Report Overview

Video Streaming Service Market Highlights

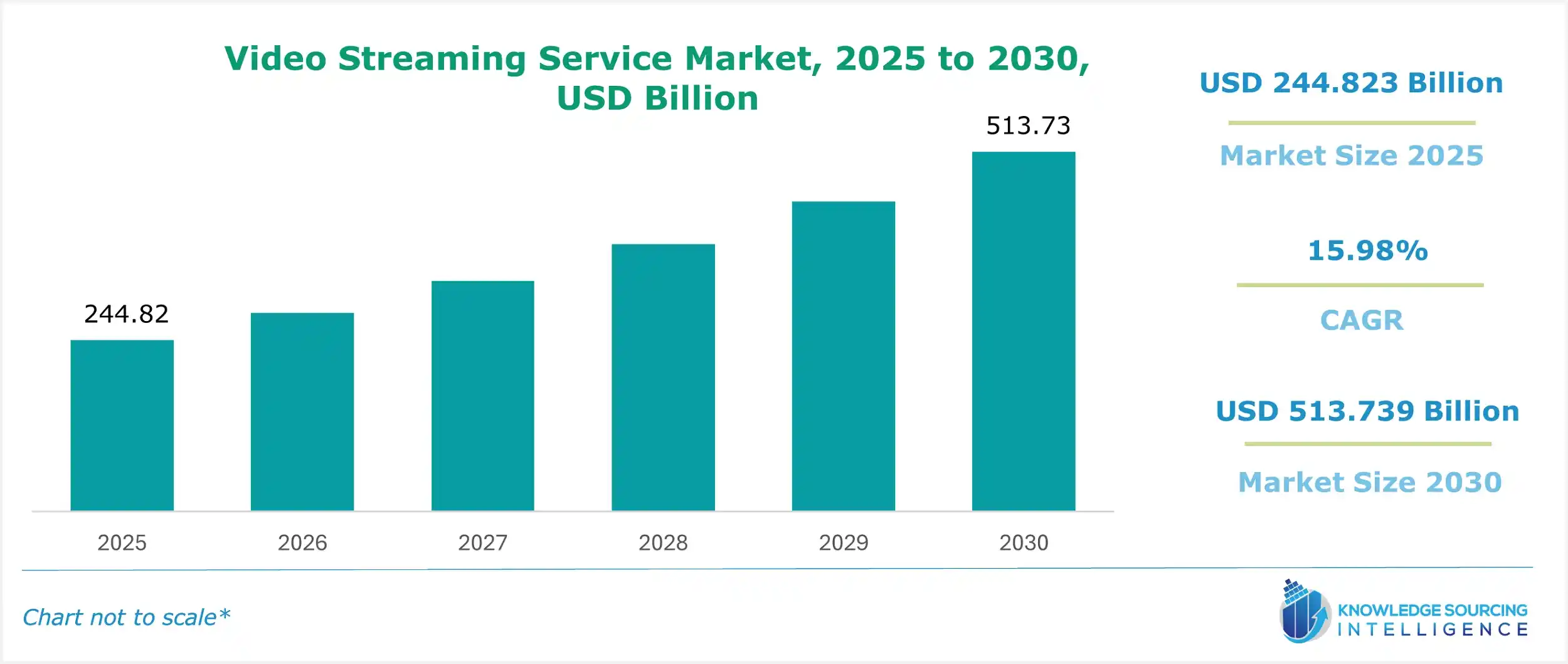

Video Streaming Service Market Size:

The Video Streaming Service Market, valued at US$244.823 billion in 2025, is projected to grow at a CAGR of 15.98%, reaching US$513.739 billion by 2030.

The video streaming service market is driven by the increase in consumers and is expected to grow as newer technological advancements are released. The adoption of 5G technology is another significant factor in the rising demand for streaming services. The convenience of watching movies, series, videos, and live programs without leaving the house influences the video streaming service market. With the adoption of on-demand entertainment, streaming services allow us to watch what we want. This is one of the main reasons for the rise of streaming services such as Netflix, Amazon Prime Video, etc.

