Report Overview

Virtual Power Plant Market Highlights

Virtual Power Plant Market Size:

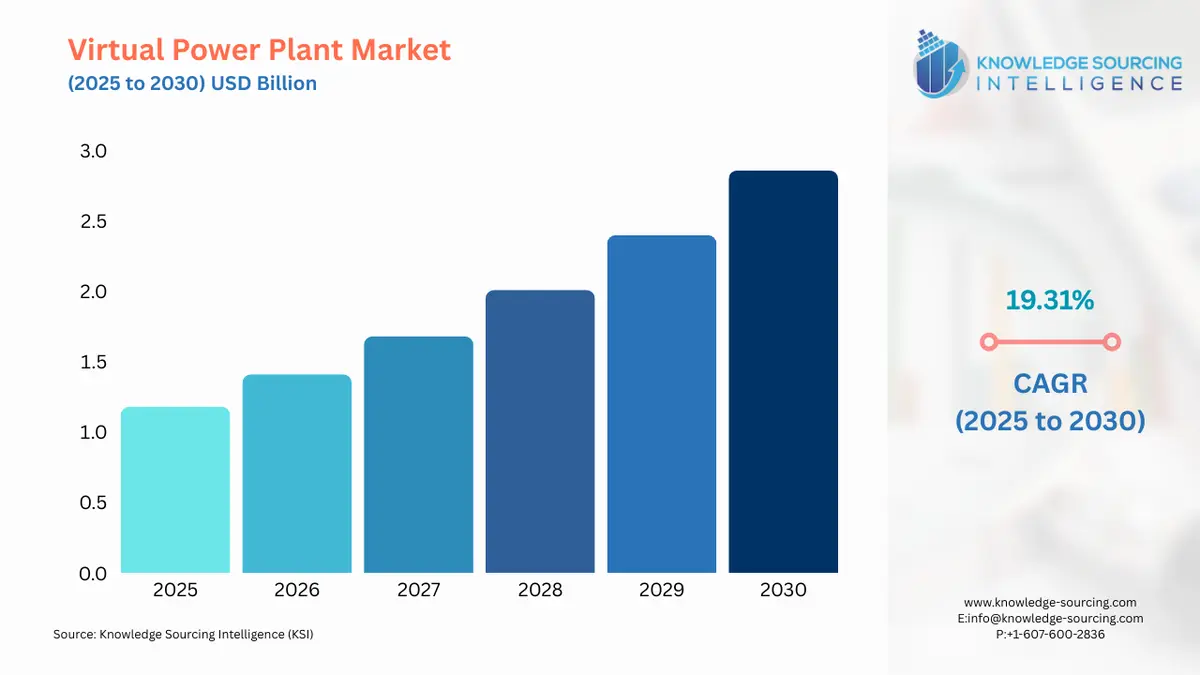

The virtual power plant market is forecasted to achieve a 18.73% CAGR, reaching USD 3.311 billion in 2031 from USD 1.182 billion in 2025.

A Virtual Power Plant harnesses the combined capacity of various distributed energy resources (DERs) spread throughout the network, creating a unique operational portfolio tailored to the specific characteristics of these DERs. Virtual power plants find applicability in several areas, including EV chargers, home appliances, HVAC equipment, and batteries. The escalating growth of the virtual power plant industry is largely propelled by the expanding renewable energy, improved EV charging infrastructure, and emerging energy storage technologies.

Virtual Power Plant Market Growth Drivers:

Increasing renewable energy drives virtual power plant market growth.

Virtual Power Plants are used in integrating renewable energy sources such as solar panels and wind turbines into the power grid through advanced software. The rising demand for renewable energy due to growing global concern about climate change and the need to reduce greenhouse gas emissions has provided a positive outlook for the market demand for virtual power plants. According to the International Renewable Energy Agency, in 2022, global wind energy capacity experienced a boost of 75 GW, marking a growth of 9%. Solar photovoltaic power also saw a significant expansion, with an addition of 191 GW.

Increasing EV charging infrastructure bolsters the virtual power plant market growth.

Virtual Power Plants are used in the electric vehicle charging infrastructure by managing and balancing the electricity load. Due to the increasing EV adoption, the demand for power during peak charging times can stress the electrical grid. Virtual power plants, through their integrated control of diverse distributed energy resources, help to stabilize the grid, ensuring that power is effectively allocated during these high-demand periods. According to the International Energy Agency, in 2022, the United States witnessed the installation of approximately 6,300 fast charging stations and by the close of the year, the cumulative number of fast charging stations hit 28,000.

Emerging energy storage systems drive the virtual power plant market expansion.

Virtual Power Plants are instrumental in energy storage systems because they can efficiently manage when and how much stored energy to release into the grid, optimizing the use of energy storage systems based on real-time demand and supply conditions. This facilitates a more stable and reliable grid, particularly important given the intermittency of renewable energy sources like wind and solar. The growth of energy storage systems is driven by increasing renewable energy deployment and investments which is driving the virtual power plant market’s growth. According to the International Energy Agency, in 2022, worldwide investments in battery energy storage surpassed USD 20 billion, showcasing robust growth. The momentum is set to continue, with projected investments for 2023 reaching a record of over USD 35 billion.

Virtual Power Plant Market Geographical Outlook:

North America is projected to dominate the virtual power market.

North America will hold a significant share of the virtual power plant market due to the region's significant investment and collaborative efforts. Substantial financial commitments are being made by various companies, utilities, and government bodies to scale up VPP projects in North America. For instance, in 2020, Sidewalk Infrastructure Partners disclosed their pledge of $100 million towards OhmConnect to scale its operations. This substantial investment is earmarked for the establishment of Resi-Station, which is set to become North America's most extensive virtual power plant.

Virtual Power Plant Market Restraints:

High initial cost restrains the virtual power plant market growth.

The growth of the virtual power plant (VPP) industry can be hindered by the significant initial investment necessary to establish these systems. The development of a VPP involves the integration of a wide array of energy resources, each with its own costs, and the installation of sophisticated control and communication infrastructures. These components, when combined, constitute a sizable initial expenditure, which can prove challenging for some companies or regions, particularly those with budget constraints or in poor areas. This high financial barrier to entry can therefore curtail the widespread adoption of VPPs, acting as a notable deterrent in the overall expansion of the VPP industry.

Virtual Power Plant Market Key Developments:

December 2025: NextEra Energy and Google Cloud announced a landmark partnership to accelerate AI growth and transform energy infrastructure by developing gigawatt-scale data center capacity.

November 2025: Enphase Energy expanded European VPP support by launching one-minute data telemetry and integrating remote control capabilities for in-home EV chargers and heat pumps.

September 2025: CPower Energy reported a 40% increase in VPP customer dispatch events, demonstrating the critical role of aggregated commercial and industrial load flexibility for grid stability.

List of Top Virtual Power Plant Companies:

Toshiba Energy Systems & Solutions Corp (Toshiba Corp)

Statkraft

Next Kraftwerke (Shell Overseas Investment B.V)

Honeywell International Inc.

Enel X

Virtual Power Plant Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Virtual Power Plant Market Size in 2025 | USD 1.182 billion |

Virtual Power Plant Market Size in 2030 | USD 2.858 billion |

Growth Rate | CAGR of 19.31% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Virtual Power Plant Market |

|

Customization Scope | Free report customization with purchase |

Virtual Power Plant Market Segmentation

By Energy Type

Biomass & Biogas

Hydro

Wind

Solar

By Application

EV Chargers

Home Appliances

HVAC Equipment

Batteries

Others

By End-User

Residential

Commercial

Industrial

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others