Report Overview

Stethoscope Market Size, Share, Highlights

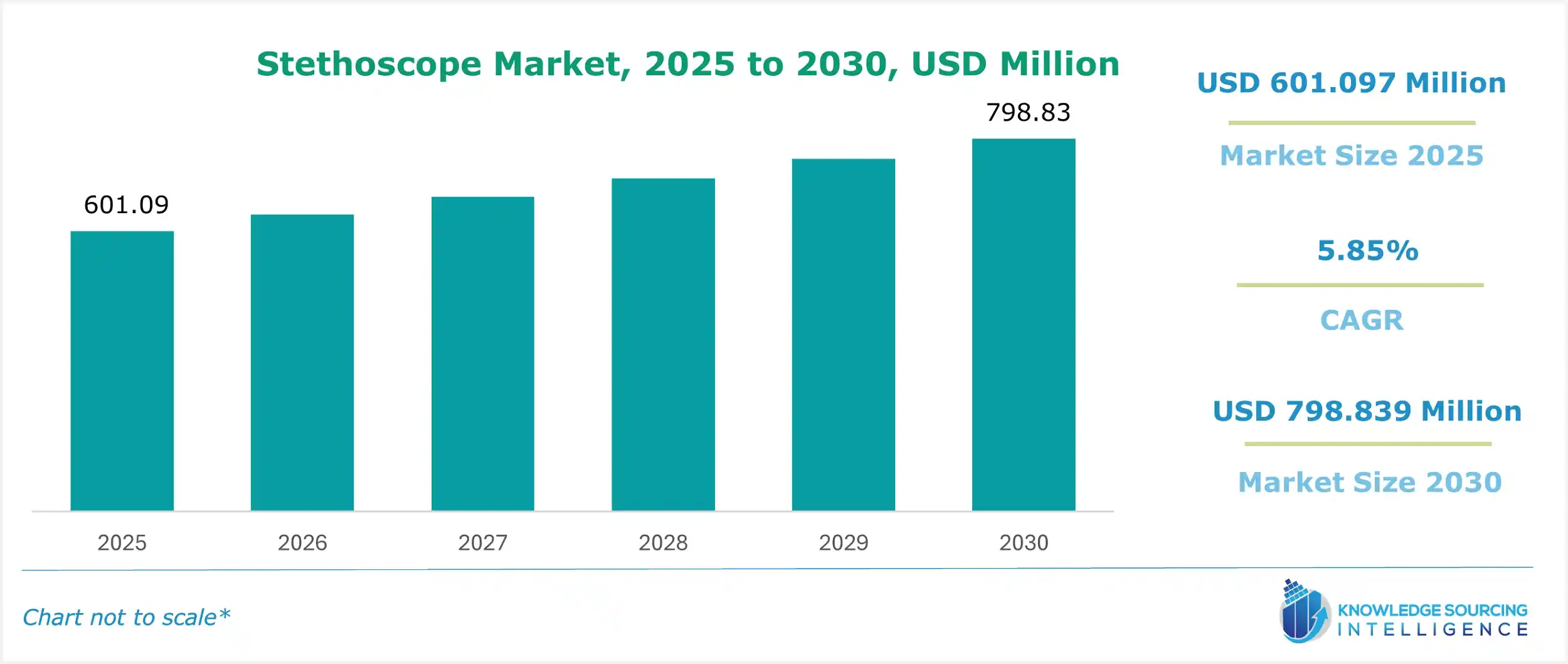

Stethoscope Market Size:

The Stethoscope market, valued at US$798.839 million in 2030 from US$601.097 million in 2025, is projected to grow at a CAGR of 5.85% through 2030.

The profusion of technological advancements among electronic and digital stethoscopes has helped raise the stethoscope market growth unprecedentedly compared to the traditional types. This has certainly imparted an edge to the stethoscope market. The salient developments that the stethoscope market has experienced include but are not limited to the superior digital sound transmission capabilities of digital stethoscopes and their increasing integration in the deployment of telemedicine. Despite certain alternative breakthroughs like portable and handheld ultrasound systems, stethoscopes remain the most preferred device by healthcare professionals to conduct an initial physical assessment of patients. High demand for electronic stethoscopes has led the global stethoscope market to grow rapidly during the projection period.

Stethoscope Market Overview & Scope:

The Stethoscope market is segmented by:

- Type: The stethoscope market is segmented by type into acoustic stethoscope, electronic stethoscope, and smart stethoscope. Electronic stethoscopes amplify sound with microphones and electronic amplification and thus improve auscultation abilities, unlike conventional acoustic stethoscopes. Healthcare practitioners can more clearly and accurately identify faint or unusual sounds thanks to these devices' excellent sound quality. Electronic stethoscopes have extra features like digital recording, noise cancellation, and Bluetooth connectivity to further enhance their diagnostic potential. As telemedicine and remote patient monitoring systems become more popular, their role in enabling smooth audio transmission and virtual consultations is contributing to an increased demand for electronic stethoscopes.

