Report Overview

Tissue Diagnostics Market - Highlights

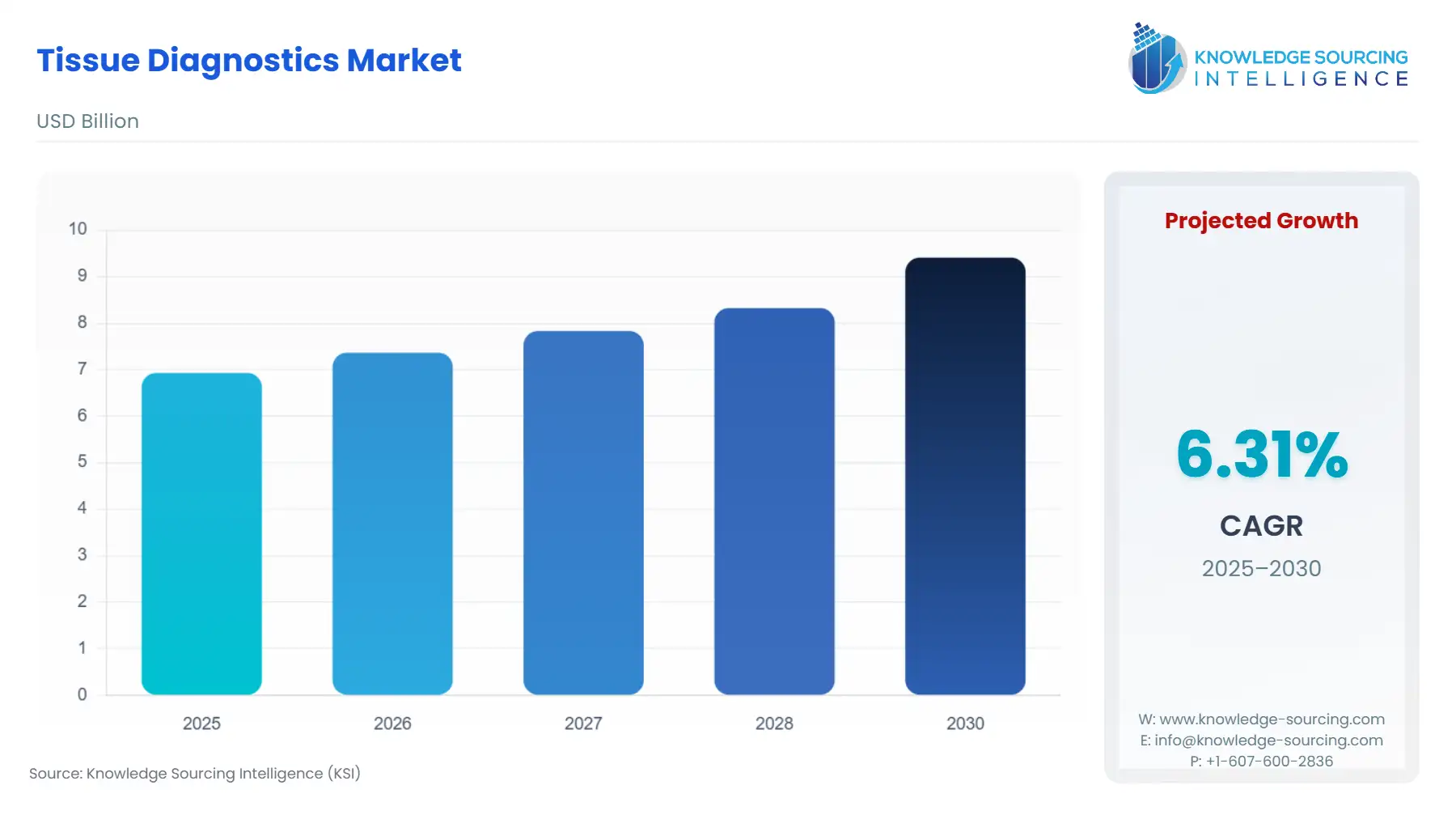

Tissue Diagnostics Market Size:

The tissue diagnostics market is expected to grow from USD 6.9 billion in 2025 to USD 9.4 billion in 2030, at a CAGR of 6.3%.

The tissue diagnostics market refers to the industry that involves the development, production, and commercialization of diagnostic tests and tools used to examine tissue samples to diagnose diseases or assess various medical conditions. This market includes multiple products such as instruments, consumables, accessories, and technologies like immunohistochemistry (IHC), in situ hybridization (ISH), digital pathology, and special staining techniques. Tissue diagnostics play a crucial role in areas such as cancer diagnosis, infectious disease diagnosis, autoimmune disease diagnosis, cardiovascular disease diagnosis, and more.

Tissue Diagnostics Market Growth Drivers:

Increasing prevalence and incidence of chronic diseases.

