Report Overview

Safety Switches Market Report, Highlights

Safety Switches Market Size:

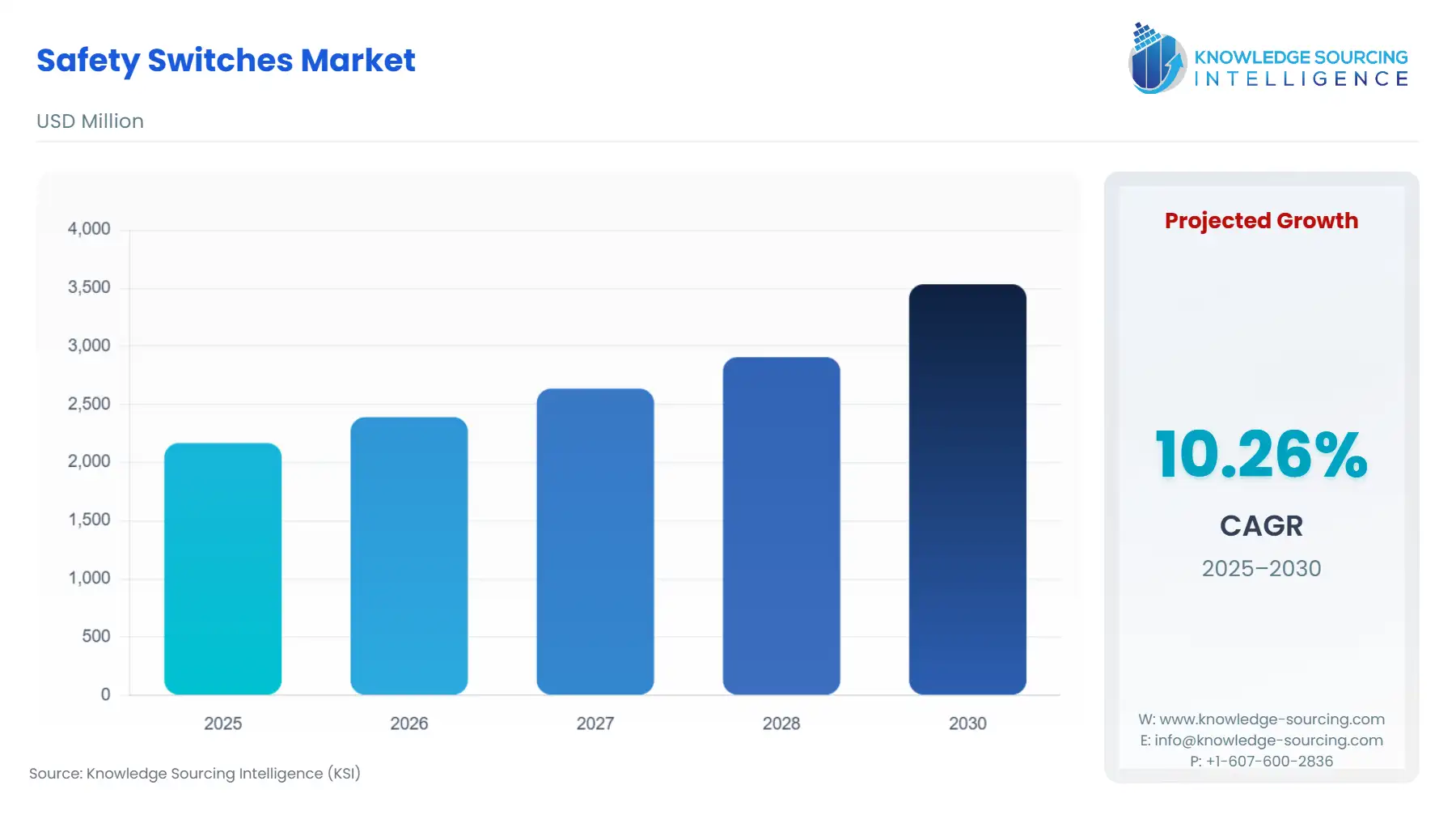

The safety switches market will grow at a CAGR of 10.26% from USD 2.169 billion in 2025 to USD 3.535 billion in 2030.