- Application: The application is segmented into academics, cardiology, fetal, neonatal, neurology, and pediatric. The fast-growing market share of stethoscopes, specifically within the cardiology field, reflects its high demand. These instruments are pivotal in the cardiologist's accurate diagnosis of heart sounds, murmurs, and other abnormalities to ensure timely recognition and treatment of cardiovascular diseases that rank among the leading causes of morbidity and mortality worldwide.

- End-User: The stethoscope market by end-user is segmented into academic institutions, ambulatory surgical centres, hospitals, medical institutions, paramedical services, and others. Hospital admissions have increased significantly due to the rising number of patients getting treated for numerous ailments and therapies. Remarkably, hospitals form the biggest consumers in the stethoscope marketplace for product and service purchases. Stethoscopes are essential for streamlining therapeutic procedures, enhancing productivity, and facilitating prompt and accurate diagnosis.

- Region: Because of its growing elderly population, rising chronic disease burden, key market participants, and a growing number of hospitals, North America is anticipated to account for a sizeable portion of the global stethoscope market.

Top Trends Shaping the Stethoscope Market:

1. Technological Advancement

- Continuous innovation in stethoscope technology drives innovation and enhances capabilities toward diagnosis, increasing market expansion. Recent technological advancements have equipped medical professionals with previously unknown levels of accuracy and flexibility for auscultation, from conventional acoustic models to electronic or even digital versions. Features that increase diagnostic efficiency and accuracy, such as recording on digital media, Bluetooth, and noise cancellation, make integrating it into contemporary healthcare procedures easier. In addition, by focusing on specific clinical needs such as improved auscultation in noisy environments or telemedicine use, these innovations make the stethoscope more applicable in different healthcare settings.

2. Demand for Lightweight Medical Devices

- The market is significantly influenced by the need for lightweight, portable stethoscopes, particularly due to changing healthcare environments. Compact diagnostic devices are necessary because healthcare professionals are favouring mobility and convenience in their practice. Portable stethoscopes can be used in various clinical settings, including crowded hospital wards, distant medical facilities, and even home visits. Additionally, lightweight designs improve comfort and efficiency by lessening the strain that extended use places on healthcare personnel. The demand for portable stethoscopes is increasing due to the growth of telemedicine and mobile healthcare solutions, enabling remote patient evaluations and teleconsultations.

Stethoscope Market Growth Drivers vs. Challenges:

Opportunities:

- Artificial Intelligence Integration: The integration of AI technology offers a substantial opportunity for the stethoscope market. Stethoscopes with AI capabilities are more accurate and proficient in analyzing auscultatory sounds. The technology assists healthcare practitioners in diagnosis and decision-making. Using machine learning algorithms, these smart stethoscopes recognize subtle patterns or conditions in heart and lung sounds, giving more accurate information about a patient's health status.

- Rising e-commerce: Growing stethoscope accessibility online will help this market expand. The area of online sales that is expanding the fastest is e-health. These e-commerce sites provide customer support, offer exclusive deals, and have return policies in case a product is defective. They also offer solutions in case the product does not meet the customer's expectations, which fosters trust between customers and online sellers and, consequently, increases the likelihood that the customer will make an online purchase.

Challenges:

- High Costs: Adopting modern stethoscopes may be hampered by their cost, particularly in environments with limited resources. Stethoscope adoption may be constrained in areas with poor healthcare infrastructure because of availability and cost. Developments in imaging technologies and point-of-care devices are challenging the conventional use of stethoscopes for diagnosis.

Stethoscope Market Regional Analysis:

- North America: The stethoscope market in North America is primarily growing due to the increasing prevalence of chronic diseases, such as respiratory and cardiovascular diseases, resulting from unhealthy lifestyle choices. The dominance of governmental initiatives and the prevailing influence of major manufacturers are important factors that are also driving market expansion.

Stethoscope Market Competitive Landscape:

The market is fragmented, with many notable players, including 3M, ABN Medical, AdamRouilly, and AMD Global Telemedicine, Inc., among others:

- New Product: In March 2024, the UK-based business ChestPal introduced ChestPal Pro, a new digital stethoscope for medical professionals in the US. With its automatic crackle and wheeze detection and classification, which includes converting lung sounds to visual spectrograms; accuracy and dependability across lung sound types; and simple lung sound recording, monitoring, and transmission features, ChestPal™ Pro is the most clinically useful smart stethoscope available.

Stethoscope Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Stethoscope Market Size in 2025 | US$601.097 million |

| Stethoscope Market Size in 2030 | US$798.839 million |

| Growth Rate | CAGR of 5.85% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Stethoscope Market |

|

| Customization Scope | Free report customization with purchase |

The Stethoscope Market is analyzed into the following segments:

By Type

- Acoustic Stethoscope

- Electronic Stethoscope

- Smart Stethoscope

By Application

- Academics

- Cardiology

- Fetal

- Neonatal

- Neurology

- Pediatric

By End-User

- Academic Institutions

- Ambulatory Surgical Centers

- Hospitals

- Medical Institutions

- Paramedical Services

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa