Report Overview

Power Supply Market Report, Highlights

Power Supply Market Size:

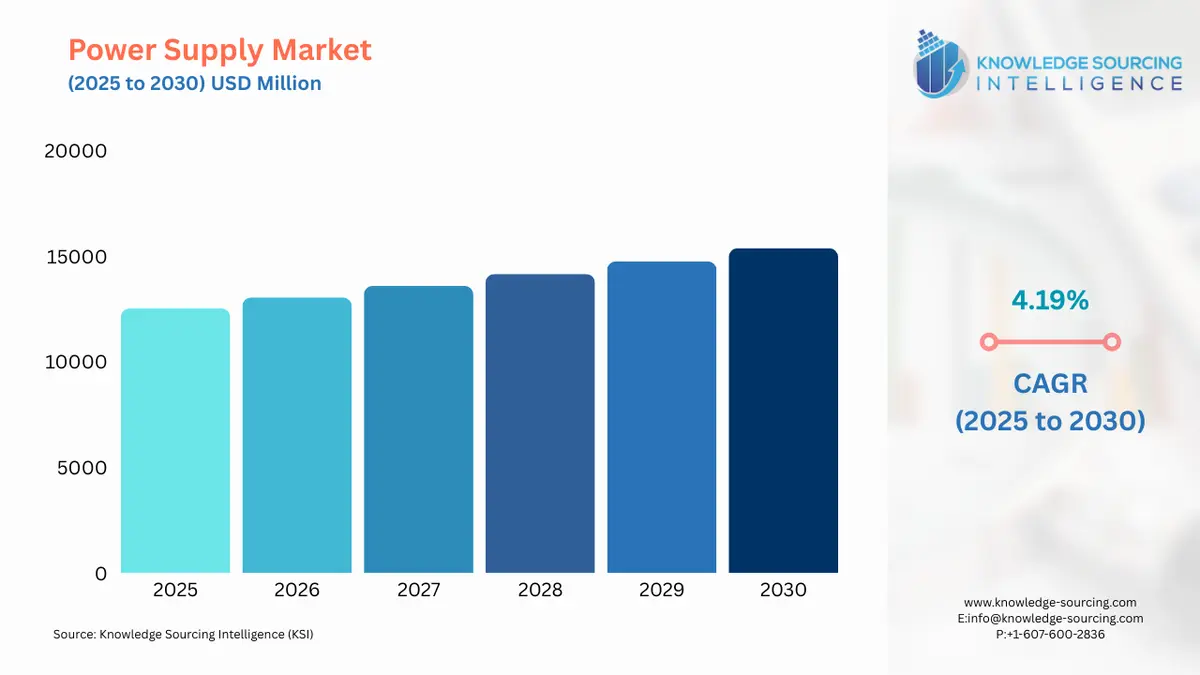

The Power Supply Market will reach US$15,368.851 million in 2030 from US$12,518.123 million in 2025 at a CAGR of 4.19% during the forecast period.

Introduction to the Power Supply Market:

The global power supply market is a critical component of the modern industrial and technological landscape, underpinning the functionality of countless systems across industries such as telecommunications, healthcare, automotive, aerospace, consumer electronics, and renewable energy. Power supplies, encompassing devices that convert and regulate electrical energy to meet the specific requirements of electronic systems, are indispensable for ensuring operational efficiency, reliability, and safety. These devices range from simple AC-DC converters to sophisticated uninterruptible power supply (UPS) systems and high-efficiency power management solutions tailored for advanced applications like electric vehicles (EVs) and data centers. As of 2025, the market is experiencing dynamic growth driven by technological advancements, increasing energy demands, and a global push for sustainability, though it faces challenges from supply chain complexities and regulatory pressures.

