Report Overview

Solar Panel Recycling Market Highlights

Solar Panel Recycling Market Size:

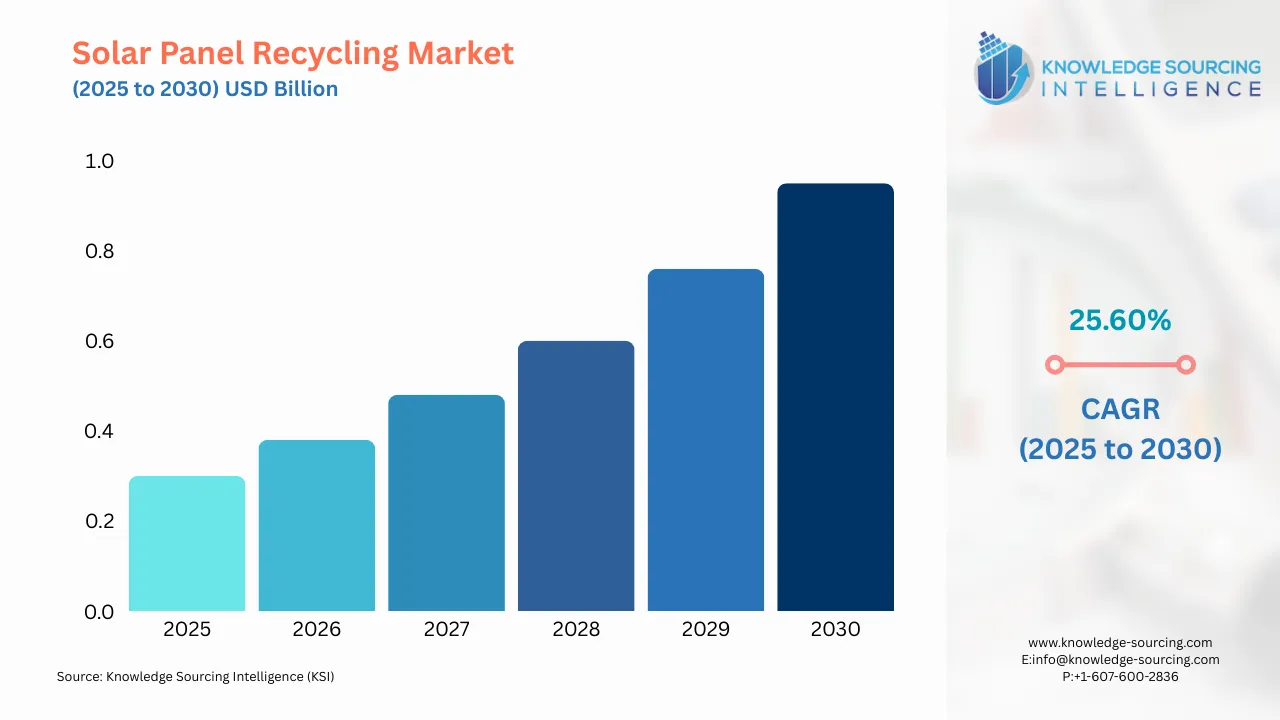

The solar panel recycling market is expected to grow at a CAGR of 25.60%, reaching a market size of US$0.952 billion in 2030 from US$0.304 billion in 2025.

The increasing adoption of solar panels in the midst of the renewable energy wave, together with the high recycling value of recoverable materials from disposed of solar panels, are key factors fueling the solar panel recycling market expansion. Also, the hazardous waste composition and easy recycling of the major components in a solar panel are key proponents of the market growth. By the year 2050, the United States is said to have the largest quantity of disassembled panels, second only to China, with an estimated total weight estimated at 10 million clip tons. Globally, there was an overall increase of about 50% for all kinds of sources that produce renewable forms of energy, and for most regions, including Europe and the USA,

Moreover, at least 510 gigawatts (GW) were added in 2023 alone under the “Renewables 2023” report by IRENA, which also noted that three-quarters of these new capacities were based on solar photovoltaics (PV).

Moreover, the quick pace at which solar panel waste is being generated is profoundly expected to expand the requirements for solar panel recycling, in this manner quickening the market development. Additionally, to enhance the market size during the forecast period, government regulations as well as policies on waste from solar panels will still be potential drivers.

Solar Panel Recycling Market Growth Drivers:

- Recyclable monetary value, ease of raw material recyclability, and government policies are anticipated to propel the Solar Panel Recycling Market growth.

