Report Overview

Urinary Tract Infection Testing Highlights

Urinary Tract Infection Testing Market Size:

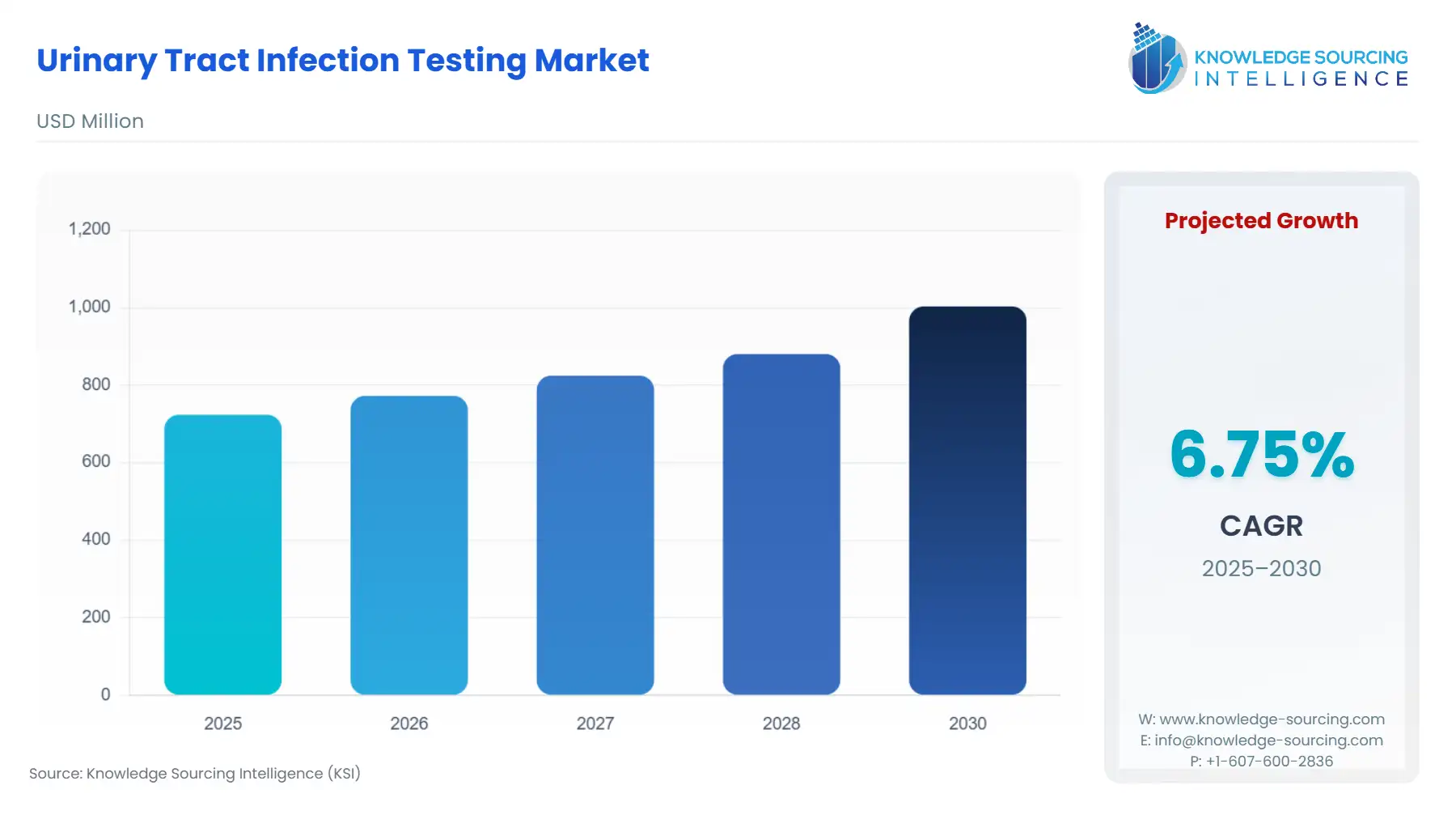

Urinary Tract Infection Testing Market is anticipated to grow at a 6.55% CAGR, increasing from USD 723.625 million in 2025 to USD 1058.701 million in 2031.

Urinary Tract Infection Testing Market Trends:

Urinary tract infection (UTI) testing involves various methods to detect and diagnose infections affecting the urinary system like the kidneys, ureters, bladder, and urethra. The choice of testing method depends on the patient's symptoms, medical history, and the severity or recurrence of UTIs. The increasing prevalence of UTIs, growing awareness of UTIs along with the rise of an ageing population and chronic conditions has emerged as a significant driving force behind the substantial growth of the urinary tract infection testing industry.

Urinary Tract Infection Testing Market Growth Drivers:

The increasing prevalence of UTIs bolsters the urinary tract infection testing market growth.

Urinary tract infection (UTI) tests are pivotal in diagnosing urinary tract infections, ensuring accurate identification of infections within the urinary system. Rapid diagnostic tests swiftly detect specific proteins or substances associated with UTIs, providing quick results for immediate treatment decisions. The surge in urinary tract infection cases globally has intensified the demand for efficient and accurate testing methods. As UTIs become more prevalent, people are aiming to seek timely medical attention and undergo UTI testing for early diagnosis and appropriate treatment. For instance, as per the NIH, urinary tract infections constitute a frequent cause for healthcare consultations. In the United States alone, UTIs lead to approximately 7 million office visits, 1 million emergency department visits, and more than 100,000 hospitalizations, accumulating an annual cost of $1.6 billion.