Power supplies are essential for transforming raw electrical input, whether from grid power, renewable sources, or batteries, into usable forms for various applications. They include switched-mode power supplies (SMPS), linear power supplies, DC-DC converters, and specialized modules for renewable energy integration. The market serves diverse sectors, with applications ranging from powering medical imaging equipment to supporting the burgeoning infrastructure of 5G networks and Internet of Things (IoT) devices. The rise of smart grids, energy storage systems, and electrification in transportation has further amplified the importance of power supplies, making them a linchpin in the transition to a more connected and sustainable world.

The power supply market is shaped by rapid technological evolution and increasing demand for energy-efficient solutions. For instance, the adoption of wide-bandgap semiconductors like silicon carbide (SiC) and gallium nitride (GaN) has revolutionized power supply design, enabling higher efficiency, smaller form factors, and improved thermal performance. These advancements are particularly critical in high-growth areas such as EV charging infrastructure and renewable energy systems, where efficiency and reliability are paramount. Additionally, the proliferation of data centers, driven by cloud computing and artificial intelligence (AI), has spurred demand for high-capacity, modular power supplies capable of handling immense computational loads.

Power Supply Market Drivers:

- Rising Demand for Renewable Energy Integration: The global push toward decarbonization has accelerated the adoption of renewable energy sources like solar and wind, necessitating advanced power supply systems for energy conversion, storage, and grid integration. Inverters, rectifiers, and power management modules are critical for ensuring stable power delivery from variable renewable sources. The International Energy Agency (IEA) projects that global renewable energy capacity will grow by 25% annually through 2030, driven by policy support and cost declines in solar and wind technologies. This growth directly increases demand for efficient power supplies to manage energy flow and storage.

- Electrification of Transportation: The rapid rise of electric vehicles has created a surge in demand for high-efficiency power supplies for EV charging infrastructure and onboard power management systems. BloombergNEF’s 2024 Electric Vehicle Outlook estimates global EV sales will reach 30 million units by 2025, supported by government incentives and expanding charging networks. High-power DC-DC converters and fast-charging systems are essential to meet the needs of ultra-fast charging stations, which can deliver up to 350 kW of power. This trend is driving innovation in compact, high-efficiency power supplies.

- Growth in Data Centers and AI: The expansion of data centers to support cloud computing, AI, and machine learning has significantly increased demand for high-density, modular power supplies. The Uptime Institute’s 2024 Global Data Center Survey reports that data center power consumption is expected to double by 2030 due to AI-driven workloads, requiring scalable and energy-efficient power solutions. Advanced power supplies with high power density and redundancy are critical for ensuring uninterrupted operation in these facilities.

- Advancements in Semiconductor Technology: The adoption of wide-bandgap semiconductors like SiC and GaN has transformed power supply design, enabling higher efficiency, smaller form factors, and improved thermal management. These materials are particularly valuable in high-frequency applications such as telecommunications and industrial automation. A 2024 report by the IEEE Power Electronics Society highlights that GaN-based power supplies can achieve efficiencies of up to 98%, making them ideal for 5G infrastructure and renewable energy systems.

Power Supply Market Restraints:

- Supply Chain Disruptions: Global supply chain constraints, particularly for semiconductors and critical materials like rare earth elements, pose significant risks to power supply manufacturers. The World Bank’s 2024 Global Economic Prospects report notes that shortages of components such as transformers and capacitors could lead to production delays and increased costs. These disruptions are exacerbated by geopolitical tensions and trade restrictions affecting raw material availability.

- Regulatory Compliance Costs: Stringent energy efficiency regulations, such as the EU’s Ecodesign Directive and the U.S. Department of Energy’s efficiency standards, require manufacturers to invest heavily in research, development, and compliance testing. While these regulations promote sustainability, they increase production costs and complexity, particularly for smaller manufacturers. Compliance with these standards is mandatory for market access in key regions, creating a barrier to entry for some firms.

