Report Overview

Service Robot Market - Highlights

Service Robot Market Size:

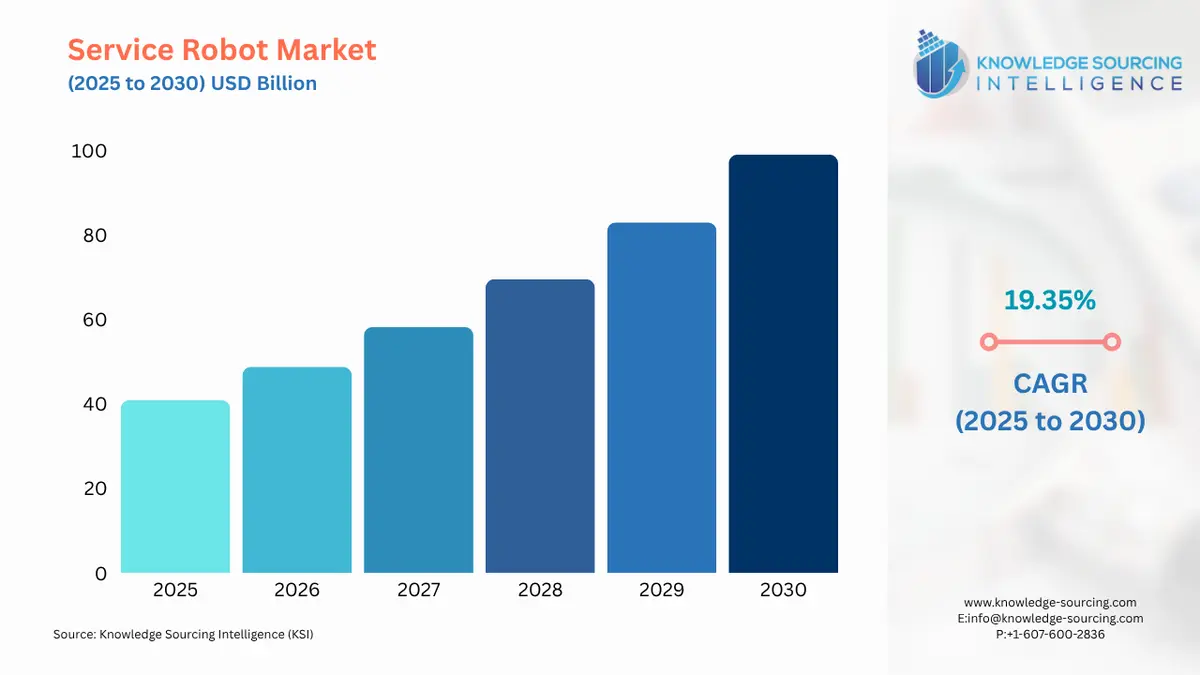

The Service Robot Market is projected to grow at a CAGR of 19.35% to reach US$99.040 billion by 2030 from US$40.890 billion in 2025.

Service Robot Market Introduction

The service robot market is a dynamic and expanding sector within the broader robotics industry, focused on creating autonomous or semi-autonomous devices that assist humans in a wide range of tasks outside of traditional industrial manufacturing. Unlike their factory-based counterparts, service robots are designed to operate in complex, unpredictable, and often human-centric environments. This includes everything from a robot vacuum cleaning a home to a surgical robot assisting in an operating room. The market's evolution is driven by significant advancements in artificial intelligence (AI), sensor technology, and mechatronics, which are enabling robots to perceive their surroundings, make decisions, and interact with people and objects with increasing sophistication.

The market is broadly categorized into two key segments: Professional Service Robots and Personal Service Robots. Professional service robots are deployed in commercial settings, such as healthcare, logistics, and agriculture, to perform specific, often repetitive or dangerous tasks. Examples include autonomous mobile robots (AMRs) that transport materials in warehouses, surgical robots that assist in complex medical procedures, and cleaning robots used in large public spaces. These robots are a direct response to the need for increased efficiency, improved safety, and a solution to labor shortages. Their development is often a collaborative effort between robotics firms and the end-user industries, leading to highly specialized and integrated solutions.

On the other hand, Personal Service Robots are designed for use by individuals, typically in a home environment. The most common examples are robotic vacuum cleaners and lawnmowers, but the segment is rapidly expanding to include companion robots, educational robots for children, and personal assistants for the elderly. The focus here is on affordability, ease of use, and a user-friendly interface. While this segment is still smaller in revenue compared to professional robots, it has a massive long-term growth potential as technology becomes more accessible and integrated into daily life.

The service robot market's growth is fueled by several major drivers, including the global labor shortage, the demand for automation to improve efficiency and reduce costs, and the rapid pace of technological innovation in AI and robotics. The demographic shifts in many developed nations, with aging populations and a declining workforce, have created a strong business case for automation in sectors like healthcare and logistics. These robots are not just replacing human labor but are augmenting it, allowing humans to focus on higher-value tasks that require creativity, empathy, and critical thinking.

