Report Overview

Global Testing Equipment And Highlights

Testing Equipment and Services Market Size:

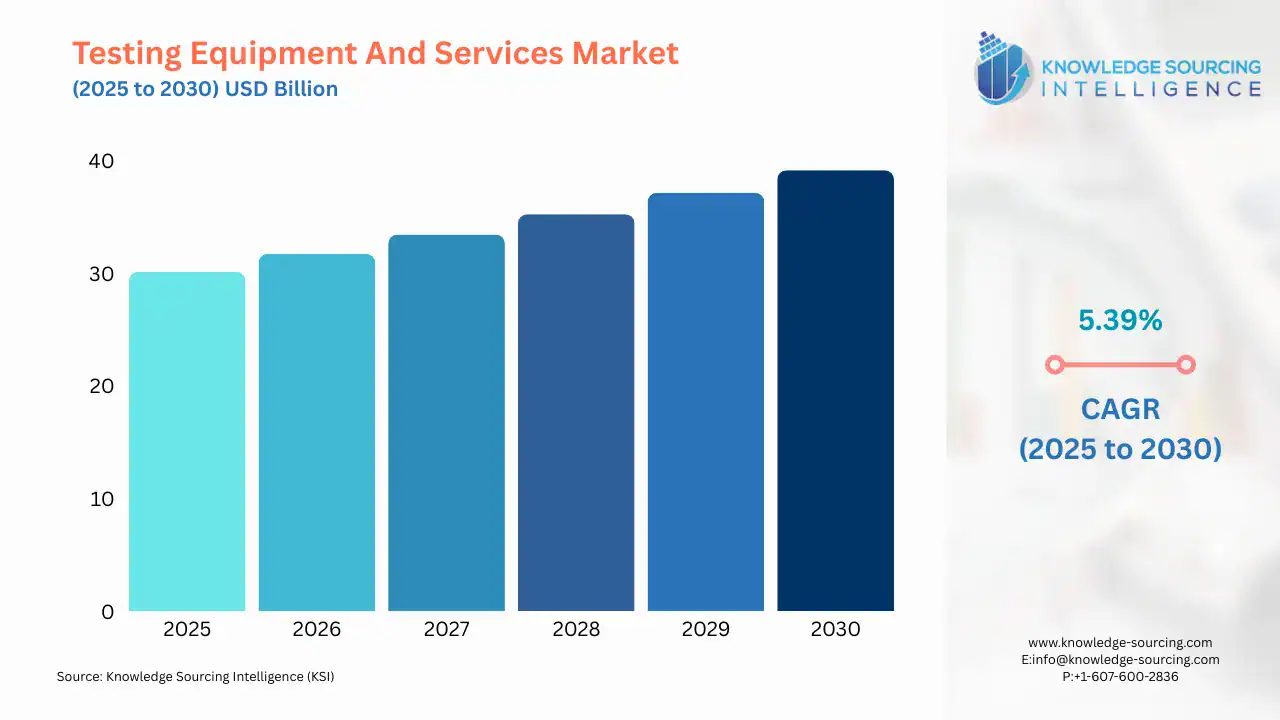

The global testing equipment and services market is projected to grow at a CAGR of 5.39% from US$30.107 billion in 2025 to US$39.135 billion by the end of 2030.

The demand for strict adherence to regulations and compliance with quality inspection and testing services is one of the primary factors driving the global market for testing and equipment. Further, penalties are imposed on firms that do not align with the agreeable guidelines or regulations by government organizations to prevent any misfortune from occurring to consumers because of an inferior or poorly manufactured product. For example, federal law in the U.S. ensures that manufacturers and importers test their consumer products to ensure compliance with the requirements about consumer product safety and, more so, certify the product.

Such laws in different regions or countries push producers to manufacture their products according to the specified regulations and guidelines using the necessary testing equipment and services. This helps drive the global testing equipment and services market growth. Companies belonging to different end-users have been showing a booming demand for testing equipment and services as they aim to ensure that their product is of premium and utmost quality so that it does not deteriorate easily and can meet the needs of the consumer.

Some of the prominent players in the global testing equipment and services market include MTS Systems Corporation, National Instruments, ATA Engineering, Inc., SGS SA, and Brüel & Kjær, among others. These companies have a considerable market share due to their good image and product offerings. Major players in the global testing equipment and services market have been propelling their growth with the help of their competitive positions and strategies.

Testing Equipment and Services Market Growth Drivers:

- Increasing consumer electronics is expected to propel the global testing equipment and services market growth.

