Report Overview

Sports Technology Market - Highlights

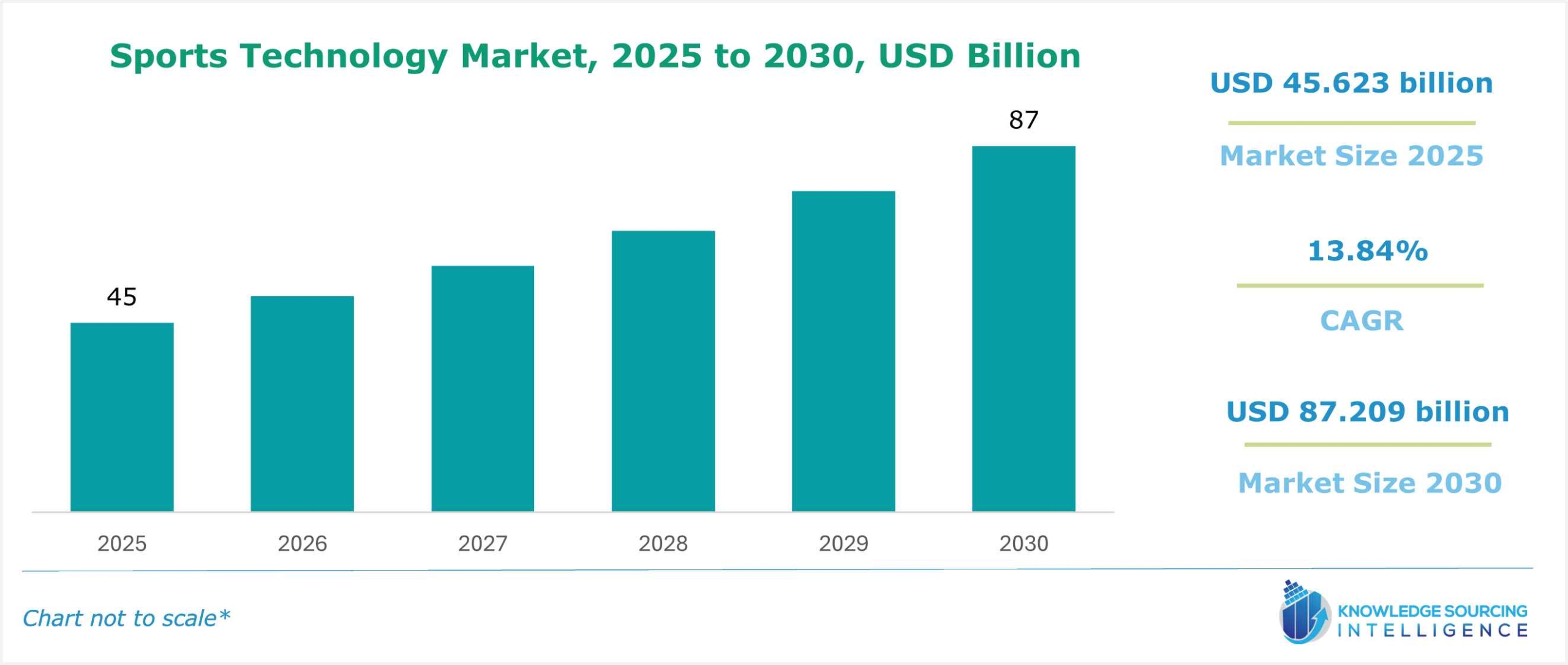

Sports Technology Market Size:

The Sports Technology market is estimated to reach US$87.209 billion by 2030 from US$45.623 billion in 2025, growing at a CAGR of 13.84%.

Sports technology involves the use and integration of technologies, like software or physical devices, that help to improve and measure the performance of athletics. Broadcasters also use these technologies to boost the viewing experience of the global audience, which in return can boost the revenue of the sports sector.

