Report Overview

Pneumococcal Vaccines Market Report, Highlights

Pneumococcal Vaccines Market Size:

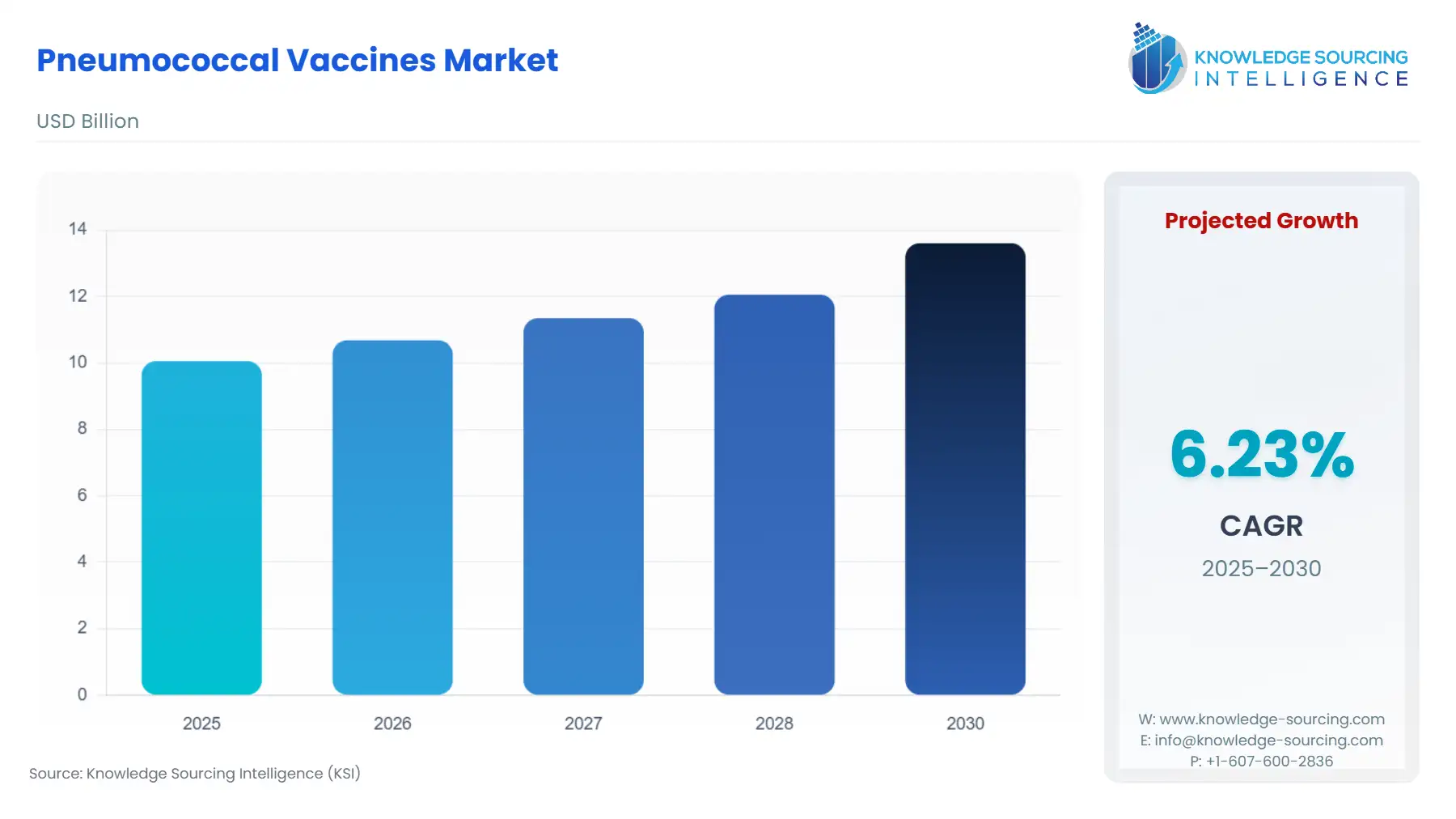

The global pneumococcal vaccine market is forecasted to rise at a 6.23% CAGR, reaching USD 13.607 billion by 2030 from USD 10.058 billion in 2025.

Vaccines that help prevent pneumococcal disease caused by Streptococcus pneumoniae bacteria are classified as pneumococcal vaccines. Pneumococcal diseases are most common in younger children; however, adults and the elderly are more prone to pneumococcal contaminations and even death. Immunization is one of the widely accepted forms to prevent disease spread, driving the demand for pneumonia vaccines.

Major driving factors, such as the implementation of regular vaccination programs under the national policy, are aiding the market's growth. Secondly, rising awareness against pneumonia, directives launched by WHO and UNICEF, and increasing government support assist the market’s expansion in the current scenario.

Pneumococcal Vaccine Market Drivers:

- The growing incidence of childhood pneumonia is expected to drive the demand for pneumococcal vaccines.

Among all the infectious diseases prevalent among children, pneumonia has the highest share of fatalities in children. More than 800 thousand children under the age of five lose their lives every year due to pneumonia, while the number is around 2.2 thousand per day. Around 153 thousand of those children are newborns. According to data from UNICEF, 1,400 cases per 100,000 children suffer from pneumonia every year, which makes it 1 out of 71 children.