- High Initial Investment for Advanced Technologies: The transition to SiC and GaN-based power supplies involves significant upfront costs for research, development, and manufacturing retooling. These costs can be prohibitive for small and medium-sized enterprises (SMEs), limiting their ability to compete with larger players. Additionally, the high cost of these advanced materials can deter adoption in price-sensitive markets, slowing market penetration.

- Technical Complexity in High-Power Applications: As power demands increase in applications like data centers and EV charging, designing power supplies that balance efficiency, reliability, and thermal management becomes more complex. The need for advanced cooling systems and robust fault-tolerance mechanisms adds to development costs and timelines, posing challenges for manufacturers aiming to meet market demands.

Power Supply Market Segmentation Analysis:

- By Frame Type, the open frame is expected to witness significant growth

Open frame power supplies dominate the frame type segment due to their compact design, cost-effectiveness, and versatility across applications. These power supplies lack an outer enclosure, making them lightweight and suitable for integration into systems where space and heat dissipation are critical, such as in consumer electronics, medical devices, and industrial equipment. Their design allows for easy customization and integration, which is particularly valuable in applications requiring high power density and flexibility.

Open frame power supplies are favored in industries prioritizing miniaturization and efficiency, such as telecommunications and medical equipment. The rise of compact devices, including IoT-enabled gadgets and portable medical diagnostics, has driven demand for open frame solutions. For instance, the IEEE Power Electronics Society reported in 2024 that open-frame power supplies are increasingly adopted in 5G infrastructure due to their ability to support high-frequency, high-efficiency designs using gallium nitride (GaN) semiconductors. The segment is also benefiting from the trend toward modular designs, allowing manufacturers to reduce production costs while meeting diverse application needs.

In 2024, Delta Electronics launched a new series of open-frame power supplies optimized for renewable energy applications, emphasizing high efficiency and compact form factors to support solar inverters and energy storage systems. This reflects the segment’s alignment with the global push for sustainable energy solutions.

- By Output, single output power supplies are gaining traction

Single-output power supplies, which deliver a single voltage level, are the most prominent in the output segment due to their simplicity, reliability, and widespread use in applications requiring consistent power delivery. They are extensively used in telecommunications, industrial automation, and consumer electronics, where a stable, single voltage is critical for system performance.

The dominance of single-output power supplies is driven by their cost-effectiveness and compatibility with a broad range of devices, from telecom base stations to LED lighting systems. The Uptime Institute’s 2024 Global Data Center Survey notes that single output power supplies are critical for data centers, where consistent voltage is essential for powering servers and cooling systems. The segment’s growth is further fueled by the increasing demand for energy-efficient solutions in industrial and telecom applications, where single-output designs minimize power losses.

Schneider Electric introduced a new line of single-output power supplies in 2024, designed for industrial automation with enhanced efficiency and IoT-enabled monitoring capabilities. This development underscores the segment’s role in supporting smart, connected systems.

- By Type, the DIN rail mount segment is growing considerably

DIN rail mount power supplies lead the type segment due to their widespread use in industrial automation, building management systems, and telecommunications. These power supplies are mounted on standardized DIN rails, offering ease of installation, modularity, and reliability in harsh environments.

The growth of DIN rail mount power supplies is driven by the increasing automation of industrial processes and the expansion of smart infrastructure. Their robust design makes them ideal for applications requiring stable power in challenging conditions, such as factory automation and renewable energy systems. A 2024 report by the International Energy Agency highlights the role of DIN rail power supplies in supporting distributed energy systems, particularly in solar and wind installations. The segment’s growth is also supported by the rising adoption of single-phase DIN rail solutions in urban infrastructure projects.

In 2024, Phoenix Contact released a new series of DIN rail power supplies with enhanced power density and IoT connectivity, targeting smart factory applications.

- By End User, the telecommunications sector is growing significantly

The telecommunications sector is the leading end-user segment, driven by the global rollout of 5G networks, the proliferation of IoT devices, and the expansion of data centers. Power supplies in this sector must deliver high reliability, efficiency, and scalability to support critical infrastructure like base stations and network equipment.

