Report Overview

Solar Connector Market - Highlights

Solar Connector Market Size:

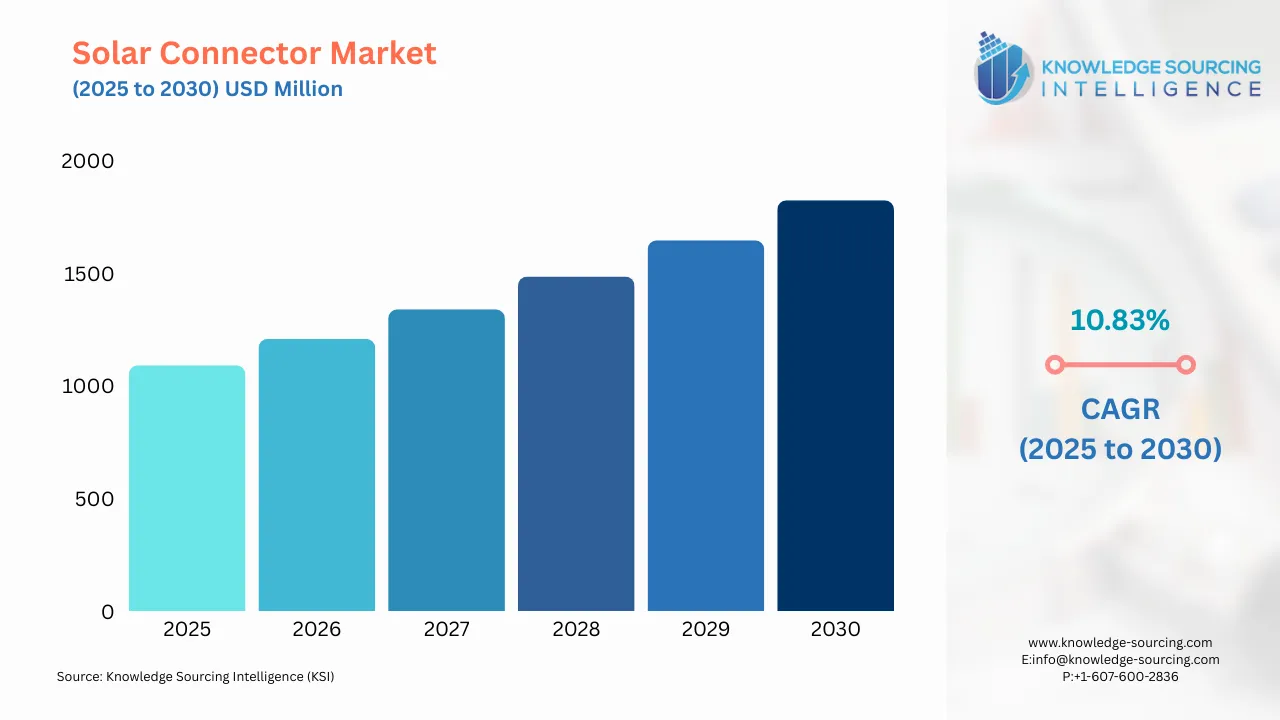

Solar Connector Market is forecasted to rise at a 10.51% CAGR, reaching USD 1986.252 million in 2031 from USD 1,090.788 million in 2025.

Solar connectors play a crucial role in establishing and enhancing electrical connectivity within solar energy systems. Solar connectors are categorized into different types, including MC4, MC3, and Tyco Solarlok, based on their design and specifications. Solar connectors serve a wide range of end users, including residential, commercial, and industrial sectors, thereby enabling efficient electrical connectivity within solar energy systems. The prominent driver propelling the solar connector industry's growth is the substantial increase in solar installation worldwide coupled with favorable investments.

Solar Connector Market Growth Drivers:

High maintenance cost restrains the solar connector market.

The high maintenance costs associated with solar panels are acting as a significant barrier to the growth of the solar connector market. The expenses incurred for maintaining solar systems can range from Rs 1,000 to Rs 3,000 per kilowatt (kW). These costs include regular cleaning, inspection, and repair of the panels, as well as monitoring and replacing components as needed. The financial burden imposed by these maintenance expenses hampers the widespread adoption of solar connectors and poses challenges for businesses and individuals seeking to invest in solar energy solutions.

Solar Connector Market Segmentation Analysis:

Adoption of solar energy by commercial and industrial bolsters the solar connector market.