The increasing revenue generation in the sports sector is among the major factors propelling the market forward. Federation Internationale de Football Association or FIFA, in its annual report, stated that in 2023, the organization's total revenue amounted to about US$1,169 million, in which about US$267.220 million was earned through television broadcasting rights and US$455.916 million was accounted for marketing rights. With the increasing revenue of the sports sector globally, the investments in technology to improve the viewership experience and accuracy of the game will expand significantly.

The growth of sports technology is attributed to the increasing importance of utilizing integrated technologies to enhance fan engagement at sporting events. Moreover, businesses in the smart stadium sector should see a large increase in opportunity due to the developing sports league culture in developed and emerging economies. Additionally, because 4K digital sign displays with embedded software and media players give customers an affordable Ultra HD digital signage solution, demand for these displays is expected to increase.

Sports Technology Market Growth Drivers:

- Growing Sports Viewership

One of the major factors driving the sports technology market’s growth globally is the increasing popularity of sports. Leagues and sporting events are among the most common and most watched entertainment sources, with many events like the FIFA World Cup, Cricket World Cup, Olympics, and NFL attracting huge amounts of global viewership. With the rising sports viewership for certain types, like soccer, cricket, baseball, and tennis, among many others, the investment by the organizing committees increases, pushing the need for advanced technologies in the industry.

The global viewership of sports events grew massively with the introduction of live-streaming technologies. International Federation of Association Football (FIFA), in its report, stated that during the 2022 FIFA World Cup, the final game attracted a total of 24.08 million average audience in France, whereas about 26 million audience were attracted in the USA. In Pan-Middle East & North Africa, the audience share reached 242.79 million.

- Increasing global demand for wearable technology.

The wearable technology market is growing due to the increasing consumer preference for smart wearable products that provide health monitoring by using sensors to monitor oxygen saturation, cholesterol levels, and calories burned. Moreover, many technological giants namely Fitbit, Samsung, Noise, Fossil Group Inc., and many more are making smart athletic watches for health tracking.

This attribute will attract users as it simplifies the process of undertaking health checks, which will increase the market growth opportunities. For example, Xiaomi Corp. has the Xiaomi Watch S1 Series. Besides health and sleep tracking, it also features 117 sports modes. It has wireless charging and supports the use of Alexa voice assistance.

Moreover, smart hats and virtual and augmented reality headset applications in digital media and healthcare industries will also enhance this market. Additionally, growing trends in virtual reality can positively influence the dynamics within the market for wearable devices. For instance, according to the 2022 Consumer Attitudes Toward Technology Survey, 32% of respondents confirmed owning any VR devices, while an additional 15% expected to purchase one within the following year.

