Report Overview

Sprockets Market - Strategic Highlights

Sprockets Market Size:

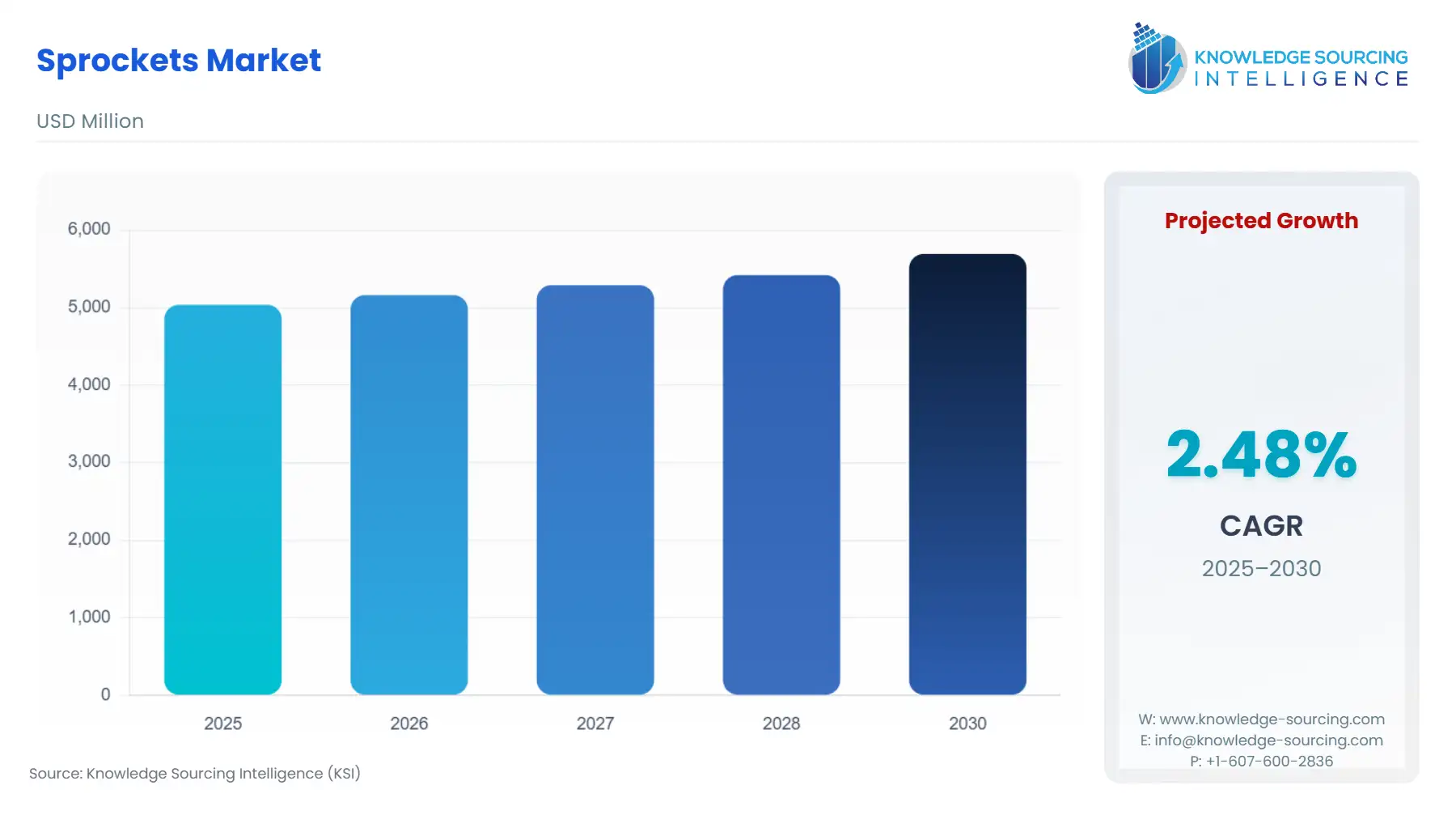

Sprockets Market is forecasted to rise at a 2.41% CAGR, reaching USD 5.809 billion in 2031 from USD 5.037 billion in 2025.

Sprockets are mechanical components used to convey rotating motion between two shafts in equipment. To transmit power from a driving source to a driven source, they are often employed in conjunction with chains or belts. Automobile engines, industrial machinery, and other items all frequently use sprockets to meet certain needs like speed, torque, and load capacity. They are offered in a variety of sizes, combinations, and materials such as stainless steel, bronze, and others. The most common kind of sprockets are roller chain sprockets with widespread use ranging from bicycles and motorcycles to conveyors and industrial machines.

