Report Overview

Synchronous Motor Market - Highlights

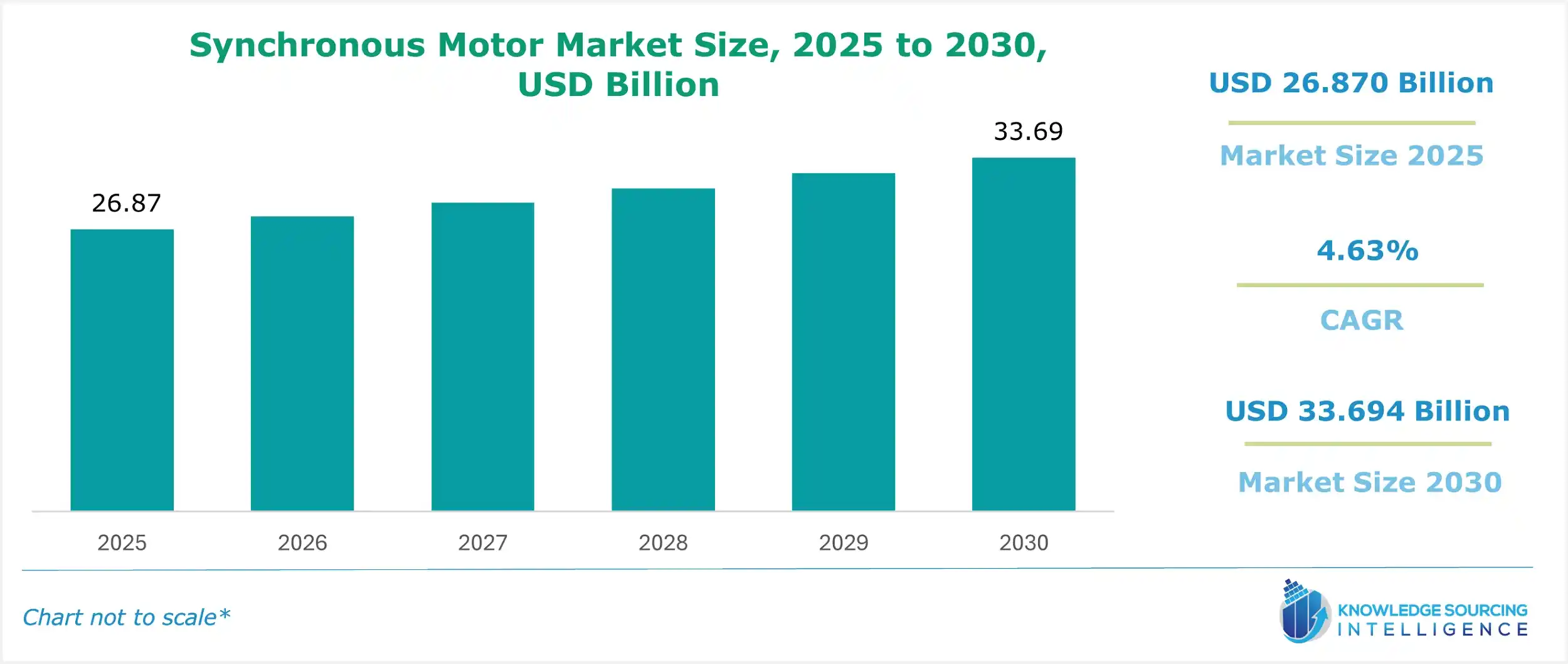

Synchronous Motor Market Size:

Synchronous Motor Market, with a 4.49% CAGR, is set to grow to USD 34.974 billion in 2031 from USD 26.870 billion in 2025.

Synchronous Motor Market Overview:

A synchronous motor refers to an electric motor that operates at a synchronous speed known as synchronous speed. This type of motor generates an electromotive force (EMF) at a consistent speed. There are various types of synchronous motors, including hysteresis synchronous motors, reluctance synchronous motors, permanent magnet synchronous motors, and direct current excited synchronous motors. The expansion of renewable energy and the rise in industrialization are the prominent drivers to boost the synchronous motor market size year by year.

In industries that require accuracy and efficiency, synchronous motors are gaining momentum due to their ability to maintain a consistent motion speed under varying loads and being beneficial in installations such as robotics, compressors, or process automation. As factories modernise their systems and require motors that can maintain stable performance and minimal energy losses, synchronous motors will remain a top choice.

The synchronous motor market is advancing with energy-efficient motors, including high-power-density motors and rare-earth-free, magnet-free motors, catering to industries like manufacturing and HVAC. Synchronous motor control, paired with variable frequency drives (VFDs), ensures precision and efficiency, meeting motor efficiency IE4 and IE5 standards. Liquid-cooled motors enhance performance in high-demand applications, while smart motors and IoT motors enable real-time monitoring and predictive maintenance. Digital motor control systems integrate seamlessly with IoT platforms, providing data-driven insights for optimized operations. These innovations address industry experts’ needs for reliable, sustainable, and high-performance motor solutions in modern industrial ecosystems.

As companies face growing pressure to lower energy use, coupled with stricter mandates, the adoption of permanent magnet synchronous motors (PMSMs) is likely to grow. PMSMs are known for being high-efficiency motors that provide a notable reduction in operational losses and maintenance, thereby improving productivity. In manufacturing and mobility sectors, which increasingly emphasise Industry 4.0 and electric vehicles, synchronous motors enable precision in control as well as response time to motion. Synchronous motors can also function well with software-integrated smart systems and digital controllers, allowing sufficient versatile adaptations and reliability throughout the entire motor range.

While energy efficiency, performance stability, and automation are top of mind, synchronous motors will continue to displace legacy motor technologies in the industrial and commercial sectors.

With more people using electric-powered and hybrid vehicles, there is increased demand for high-performance motors. This change is driving demand for synchronous motors in the electric vehicle sector, as permanent magnet synchronous motors are utilised broadly in electric vehicle manufacturing. The steady growth visible in this chart is representative of a larger shift towards power systems that are both efficient and reliable (which all industries are spending their money to invest in).

The energy efficiency movement is gaining momentum as governments provide some impetus to increase the efficiency of synchronous motors. In the EU, new Ecodesign regulations are now in effect, requiring motors to achieve IE4 (super-premium) efficiency, which is forecasted to save about 110?TWh of electricity each year by 2030, and help to reduce CO2 emissions. In the U.S., the Department of Energy's Next Generation Electric Machines program is funding research into advanced motor technologies - high-speed PMSM, new drive electronics, etc., to increase efficiency and reduce energy consumption of various industries. Collectively, these initiatives enable vehicles to overcome additional hurdles and provide manufacturers and consumers with synchronous motors at a better price point, particularly for industrial and commercial applications.

Synchronous Motor Market Trends:

The synchronous motor market is shaped by decarbonization in industrial applications and the electrification of industry, driving demand for Industry 4.0 motors. These motors integrate with smart systems, supporting sustainable manufacturing through enhanced efficiency and reduced emissions. Motor miniaturization trends enable compact, high-performance designs for space-constrained applications in automotive and robotics. Advanced control systems and IoT connectivity facilitate predictive maintenance and real-time performance optimization. These trends align with global sustainability goals, leveraging smart, efficient motors to enhance productivity and reduce environmental impact in increasingly automated and electrified industrial processes.

Synchronous Motor Market Drivers:

The growth in the renewable energy sector drives the synchronous motor market growth.

The synchronous motor industry is thriving due to the rapid expansion of renewable energy sources, particularly wind and solar power. Synchronous motors are widely used in wind turbines and solar power plants. These motors ensure efficient power generation by maintaining synchronization with the grid and delivering stable electrical output. Growing renewable energy demands reliable and synchronized power generation. As per the International Energy Agency, in 2021, renewable electricity generation expanded by almost 8%, reaching up to 8,300 TWh.

The rise in automation and robotics boosts the synchronous motor market size

Industries across various sectors are adopting automation and robotics to enhance productivity and operational efficiency. In this context, synchronous motors play a crucial role as they are extensively utilized in automation systems and robotic applications. These motors are preferred due to their ability to provide precise control, high torque output, and synchronous operation. According to the International Federation of Robotics (IFR), the installation of new industrial robots in factories reached an all-time high in 2021, with a total of 517,385 units installed. This remarkable figure represents a growth rate of 31% year-on-year. The increase in robot installations signifies the accelerating adoption of automation and robotics across industries worldwide.

