Report Overview

Rubber Additives Market Size, Highlights

Rubber Additives Market Size:

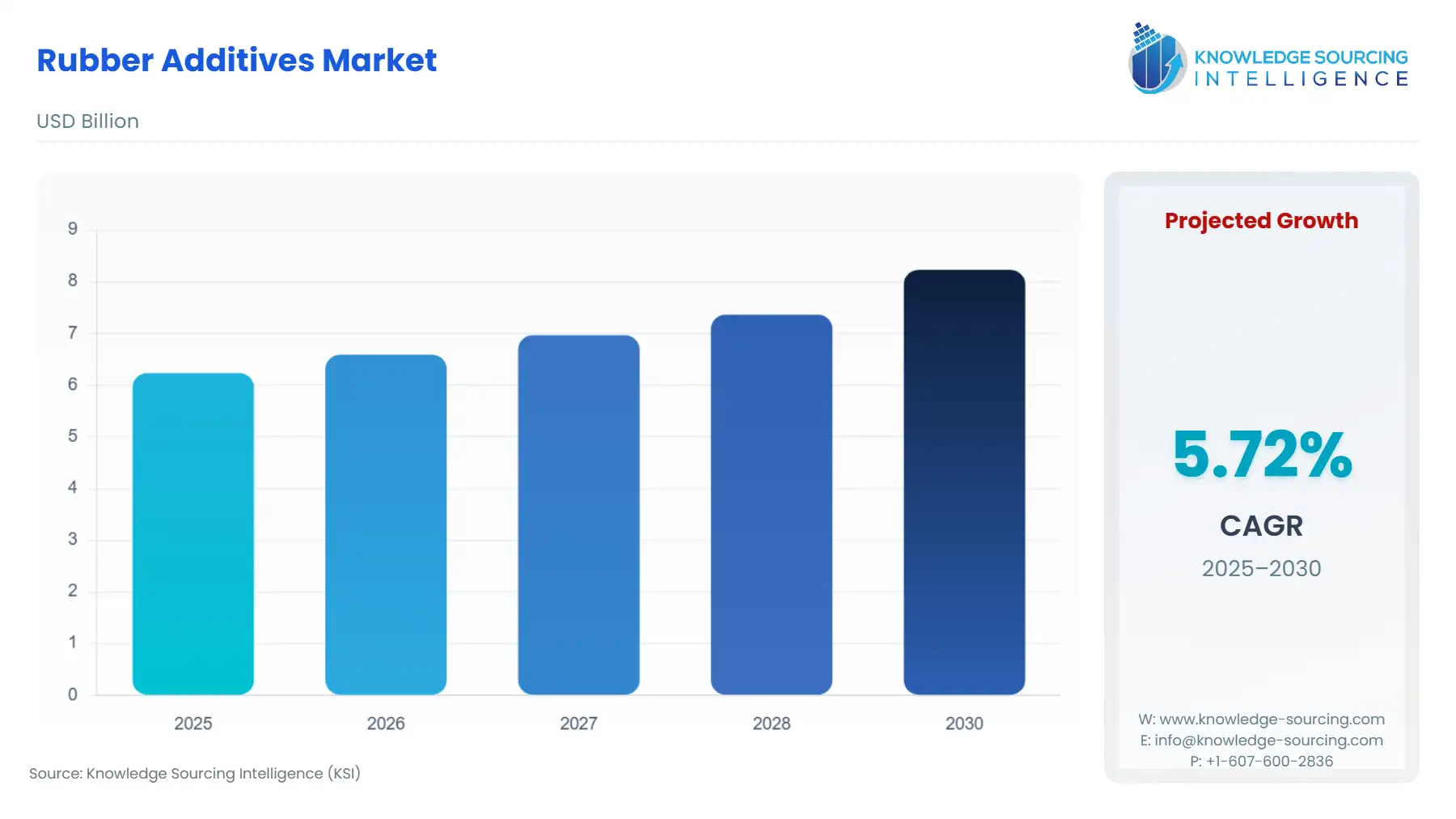

The rubber additives market will grow from US$6.233 billion in 2025 to US$8.231 billion in 2030 at a CAGR of 5.71%.

