Report Overview

Automated Testing Equipment Market Highlights

Automated Testing Equipment Market Size:

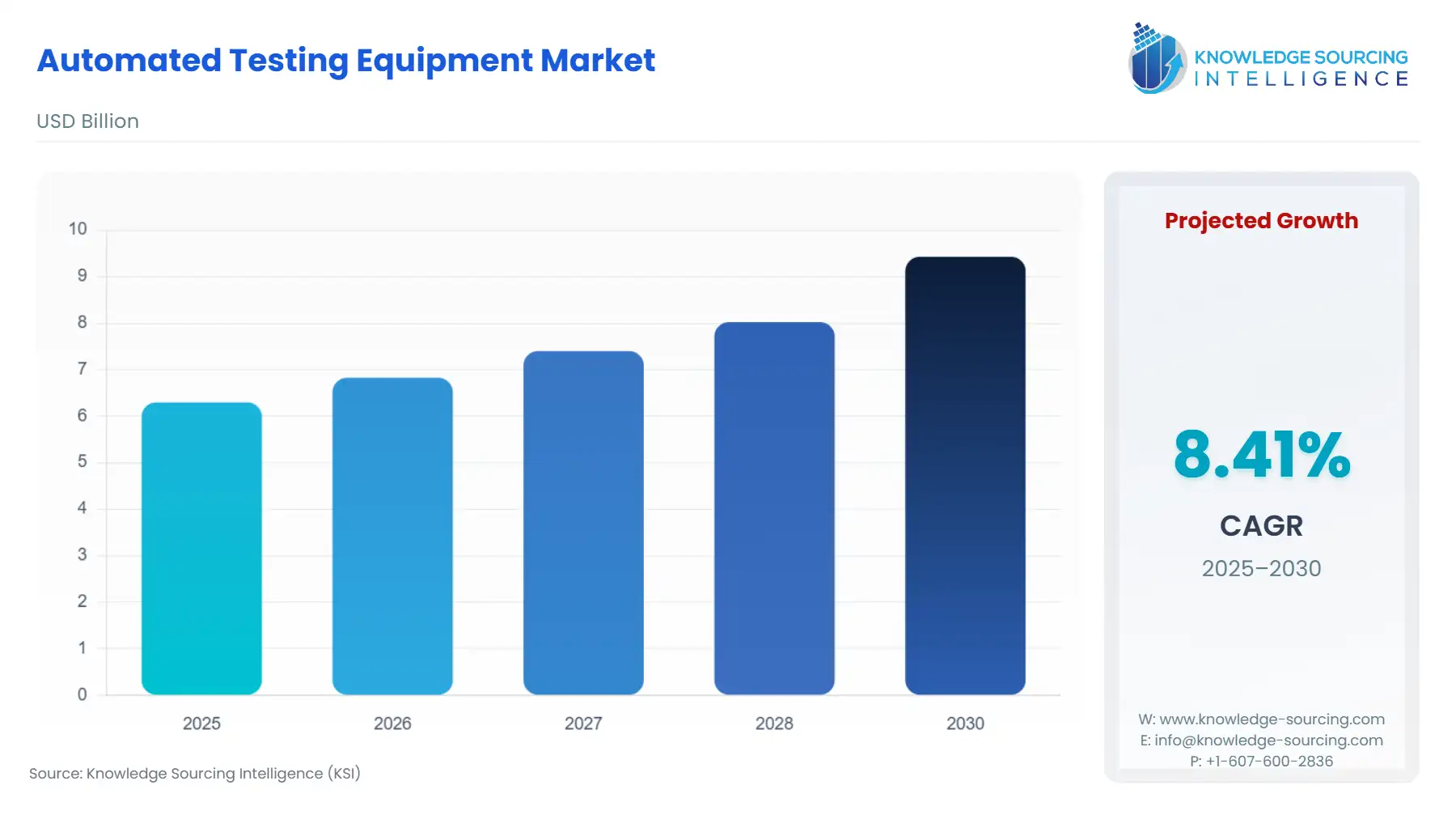

The automated testing equipment market is expected to grow at a CAGR of 8.40%, reaching a market size of US$9.428 billion in 2030 from US$6.297 billion in 2025.

Automatic test equipment (ATE), often called automated testing equipment, is computerized machinery that executes and evaluates functionality, performance, quality, and stress tests on electronic devices and systems using test instruments. As the name implies, ATE automates typically manual electronic test equipment and processes with a minimum of human input.

Automatic test equipment tests electronic devices to ensure their performance, functionality, and safety for those who use them. Some of the electronic devices examined by automatic test equipment are integrated circuits, PCBs, HDDs, and line-replaceable units that support airplanes, spacecraft, and satellites.