Growing awareness of UTIs drives urinary tract infection testing market growth.

Increased awareness among individuals about UTIs and their symptoms prompts proactive measures, including seeking diagnostic testing for early detection and treatment. This heightened awareness encourages individuals experiencing symptoms such as frequent urination, burning sensation during urination, or lower abdominal pain to promptly consult healthcare providers and undergo UTI testing, typically involving methods like urinalysis, urine cultures, or rapid diagnostic tests. The growing awareness of UTIs among individuals and healthcare professionals contributes to the expansion of the urinary tract infection testing market. As awareness leads to increased demand for UTI testing, there is a concurrent surge in the development and adoption of advanced testing technologies and methodologies.

The ageing population drives the urinary tract infection testing market expansion.

The ageing population often faces an increased susceptibility to urinary tract infections (UTIs) due to various factors such as weakened immune systems, comorbidities, urinary incontinence, and the prevalence of catheter use among seniors. UTI testing in this demographic is crucial as symptoms in older adults might be subtle or atypical, leading to underdiagnosis and delayed treatment. For instance, according to a 2021 report by the World Trade Organization (WHO), By 2030, 1 in 6 people in the world will be aged 60 years or over. Additionally, between 2015 and 2050, the proportion of the world's population over 60 years will nearly double from 12% to 22%. Also, the number of persons aged 80 years or older is expected to triple between 2020 and 2050 to reach 426 million.

Urinary Tract Infection Testing Market Geographical Outlook:

North America is expected to dominate the market.

North America is projected to account for a major share of the urinary tract infection testing market owing to the region’s increasing prevalence of Urinary tract infections (UTIs) and the growing affordability of UTI testing, particularly in countries like the United States and Canada. For instance, according to the National Institute of Health (NIH), Urinary tract infections (UTIs) are one of the most frequent clinical bacterial infections in women, accounting for nearly 25% of all infections and around 50–60% of women in the United States develop UTIs in their lifetimes, underscoring the rising prevalence of UTIs in the region and the critical need for accessible and accurate urinary tract infection (UTI) testing solutions in the region.

Urinary Tract Infection Testing Market Challenges:

Antibiotic overuse and resistance will restrain the urinary tract infection testing market growth.

The growth of the urinary tract infection testing industry may be restrained by the overuse of antibiotics for UTIs. Pervasive and indiscriminate use of antibiotics without proper diagnostic confirmation contributes significantly to the emergence of antibiotic-resistant bacteria creating an environment where bacteria evolve to become resistant to commonly prescribed antibiotics. As a result, the efficacy of UTI testing could be compromised due to the evolving nature of antibiotic resistance, leading to challenges in accurately diagnosing and effectively treating UTIs. These pose a challenge to the market's expansion and may require promotion of rational antibiotic use and education and awareness campaigns targeting both providers and the public are essential to emphasize the importance of proper UTI testing before antibiotic administration.

Urinary Tract Infection Testing Market Company Products:

Urinary Tract Infection (UTI) Testing Research Solutions: This real-time PCR solution by Thermofisher is optimized to provide results within 5 hours, surpassing traditional culture-based methods. Offering a seamless end-to-end process, it handles numerous samples daily with minimal intervention. The TaqMan OpenArray Urinary Tract Microbiota Comprehensive Plate efficiently identifies up to sixteen bacteria, swiftly pinpointing specific microorganisms causing urinary tract infections.

Rapid Diagnostic Point of Care Test for UTI Detection: Ranox’s UTI testing aids in promptly identifying UTIs, enhancing precise and targeted treatment. It offers species-level identification and comprehensive patient profiling from a single urine sample. Detecting 23 bacterial strains, 1 fungal type, and 8 resistance markers, it delivers same-day results, aiding healthcare professionals in choosing the most suitable treatment for patients.

Urinary tract infections test: Prisma SA's urinary tract infections test is designed for individuals seeking to detect the presence of leukocytes, blood, nitrites, or proteins in urine, suggesting a potential ongoing infection. This test utilizes plastic strips with various reactive sections. It is intended for both qualitative and semi-quantitative identification of leukocytes, blood, nitrites, and proteins in urine.

List of Top Urinary Tract Infection Testing Companies:

Thermo Fisher Scientific

Beckman Coulter

Randox

Prima Lab SA

NxGen MDx

Urinary Tract Infection Testing Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Urinary Tract Infection Testing Market Size in 2025 | USD 723.625 million |

Urinary Tract Infection Testing Market Size in 2030 | USD 1,003.167 million |

Growth Rate | CAGR of 6.75% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Urinary Tract Infection Testing Market |

|

Customization Scope | Free report customization with purchase |

Urinary Tract Infection Testing Market Segmentation

By Infection Type

Urethritis

Cystitis

Pyelonephritis

By Test Type

Urinalysis

Urine Culture Test

Others

By End-User

Hospitals

Diagnostic Centers

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others