Rise in demand for electric vehicle production

The surge in electric vehicles has significantly propelled the demand for the synchronous motors industry. These motors are used in the electric vehicle industry as they provide high efficiency, compact size, and excellent torque control capabilities. The growing demand for EVs has boosted the expansion of the synchronous motor market. According to the International Energy Agency, in 2021, the majority of electric car sales worldwide were dominated by China and Europe, accounting for over 85% of the total. The United States followed suit, representing 10% of global sales.

Stringent regulations on energy efficiency

The biggest factor driving the synchronous motor market is the global trend toward more stringent energy efficiency regulations. Governments worldwide are legislating, regulating, and incentivising efforts to reduce the power consumption of industry and carbon emissions. These changes will have direct implications on the way motors are selected, designed, and applied in industries.

For example, the Ecodesign Directive from the European Union (Regulation EU 2019/1781) mandates efficiency standards for electric motors in a wide range of power ratings, including a phased-in implementation of IE4 (super-premium efficiency) for the majority of motors beginning July 2023. This development will certainly impact all manufacturers, including producers of permanent magnet synchronous motors (PMSMs), since synchronous motors are one of the few motor technologies that can consistently meet or exceed these energy efficiency standards. The EU expects to save approximately 110Terawatt-hours (TWh) of electricity every year by 2030; this is equivalent to the yearly electricity consumption of the Netherlands. One statistic alone illustrates the seriousness of these regulations, and their potential impact is quite substantial.

Synchronous motors are more energy efficient than their mostly traditional predecessors at variable loads, which leads many businesses to gravitate toward synchronous motors as their solution for long-term energy savings and regulatory compliance. The regulatory pressure has created a need for businesses to shift toward synchronous motors, while also pushing manufacturers to innovate, improve materials (in some applications), and develop smart motor control solutions that are more efficient and reduce waste. Similar trends are emerging in India, where the government has prohibited the use of inefficient IE1 motors and is actively encouraging the replacement of older IE2 motors as industries migrate to IE3 and IE4. Through initiatives like the National Motor Replacement Programme and BEE schemes, large power users are incentivised to move towards higher efficiencies in motor replacements.

These actions are changing the focus of a cost-competitive market to consider lifecycle savings, reliability, and the reduction of the environmental footprint of new equipment. In the synchronous motor sector, this development is creating a stronger position not just in new installations, but also in replacements in many office sectors. In short, energy regulations are driving compliance and will also change demand and accelerate innovation in the motor sector.

The chart depicts potential energy savings from the European Union Eco-design directives on the efficiency of electric motors. The Ecodesign regulations focus on the use of electric motors for industrial and commercial use; in 2020, the regulatory efforts contributed approximately 52 TWh of energy savings annually; by 2030, they are expected to increase to approximately 107 TWh annually, likely due to the stricter efficiency classifications, such as the IE4 and IE5 classifications for motors from 0.75 kW to 1000 kW found in at manufacturing plants, HVAC systems, power generation plants, and water treatment plants.

The dramatic increase in savings from 2020 to 2030 corresponds with the expected increase in the role of high-efficiency motors, especially synchronous motors (including PMSM synchronous motors), in helping to meet climate and energy reduction targets. These motors are more efficient and perform better than induction motors because they experience lower energy losses. Regulatory approaches to higher efficiency motors will steer industries towards these technologies, and the adoption rates will only increase moving forward, creating momentum in the synchronous motor market. This figure illustrates the relative trends of which policy-driven demand is part of the bigger picture, and that regulatory frameworks can help to catalyse energy-efficient industrial solutions.

Synchronous Motor Market Restraints:

The initial investment is a challenge to the synchronous motor industry’s growth.

The synchronous motor industry encounters a challenge concerning the high initial costs associated with the installation and integration of synchronous motors into power systems. These costs encompass equipment procurement, engineering services, and infrastructure development. In regions with limited financial resources or tight budgets, these expenses can discourage potential buyers from investing in synchronous condensers. Put simply, the upfront investment required can act as a barrier for many buyers, thus impeding the growth of the synchronous motor market.

Synchronous Motor Market Geographical Outlook:

The Asia Pacific region is expected to dominate the market.

