Report Overview

Airborne Wind Energy Market Highlights

Airborne Wind Energy Market Size:

Airborne Wind Energy Market, with a 7.69% CAGR, is projected to increase from USD 1.472 billion in 2025 to USD 2.296 billion in 2031.

Airborne Wind Energy Market Trends:

The airborne wind energy market is predicted to expand at a constant pace during the projected period. Airborne wind energy is an innovative design concept that utilizes a rotor suspended in the air without the need for a tower. By harnessing the higher wind velocity and consistency at elevated altitudes, it can optimize energy generation while eliminating the costs associated with tower construction. This novel approach presents a promising solution for more efficient and cost-effective wind energy generation for its end users. The increasing demand for wind electricity generation, and technological advancements coupled with substantial financial investments are fuelling the airborne wind energy industry growth.

Airborne Wind Energy Market Segmentation Analysis:

Rising wind electricity generation demand bolsters the airborne wind energy market.

Airborne wind energy is an innovative approach to wind power generation that harnesses strong, steady high-altitude winds by using devices like kites, drones, or other air foils to generate electricity. The mechanism includes launching these devices into higher altitudes where wind currents are stronger and more consistent, transmitting the captured wind energy back to the ground via a tether. The increasing demand for wind energy is primarily driven by the global urgency to transition to renewable and clean energy sources in response to the escalating threat of climate change. According to the International Energy Agency, in 2022, there was an unprecedented surge in wind electricity generation, marking an increase of 265 terawatt-hours (TWh), a 14% jump from the previous year.

Technological advancements drive the airborne wind energy market expansion.

Continual technological breakthroughs and innovations within the airborne wind energy market are profoundly shaping its future. Developments have been made towards enhancing the efficiency and functionality of key components, including kites, and drones. This progress encompasses not only the refinement of the designs of these airborne devices but also the improvement in their operational capabilities and energy conversion efficiency. For instance, in March 2023, Skysails-Power developed an innovative device that generates electricity through a "pumping cycle." In this system, an autonomously launched kite maneuvers against the wind in a figure-eight pattern, unwinding a tether from a generator. This continuous action generates energy as the kite's movement pulls the rope.

Investments drive airborne wind energy market growth.

Investments in airborne wind energy play a pivotal role in the airborne wind energy industry growth as they provide crucial financial support for the research, development, and commercialization of advanced AWE technologies. With increased funding, companies can focus on refining and scaling their AWE systems, optimizing designs, and enhancing overall efficiency thereby driving technological advancements. For instance, in February 2021, the Estonian startup, Hepta Airborne, secured €2 million in funding to expand its drone-based solutions for inspecting and analyzing power lines. Also, in July 2023, EnerKite and Kitemill secured a combined investment of €2 million through crowdfunding initiatives in Europe. The investment has further bolstered the commercialization of Airborne Wind Energy (AWE)

Airborne Wind Energy Market Geographical Outlook:

Europe is expected to dominate the airborne wind energy market.

Europe will hold a significant share of the market due to the substantial financial investments in wind energy. For instance, according to the WindEurope annual report, in 2022, Europe demonstrated its commitment to strengthening its energy infrastructure by investing a significant sum of €17 billion in the development of new wind farms. Additionally, the market growth is further propelled by strategic acquisitions by tech giants and establishments of airborne wind energy test centers. For example, in June 2023, Norway's Kitemill acquired Exact Aircraft which signified a step forward in its ongoing efforts to commercialize its autonomous airborne wind energy technology. Also, in May 2021, RWE inaugurated an airborne wind energy testing site in Ireland.

Airborne Wind Energy Market Growth Drivers:

Weather dependency may restrain the airborne wind energy market growth.

The operational efficiency of airborne wind energy systems is fundamentally linked to the wind which inherently makes their performance more susceptible to the weather patterns. This greater weather dependency, in comparison to their ground-based wind turbine counterparts, potentially acts as a constraint on the growth of the airborne wind energy industry. This limitation arises because the variability of wind at different times of the year and in different geographical locations introduces a level of unpredictability in the energy production of these systems Additionally, extreme weather conditions might also pose risks to the durability and functionality of airborne wind energy devices, further complicating their operational logistics. As a result, weather dependency potentially slows down the adoption rate and expansion of the airborne wind energy market.

