Report Overview

Solvent Based Adhesive Tape Highlights

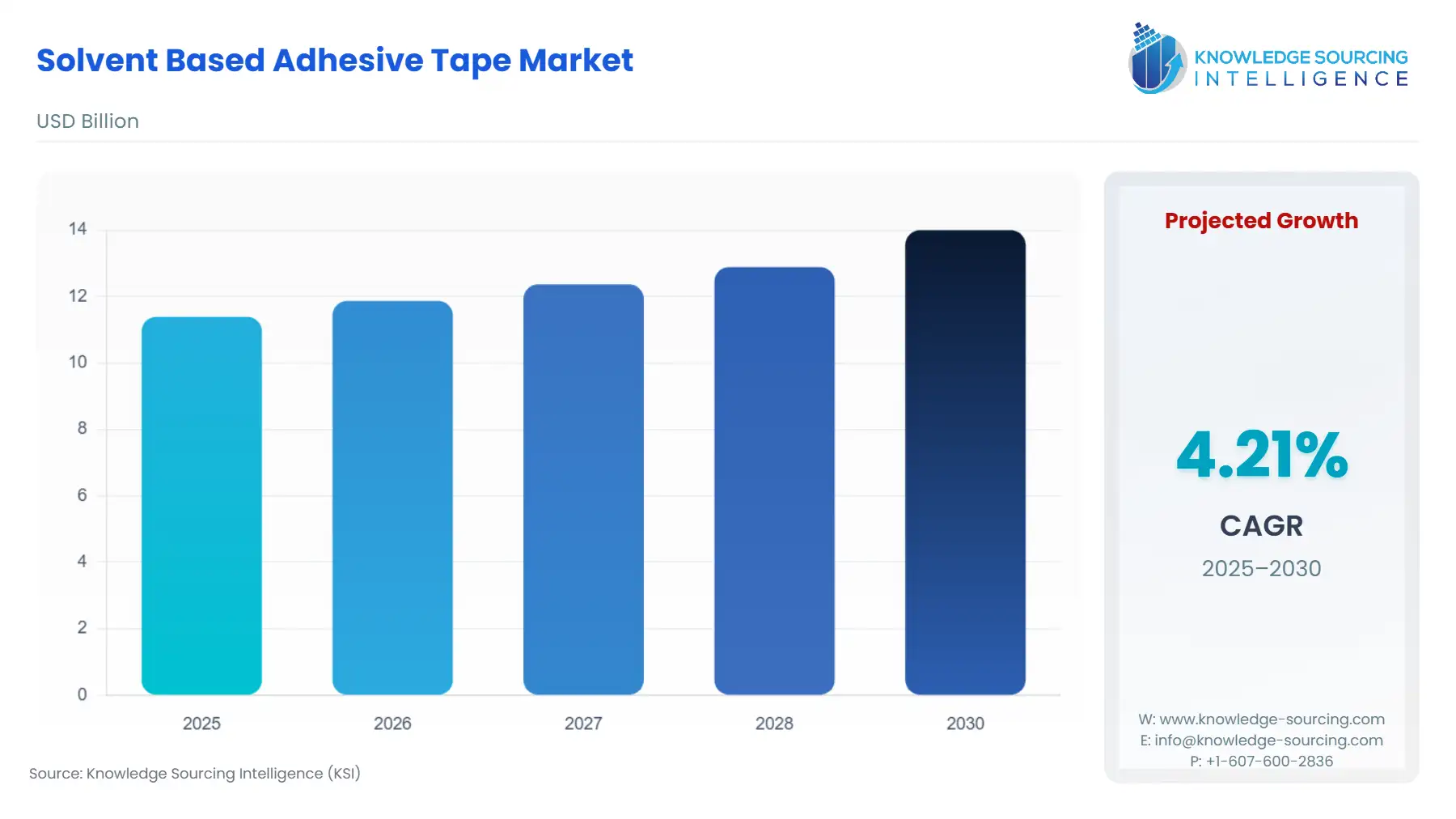

Solvent-Based Adhesive Tape Market Size:

The Solvent Based Adhesive Tape Market will reach US$13.998 billion in 2030 from US$11.389 billion in 2025 at a CAGR of 4.21% during the forecast period.

The packaging, tape, and medical sectors all often utilize solvent-based adhesive tapes because of their great resilience to various environmental variables. The rising demand in emerging markets for adhesives with solvent bases is due to the rising preference for solvent-based adhesives over water-based adhesives, technological developments in adhesive compositions using solvents, and the growth of internet purchasing.

Solvent-Based Adhesive Tape Market Growth Drivers:

- Increasing Sales of Industrial Adhesives

The growth in net sales of industrial adhesives and tapes has positively impacted the rise in the solvent-based adhesive tapes market. Solvent pressure-sensitive adhesive tapes provide several significant benefits, which include, good performance at both low and hot temperatures, high grip, or heat sealing, highly effective temperature resistance, excellent adherence to a variety of substrates, including ABS, PVC, PS, PA, and aluminum, and aggressive approach, for fusing different types of materials.

- Growing Popularity of Silicone-based Adhesive Tape

The silicone-based adhesive tape which is based on resin is growing in popularity across a variety of end-use industries and is anticipated to dominate the market because it adheres to difficult surfaces and maintains its adhesion over a broad temperature range. Additionally, acrylic-based adhesive tapes are gaining popularity. For instance, premium grade solvent-based acrylic PP807 is a general-purpose label protection tape used for industrial and production laminating, joining, covering, and protecting tasks as well as for shielding labels and handling instructions. PP 807 provides a moisture-proof barrier to protect sensitive information and is resistant to germs, fungus, solvents, weathering, and yellowing.