The consumer electronics industry is expected to hold a fairly significant market share during the forecasted period. The major driving force in this market has been a higher disposable income among consumers and, thus, their ability to purchase general operating consumer electronics devices. The miniaturization of electronics and electrical components is further fuelling the demand for these services to test the working and efficiency of such tiny and complicated structures. The global automotive industry will probably witness a decent CAGR between 2025 and 2030, owing to the significant technological revolutions that automobiles are undergoing at present, including the proliferation of complex parts, requiring a lot of effective and state-of-the-art testing equipment and services to test the safety and durability of new and improved features.

- Rising investment and product innovation are predicted to fuel the global testing equipment and services market expansion

All global market participants are putting more effort into undertaking various growth strategies such as product launches, partnerships, and a few others towards increasing their market footprint and gaining a larger market share. Demand for such advanced testing equipment derives from an increase in R&D investments in electronics, telecommunications, and automotive. The speed of technological advances demands advanced equipment for product quality and reliability assurance. Increasingly stringent regulations and quality standards across many industries also fuel the uptake of testing equipment and services to enhance safety standards.

In January 2024, GRL India launched a special lab to provide mandatory telecom product testing services. This lab is one of very few recognized by India's Telecommunication Engineering Centre (TEC) as a Certification Accreditation Body (CAB), which was authorized to provide services under its Mandatory Testing and Certification of Telecommunication Equipment (MTCTE) scheme in the country. Today, GRL provides testing services as per the MTCTE Essential Requirements (ER) for optical, interface, and security testing services according to ITSARs under the NCCS ComSec Scheme. NABL also accredits this laboratory against ISOIEC 17025:2017. This all speeds up the time it takes for manufacturers to market.

In December 2024, GienTech launched the Testing Center of Excellence (TCoE 3.0), an AI-powered end-to-end solution for completely revolutionizing the future of enterprise software testing. Software systems developed in mission-critical scenarios would be built quickly and smartly by companies using novel, innovative artificial intelligence, machine learning, automation, and agile testing methodologies for dependable real use.

Testing Equipment and Services Market Geographical outlooks:

- Asia Pacific region to hold significant shares of the global testing equipment and services market

In geographical terms, the global testing equipment and services market can be segmented as follows: North America, South America, Europe, MEA, and APAC. It is estimated that during the predicted period, North America will hold the largest market share because of the strict equipment testing rules in countries like the US and Canada. Such rigorous restrictions concerning quality and test inspections across different industry verticals have prompted market players to keep extending their reach into this country.

The increasing rate of industrial automation and the growth of sectors such as automotive, aerospace, and oil and gas in North America presents a strong opportunity for market players. These businesses are eager to expand their client base in the region and enhance the growth of testing equipment and services available in the market.

The testing equipment and services market in the Asia-Pacific region is set to grow strongly over the forecast period due to significant levels of consumer electronics production in countries such as China and India. In addition, companies within the market are positioning themselves with investments in APAC countries that capture the benefits and offer next-generation testing services and equipment.

Testing Equipment and Services Market Key Developments:

- February 2024- Keysight Technologies introduced the E7515W UXM Wireless Connectivity Test Platform for Wi-Fi. This network emulation solution simulates Wi-Fi devices and traffic to cover new use cases on the latest IEEE 802.11be standards. This combination of capabilities for faster test setups, reduced complexity, and improved performance accelerates time-to-market for Wi-Fi 7 devices, which will comprise the next generation of Wi-Fi wireless communications technology.

- June 2023- DEKRA rolled out AI Testing and Certification services offerings that focus on the safety and security of AI-driven products and services. The company claims future-focused, all-in services and the requisite global market access to upcoming regulations. DEKRA is indeed a global partner with all developments in the lifecycle of AI solutions, promoting safety and security in AI-enabled solutions.

List of Top Testing Equipment and Services Companies:

- MTS Systems Corporation

- National Instruments.

- ATA Engineering, Inc.

- SGS SA

- Brüel & Kjær

Testing equipment and services market scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Testing Equipment And Services Market Size in 2025 | US$30.107 billion |

| Testing Equipment And Services Market Size in 2030 | US$39.135 billion |

| Growth Rate | CAGR of 5.39% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Testing Equipment And Services Market |

|

| Customization Scope | Free report customization with purchase |

The global testing equipment and services market is analyzed into the following segments:

- By Offering

- Equipment

- Services

- By End-User Industry

- Aerospace

- Automotive

- Consumer Electronics

- Energy and Power

- Construction

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Testing Equipment and Services Market Size:

- Testing Equipment and Services Market Key Highlights:

- Testing Equipment and Services Market Growth Drivers:

- Testing Equipment and Services Market Geographical outlooks:

- Testing Equipment and Services Market Key Developments:

- List of Top Testing Equipment and Services Companies:

- Testing equipment and services market scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 15, 2025