Additives can include vulcanization processes, fillers, accelerators, and other materials and are used to enhance processability, facilitate or accelerate cross-linking, or improve the finished rubber product properties. The increasing consumption of rubber polymers from various industries, such as the growing automotive, manufacturing, and electrical insulation industries, drives the global rubber additives market. Moreover, using rubber in non-tire applications also significantly impacts the market growth. However, stringent regulations and policies from necessary authorities worldwide impair market growth. Geographically, the Asia Pacific region is expected to drive the global market of rubber additives on account of the expansion of various end-use industries, owing to rapid industrialization, especially in countries like India and China. Similarly, Europe is estimated to have significant market growth due to the expansion of the automobile market in Germany.

Rubber Additives Market Growth Drivers:

- Rising demand in the tire and rubber industry

Rubber additives, including combinations of synthetic rubbers like styrene-butadiene rubber and butadiene rubber, are used widely in tire manufacturing. This usage of rubber additives will result in the growth of the tire industry as it will support the manufacturing of high-quality tires, thus increasing their demand. Furthermore, an increase in big data adoption and the increasing demand for device automation are also boosting the market's growth.

According to the U.S. Tire Manufacturers Association, as of 2021, the total tire shipments in the United States increased from 332.7 million units in 2019 to 335.2 million units in 2021, reaching 340.2 million units in 2022. Furthermore, compared to 2021, there was an expected increase in the Original Equipment (OE) shipments for passenger, light trucks, and truck tires, constituting 6.2%, 4.4%, and 6.3%, respectively, resulting in a total of 2.9 million units.

- Growing demand from the infrastructure and construction industry

The rapid expansion of infrastructure development globally is another primary driver for the rubber additives market. Governments and private sectors invest heavily in building and upgrading transportation networks, including roads, bridges, and airports, to support urbanization and economic growth. These rubber additives, in this regard, are used efficiently to ensure that buildings remain watertight and are protected from environmental damage because they are energy-efficient.

According to the Asian Development Bank, there is a need for developing Asia to invest $1.7 trillion per year in infrastructure until 2030 to grow efficiently and maintain its growth momentum while effectively responding to climate change and tackling poverty. Additionally, as cities expand and there is growth in infrastructure projects, the results will directly correlate with the growth of construction materials like rubber additives, which are essential components ensuring longevity and structural integrity. Moreover, the increasing complexity of modern engineering projects necessitates the efficient use of rubber additives that can meet stringent safety and performance standards. This trend is particularly pronounced in emerging economies where rapid urbanization occurs, further driving the need for innovative construction solutions and propelling the rubber additives market forward.

Rubber Additives Market Geographical Outlook:

- The European region is expected to contribute to the rubber additives market’s growth during the forecast period.

The major economies like Germany and the United Kingdom are expected to drive the European region's rubber additives market. According to U.S. News & World Report, Germany has the most developed infrastructure, followed by the United States. According to the Global Infrastructure Hub 2024, Germany’s infrastructure investment is segmented into different sectors, such as the transportation sector, constituting 51% of total investment in infrastructure with an annual rate of US$20,336 million, followed by the renewable generation with 15% at an annual rate of 5,846 million. Moreover, the Federal Government’s imperative transport infrastructure planning tool, the 2030 Federal Transport Infrastructure Plan (FTIP) of Germany, is also an effective step towards the rubber additives market’s growth. This is mainly because this plan is a step towards upgrading and adding new construction projects for the road, rail, and waterway modes.

Rubber Additives Market Restraints:

- Environmental constraints about rubber chemicals will act as a restraining factor that will hamper the rubber additives market’s growth.

Rubber Additives Market Segment Analysis:

- The rubber additives market by type is segmented into accelerators, anti-degradants, vulcanization, tackifiers, and others.

The rubber additives are broadly segmented into accelerators and anti-degradants and are widely used in the automotive and construction industries. With the growing economies of Asia and Africa, the demand for rubber additives will drive market growth, along with growth in the end-user industries.

Rubber Additives Market Key Developments:

Rubber Additives Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Rubber Additives Market Size in 2025 | US$6.233 billion |

| Rubber Additives Market Size in 2030 | US$8.231 billion |

| Growth Rate | CAGR of 5.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Rubber Additives Market |

|

| Customization Scope | Free report customization with purchase |

The rubber additives market is segmented and analyzed as follows:

- By Type

- Accelerators

- Antidegradants

- Vulcanization

- Tackifiers

- Others

- By Application

- Non-Tire

- Tire

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

- North America