One of the most important factors that would boost future market growth is the high resale value of used solar panels and recycled raw materials. Further, most of the weight of solar panels, or 75% of the total weight, is made from glass, which is already an established industry in terms of recycling. Also, as per IRENA data Cumulative waste volumes (early-loss scenario) of the top five countries for end-of-life PV panels in 2050. This shows that there will be an increase in the recycling of PV panel waste to cope with this increase, and will show a rise in the solar panel recycling market in the coming years.

Furthermore, since past governments have ensured that all regulations regarding solar panels recycling, hazardous waste disposal have been implemented properly, CSR just like global companies has grown tremendously in the entire market. In USA such as Washington there was on July 1st 2023 a law enacted which requires photovoltaic (PV) module manufacturers within this jurisdiction to finance any recycling programs related to their products.

In addition, the Massachusetts Department of Environmental Protection (MassDEP) published a report in August 2023, with assistance from the Massachusetts Clean Energy Center, Department of Energy Resources, and the Recycling Works in Massachusetts program, to inform the development of future policy and programs about solar panel recycling. Recycled monetary value, along with easy recyclability of raw materials, is projected to increase the market share. Also, favourable government policies for solar panels and hazardous waste management are anticipated to enhance the market lucrativeness of the solar panel recycling market during the forecast period.

- The rising utilization of silicon-based solar panels will bolster the market for semi-flexible cable.

Silicon is the fundamental element used in solar panels and this is why they are preferred. Most photovoltaic cells have silicone semiconductors as a result of their unique mixture of features. They also have a low density-to-weight ratio and long life cycles thus can provide sustainable energy for long periods. These reasons act as catalysts for the swift proliferation of such solar technologies within societies.

Moreover, besides recovering useful materials from end-of-life panels, ROSI established a patented process of reintroducing them into diverse industries such as solar and semiconductor manufacturing. Additionally, in September 2023, Researchers at NTU Singapore have developed a productive process for extracting high-purity silicon from solar panels that have expired, enabling the production of lithium-ion batteries that may help fulfil the growing demand for electric vehicles worldwide. The bulk of solar cells are made of high-purity silicon, but after 25 to 30 years of operation, they are usually thrown away.

Further, RMIT University and the University of Melbourne teamed with OJAS, a Melbourne-based firm, to set up an upcycling facility to recycle silicone cells and polymers from PV modules.

Solar Panel Recycling Market Restraints:

- Economic viability challenges are expected to hamper the growth

The major hurdles that are hindering the global market of recycled solar panels are the economic viability and cost-effectiveness of recycling processes. Despite the increasing significance of recycling used solar cells, serious financial constraints can significantly impede market growth.

Solar Panel Recycling Market Geographical Outlook:

- North America is expected to take the lead in terms of market share.

Due to rising knowledge about renewable sources for industry as well as trade, there is a significant increase in demand for solar panels in North America. Furthermore, the region is home to emerging technologies which has led to an expanded pace of adoption of advanced solar technology and recycled panels.

Further, the government regulations in the United States, as well as Canada, aimed at allaying environmental concerns, have contributed to a significant change towards the utilization of renewable sources of energy. Additionally, Canada’s solar power sector has witnessed a significant increase over the years with the ongoing and upcoming government relaxations for promoting the use of renewable energy. Promising growth in solar energy adoption coupled with a surge in the solar field requires maintenance and replacement demand, which are projected to significantly increase solar panel waste generation, creating the potential for solar panel recycling services

Solar Panel Recycling Market Key Developments:

- In April 2024, Enjoy SOLARCYCLE, a cutting-edge technology-based solar recycling company, and Sol Systems, a pioneer in the development and financing of renewable energy solutions, announced a partnership that will help guarantee that Sol Systems' solar energy projects are truly sustainable over the course of a panel's lifecycle. Solar power is increasing, and so is the opportunity to develop a zero-waste, genuinely indigenous solar circular economy. To address the issue of retired panel reuse and recycling, this new partnership seeks to accomplish it.

- In July 2023, Rexia Corporation, a new company established by Marubeni Corporation and HAMADA Co., Ltd., has begun providing related services in recycling and reuse, such as buying, selling and disposing of used solar panels.

List of Top Solar Panel Recycling Companies:

- Recycle Solar Technologies Ltd.

- First Solar

- Veolia

- We Recycle Solar

- Cleanites Recycling

Solar Panel Recycling Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Solar Panel Recycling Market Size in 2025 | US$0.304 billion |

| Solar Panel Recycling Market Size in 2030 | US$0.952 billion |

| Growth Rate | CAGR of 25.60% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Solar Panel Recycling Market |

|

| Customization Scope | Free report customization with purchase |

Solar Panel Recycling Market is analyzed into the following segments:

- By Panel Type

- Silicon-based

- Thin film-based

- By Material

- Glass

- Metal

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America