Report Overview

Wave Energy Market - Highlights

Wave Energy Market Size:

The wave energy market is set to increase at a 18.07% CAGR, growing from USD 93.913 million in 2025 to USD 254.441 million in 2031.

Wave Energy Market Navigation

Wave energy is a type of renewable energy that is produced from the motion of the waves. To harness wave energy, electricity generators are positioned in various ways on the ocean's surface. Wave energy uses a variety of different technologies. The energy from the rise and fall of the waves is captured by absorbers with the help of a buoy. A linear or rotational generator is used to transform the recovered energy into electrical energy which is used in daily life.

Wave Energy Market Growth Drivers:

High energy potential in waves

As per the US Energy Information report, the energy potential of waves off coastlines in the United States reached 2.64 trillion kWh in 2021. Electric generators having a generating capacity of at least one megawatt are used for utility-scale power. Potential locations for the use of wave energy include the west coasts of the United States, Europe, Japan, and New Zealand. There are several emerging techniques and technologies for catching wave energy and transforming it into power which is fueling the wave energy industry. These techniques include putting equipment on the water's surface or just below it and anchoring equipment to the ocean floor.

Factors that will boost the market for wave energy

The rapid growth of the renewable energy sector and the rising need for electricity from the marine industry are the main drivers propelling the wave energy market growth over the anticipated timeframe. However, the wave energy market growth was primarily being constrained by the high capital expenditures involved in developing infrastructure for generating wave energy but the government in various nations in investing in such projects which fueling the market. Additionally, it is anticipated that the top players in the global wave energy market will gain from an increase in government initiatives and financial support for the renewable energy industry.

The rapid switch to renewable energy from fossil fuels

Companies are responding to the energy transition which is transforming the global energy industry from fossil-based energy production and consumption systems to renewable energy sources. According to the International Energy Agency (IEA), the capacity for renewable power will increase by 50% globally between 2019 and 2024. The most economical kind of marine energy, which accounts for up to 80% of all marine energy worldwide, is wave energy. Wave energy has a high-power density that is typically 30 kW/m, which makes it 5 times more powerful than wind energy and therefore propelling the wave energy industry. Waves may be predicted using sophisticated prediction algorithms 10 hours to several days in advance.

Government programs to promote the use of wave energy

Various tactics are being employed by nations to support the renewal energy initiatives, including target-based growth, subsidies, and restrictions on the expansion of conventional power plants. Governmental organizations can provide scalable, affordable solutions that reach beyond the whole energy supply by using infrastructural resources. Countries like the UK have started projects for the spread of clean energy that involve cost reduction in technology, a reduction in carbon emissions, and the development of cutting-edge technologies to evaluate the viability of a unique sort of electricity.

Increasing use in power generation

It is projected that the use of wave energy in power generation would have the largest wave energy market share. The core of the utilization can be linked to a strong emphasis on the production of electrical energy from renewable sources. Therefore, increasing the power sector's capacity is required to satisfy the growing global demand. Electricity produced from the sea is becoming well-liked and is predicted to dominate the wave energy industry due to its potential, dependability, and high availability when compared to other conventional renewable resources. The desalination sector is also a critical area for the industry as the use of saltwater to create drinking water and potable water has grown in popularity.

International Collaboration and increasing commercialization

Countries and organizations are working together on R&D and deployment projects to hasten the wave energy market growth. For instance, the European Marine Energy Centre (EMEC) and the Ocean Energy Systems (IEA-OES) of the International Energy Agency. Additionally, several early-stage commercial deployments and pilot projects are now under progress, demonstrating the promise of wave energy as a dependable and sustainable energy source. These initiatives also offer insightful information for future technological advancement and cost-cutting.

Wave Energy Market Geographical Outlook:

It is projected that the European wave energy market would account for the biggest market share.

Europe is anticipated to hold the largest wave energy market share for wave energy. Wave energy is the most advanced ocean energy technology. The EU aspires to have built 100 GW of wave capacity by 2050. To achieve these objectives, the wave energy industry must overcome a variety of challenges, including those relating to technical readiness, funding, market development, administrative and environmental issues, and the accessibility of grid connections, particularly in remote areas. These limitations are now impeding the sector's capacity to attract inward investments and engage with the supplier chain to unleash cost-reduction strategies.

Government Initiatives

United Kingdom: By 2030, the UK government wants to produce 30% of the nation's power from offshore renewable sources, thus it has allocated £160 million towards the development of wave-generating projects.