However, the market also faces significant restraints. The high initial capital expenditure for purchasing and implementing these robots can be a major barrier, particularly for small and medium-sized enterprises (SMEs). The cost of research and development, combined with the need for specialized hardware and software, makes the technology expensive. Additionally, there are ethical and social concerns regarding job displacement, data privacy, and safety. The public's perception of robots, as well as the need for robust regulatory frameworks, is crucial for the market's long-term success. Overcoming these challenges will require continuous innovation, strategic partnerships, and a clear communication strategy to demonstrate the value proposition of service robots to a wider audience. The service robot market is not just about technology; it's about reimagining how humans and machines can work together to build a more efficient, safe, and prosperous future.

Service Robot Market Overview

The growing demand for service robots in the healthcare and education industries is driving the service robot market growth. The declining price of personal robots, owing to rapidly growing competition in the market, is driving the adoption of service robots for domestic tasks, further augmenting this market growth. In addition, the rapidly aging population, as well as an increasing number of rehabilitation centers, is driving the demand for service robots, as they can provide assistance to elderly people. Other drivers include rising spending power and high-speed innovation. However, high initial costs are restraining adoption and hampering service robot market growth.

Regionally, Europe commands a substantial market share and holds a prominent position throughout the forecast period. Rapid innovation and the broadening use of service robots are fueling regional market expansion. In Europe, the adoption of robots is growing in fields like education, entertainment, and healthcare. Likewise, North America secures a significant share, driven by early technology adoption in the United States and the presence of numerous leading companies, which bolster its market standing. Meanwhile, the Asia Pacific (APAC) region is witnessing rapid growth during the forecast period, propelled by increased automation in logistics and rising investments, boosting the APAC service robot market.

The service robot market report provides an in-depth analysis of the global industry, offering strategic and executive-level insights supported by data-driven analysis and projections. Regularly updated, it equips decision-makers with practical intelligence on current trends, emerging opportunities, and competitive dynamics. The report examines demand for various service robot categories, including professional and personal types, and their uptake across different regions. It also assesses the latest technological developments in the service robotics field, alongside key government policies, regulations, and macroeconomic factors, delivering a comprehensive perspective of the market.

Some of the major players covered in this report include iRobot Corporation, Samsung Electronics Co., Ltd., Honda Motor Co., Ltd., Panasonic Corporation, and Intuitive Surgical Inc., among others.

Service Robot Market Drivers

Global Labor Shortages and Rising Labor Costs: A key driver for the service robot market is the increasing global labor shortage and the corresponding rise in labor costs. In many industries, particularly logistics, healthcare, and hospitality, companies are struggling to find and retain workers for repetitive, physically demanding, or dangerous jobs. This is especially true in developed economies with aging populations. Service robots offer a compelling solution by automating these tasks, thereby ensuring operational continuity and reducing reliance on a dwindling human workforce. For example, autonomous mobile robots (AMRs) in warehouses handle material transport and sorting, freeing up human workers for more complex tasks like quality control or customer service. The deployment of surgical robots in hospitals addresses the shortage of specialized surgeons and can improve procedural precision. This push for automation is a direct response to economic pressures and demographic shifts, making service robots an essential investment for businesses looking to enhance efficiency and maintain profitability in a challenging labor market.

Technological Advancements in AI and Robotics: The service robot market is being profoundly shaped by rapid technological advancements in artificial intelligence, machine learning, and robotics hardware. Modern service robots are no longer simple machines following pre-programmed commands; they are equipped with sophisticated sensors, advanced computer vision systems, and AI-powered software that enable them to navigate complex, unstructured environments and perform tasks with high levels of autonomy. For instance, AI allows robots to learn from their surroundings, adapt to new situations, and interact with humans more naturally. This is particularly important for applications in healthcare and hospitality, where robots must operate safely and effectively alongside people. The development of more powerful processors and energy-efficient batteries is also enhancing robot capabilities, enabling them to work for longer periods and handle more demanding tasks. These technological leaps are making service robots more capable, reliable, and cost-effective, thus accelerating their adoption across various sectors.

Growth in the E-commerce and Logistics Sectors: The explosive growth of e-commerce has created a massive demand for automation in the logistics and warehousing sectors, acting as a major catalyst for the service robot market. To meet the ever-increasing consumer expectations for fast and accurate delivery, fulfillment centers are turning to robots to streamline their operations. Autonomous mobile robots (AMRs) are a prime example, as they are used to transport goods, assist in sorting, and manage inventory with high efficiency. Unlike traditional, fixed-rail automation systems, AMRs are flexible and can be easily integrated into existing warehouse layouts, making them a scalable solution for businesses of all sizes. The ability of these robots to work around the clock, with minimal error, allows companies to process orders faster and more efficiently, directly impacting their bottom line and competitive advantage. The continued expansion of online retail ensures that the demand for these robotic solutions will remain strong.

