Report Overview

Photoresist Chemicals Market Size, Highlights

Photoresist Chemicals Market Size:

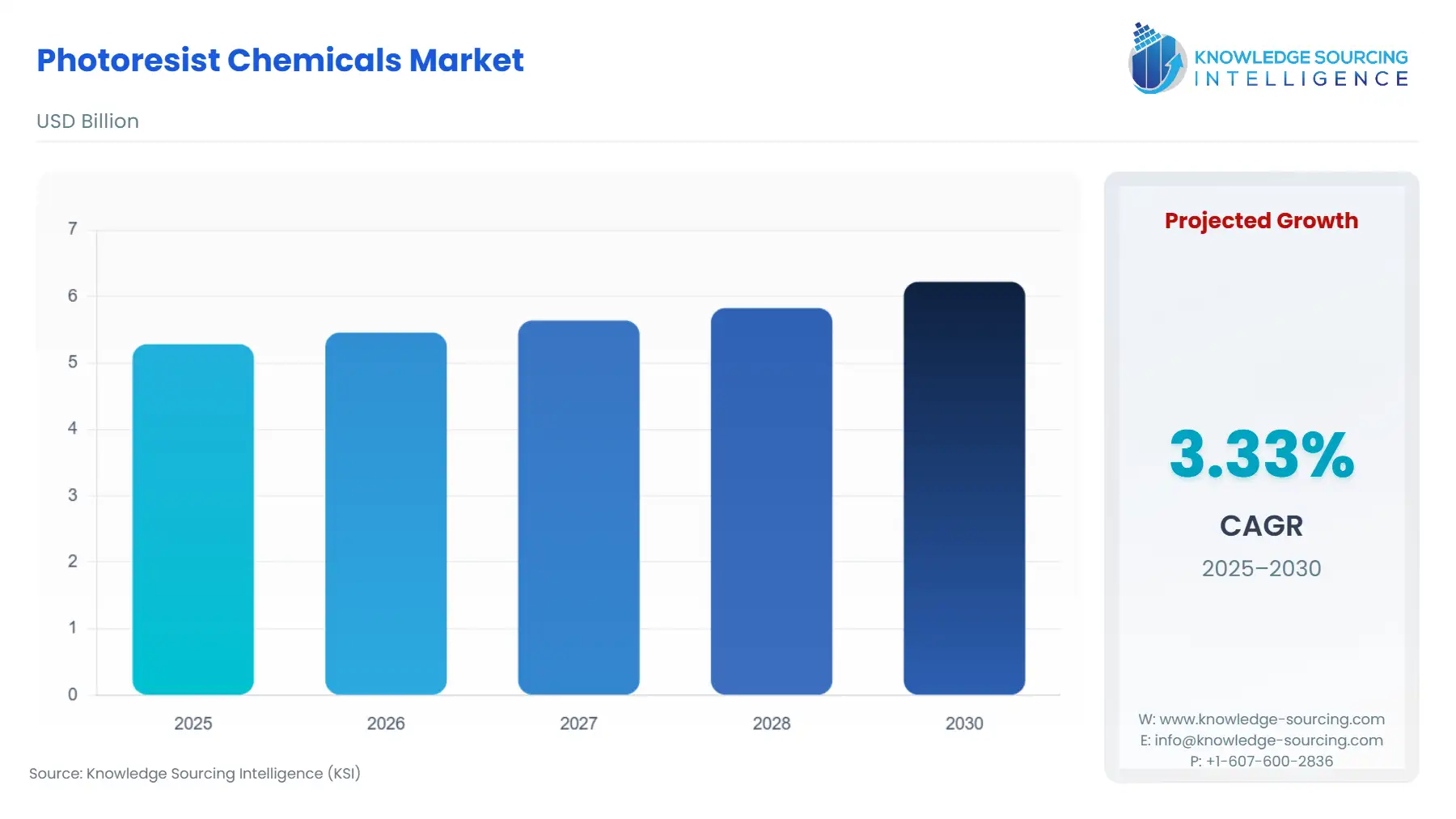

The Photoresist Chemicals Market is set to rise from USD 5.283 billion in 2025 to USD 6.222 billion by 2030, with a 3.33% CAGR.