The Asia-Pacific region is witnessing significant growth in the synchronous motor market, primarily driven by the integration of renewable energy sources like wind and solar power. This surge in renewables has created a higher demand for reactive power compensation and voltage regulation, which can be effectively met by synchronous motors. Furthermore, ongoing grid modernization initiatives aimed at improving power system reliability, stability, and efficiency have further accelerated the adoption of the synchronous motor industry. As a result, the synchronous motor market in the Asia-Pacific region has experienced remarkable expansion. According to the International Renewable Energy Agency (IRENA), the Asia-Pacific region installed a staggering 1522.2 GW of renewable energy capacity in 2021.

North America, particularly the US, is also predicted to grow significantly

Synchronous motors offer higher energy efficiency and precision control, enabling their high applicability in several sectors ranging from oil & gas to automotive. The industrial productivity in the USA is experiencing an upward trajectory, with various strategic maneuvers being undertaken to increase the scale.

Moreover, with the ongoing investment in industrial automation, the robotics demand has also witnessed positive growth in the country. According to the International Federation of Robotics, in 2024, robotics installations in the country’s automotive sector reached 13,747 units, marking a 10.67% growth over 2023’s installation. The same source also specified that the installation in the food and beverage sector also witnessed a 22% growth.

Additionally, the growing electric vehicle transition in the country is also propelling the demand for synchronous motor types such as permanent magnet synchronous motors, which assist in power adjustment. According to the International Energy Agency, the battery electric vehicle sales in the USA reached 1.2 million units, representing a 9% growth over the sales conducted in 2023. Moreover, the same source also stated that the percentage share of electric vehicles in overall vehicle sales in the country is gaining traction, supported by government-backed initiatives to reduce carbon emissions.

Moreover, the growing emphasis on expanding energy scale and increasing overall production capacity, followed by the establishment of renewable energy projects, has also provided new growth opportunities for the market, with wind energy holding high applicability for such motors. Additionally, the ongoing improvement in HVAC systems and pumping applications in water treatment facilities and investments in opening new treatment centers in major US states are also additional driving factors.

Synchronous Motor Market Company Products:

2-pole turbo synchronous motors: This product is made by General Electric, and the 2-pole turbo synchronous motor has accumulated an impressive running time of more than 1 million hours in 25 years. Additionally, the 2-pole turbo range of motors has proven to be well-suited for hazardous environments, making them a suitable choice for applications in such areas.

MS2N Performance: MS2N motors offer a unique blend of high dynamics, compact dimensions, and exceptional energy efficiency. These motors are designed to deliver optimal performance while maintaining a compact form factor. The MS2N motors offer rotors with low and medium inertia, providing the flexibility for optimum customization based on specific application requirements.

SMK Series Low-Speed Synchronous Motors: This product is made by Oriental Motor Co., Ltd. Low-speed synchronous motors offer exceptional advantages in terms of highly precise speed regulation, low-speed rotation capabilities, and rapid bi-directional rotation. These motors excel in delivering accurate and consistent rotational speeds.

600 Series - Synchron A & D Mount: Hansen Corporation has developed a precision timing motor specifically designed for use in appliances, instruments, event recorders, and clocks. This motor ensures accurate timing and reliable performance in various applications where precise timing is essential. This product is offered in a round case design and is available with either a two-hole or four-hole mounting plate configuration.

A manufacturer launched an IE5-rated synchronous motor with digital motor control, offering IoT integration for predictive maintenance in sustainable manufacturing applications.

List of Top Synchronous Motor Companies:

Nidec Corporation

General Electric

Fuji Electric Co., Ltd.

Bosch Rexroth AG (Robert Bosch)

TOYO DENKI SEIZO K.K.

Synchronous Motor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Synchronous Motor Market Size in 2025 | USD 26.870 billion |

Synchronous Motor Market Size in 2030 | USD 33.694 billion |

Growth Rate | CAGR of 4.63% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Synchronous Motor Market |

|

Customization Scope | Free report customization with purchase |

Segmentation:

By Type

Non-excited synchronous motor

Hysteresis synchronous motor

Reluctance synchronous motor

Permanent magnet synchronous motor

Direct current excited synchronous motor

By Mounting Type

Horizontal

Vertical

By Application

Pumps

Compressors

HVAC System

Actuator

Others

By End-User

Oil & Gas

Chemicals

Mining

Power & Energy

Paper & Pulp

Marine

Automotive

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others