Safety Switches Market Trends:

The projected increase in demand for safety switches, particularly for service entrances and fault protection, is poised to propel market growth in the foreseeable future. Heightened concerns regarding the safety and well-being of industrial personnel are contributing to this momentum.

Governments worldwide are implementing stricter regulations aimed at enhancing worker safety in industrial settings, thereby underscoring the importance of safety switches.

Safety switches play a crucial role in preventing accidents by swiftly halting machinery upon detecting safety hazards. Furthermore, the growing adoption of automation in sectors such as manufacturing, oil & gas, and chemicals is driving the demand for reliable safety solutions.

Non-contact safety switches offer numerous advantages over conventional mechanical switches, including increased reliability, reduced wear and tear, and improved resilience to challenging environments.

The safety switches market is divided by application into light-duty and heavy-duty applications. Light-duty safety Switches are utilized in various settings such as packaging machinery, food processing equipment, light industrial assembly lines, printing presses, and woodworking equipment.

On the other hand, heavy-duty safety switches find application in demanding environments including metal processing machinery, chemical processing plants, oil and gas refineries, construction equipment, and power generation plants.

Regarding end-users, the safety switches market is categorized into industrial, commercial, and residential sectors. In the industrial sector, safety switches are deployed in manufacturing facilities, power plants, and other industrial settings to ensure worker safety.

The commercial sector encompasses establishments like office complexes, shopping malls, and high-rise structures, where machinery is used for maintenance, cleaning, or specific operations.

In the residential sector, safety switches are installed in areas like garages, workshops, or laundry rooms to mitigate electrical hazards.

Furthermore, the safety switches market is classified by installation type into switchboard safety switches, PowerPoint safety switches, and portable safety switches.

Switchboard Safety Switches are integral components of electrical switchboards, serving as central distribution points for electrical power within buildings or facilities. PowerPoint Safety Switches, typically lightweight in nature, are suitable for safeguarding individual appliances or circuits.

Portable Safety Switches, on the other hand, are employed in construction sites, maintenance applications, or in conjunction with power tools to ensure safety on the go.

Safety Switches Market Growth Drivers:

- Growing industrial automation will pave the way for the use of safety switch devices in the upcoming years.

Global industrial automation is expected to soar in the upcoming years with the growing inclination towards the adoption of digitized technologies. Also, with the growing labor costs, there is a high demand for creating automated solutions for failure management in the future.

The growing need for the reduction of the risk of accidents in industrial sites is fueling the market demand in the coming years, with burgeoning high demand for effective automation solutions, such as the use of an automated safety switch. With advancements in technology, the market is expected to see robust growth in the upcoming years.

Furthermore, the increasing need to cut the overall cost of production is augmenting the market demand, with growing automation in industries. Hence, automation allows organizations to get real-time information regarding processes, and hence, continuous monitoring is also possible. The emergence of the industrial Internet of Things (IIoT) is further supporting the use of automation in industries, promoting market growth as well in the coming years.

- Rapid urbanization is fueling the market demand in the forecast period

Rapid urbanization, along with the global population rise, has resulted in the expansion of cities, complex infrastructure development, rapid industrialization, and technological advancements to meet the evolving needs of consumers. This is due to the changing living conditions of the urban population to keep pace with the fast life of the cities.

Additionally, as the bigger cities demand more energy to satisfy the needs of their large populations, there is a high demand for facilities as well. With developments in the infrastructure sector (residential, commercial, and industrial), the market demand for safety switches is expected to surge in the forecast period and the upcoming years.

As per the United Nations estimates, by 2030, around USD57 trillion will be required for urban infrastructure investment. The number of people in housing is estimated to grow from over 1 billion in 2017 to 3 billion in 2030, with the rise of the urban population.

- Changing Industrial Safety Standards

Regulatory agencies are consistently revising and refining safety protocols for industrial equipment. With varying voltage and weather conditions, as well as diverse safety concepts across different countries, each nation establishes its safety standards.

When switches are certified to meet these standards, they are exempt from further testing when incorporated into devices seeking standard certification. To keep pace with evolving regulations, safety switch manufacturers are actively innovating to ensure their products align with the latest safety guidelines.