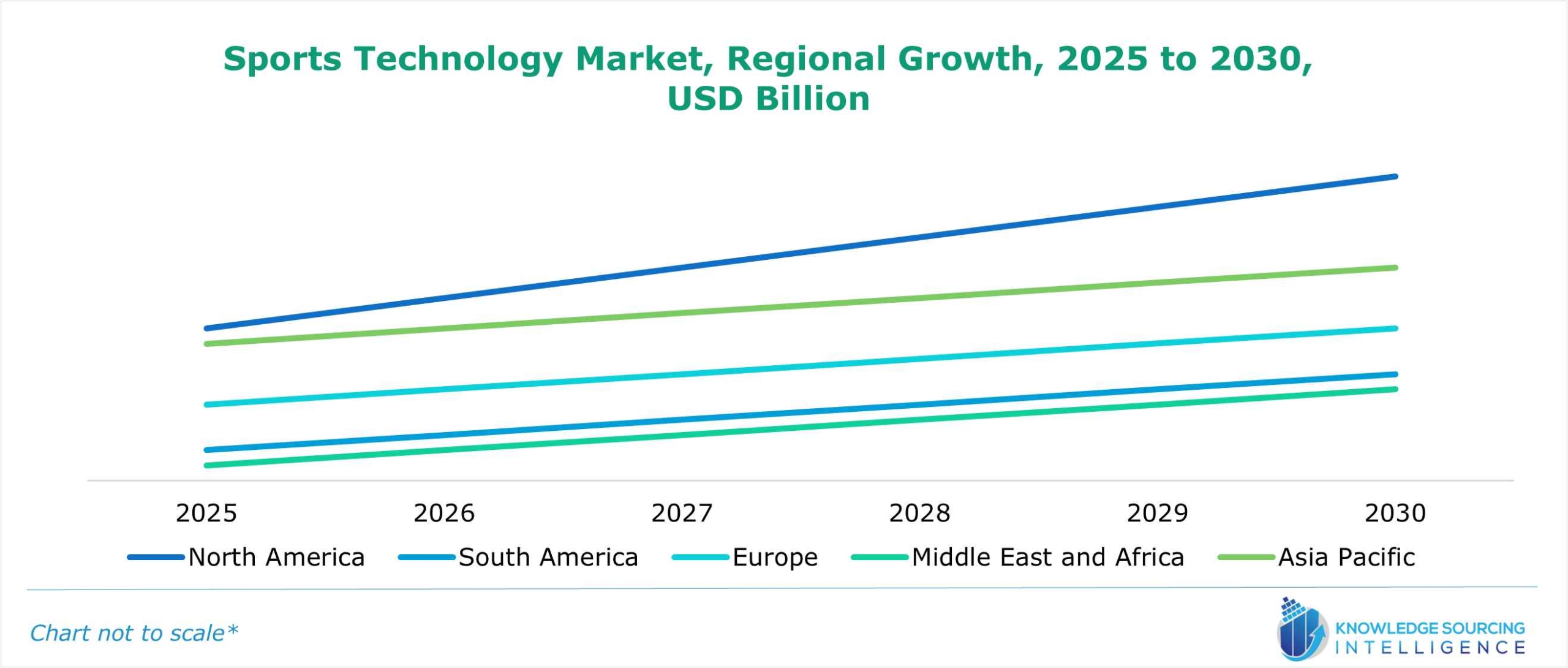

Sports Technology Market Geographical Outlook:

- The North American region is expected to witness significant growth in the sports technology market.

The booming sports industry has established new opportunities for future-oriented technologies such as smart stadiums, crowd sentiment analysis, and eSports in North America. Country-wise, the regional market is analyzed into the United States, Canada, and Mexico. The US will account for a considerable market share fuelled by the ongoing investment to improve sports analytics.

As one of the major economies globally, the United States stands at the forefront of innovations and investments to bolster the same. The economy is emphasizing optimizing the usage of advanced solutions in various sectors, which has provided a new framework for modern technologies such as Artificial Intelligence, VR & AR to bolster advanced analytics.

The sports culture in the economy is booming, fueled by the changing competitive landscape, which has propelled the athlete transition to meet new demands. Moreover, the growing prevalence of sports injuries has further augmented the demand for modern solutions that would assist in tracking and analyzing the player’s performance, thereby preventing the risk of overload.

According to America’s National Safety Council, in 2023, sports-related injuries witnessed a 2% growth in 2022, with basketball-related injuries signifying a 6.05% growth. Likewise, the same source also specified that people aged between 15 and 24 years had the highest injury rate, with 90% of the injury victims being treated in an emergency.

Moreover, technological breakthroughs such as wearables and digital signage are also improving a player’s performance, as they are equipped with advanced sensors that bolster advanced analytics. Furthermore, government-backed investments and schemes to bolster AI in the sports sector, followed by investments in smart stadiums are also additional driving factors for the regional market growth.

Sports Technology Market Key Developments:

- In September 2024, HYPE Sports Innovation, the largest sports innovation ecosystem in the world, announced a partnership with IBM. With this work, sports tech startups will have unrivaled access to IBM Watsonx, the AI and data platform, opening up new opportunities. Having such cutting-edge tools at their disposal can be revolutionary for startups, particularly those in the sports technology sector. Developing, testing, and implementing AI-driven solutions that can revolutionize everything from fan engagement to player analytics is an amazing prospect.

