pull (Brazil Ministry of Agriculture). |

Biorational Pesticide Market Segment Analysis

- By Technology — Biorational Insecticide

Biorational insecticides—including microbial agents, botanicals and semiochemicals—solve two farmer constraints simultaneously: residue limitations and resistance management. Microbial insecticides such as Bacillus thuringiensis and entomopathogenic fungi support residue-free or reduced-residue production while delivering targeted pest control. Their compatibility with organic certification and IPM frameworks increases addressable acres in both specialty and broadacre systems. Adoption strengthens where resistance reduces the efficacy of key synthetics, making biologicals essential in rotation plans to restore control reliability. High-value crops such as tomatoes, berries and greenhouse vegetables adopt early due to stringent residue thresholds. Formulation advancements such as stable dry granules, foliar sprays and seed treatments expand usability and widen the efficacy window. Companies with broad label claims and validated multi-pest performance convert grower trials into repeat purchases. Strategic alliances with distributors and seed channel partners accelerate coverage and directly expand unit demand (Evergreen Growers).

- By End-User — Tomato Growers

Tomato growers represent a high-velocity market segment due to stringent residue limits, intensive production cycles and high crop value. Biorational products meet key needs in this segment: soft-residue profiles compatible with short pre-harvest intervals, selective pest control that preserves beneficial insects, and compliance with retailer and export market residue standards. Biofungicides that induce plant defenses and bioinsecticides with pest-specific modes of action enable growers to rotate or partially replace synthetics while maintaining control. Adoption is strongest in greenhouse and high-value field systems where premium pricing offsets higher biological costs. Access to trained advisors and strong retail channels further accelerates adoption. Label expansions, compatibility with tank-mix partners and improved formulations strengthen grower confidence and increase repeat purchase rates (Evergreen Growers).

Biorational Pesticide Market Geographical Analysis

- United States: EPA’s dedicated biopesticide registration and strong extension systems support rapid trialing and adoption in specialty crops and turf (Environmental Protection Agency).

- Brazil: Advanced MAPA regulatory throughput and major row-crop acreage create one of the world’s strongest commercial demand profiles for biological insecticides and nematicides (MDPI).

- Germany (Europe): Stringent EU regulations under 1107/2009 slow new product approvals; demand is concentrated in high-value horticulture where pricing permits biological adoption (European Commission).

- South Africa: National Act 36 reforms and recent regulatory clarifications improve certainty; adoption depends on guidance harmonization and grower education (South Africa Agriculture Agency).

- India: CIB&RC provisional and full registration pathways plus fee concessions accelerate biopesticide approvals, strengthening uptake in rice, fruits and vegetables (PPQS).

Biorational Pesticide Market Competitive Environment

Syngenta leverages a global distribution network and deep R&D capabilities while expanding biologicals through partnerships with Intrinsyx Bio, Ginkgo Bioworks and others (Syngenta). Valent BioSciences focuses on low-risk biologicals and expanded its Melnik & Shafer research center in 2024, strengthening discovery and pipeline throughput (Valent BioSciences). Marrone Bio provides commercialized biofungicides and bioinsecticides such as Regalia and Grandevo, with strong traction in specialty crops (Evergreen Growers).

Biorational Pesticide Market Developments

- Jul 2024 — Syngenta & Intrinsyx Bio collaboration: Expansion of endophyte-based biological solutions for seed and foliar applications.

- Jul 2024 — Syngenta & Ginkgo Bioworks partnership: Scaling microbial strain production to accelerate biological product launch readiness.

- May 2024 — Valent BioSciences R&D expansion: Opening of a major addition to the Melnik & Shafer Biorational Research Center.

Biorational Pesticide Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Biorational Pesticide Market Size in 2025 | US$6.268 billion |

| Biorational Pesticide Market Size in 2030 | US$11.381 billion |

| Growth Rate | CAGR of 12.67% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Biorational Pesticide Market |

|

| Customization Scope | Free report customization with purchase |

Biorational Pesticide Market Segmentation

By Type:

- Biorational Fungicides

- Biorational Nematicides

- Biorational Insecticides

By Crop:

- Berries

- Corn

- Oats

- Tomatoes

- Barley

- Others

By Form:

- Dry

- Liquid