Photoresist Chemicals Market Key Highlights

The global photoresist chemicals market provides the foundational materials required for the photolithography process, which is central to semiconductor fabrication and the production of advanced electronic components. As the minimum feature size on semiconductor chips continues to shrink in pursuit of higher performance and greater integration density, the technical specifications and purity requirements for photoresist materials have intensified, placing immense pressure on the materials science and chemical engineering capabilities of key suppliers. This rigorous technical evolution is the primary determinant of current market dynamics, transforming photoresists from commodity chemicals into highly specialized, high-value process enablers critical for sub-10nm chip manufacturing.

Photoresist Chemicals Market Analysis

Growth Drivers

The global push for semiconductor miniaturization is the most compelling growth driver, directly increasing the demand for advanced photoresist formulations. Specifically, the adoption of Extreme Ultraviolet (EUV) lithography by leading chip manufacturers compels demand for completely new chemical platforms, such as metal-oxide resists, which offer the high-resolution required for 5nm and 3nm node production. This technological shift does not simply increase volume demand but fundamentally creates a new, high-margin market segment for ultra-specialized photoresist chemicals. Furthermore, the global proliferation of advanced technologies, including 5G infrastructure, high-performance computing (HPC), and Artificial Intelligence (AI) accelerators, directly translates into elevated consumption of semiconductor materials. Each new data center or 5G base station requires thousands of complex logic and memory chips, which are exclusively produced using sophisticated photolithography processes, thus geometrically increasing the total addressable market and demand for high-end DUV and EUV photoresists.

Challenges and Opportunities

The primary market challenge is the acute technological barrier to entry and the non-fungible nature of advanced photoresists. Developing a new photoresist formulation that meets the strict performance and yield criteria for cutting-edge semiconductor fabrication is a multi-year, multi-million-dollar endeavor, limiting the number of credible suppliers. This concentration risk presents a supply chain vulnerability for end-users, creating an opportunity for geopolitical and regional diversification. A key opportunity is the surging demand from the Flat Panel Display (FPD) and Optoelectronics sector, driven by the rollout of high-resolution OLED and advanced LCD panels for consumer electronics and automotive displays. While less technologically demanding than semiconductor resists, this sector offers high-volume, stable demand for certain Negative and Positive Photoresist types, enabling diversification for manufacturers outside the leading-edge logic segment.

Photoresist Chemicals Market In-Depth Segment Analysis

By Technology: Deep Ultraviolet (DUV) Photoresist

DUV Photoresist, primarily utilizing ArF light sources, remains the cornerstone of high-volume manufacturing across a vast array of semiconductor devices. The core demand driver for this segment is the sustained requirement for cost-effective fabrication of mature and intermediate process nodes, which are foundational for automotive electronics, power management ICs, memory chips, and legacy microcontrollers. Even with the rise of EUV, DUV photoresists maintain demand supremacy due to the necessity of a significant number of DUV exposure steps in the manufacturing sequence for advanced chips, complementing EUV’s limited layers. Furthermore, the introduction of immersion lithography and multi-patterning techniques (e.g., LELE, SAQP) on DUV platforms exponentially increases the consumption of 193nm photoresists per wafer processed, thereby mechanically scaling demand for this specific chemical category independent of new node development.

By End-User Industry: Electronics & Semiconductor Industry

The Electronics and Semiconductor Industry is the paramount demand driver, consuming photoresist materials as an indispensable raw material. This industry's growth directly correlates with the demand for photoresists. The fundamental driver is the cyclical and secular expansion of global electronics production, spanning from smartphones and laptops to complex industrial automation systems. Specifically, the long-term strategic decisions by major Foundries (e.g., TSMC, Samsung, Intel) to aggressively ramp up capacity for advanced logic and memory chips serve as the single largest catalyst for photoresist demand. The need to maintain stable, high-yield production across numerous fabrication lines necessitates reliable, certified, and consistently delivered volumes of both positive and negative photoresists, tying the material’s demand profile to the industry’s multi-billion-dollar capacity investment cycles.

Photoresist Chemicals Market Geographical Analysis

US Market Analysis (North America)

Demand in the US market is heavily influenced by domestic semiconductor manufacturing reshoring initiatives and substantial government funding aimed at bolstering the national supply chain. This policy shift directly drives demand for highly specialized photoresists as major global chipmakers establish or expand new US-based fabrication facilities, such as those in Arizona and Ohio. The demand profile is skewed towards leading-edge DUV and EUV materials necessary for high-performance computing chips and advanced microprocessors.