The rising prevalence of chronic diseases, including cancer, cardiovascular diseases, and neurological disorders, has propelled the demand for tissue diagnostics to unprecedented heights. Globally, chronic diseases are responsible for 74% of all deaths annually, resulting in the loss of approximately 41 million lives, as the World Health Organization (WHO) reported. Tissue diagnostics, comprising a range of histopathological techniques and molecular assays, are pivotal in facilitating accurate disease diagnosis and tailored treatment strategies. The intricate nature of these chronic conditions necessitates a comprehensive understanding of the underlying tissue abnormalities and molecular alterations, which can be effectively achieved through tissue diagnostics.

The growing geriatric population.

Additionally, the growing population of individuals aged 60 years and older has increased in 2021. As this age group is more susceptible to developing cancer, the rising population size underscores the increased demand for tissue diagnostics services. Healthcare providers and diagnostic companies must adapt and expand their resources to meet the growing need for accurate cancer diagnosis and treatment decision-making. Advancements in tissue diagnostic technologies can play a crucial role in addressing the burden of cancer in these demographics and improving patient outcomes.

Favorable government initiatives:

Governments worldwide are increasingly recognizing the potential of tissue diagnostics technologies, including their significant impact on healthcare and disease management. These technologies offer valuable insights into disease diagnosis, personalized treatment planning, and monitoring patient response to therapy. Governments aim to enhance healthcare outcomes and improve patient care by supporting the adoption and advancement of tissue diagnostics.

Significant increase in diagnostic innovation

The previous few years have seen a significant increase in diagnostic innovation, due to which major corporations have introduced advanced products for the growing immunohistochemistry (IHC) market. For instance, the DISCOVERY ULTRA system by Roche enhances the capacity to execute manual and completely automated experiments concurrently without experiencing synchronization issues because of its 30 independent slide drawers. A wide variety of IHC and ISH experiments, comprising FISH, protein IHC/ISH, and multiplex assays, among others, can be fully automated using the system. Similarly, Creative Diagnostics released a comprehensive array of immunohistochemistry pathology antibodies in December 2021.

Hospitals use tissue diagnostic solutions at high rates.

Tissue-based diagnostic testing by hospitals is replacing more conventional testing techniques. This is because tissue diagnostic tests take less time than traditional techniques. the rising prevalence of chronic diseases also increases the demand for tissue diagnostics in hospitals. For instance, an estimated 1.9 million new cancer cases were identified in 2022, according to Cancer Facts and Figures 2022, released in January 2022 by the American Cancer Society. The rising incidence of cancer and the heavy load of other chronic diseases enhance the need for precise diagnosis and treatment.

Tissue Diagnostics Market Geographical Outlook:

Based on geography, the tissue diagnostics market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The North American region, particularly the United States, has a well-established healthcare infrastructure and advanced diagnostic technologies, making it a prominent market for tissue diagnostics. Europe is another significant market for tissue diagnostics, with countries like Germany, France, and the United Kingdom leading in terms of market size and advancements in diagnostic technologies. The region benefits from a strong focus on early disease diagnosis, well-established healthcare systems, and increasing cancer screening and prevention awareness.

The United States is at the forefront of the tissue diagnostics market, representing North America's largest and most dynamic market. With its advanced healthcare infrastructure, extensive research and development capabilities, and high prevalence of cancer, the country offers a fertile ground for the growth and innovation of tissue diagnostics. The United States houses numerous leading players in the industry, driving competition and technological advancements. The emphasis on precision medicine and personalized healthcare further propels the adoption of tissue diagnostics as healthcare providers strive for accurate diagnoses and tailored treatment approaches. With a strong focus on research, collaborations, and cutting-edge technologies, the United States plays a pivotal role in shaping the future of tissue diagnostics, improving patient outcomes, and advancing the field of healthcare diagnostics.

Tissue Diagnostics Market Key Players:

Key players in the tissue diagnostics market include Abbott Laboratories, Agilent Technologies, BD (Becton, Dickinson, and Company), BioGenex, and Cardinal Health. These companies invest heavily in research and development to develop new technologies and solutions to meet the growing demand. For instance, in 2021, "Ventana HER2 Dual ISH DNA Probe Cocktail" was launched by Roche Diagnostics, a subsidiary of F. Hoffmann-La Roche Ltd. This product is used to detect human epidermal growth factor receptor 2 (HER2) gene amplification in breast and gastric cancer tissue samples. It provides clinicians with valuable information for determining the appropriate treatment approach, such as targeted therapies like HER2 inhibitors.

Tissue Diagnostics Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 6.9 billion |

| Total Market Size in 2031 | USD 9.4 billion |

| Growth Rate | 6.3% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Product, Technology, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|