European Union: With an emphasis on research, innovation, and market adoption, the European Union (EU) has committed €300 million for wave energy projects between 2021 and 2027 under the Horizon Europe program.

United States: For improvements to the current wave energy infrastructure, the U.S. Department of Energy offered financing of USD 35 million.

Australia: Wave power projects among others have received more than AUD 50 million from the Australian Renewable Energy Agency (ARENA).

Wave Energy Market Developments:

In May 2023. Kaoko Green Energy Solutions (Pty) Ltd in Namibia and AW-Energy, a pioneer in near-shore wave energy technology, signed a Memorandum of Understanding (MOU). The MOU intends to manufacture green hydrogen from renewable energy sources, including wave energy and is focused on the growth of renewable energy.

In October 2022, Danish offshore vessel owner Maersk Supply Service and Swedish wave energy converter business CorPower Ocean constructed a 6.2km subsea export cable off the coast of northern Portugal to power the HiWave-5 Project.

In August 2022, Bombora Wave Power, the company that develops wave energy converters, finished tank testing on a floating foundation structure that is suited for the InSPIRE system, which integrates a wind turbine with Bombora's wave technology into a single floating offshore platform.

List of Top Wave Energy Companies:

Eco Wave Power

Bombora Wave

CalWave

Oscilla Power

AW-Energy

Wave Energy Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

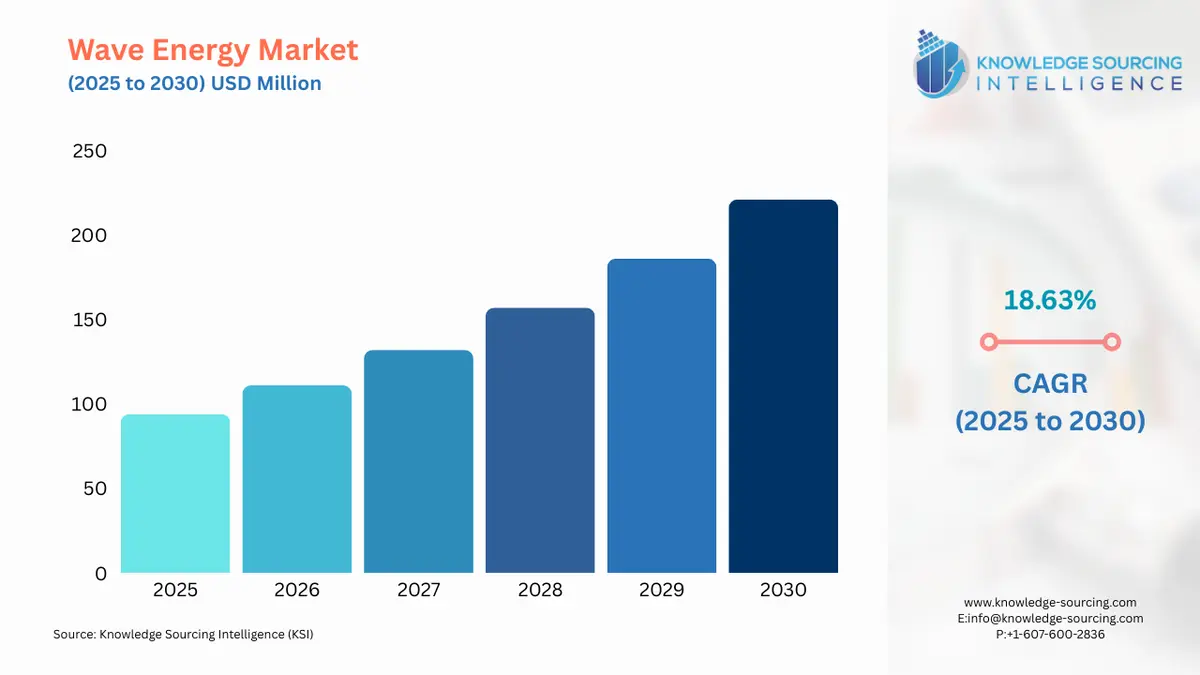

Wave Energy Market Size in 2025 | USD 93.913 million |

Wave Energy Market Size in 2030 | USD 220.683 million |

Growth Rate | CAGR of 18.63% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Wave Energy Market |

|

Customization Scope | Free report customization with purchase |

Wave Energy Market Segmentation

By Technology

Oscillating Water Column

Oscillating Body Converters

Overtopping Converters

By Application

Power Generation

Water Desalination

Pumping of Water

Environmental Protection

By Location

Onshore

Offshore

Nearshore

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others