Service Robot Market Restraints

High Initial Investment and Implementation Costs: A significant restraint on the service robot market is the substantial initial capital expenditure required for procurement, programming, and integration. While the long-term cost savings from automation can be significant, the upfront cost of purchasing advanced service robots, along with the expense of customizing software, training staff, and reconfiguring workspaces, can be a major barrier for many businesses, particularly small and medium-sized enterprises (SMEs). The development of "Robots-as-a-Service" (RaaS) models is a new trend designed to mitigate this, allowing companies to lease robots rather than buy them, but the overall cost remains a significant consideration. The complexity of integrating these sophisticated systems into existing workflows and the potential for unexpected maintenance costs also add to the financial risk. This high entry barrier limits the widespread adoption of service robots, especially in industries where profit margins are thin.

Ethical Concerns and Job Displacement Fears: The service robot market faces public and political scrutiny due to ethical concerns and fears of widespread job displacement. As robots become more capable and autonomous, there is a growing debate about their impact on the human workforce. Employees may view robots as a threat to their job security, leading to resistance to adoption within organizations. This can create a need for extensive training and upskilling programs to help workers transition into new roles that involve collaboration with robots. Furthermore, there are broader societal concerns regarding the future of work and the potential for increased inequality. The development of humanoid robots and AI-powered service robots raises complex ethical questions about data privacy, accountability for robotic errors, and the role of robots in social interactions. Addressing these concerns through clear communication, re-skilling initiatives, and robust regulatory frameworks is critical for fostering public trust and ensuring a smooth transition to a more automated future.

Service Robot Market Segmentation Analysis

Professional Service Robots: The Professional Service Robots segment is the largest in the service robot market, driven by the strong business case for automation in commercial and industrial settings. These robots are designed for specific tasks in sectors such as logistics, healthcare, agriculture, and construction. Unlike personal robots, which are typically for consumer use, professional robots are integrated into business operations to improve efficiency, enhance safety, and reduce operational costs. Their high value-add and ability to perform complex, repetitive, or dangerous tasks make them an indispensable tool for businesses. Examples range from surgical robots that assist with minimally invasive procedures to AMRs that transport goods in warehouses. The strong demand from these industries, combined with the continuous development of specialized, high-performance robotic solutions, ensures that the professional service robots segment will continue to lead the market in terms of revenue and growth.

By Application, the healthcare sector is rising rapidly: The Healthcare sector is the largest application segment for service robots. This is driven by a confluence of factors, including an aging global population, a shortage of medical staff, and the need for greater precision in medical procedures. Service robots in healthcare are used for a variety of tasks, from assisting in surgery and patient rehabilitation to disinfecting hospital rooms and delivering medicine and supplies. Surgical robots, such as those that perform minimally invasive procedures, offer greater precision and control for surgeons, leading to better patient outcomes and faster recovery times. In logistics, robots can manage inventory and transport lab samples, freeing up nurses and other staff to focus on direct patient care. This sector's strong demand for solutions that improve efficiency, reduce costs, and enhance the quality of care positions it as the most significant application area for service robots.

North America is expected to grow significantly in the market: North America is the dominant region in the service robot market, holding the largest revenue share. This leadership is due to a robust ecosystem of technological innovation, significant investment in research and development, and a high rate of adoption across key industries. The United States, in particular, is a hub for robotics and AI development, with numerous leading companies and a strong venture capital environment. The region's advanced technological infrastructure and high labor costs have created a strong business case for automation, leading to the early and widespread adoption of service robots in logistics, healthcare, and other sectors. Additionally, supportive government initiatives and a large market for both professional and personal service robots further contribute to the region's dominance. This combination of innovation, investment, and market expansion solidifies North America's position at the forefront of the service robot market.

Service Robot Market Key Developments

April 2025: Following the launch of the all-electric Atlas robot, Hyundai announced plans for the first commercial deployment of the new model within its factories. This marks a major step in moving the Atlas platform from a research project to a practical tool for automotive manufacturing.

March 2025: Richtech Robotics, a U.S.-based company, showcased its new lineup of AI-powered robots, including models for hospitality and healthcare, at CES 2025. These robots, such as ADAM and Medbot, are designed to perform a range of tasks, from serving food to assisting with patient care.

September 2024: The International Federation of Robotics (IFR) released a report highlighting a significant increase in industrial robot installations, with Canada seeing a 37% rise. This data reflects a strong global trend toward automation, which directly impacts the professional service robot market.

June 2024: GXO Logistics, a leading contract logistics provider, announced a research and development partnership with robotics company Apptronik. The collaboration will focus on integrating Apptronik's humanoid robot technology into various logistics processes to enhance efficiency and address labor challenges.

Service Robot Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 40.890 billion |

| Total Market Size in 2030 | USD 99.040 billion |

| Forecast Unit | Billion |

| Growth Rate | 19.35% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Mobility, Application, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Service Robot Market Segmentation:

By Type

Professional Service Robots

Personal Service Robots

By Mobility

Mobile Robots

Fixed Robots

By Application

Healthcare

Logistics and Warehousing

Domestic and Household

Education and Training

Security and Surveillance

Others

By Region

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

UK

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Thailand

Indonesia

Others