Airborne Wind Energy Market Company Products:

SKS PN-14: Skysails Power’s SKS PN-14 onshore wind power system is designed to deliver clean electricity on demand, even in low-wind locations. It achieves this by harnessing wind at altitudes ranging from 200 to 400 meters, where the wind currents are stronger and more consistent, thus ensuring high yields. An added advantage of the SKS PN-14 system is its safety measures. In regions prone to hurricanes and typhoons, the system can be easily retrieved and stowed away before these natural disasters strike, providing a reliable and weather-resilient wind power solution.

Kitemil Solution: Kitemill's solution employs a kite tethered to a ground-based generator, utilizing the power of wind much like traditional kites. As the kite sails in a helical pattern along the wind direction, it pulls the tether from the winch generator at the ground station, thereby generating electricity. A key advantage of Kitemill's solution lies in its efficiency and sustainability - the system requires less than 10% of the material resources used by conventional wind turbines of the same capacity, highlighting its potential as a low-impact and economical alternative in wind energy generation.

List of Top Airborne Wind Energy Companies:

SkySails Group GmbH

Kitemill

Kitepower (Enevate B.V.)

EnerKite GmbH

eWind Solutions Inc.

Airborne Wind Energy Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

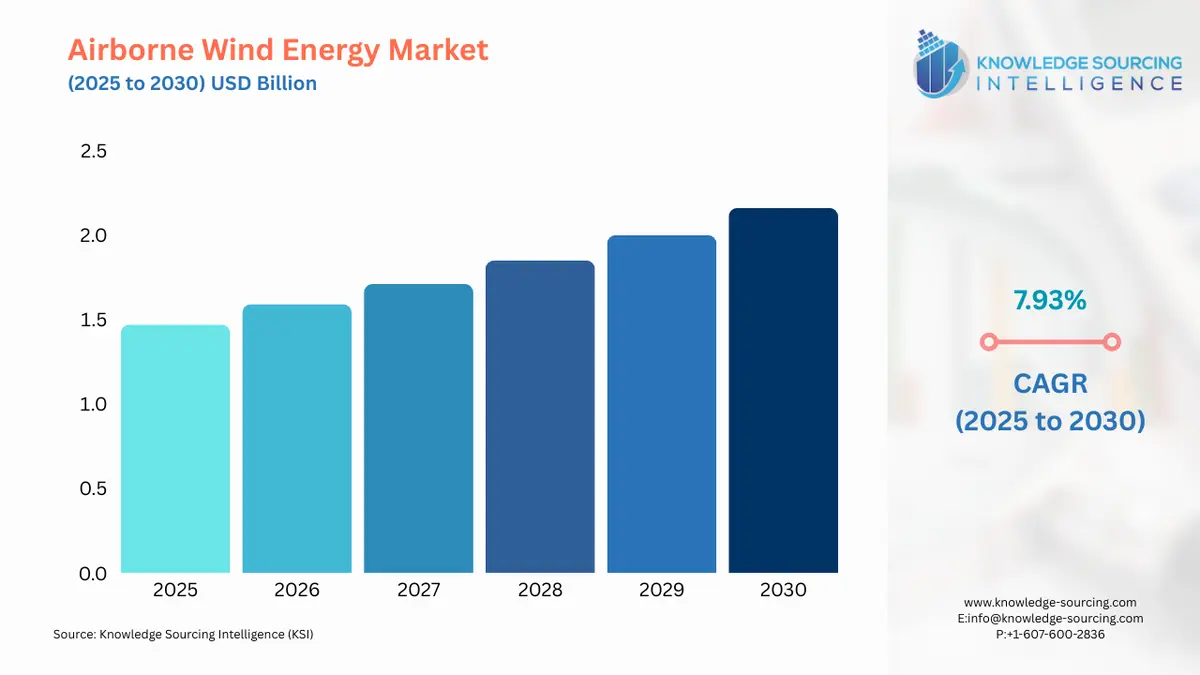

Airborne Wind Energy Market Size in 2025 | USD 1.472 billion |

Airborne Wind Energy Market Size in 2030 | USD 2.156 billion |

Growth Rate | CAGR of 7.93% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Airborne Wind Energy Market |

|

Customization Scope | Free report customization with purchase |

Airborne Wind Energy Market Segmentation

By Device

Large Kites

Balloons

Drones

Others

By Technology

Large Turbines (Above 3MW)

Smaller Turbines (Less Than 3MW)

By Application

Offshore

Onshore

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others