Brazil Market Analysis (South America)

The demand for photoresist chemicals in Brazil is modest and largely focused on the production of Printed Circuit Boards (PCBs) and less advanced semiconductor packaging and assembly. The local demand is centered on more mature, conventional positive and negative photoresists required for consumer electronics assembly and industrial applications. Demand expansion is intrinsically linked to the government’s ability to attract foreign direct investment into integrated device manufacturing and increase domestic electronics production capacity.

Germany Market Analysis (Europe)

Germany’s photoresist demand is characterized by two distinct segments: advanced R&D and specialized industrial applications. While high-volume chip manufacturing is lower than in Asia, the demand is strong from microelectromechanical systems (MEMS) manufacturers for automotive and industrial sensor technologies, requiring specialized thick-film and negative photoresists. The development of major new fabrication facilities by companies like Intel also represents a significant, government-backed injection of demand for leading-edge photoresist materials.

South Africa Market Analysis (Middle East & Africa)

The South African market for photoresist chemicals is negligible in the semiconductor fabrication sense. Demand is primarily generated by smaller-scale PCB manufacturers, educational institutions, and materials research laboratories. The primary photoresist consumption is for basic photolithography processes using conventional, older-generation positive resists. Expansion is contingent upon the development of a local electronics manufacturing base or an increase in sophisticated industrial or defense-related micro-fabrication.

Japan Market Analysis (Asia-Pacific)

Japan remains the global epicenter of photoresist supply and a substantial consumer, where demand is fueled by the nation's world-leading materials science companies. The demand profile is highly advanced, focusing on the R&D and pilot production of next-generation EUV, nanoimprint, and specialized DUV resists. Japanese domestic chip fabrication, particularly for memory and specialty logic, constitutes a strong, captive demand for the most sophisticated, high-purity chemical formulations, making it a critical hub for market innovation and consumption.

Photoresist Chemicals Market Competitive Environment and Analysis

The competitive landscape is an oligopoly dominated by a small number of chemical and materials science conglomerates, primarily based in Japan and the US, who possess the proprietary polymer and purification technologies required for high-purity electronic materials. Competition centers not on price but on material performance, consistency, and the ability to maintain a stable, global supply chain, with deep collaboration required between material suppliers and chip manufacturers.

Photoresist Chemicals Market Company Profiles

- JSR Corporation: JSR is a critical player, particularly strong in the advanced lithography space. Its strategic positioning is centered on being an integrated solutions provider for cutting-edge nodes. The company acquired Inpria Corporation, a move that secured a leading position in the development and supply of metal-oxide EUV photoresists, essential for sub-7nm logic production.

- Tokyo Ohka Kogyo (TOK): TOK maintains a dominant position across a broad range of photoresist types, from conventional to advanced DUV and EUV materials. Their strategic positioning is focused on geographic and product diversification to serve the global semiconductor and FPD markets.

Photoresist Chemicals Market Recent Development

- In January 2025, Lam Research announced that its Aether dry photoresist technology was selected by a leading memory manufacturer as the production tool of record for the most advanced DRAM nodes.

- In October 2024, DuPont announced the opening of the new “East Star” building at its Sasakami site in Agano-shi, Niigata, Japan, nearly doubling the site’s photoresist production capacity to better meet global demand for lithography materials.

Photoresist Chemicals Market Segmentation

By Product Type

- Positive Photoresist

- Negative Photoresist

- Others

By Technology

- Deep Ultraviolet (DUV) Photoresist

- Extreme Ultraviolet (EUV) Photoresist

- Electron Beam (E-beam) Photoresist

- X-ray Photoresist

- Others

By Application

- Semiconductor Manufacturing

- Photolithography

- Microelectronics & Microelectromechanical Systems

- Printed Circuit Boards (PCBs)

- Flat Panel Displays & Optoelectronics

- Solar Cells

- Others

By End-User Industry

- Electronics & Semiconductor Industry

- Automotive Industry

- Healthcare & Medical Devices

- Aerospace & Defense

- Consumer Electronics

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

Photoresist Chemicals Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Photoresist Chemicals Market Size in 2025 | US$5.078 billion |

| Photoresist Chemicals Market Size in 2030 | US$6.395 billion |

| Growth Rate | CAGR of 4.72% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Photoresist Chemicals Market |

|

| Customization Scope | Free report customization with purchase |