- In August 2024, Catapult, a market leader in sports technology solutions, announced the launch of Live-In Game Video Solutions, with an agreement with Southeastern Conference (SEC). The company stated that the latest solutions offer coaches to make informed game-day decisions and the capability to view live video.

Sports Technology Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 45.623 billion |

| Total Market Size in 2031 | USD 87.209 billion |

| Growth Rate | 13.84% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Sports, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

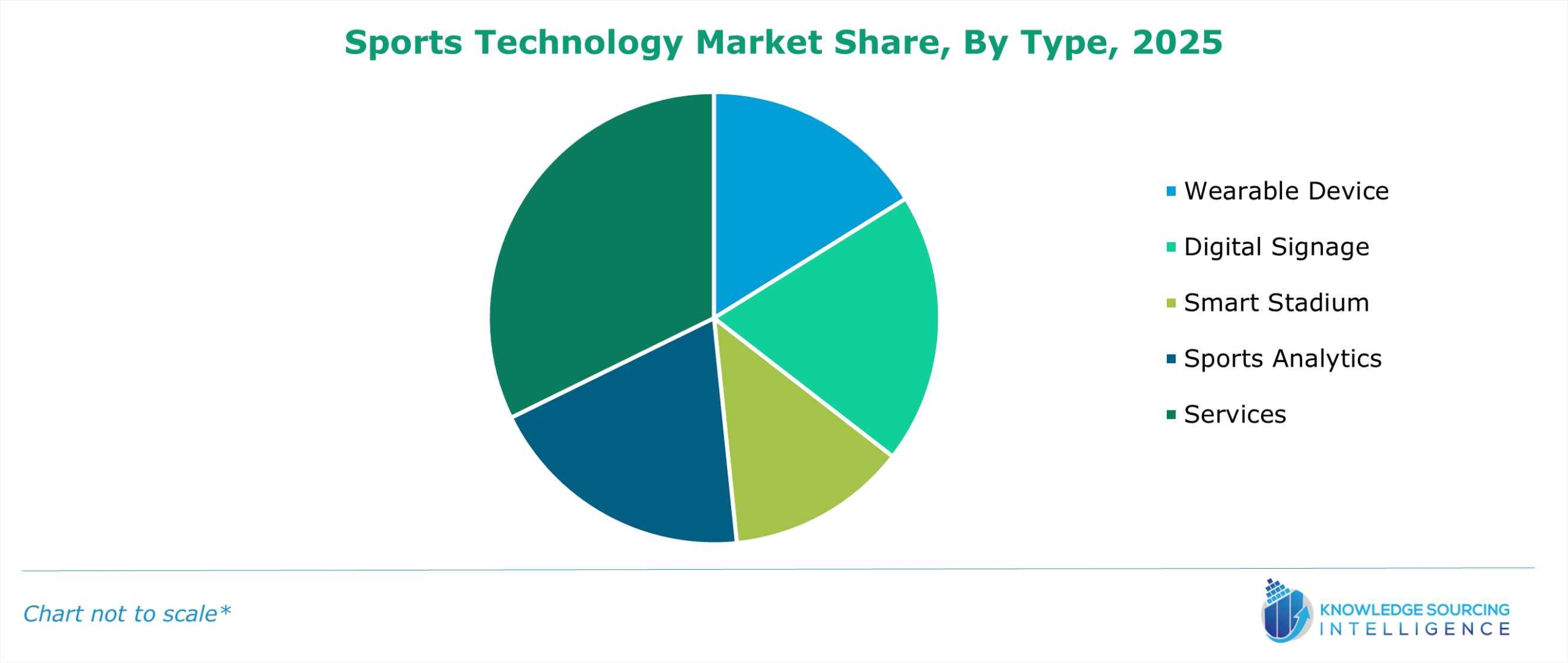

Sports Technology Market Segmentation:

- By Type

- Wearable Device

- Digital Signage

- Smart Stadium

- Sports Analytics

- Services

- By Sports

- Soccer

- Basketball

- Tennis

- Cricket

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific Region

- China

- India

- Japan

- South Korea

- Others

- North America