The South Asian region has the highest incidence rate, with 2,500 cases per 100,000 children, while the West and Central African region has an incidence rate of 1,620 cases per 100,000 children. These numbers are creating an alarming situation to combat child mortality rates, which is expanding the demand for pneumococcal vaccines, thereby stimulating their market expansion.

- Growing disease awareness campaigns and government policies have provided new growth prospects.

Pneumococcal vaccines are given primarily to children aged 2 years and above to protect them from illness caused by S. pneumoniae bacteria. Hence, various International organizations like WHO, UNICEF, and UNDP, in conjunction with the national government, are working to reduce pneumonia infection rates, especially among the children and older generation who are more susceptible to such diseases.

The implementation of vaccine programs such as the nationwide expansion of pneumococcal conjugate vaccine (PCV) launched by the Ministry of Health under the “Universal Immunization Program” aimed to spread awareness against pneumonia and boost the immune system of children aged under 5 years through appropriate vaccines. These plans and policies boost the vaccine market by introducing novel products and expanding the existing product portfolios.

Likewise, various underdeveloped countries with higher prevalence rates of pneumonia are receiving aid from international organizations. For instance, as per the March 2024 UNICEF press release, Iran received nearly 564,000 doses of pneumococcal conjugate vaccine (PCV) to prevent pneumococcal-related infection from spreading among children; the shipment arrived in Tehran on March 17. Such assistance has led to an upward market trajectory for pneumococcal vaccines.

Pneumococcal Vaccine Market Segment Analysis:

- The conjugate vaccine is expected to show significant growth during the given time frame.

By type, the global pneumococcal vaccine is analyzed into the conjugate vaccine and polysaccharide vaccine. The former is anticipated to show remarkable growth as it provides immunity against diseases such as pneumonia and meningitis, which are mostly found in infants and adults aged 65 years and above. The ongoing vaccination development to battle such illnesses has provided a major boost to the segment's growth.

For instance, in April 2023, Pfizer announced that the company received the Food and Drug Administration’s approval for its “PREVNAR 20®” vaccine. This vaccine would protect infants and children aged six weeks to 17 years against invasive pneumococcal disease caused by 20 S. pneumoniae.

Pneumococcal Vaccines Market Geographical Outlook:

- North America is anticipated to account for a considerable market share.

Based on geography, the global market is analyzed into five major regions, namely North America, South America, Europe, Middle East and Africa, and Asia Pacific. North America is estimated to constitute a remarkable market share, fuelled by the ongoing efforts to reduce pneumonia spread among children. This has led major governing authorities, such as the U.S. FDA, to grant approval to certain vaccines.

For instance, in June 2024, Merck received the U.S FDA’s approval for its “CAPVAXIVE™” vaccine, which is designed to provide active immunization to adults aged 50 years and above by covering at least 84% of invasive surgical diseases caused by S. pneumoniae serotypes. Likewise, various biotech vaccine manufacturers are in initiative phases for pneumococcal vaccine development. For instance, in January 2024, Vaxcyte Inc. announced the completion of enrolment for its clinical phase ½ to study the VAX-31 pneumococcal conjugate vaccine designed to prevent IPD (Invasive Pneumococcal Disease) in adults aged 50 years and above.

Besides the ongoing development of the pneumococcal vaccine, the growing prevalence of pneumonia in children is also driving the overall market growth in North America. For instance, according to the pediatric pneumonic update provided by the Center for Disease Control and Prevention, as of November 2023, the emergency visits diagnosed pneumonia stood at 1.7% for children aged 0 to 1 year, 2.4% for 2 to 4 years and 1.5% for 5 to 17 years.

Pneumococcal Vaccine Market Restraints:

- The high cost of vaccine production is expected to hamper the overall market growth.

The high cost and long duration of the vaccine production process are challenging factors for market growth. Moreover, the various phases a vaccine has to go through require proper testing and monitoring to acquire the desired results, which is time-consuming. However, government subsidies on vaccine production and funds released by international organizations are helping to clear the hurdles in the path.

Pneumococcal Vaccine Key Market Development:

- In January 2024, Pfizer announced that the CHMP (Committee for Medicinal Products for Humans) adopted a positive opinion regarding granting authorization to the company’s “20vPnC.” This will be used to prevent the spread of invasive diseases such as acute otitis and pneumonia in adults and children aged 6 weeks to 18 years.

- In October 2023, Vaxcyte Inc. formed a commercial manufacturing agreement with Lonza to bolster the manufacturing and commercialization of Vaxcyte’s PCV candidates “VAX-31” and “VAX-24” to prevent the disease spread in the adult and geriatric population. The collaboration will leverage Lonza’s custom-manufacturing suite and infrastructure.

Pneumococcal Vaccines Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Pneumococcal Vaccines Market Size in 2025 | US$10.058 billion |

| Pneumococcal Vaccines Market Size in 2030 | US$13.607 billion |

| Growth Rate | CAGR of 6.23% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Pneumococcal Vaccines Market |

|

| Customization Scope | Free report customization with purchase |

Pneumococcal Vaccines Market Segmentation:

- By Type

- Conjugate Vaccines

- Polysaccharide Vaccines

- By Application

- Routine Vaccination

- Vaccination For Disease/Infection

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- Indonesia

- Taiwan

- Thailand

- Others

- North America