The telecommunications industry’s demand for power supplies is propelled by the need for uninterrupted power to support 5G infrastructure and edge computing. The IEEE Power Electronics Society notes that power supplies with GaN and silicon carbide (SiC) technologies are increasingly used in telecom applications to achieve efficiencies above 98%. The segment is also driven by the growing number of IoT devices, which require compact, efficient power solutions.

In 2024, Nokia partnered with a power supply manufacturer to develop high-efficiency solutions for 5G base stations, emphasizing energy savings and reliability.

Power Supply Market Geographical Outlook:

- The Asia Pacific market is rising considerably

The Asia Pacific region dominates the power supply market due to its rapid industrialization, technological advancements, and significant investments in renewable energy, telecommunications, and electric vehicle infrastructure. Countries like China, Japan, India, and South Korea are key contributors to the region’s market leadership.

Asia Pacific’s growth is driven by its role as a global manufacturing hub for electronics and power supply components, coupled with increasing demand for energy-efficient solutions in renewable energy and EV charging. The IEA reports that Asia Pacific accounts for over 50% of global renewable energy capacity additions, driving demand for advanced power supplies. The region’s burgeoning data center market, fueled by AI and cloud computing, further boosts demand for high-density power supplies.

In 2024, China’s State Grid Corporation announced investments in smart grid technologies, incorporating advanced power supply systems to enhance energy efficiency.

Power Supply Market Key Developments:

- Seasonic 3200W PSU (2025): Seasonic unveiled a 3200W power supply with sensors to prevent overheating and melting.

- Delta Electronics Open Frame PSUs (2024): Delta launched high-efficiency open frame power supplies for renewable energy and compact applications.

- Schneider Electric Smart UPS Systems (2024): Schneider Electric released an IoT-enabled UPS with cloud-based analytics for industrial and data center efficiency.

- Corsair RMx SHIFT Series Launch (2023): Corsair introduced ATX 3.1-compliant RMx SHIFT PSUs with side-positioned connectors for enhanced cable management.

Power Supply Market Segmentations:

Power Supply Market Segmentation by frame type:

The market is analyzed by frame type into the following:

- Open Frame

- Enclosed Frame

Power Supply Market Segmentation by output:

The report analyzed the market by output as below:

- Single Output

- Multiple Output

- Dual Output

Power Supply Market Segmentation by type:

The market is analyzed by type into the following:

- Din Rail Mount

- Wall Mount

- PCB Mount

- Panel Mount

Power Supply Market Segmentation by end user:

The market is analyzed by end user into the following:

- Telecommunications

- Consumer Electronics

- Medical & Healthcare

- Aerospace & d\Defense

- Automotive

- Others

Power Supply Market Segmentation by regions:

The study also analysed the power supply market into the following regions, with country level forecasts and analysis as below:

- North America (US, Canada, and Mexico)

- South America (Brazil, Argentina, and Others)

- Europe (Germany, UK, France, Spain, and Others

- Middle East and Africa (Saudi Arabia, UAE, and Others)

- Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)

Power Supply Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Power Supply Market Size in 2025 | US$12,518.123 million |

| Power Supply Market Size in 2030 | US$15,368.851 million |

| Growth Rate | CAGR of 4.19% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Power Supply Market |

|

| Customization Scope | Free report customization with purchase |

Our Best-Performing Industry Reports:

Navigation:

- Power Supply Market Size:

- Power Supply Market Highlights:

- Introduction to the Power Supply Market:

- Power Supply Market Drivers:

- Power Supply Market Restraints:

- Power Supply Market Segmentation Analysis:

- Power Supply Market Geographical Outlook:

- Power Supply Market Key Developments:

- Power Supply Market Segmentations:

- Power Supply Market Scope:

- Our Best-Performing Industry Report

Page last updated on: September 22, 2025