Solar connectors are used in solar systems to establish reliable connections between solar panels, inverters, and other components. They ensure the seamless transfer of power generated by solar panels to the electrical grid or local consumption points. The growing shift towards sustainability has increased solar PV adoption in commercial and industrial sectors which has simultaneously increased the market demand for solar connectors. According to the International Energy Agency, the global commercial and industrial solar PV power capacity reached 243 GW in 2021, and it experienced significant growth of 22.6% in 2022, reaching a capacity of 298 GW.

Adoption of solar energy by residential drives the solar connector market.

Solar connectors are crucial components in solar systems to ensure the seamless flow of electricity generated by the solar panels to the desired destination, such as batteries, inverters, or the electrical grid. The increasing adoption of solar panels in residential settings can be attributed to the improved efficiency and electricity affordability which is making them an appropriate option for homeowners seeking to reduce their reliance on traditional grid electricity and lower their energy costs. According to the International Energy Agency, the residential sector witnessed significant growth in global solar PV power capacity, reaching 144 GW in 2021. This capacity experienced a remarkable increase of 34.4% in 2022, surging to 195 GW.

Investments in the solar industry drive solar connector market growth.

Solar connectors are used in solar energy systems to facilitate the seamless flow of electricity between solar panels, inverters, and other components. Ensuring optimal performance and efficiency of the solar power system. The increase in adopting solar energy is driven by investments made in solar power projects which leads to advancements in technology, cost reductions, and increased efficiency, creating a positive cycle of growth and further driving the adoption of solar connectors. For instance, in June 2022, Vikram Solar Ltd, an Indian solar panel manufacturer, announced its new venture that aims to invest up to $1.5 billion in the U.S. solar energy supply chain. The venture's first step will involve establishing a factory in Colorado.

Solar Connector Market Geographical Outlook:

North America is predicted to dominate the solar connector market.

North America will account for a significant solar connector market share due to favorable government investments in the solar industry and the widespread adoption of solar energy by commercial, residential, and industrial sectors. For instance, in April 2023, the US Department of Energy a substantial investment of $82 million aimed at bolstering domestic solar manufacturing and recycling, as well as fortifying the American clean energy grid. Additionally, according to the Solar Energy Industries Association, In 2021, the cumulative installed solar capacity for residential purposes in the United States reached 29,311.89 MWdc. up 23.5% in 2022, reaching 23,353.28 MWdc. Additionally, solar installations in the commercial sector witnessed a growth of 10% in 2022 compared to the previous year.

Solar Connector Market Company Products:

SOLARLOK PV4-S DC Crimp Connectors: TE Connectivity offers SOLARLOK PV4-S DC Crimp Connectors, specifically designed to facilitate the connection of solar panels to the power grid, specifically adapted for 1500V DC cable solutions. These connectors find applications in various components of solar energy systems such as solar and micro inverters, combiner boxes, and DC optimizers. The SOLARLOK PV4-S DC Crimp Connectors by TE Connectivity ensure reliable and efficient electrical connectivity, contributing to the seamless integration and performance of solar power installations.

PV-C3M-S 2.5-6: Phoenix Contract offers the PV-C3M-S 2.5-6 Photovoltaic connector, designed specifically for photovoltaic applications and compliant with IEC 62930 standards. This connector utilizes a spring-cage connection method and is suitable for various cable types. With a rated surge voltage of 12.8 kV, the PV-C3M-S 2.5-6 connector ensures reliable and secure electrical connectivity within photovoltaic systems, contributing to their efficient and safe operation.

List of Top Solar Connector Companies:

TE Connectivity

Amphenol Corporation

Phoenix Contract

Japan Aviation Electronics Industry, Ltd

QC Corporation

Solar Connector Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Solar Connector Market Size in 2025 | USD 1,090.788 million |

Solar Connector Market Size in 2030 | USD 1,823.669 million |

Growth Rate | CAGR of 10.83% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Solar Connector Market |

|

Customization Scope | Free report customization with purchase |

Solar Connector Market Segmentation

By Type

MC-4

MC-3

Tyco Solarlok

Others

By Shape

T-Joint

Y-Joint

Others

By Current

Up to 20 Amp

20 to 30 Amp

Greater than 50 Amp

By End-User

Residential

Commercial

Industrial

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others