Safety Switches Market Restraint:

- Financial and installation as major restraints

Safety switches can pose a significant financial investment in both acquisition and installation, potentially dissuading certain businesses from their implementation. The process of integrating safety switches into pre-existing machinery and systems can prove intricate and time-intensive. Additionally, there exists a lack of awareness among some businesses regarding the advantages of safety switches and the regulatory mandates dictating their use.

Nevertheless, the safety switches market is forecasted to experience robust expansion in the foreseeable future, despite encountering certain market limitations. This growth trajectory is anticipated to be propelled by heightened attention to worker safety, government-enforced regulations, and ongoing technological innovations.

Safety Switches Market Segment Analysis:

Based on product type, the safety switch market has been segmented into electro-mechanical safety switches, non-contact safety interlock switches, safety locking switches, and safety command devices, among others.

Electro-mechanical Safety Switches represent the traditional variety, employing mechanical actuation to initiate the switch. Known for their reliability and cost-effectiveness, they find widespread application across various industries. Non-contact Safety Interlock Switches operate without physical contact, typically utilizing magnetic or electromagnetic fields for activation.

Safety Locking Switches integrate a safety switch with a locking mechanism, ensuring that machine guards or doors remain closed during machinery operation, thus preventing unauthorized access to hazardous areas.

Safety Command Devices serve multiple safety functions, such as managing several safety switches, monitoring safety parameters, and facilitating communication with other safety devices within a safety control system. Other types of safety switches include magnetic safety switches and rope pull safety switches.

Safety Switches Market Geographical Outlook:

- APAC is anticipated to hold a significant share of the safety switches market.

The Asia Pacific (APAC) region is poised to claim a substantial portion of the safety switches market. Many APAC nations are currently undergoing rapid industrial expansion, leading to heightened demand for industrial machinery and equipment. Consequently, there is a growing necessity for safety solutions such as safety switches.

Notably, there's an escalating emphasis on enhancing workplace safety standards across APAC countries, with both governments and industries acknowledging the crucial role of safety regulations.

Moreover, numerous developing economies in the APAC region are witnessing significant investments in infrastructure development, particularly in sectors like construction, power generation, and manufacturing, where safety switches are integral for various applications.

Additionally, advancements in manufacturing technologies are driving down the cost of safety switches, making them increasingly appealing to businesses operating in the price-sensitive APAC markets. Considering these factors, the APAC region emerges as a formidable contender in the global safety switches market.

Safety Switches Market Developments:

- August 2023- Bernstein forged a partnership with Pacific Automation, with the collaboration between the two companies for the Australian market. As a family-owned enterprise, Bernstein serves as a supplier of industrial safety and enclosure technology.

Its product range encompasses switches, sensors, enclosures, suspension systems, operator stations, and comprehensive system solutions for operating and safeguarding complete machines and plants.

- July 2022- Littelfuse, Inc. finalized its acquisition of C&K Switches. C&K is renowned for its expertise in designing and producing high-performance electromechanical switches and interconnect solutions, boasting a robust global footprint across diverse end markets.

- November 2023- Standex International Corporation revealed its definitive agreement, executed via its subsidiary Standex Electronics Japan Corporation, to purchase the privately owned Japanese company, Sanyu Switch Co., Ltd.

Safety Switches Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Safety Switches Market Size in 2025 | US$2.169 billion |

| Safety Switches Market Size in 2030 | US$3.535 billion |

| Growth Rate | CAGR of 10.26% |

| Study Period |

2020 to 2030 |

| Historical Data |

2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Safety Switches Market |

|

| Customization Scope | Free report customization with purchase |

Safety Switches Market Segmentation:

- By Type

- Fusible safety switch

- Non-Fusible safety switch

- By Installation Type

- Switchboard safety switches

- Powerpoint safety switches

- Portable safety switches

- By Product Type

- Electro-mechanical safety switches

- Non-contact safety interlock switches

- Safety locking devices

- Safety command devices

- Others

- By Application

- Light duty applications

- Heavy-duty applications

- By End-user

- Industrial

- Commercial

- Residential

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Thailand

- Others

- North America