Sprockets Market Growth Drivers:

Surging demand for material handling equipment

Government spending on public infrastructure is driving up demand for construction or material handling equipment, particularly in emerging nations. Further, with the growth of e-commerce, there has been an increased demand for warehousing and logistics as well. Sprockets are widely used in construction and material handling equipment, including forklifts, conveyors, escalators, and elevators as they make it possible for loads to be moved smoothly and under control. Hence, with the rising demand for material handling and construction equipment, the sprockets market size is anticipated to expand.

Growth of robotics and automation

The emergence of cobots, or collaborative robots, has created new possibilities for human-robot collaboration. In automated machinery and robotic systems, sprockets are used to transmit force and motion between various joints and actuators. They make it possible for gantry systems, robotic arms, and other automated applications to move precisely. Consequently, the constant developments and automation in the robotics sector owing to ongoing research and development and increased investments will propel the overall sprockets market growth

Sprockets Market Key Players

A few examples of key market players in the sprockets market and their product offerings are as follows:

Martin Sprocket & Gear supplies a variety of sprockets including standard roller chain sprockets, double pitch sprockets, engineering class sprockets, and speciality sprockets to satisfy customer needs.

Renold Plc supplies offers a wide range of sprockets such as roller chain sprockets, conveyor chain sprockets, and special application sprockets. Applications for Renold's sprockets can be found in the mining, material handling, and agricultural industries.

Sprockets Market Restraints:

Price volatility for raw materials:

Sprocket production costs might fluctuate depending on the price of raw materials, which could limit market growth. Many raw materials like steel which is used in the production of sprockets are experiencing volatility owing to several factors, including the geo-political situations such as the conflict in Russia-Ukraine, and the potential recessions several nations are currently experiencing. Hence, the World Steel Association’s demand predictions for 2022 and 2023 witnessed downward revisions of 2.7 and 1.2 percent, respectively in October 2022.

Presence of substitutes

Sprockets may be replaced by alternate technologies, such as direct drive systems or other power transmission techniques, in some applications. This may limit the market expansion for sprockets. Further, sprockets are frequently made to standardized dimensions and standards. Their applicability for specific niches or specialized applications may be constrained by limited customization choices, which may have an impact on the market growth in those segments.

Sprockets Market Segmentation Analysis:

Growth anticipated in the manufacturing sector

By end-user, manufacturing is expected to acquire a sizeable share of the sprockets market. The expansion of consumer products and electronics stimulates sprocket demand in manufacturing procedures. Moreover, the favorable FDI inflows to bolster F&B, textile and other consumer goods manufacturing coupled with government initiatives and schemes have provided a positive scope to the market demand for sprockets for industrial machinery applications.

Further, the automotive industry requires sprockets for timing systems, crankshafts, and drive systems as they aid in the synchronization of the engine's rotating parts, guaranteeing power transfer and appropriate valve timing. Increasing automotive production is expected to propel sprockets market growth.

Sprockets Market Geographical Outlook:

Asia Pacific is the most prominent regional player.

The Asia-Pacific sprockets market is expected to grow significantly owing to the region's growing use of cutting-edge material handling techniques in the industrial, healthcare, automotive, and other sectors of the economy. The cheap labor and raw materials will also aid the market growth. Companies like Sumitomo Heavy Industries, Harmonic Drive Systems, and Nidec Corporation are making significant investments in R&D to provide sophisticated robotic systems, gears, and sprockets that are more efficient, dependable, and inexpensive in Asia Pacific. Further, government initiatives like China's Industry 4.0 and “Make in India” are encouraging smart manufacturing, which will expand the sprockets market in the region.

Moreover, North America is another prominent region for the sprockets market owing to a mature material handling sector in the United States and the presence of key players in the region.

Sprockets Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.037 billion |

| Total Market Size in 2031 | USD 5.693 billion |

| Growth Rate | 2.48% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Material, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Sprockets Market Segmentation:

By Type

Drive Sprockets

Chain Sprockets

Duplex Sprockets

Shaft Sprockets

Others

By Material

Stainless Steel

Aluminum

Bronze

Others

By End-User

Automotive

Aerospace

Manufacturing

Oil & Gas

Mining

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others