Report Overview

Baking Powder Market - Highlights

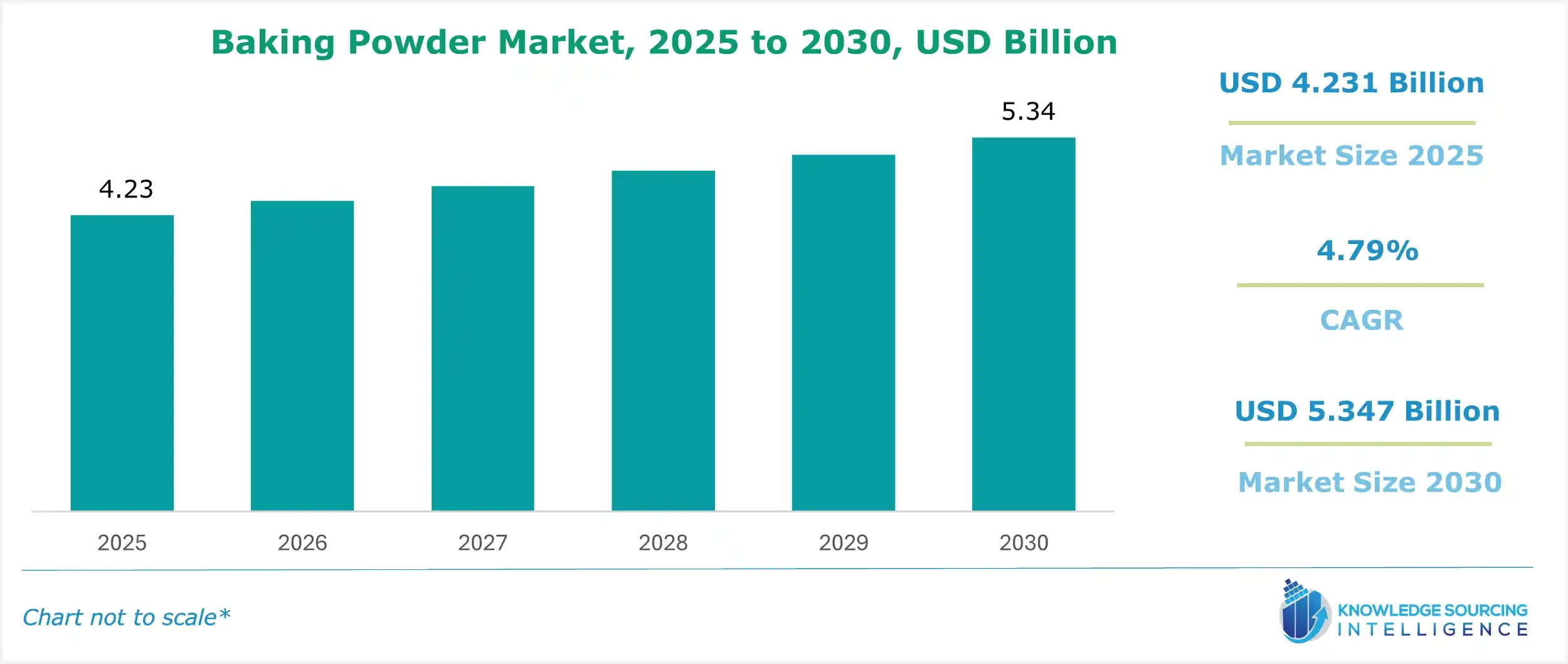

Baking Powder Market Size:

The Baking Powder Market is projected to attain a market size of US$5.347 billion by 2030, from a valuation of US$4.231 billion in 2025 at a 4.79% CAGR.

The rise in the popularity of ready-to-eat and ready-to-cook bakery products, and rising disposable income, increasing consumer purchasing power, is propelling market growth. It is driven by diverse factors, such as consumers, mostly in urban areas, who increasingly prefer bakery products that require little preparation, such as pre-packaged cakes, muffins, or baking mixes. Baking powder acts as an essential ingredient in these products to ensure consistent texture and rise in the baked goods. The growing popularity of baking mix-style products such as pancake and brownie mixes has made baking easier, thereby enhancing household consumption of baking powder. Further, brands such as Clabber Girl Baking Powder under B& G Foods, Inc., have leveraged this trend to market baking powder both retail and commercially.

Baking Powder Market Overview & Scope:

The Baking Powder Market is segmented by:

- Nature: By nature, the baking powder market is segmented into conventional, organic, gluten-free, and others. The conventional outsourcing segment is witnessing significant growth.

- Type: By type, the baking powder market is segmented into tartrate, sodium aluminum sulfate, phosphate, phosphate-free, and aluminum-free. The sodium aluminum sulfate is predicted to be the fastest-growing market share.

- Application: By application, the baking powder market is segmented into bread, cakes and pastries, cookies and biscuits, rolls and pies, and others. The bread segment is expected to have a significant market share in this segment.

- By End-User: By distribution channel, the baking powder market is segmented into online and offline. The offline segment is further segmented into hypermarkets and others. The online segment is rapidly expanding in the end-user segment.

- Region: The market is segmented into five major geographic regions, namely North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. North America is poised to hold a prominent position in the baking powder market, particularly due to its increasing demand for convenient foods like bread and pastries, the presence of regional players, and growing innovations.

Top Trends Shaping the Baking Powder Market:

1. Growing demand for organic and clean-label baking powder

- The growing trend of healthier, convenient foods and health-conscious consumers demand organic, clean-label, and healthier baking ingredients. Manufacturers are aligning with these trends with the introduction of healthier baking powder options such as bioreal organic baking powder from Agrsano GmbH & Co.KG, which is produced from the highest possible percentage of organic ingredients.

2. The online segment is growing at a rapid rate

- Expansion of the Baking Powder industry by way of online channels of distribution is being driven notably by the large-scale embracement of e-commerce and shifting consumer patterns. As internet penetration and the use of smartphones continue to increase across the world, customers are increasingly resorting to online shopping for convenience, enhanced selection of products, and time-saving. In this regard, as of March 2022, e-commerce sales in Canada amounted to approximately US$2.34 billion, as stated by Statistics Canada. It is estimated that retail e-commerce sales in the nation will total US$40.3 billion by the end of 2025. Baking powder companies and retailers are enhancing their digital platforms by incorporating features such as user reviews, detailed product information, and usage guides to reduce uncertainty and increase consumer confidence in purchasing decisions.

- Another aspect is internet availability, which, when coupled with an increasing use of smartphones and other mobile devices, makes shopping from the web more convenient than ever before. As of March 2024, out of a total of 954.40 million in India, there were 398.35 million rural internet subscribers. Further, as of April 2024, out of 6,44,131 villages in the country (village data as per Registrar General of India), 6,12,952 villages had 3G/4G mobile connectivity. Overall, 95.15 % of villages have internet access.

- In addition to this, retailers in online stores are both the prime gateways to consumers and powerful platforms for brand exposure and visibility in the baking powder industry. Online retailers often include brand marketplaces like Amazon, Walmart, and Flipkart. These online stores offer consumers a diverse variety of baking powder brands and types, affordable prices, and home delivery convenience advantages that are especially appealing within a time-constrained and technology-led shopping landscape. Increased demand for grocery shopping over the Internet has further enhanced the position of these stores to influence consumer decision-making and market penetration for baking ingredients.

3. Bread making is a high-growth area for baking powder use

- The baking powder market for bread is undergoing significant growth, led by the rising demand for bread globally, which continues to be a staple food in most parts of the world. Urbanization and lifestyle changes have contributed to increased consumption of bread in developing nations, driving demand for baking powder as a basic leavening agent in bread-making. As per the Croatian Bureau of Statistics, in 2022, annual consumption per household member of bread and buns amounted to 42.4 kg, of potatoes (fresh and frozen) to 32.1 kg, and of pork to 17.6 kg.

- Moreover, the growth of commercial bakeries and the bakery sector as a whole has heightened demand, as these businesses depend greatly on baking powder to create soft, well-risen bread and other baked products.

- Another key driver is the increasing consumer demand for convenience and convenience foods. With increasingly busy lifestyles, quick and easy foods such as pre-packaged bread and baked snacks become more popular, indirectly stimulating the baking powder market. The World Bank, in its global report, stated that as of 2023, the global urban population was recorded at 57%. The agency further stated that in 2021, the total urban population was recorded at 4.46 billion, which grew to 4.54 billion in 2022. In 2023, the total urban population across the globe was recorded at 4.61 billion. Trends towards healthy eating also come into play, as consumers desire healthier breads that have led to manufacturers developing new forms of baking powder, organic or low-cholesterol versions, for example, responding to changing dietary demands and choices.