- Technological Advancements

The amount of money spent on research and development in the chemical business has increased recently to improve the compound's durability, performance, and safety profile. The research initiatives are geared toward ensuring that these compounds adhere to legal requirements while simultaneously addressing environmental issues. These technological advancements are being used by major manufacturers around the globe while product development. For instance, India’s leading producer of lamination adhesives used in flexible packaging, Mumbai-based Brilliant Polymers, stated in August 2022 is planning to expand its Ambernath manufacturing facility. With this change, the factory's output capacity will quadruple to 45,600 metric tonnes, supported by a total investment of more than INR 100 crore.

- Europe is Expected to Grow Significantly

The industrial sector in Germany, including manufacturing, automotive, electronics, and construction, is a significant consumer of adhesive tapes. Solvent-based tapes are favoured for their strong bonding capabilities and versatility in various applications. As these industries grow and demand for adhesive solutions increases, the market for solvent-based tapes may witness growth. For instance, the construction sector of Germany contributes around 26.7% of the nation’s GDP as per the World Bank. The packaging industry also is one of the primary users of adhesive tapes. Solvent-based tapes are commonly used for packaging applications due to their excellent adhesion properties. With the rise of e-commerce and the increasing need for efficient packaging solutions, the demand for solvent-based tapes in Germany may have experienced growth.

Solvent-Based Adhesive Tape Market Key Players:

Intertape Polymer Group focuses on serving its customers with the best quality products with technical expertise and R&D to bring top-quality polymer designs. The company is an established market leader in the manufacturing & sale of a variety of tapes, films, protective packaging & engineered coated products for different industrial & retail purposes.

The global solvent-based adhesive tape market report provides an in-depth analysis of the industry landscape, delivering strategic and executive-level insights backed by data-driven forecasts and analysis. This regularly updated report equips decision-makers with actionable intelligence on current market trends, emerging opportunities, and competitive dynamics. It examines demand across various solvent-based adhesive tape resin type, such as acrylic and rubber resins, while exploring end-user segments. The report also investigates technological advancements, key government policies, regulations, and macroeconomic factors, offering a comprehensive view of the market.

Solvent-Based Adhesive Tape Market Segmentations:

Solvent-Based Adhesive Tape Market Segmentation by resin type

The market is analyzed by resin type into the following:

- Acrylic

- Rubber

- Silicone

- Others

Solvent-Based Adhesive Tape Market Segmentation by material

The report analyzes the market by material as below:

- Polypropylene (PP)

- Paper

- Polyvinyl Chloride (PVC)

- Others

Solvent-Based Adhesive Tape Market Segmentation by end-users industry

The report analyzes the market by end-users industry as below:

- Packaging, Consumer, and Office

- Healthcare

- Automotive

- Electrical and Electronics

- Building and Construction

- Others

Solvent-Based Adhesive Tape Market Segmentation by regions:

The study also analysed the Solvent-Based Adhesive Tape Market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Solvent-Based Adhesive Tape Market Competitive Landscape:

The solvent-based adhesive tape market features key players such as 3M, Nitto Denko Corporation, Tesa SE, Avery Dennison Corporation, Intertape Polymer Group Inc., LINTEC Corporation, Berry Global Group, Inc., Scapa Group plc, Lohmann GmbH & Co.KG, and Rogers Corporation, among others.

Solvent-Based Adhesive Tape Market Report Coverage:

This report provides extensive coverage as explained in the points below:

- Market size, forecasts, and trends by different resin types, with historical revenue data and analysis focusing on key factors driving adoption, current challenges faced by key players, and major growth areas.

- Market size, forecasts, and trends by material, with historical revenue data and analysis.

- Market size, forecasts, and trends by end-users industry, with historical revenue data and analysis across various segments.

- Solvent-Based Adhesive Tape Market is also analysed across different regions, with historical data, regional share, attractiveness, and opportunity of these solutions in different countries. The growth prospects and key players operating in these markets. The section also dwells on the macro factors, economic scenario and other complementing factors aiding in market growth.

- Market dynamics: The section details the market growth factors, restraints, and opportunities in the market. The segment also presents complete market scenario with the help of Porter’s five forces model.

- Competitive Intelligence: A thorough investigation on the competitive structure of the market presented through proprietary vendor matrix model, market share analysis of key players, insights on strategies of key players and recent major developments undertaken by the companies to gain competitive edge.

- Research methodology: The assumptions and sources which were considered to arrive at the final market estimates. Additionally, how our model is refined to ensure most significant factors are taken into consideration with the proper hypothesis and bottom-up and top-down approaches enhance the reliability of forecasts further strengthening the trustworthiness of the numbers being presented.

How this report is helpful to you and reasons for purchase?

- The report provides a strategic outlook of the solvent-based adhesive tape market to the decision-makers, analysts and other stakeholders in the easy-to-read format for taking informed decisions.

- The charts, tables and figures make it easy for the executives to gain valuable insights while skimming the report.

- Analyst support through calls and email for timely clarification and incorporating additional requests.

- Option of presentation or doc format with the estimates file to take care of diverse requirements.

- 15% FREE customization with all our reports help cater additional requirements with significant cost-savings.

- Option of purchasing specific segments of the study, including opting for summary reports or just the estimates file.

Solvent-Based Adhesive Tape Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Solvent-Based Adhesive Tape Market Size in 2025 | US$11.389 billion |

| Solvent-Based Adhesive Tape Market Size in 2030 | US$13.998 billion |

| Growth Rate | CAGR of 4.21% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Solvent Based Adhesive Tape Market |

|

| Customization Scope | Free report customization with purchase |