The growing demand for ATE by various end-user industries, such as the automotive and semiconductor industries, is anticipated to drive the market's growth. An increase in the number of connected devices and consumer electronics, as well as a growing emphasis by companies on quality improvement and end-to-end testing solutions, are expected to drive the market further. The execution of ATE in the semiconductor industry has improved the performance ability and speed of the procedure, eventually decreasing the cost of semiconductor devices, which is expected to positively affect the market growth.

The rise in adoption of System on Chip (SoC) and growing demand for consumer electronics due to a rising population is expected to be the primary driving forces in the ATE market. Advances in semiconductor manufacturing processes, as well as the expansion of wireless networks in developing countries, are expected to drive the automatic test equipment market in the coming years. Additionally, substantial technological developments, as well as design intricacy and the need for effective testing, are also projected to assist market expansion.

One of the major drivers for the increase in the global market size of automated testing equipment can be the increase in the demand for consumer electronics. In consumer electronics, ATEs are used to test and observe the functionality and durability of different devices like smartphones, tablets, and smartwatches, among others. The global market has witnessed a significant increase in the market demand for consumer electronics, especially in the smartphone categories.

Similarly, the increasing growth of the aerospace and defense industry globally is also projected to propel the market for ATEs forward. In the aerospace industry, they are used to test various operations of multiple onboard devices and also ensure the safety and reliability of the aircraft. Similarly, ATEs are used in the defense industry to monitor the various equipment designed for military applications, like radars, communication devices, and other electronic devices.

Automated Testing Equipment Market Growth Drivers:

- Increasing demand for the durable and advanced consumer electronics devices.

One of the major drivers for the growth in the market demand for automated testing equipment can be the increase in the global demand for consumer electronics. Consumer electronics products, like smartphones, tablets, smartwatches, and laptops, among many more, have witnessed increasing technological advances, driving their demand forward. Introducing new developments, like the thinnest smartphones and others, creates a crucial need for testing to guarantee their durability and functionality among users. The ATE verifies the performance of consumer electronics devices, like tablets and smartphones, and ensures their durability and functionality.

The increase in demand for the global smartphone of mobile phone ownership increased significantly. According to the International Telecommunication Union (ITU), about 73% of the global population had the availability of smartphones in 2022. According to the data, about 93% of the total European population has smartphones, whereas about 88% of the total population of the Americas region had smartphones in 2022.

- Increase in the global demand for the aerospace and defense industry.

Another major driver for the increase in the global market demand for automated testing equipment is the increase in the aerospace and defense industry. The global aerospace industry is growing majorly all across the globe, increasing the demand for safe and reliable airplanes. In the aerospace industry, the ATE is used to monitor the operations of devices and detect any possible risks. These machines also enhance testing accuracy with improved reliability and increased efficiency. The global increase in the demand for aeroplanes is projected to propel the demand for ATE in the global market forward. One of the leading manufacturers and suppliers of airplanes in the global market, Airbus, in its annual report in 2023, reveals an increase of about 11% in its revenue, with an increase of about 74 more aircraft delivered.

Similarly, in the defense industry, ATEs are used to monitor various military equipment, like radars, sensors, communication devices, and other electronic devices. They can also test the avionic equipment, along with various electronic modules of automobiles, used in military applications. The global increase in various nations' defense expenditure is projected to boost the defense landscape, increasing the global market size of ATEs. According to the Ministry of Defence of India, the nation increased its defense expenditure by about 13% in 2023 from the previous year. Similarly, the defense expenditure of the UK increased from about 52.8 billion euros in 2022 to about 54.2 billion euros in 2023.

Automated Testing Equipment Players and Products:

- Averna: Averna, one of the global test and quality solution providers, offers various types of automated testing equipment, which ensures its consumer products achieve the desired quality and greater profit margin. The company offers UTS-1500X, which has the capability to test full or half chassis, of the automotives. It offers burn-in tests, functional tests, environmental tests, and various other types of tests.

- WEETECH GmbH: WEETECH GmbH, a part of the Halma Company, offers various types of automated functional testing solutions, which help to simulate reality and also offer enforce switching operations. The company offers products like WK 260PC, W 434, and W454, among various others.

Automated Testing Equipment Market Key Developments:

- In May 2024, KingSpec, or Shenzhen KingSpec Electronics Technology Co., Ltd., introduced its new automated storage testing equipment that offers an efficient production of SSDs. According to the company, its new ZS101 offers multiple tests, like reliability demonstrations, firmware burning, and burn-in testing. The new ATE also offers multi-unit synchronous testing.

Automated Testing Equipment Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automated Testing Equipment Market Size in 2025 | US$6.297 billion |

| Automated Testing Equipment Market Size in 2030 | US$9.428 billion |

| Growth Rate | CAGR of 8.40% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Automated Testing Equipment Market |

|

| Customization Scope | Free report customization with purchase |

The Automated Testing Equipment market is segmented and analyzed as:

- By Component

- Hardware

- Software

- Services

- By End-User

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- North America