- In addition, expanding middle classes in developing markets such as Asia-Pacific and increased consumer interest in home baking are continually driving up the market value. Collectively, these pose a steady growth in the baking powder market, indicative of its central position within the growing global bread market.

Baking Powder Market Growth Drivers vs. Challenges:

Opportunities:

- Rising disposable income: The rising disposable income prompts consumers to purchase convenient food products along with premium baking ingredients as well as baked goods. The rise in the middle class, especially in regions such as Asia Pacific, is adopting Western bakery consumption habits, such as cakes and breads, which is boosted by increased disposable income. This is contributing to the market demand as the preparation of these foods relies on baking powders. According to the data from the U.S. Energy Information Administration (EIA) of October 2023. The disposable income globally is estimated to witness continuous growth from $10,677 per person in 2025 to $11,862 per person by 2030. Further increasing to $13,116 per capita and $14,368 per capita by 2035 and 2040, respectively.

- Rapid urbanization and demand for convenience foods: The growing urbanization leads to an increase in demand for convenience food products such as baked goods and ready-to-eat snacks, which are primary drivers of the market growth. The rise in demand for easy-to-prepare and healthier food, such as healthier breads, has increased the utilization of baking powder in commercial as well as household baking, boosting the baking powder demand globally. Additionally, according to data from the World Bank, data urban population globally was 57 per cent, which is 4.61 billion in 2023, it is an increase from 4.54 billion in 2022, representing by 1.7 per cent rise from 2022 to 2023. Moreover, the United Nations (UN) data reports that the population living in urban areas is expected to increase to 68 percent by 2050. In addition, a major rise is projected in developing nations, such as India is expected to add 416 million urban population, while China is expected to include 255 million, followed by Nigeria with 189 million by 2050 from 2018. The rise in the middle-class population in these urban regions will contribute to the demand for fast food and pre-packaged food such as muffins, and cakes, which will promote the consumption of baking powder.

Challenges:

- Competition from Substitutes: Competition from substitutes is a significant challenge for the baking powder market because it affects both demand and pricing. Alternatives such as baking soda or yeast are readily available in the market, reducing the dependency on baking powder, especially among health-conscious and DIY consumers. Also, as its substitutes are cheaper, it affects the demand for baking powder.

Baking Powder Market Regional Analysis:

- North America: The North American region will have a significant share in the market, driven by high demand for processed and packaged foods, thriving baking culture, and prominence of the food processing industry.

For instance, the United States baking powder market has experienced steady growth in recent years, driven by evolving consumer preferences, increased demand for convenience foods, and innovations in product formulations. The U.S. market benefits from a robust baking culture, a well-established food processing industry, and rising consumer interest in home baking. This growth is further supported by the rising popularity of baked goods, conscious trends, and increasing urbanization. With the growing income and urbanization, the demand for baking powder has risen. There is a significant market for ready-to-eat snacks and foods. There is a high demand for fast food products because of the change in consumers’ eating behavior. Consumers have become more aware and knowledgeable about their wellness and health. There is a substantial surge in the consumption of health-based bakery products. The consumption of nutrition bars, high-fiber bread, and breakfast cereals meets consumer demand for a balanced and healthier diet. Baking powder is required for wellness and health-oriented food products.

Baking Powder Market Competitive Landscape:

The Baking Powder Market is fragmented, with some of the major companies including B&G Foods, Inc., AB Mauri (Associated British Foods plc), and Agrano GmbH & Co. KG, among others.

- Product Launch: In July 2024, ARM & HAMMER’s Performance Products Division and Kudos Blends collaborated and introduced KODA™, a line of potassium bicarbonate-based leavening agents, which are direct alternatives to traditional baking soda (sodium bicarbonate) Leavening agents like potassium bicarbonate of KODA are key components or substitutes in baking powders, targeting health-conscious baking.

Baking Powder Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Baking Powder Market Size in 2025 | US$4.231 billion |

| Baking Powder Market Size in 2030 | US$5.347 billion |

| Growth Rate | CAGR of 4.79% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Baking Powder Market |

|

| Customization Scope | Free report customization with purchase |

Baking Powder Market Segmentation:

By Nature

- Conventional

- Organic

- Gluten-free

- Others

By Type

- Tartrate

- Sodium Aluminum Sulfate

- Phosphate

- Phosphate-free

- Aluminum-free

By Application

- Bread

- Cakes and Pastries

- Cookies and Biscuits

- Rolls and Pies

- Others

By Distribution Channel

- Online

- Offline

- Hypermarkets

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others