Video Streaming Service Market Overview & Scope:

The Video Streaming Service market is segmented by:

- Streaming Type: The Video Streaming Service market is segmented into non-linear and live.

- Platform: The Video Streaming Service market, by platform, is segmented into smartphones/tablets, PCs/Laptops, Smart TVs, and others.

- End-User: The Video Streaming Service market, by end-user, is segmented into consumer and enterprise.

- Region: The Video Streaming Service market is segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Top Trends Shaping the Video Streaming Service Market:

1. Technological advancement in Video Streaming

- There is a growing technological advancement in video streaming technology, shaping this market. There are advancements in integrating newer technologies such as artificial intelligence, virtual reality, and augmented reality.

- For instance, Broadpeak introduced a new video streaming API, Saas Platform, in support of AWS, integrating cloud-based technologies into their video streaming platform. AWS SaaS platform integrates artificial intelligence and data analytics to optimize content delivery.

Video Streaming Service Market Growth Drivers vs. Challenges:

Opportunities:

- Development of 5G technology: The introduction of 5G networks will revolutionize the way bandwidth-intensive, high-quality, and high-demand video is delivered to mobile devices. 5G is expected to provide speeds of up to 1 Gbps. This is around ten times faster than older 4G networks, which only provide speeds between 100 Mbps and 200 Mbps. According to OOKLA, a global internet speed testing company, the download speeds of 5G are 954% faster than traditional 4G networks, and the upload speeds are 311% faster. Since 5G can support a much denser network of base stations, greater bandwidth is accessible in high-traffic areas such as sports arenas and music venues. 5G technology is also expected to decrease latency in video streaming, even at higher qualities like 8K streaming, enhancing consumer experience. The 5G network is also expected to improve handheld devices' battery efficiency.

Challenges:

- Price sensitivity: The highly competitive landscape is leading market players to reduce their costs as people quickly switch to other affordable alternatives, making it difficult for companies to retain and acquire new customers.

Video Streaming Service Market Regional Analysis:

- Asia-Pacific: APAC is anticipated to grow rapidly in the video streaming service market due to its high consumer base, which is also increasing. The growing internet penetration with the development of 5G infrastructure at affordable prices will lead to rapid growth.

- North America: North America accounted for a significant market share in the video streaming service market due to high demand, disposable income, and higher internet penetration. However, the market is facing saturation and will continue to face during the forecast period.

Video Streaming Service Market Competitive Landscape:

The market is fragmented, but there is an emerging trend for consolidation due to growing acquisitions and mergers, such as the 21st Century Fox, including Star, which was acquired by the Walt Disney Company in 2019. Other players, such as Netflix Inc., Amazon Prime Video, and Disney+, among others, also have a dominant share in the video streaming service market. Some regional players, such as Tencent Video, cater to different geographies. There is also an emerging trend of niche players.

- Collaboration: In October 2024, Netflix and Universal Filmed Entertainment Group agreed to renew their existing licensing deal for animated films, including those from Illumination and DreamWorks Animation. Netflix will continue to hold exclusive rights to animated films, building exclusive content libraries to attract subscribers.

- Merger: In October 2024, Amazon acquired certain assets of MX Player. With this acquisition, Amazon is merging two of India’s free AVOD services, MX Player and Amazon miniTV, into one service, i.e., Amazon MX Player. This will allow advertisers to reach a large base of engaged Indian viewers.

Video Streaming Service Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Video Streaming Service Market Size in 2025 | US$244.823 billion |

| Video Streaming Service Market Size in 2030 | US$513.739 billion |

| Growth Rate | CAGR of 15.98% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Video Streaming Service Market |

|

| Customization Scope | Free report customization with purchase |

Video Streaming Service Market is analyzed into the following segments:

By Streaming Type

- Non-Linear

- Live

By Platform

- Smartphones and Tablets

- PCs/Laptops

- Smart TVs

- Others

By End-User

- Consumer

- Enterprise

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa