Report Overview

Osmotic Power Market - Highlights

Osmotic Power Market Size:

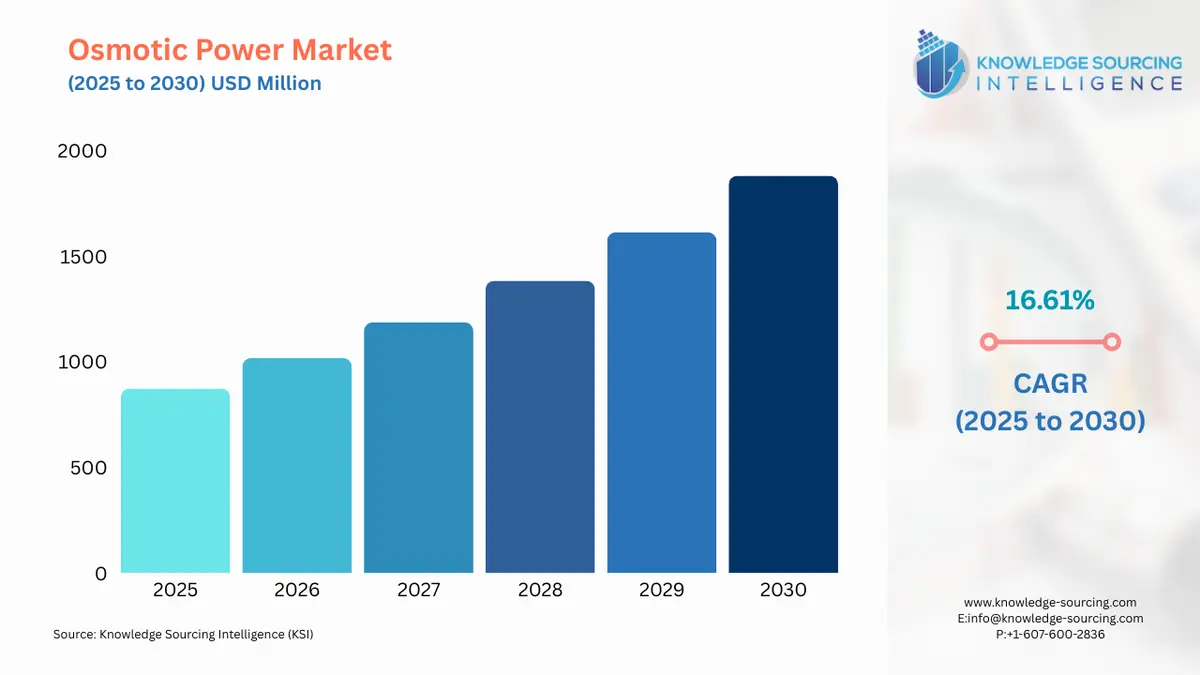

The osmotic power market is projected to increase at a 16.11% CAGR, reaching USD 2137.489 million in 2031 from USD 872.264 million in 2025.

Osmotic power is a renewable energy technology that harnesses the energy released when two solutions with different salt concentrations are mixed. This process takes advantage of the natural phenomenon of osmosis where solvent molecules move from a region of lower solute concentration to a region of higher solute concentration. The rising demand for renewable energy along with the technological advancements and potential benefits of osmotic power is a major growth driver of the osmotic power market. Moreover, the government incentives for net zero emission coupled with corporate sustainability innovations are further aiding the osmotic power market.

Osmotic Power Market Growth Drivers:

Rising Demand for Renewable Energy

As the world continues to grapple with the challenges of climate change and the need to reduce greenhouse gas emissions, there is a growing demand for clean and sustainable sources of energy. Thus, the osmotic power market is expected to grow at a faster rate as it is a renewable source of energy. For instance, in the 2020-2021 period, renewable energy sources contributed to 8% of Australia's overall energy consumption and renewable energy consumption has doubled in the last decade according to the Australian Government. Moreover, Ireland commits that at least 80% of electricity consumption is from renewable sources by 2030 through Path to Net Zero Energy and Climate Change Act.

The Potential of Osmotic Power

The potential of osmotic power as a renewable energy driver is significant and is expected to accelerate the osmotic power market. For example, osmotic power systems have the potential to provide electricity to remote areas or off-grid locations where conventional energy infrastructure may not be feasible or cost-effective. Additionally, osmotic power offers a reliable and predictable energy source since it is not subject to weather variations like solar and wind power. Moreover, the integration of osmotic power with desalination plants can lead to simultaneous electricity generation and freshwater production, addressing two critical needs.

Technological Advancements

Advances in membrane technology and engineering solutions could lead to improvements in the efficiency and cost-effectiveness of osmotic power systems. These developments may enhance the commercial viability of the technology and attract more investments. For instance, advancements in membrane materials and designs can lead to increased selectivity, higher water permeability, and reduced fouling, thus enhancing the overall efficiency of osmotic power generation. For instance, DuPont launched the first nanofiltration membrane element named FilmTec™ LiNE-XD for high-productivity lithium-brine production in July 2023. It enables increased water and lithium recovery from resources such as salt lake brine, and geothermal brine with reduced energy consumption.

Government Support and Incentives

Governments and regulatory bodies in various countries offer financial incentives, subsidies, or policy support for the development and deployment of renewable energy technologies, including osmotic power. Such support can stimulate research and development efforts and foster osmotic power market growth. For instance, China’s first combined solar and tidal power station started its operation of feeding electricity to the grid in May 2022. Additionally, the Water Technology Initiative by the Indian Department of Science and Technology supported seawater desalination through solar thermal forward osmosis in June 2021 which provided ease in the drought-prone Tamil Nadu Village.

Green Innovation and Sustainability Initiatives

Many corporations and industries are increasingly adopting sustainable practices and seeking renewable energy sources to align with their environmental commitments. These rising sustainability commitments are likely to bolster the osmotic power market. For instance, SAS achieved 60% carbon usage intensity from a base year in 2022 which is a reduction of 19% over the previous year and received validation from the Science Based Targets project for its 2050 net-zero emission reduction objective. Additionally, along with more than 200 other businesses, Lineage Logistics pledged to achieve net zero carbon emissions by 2040 which is ten years before the Paris Agreement by signing the Climate Pledge in 2022.

Osmotic Power Market Restraints:

Restraints in the Market

The osmotic power market has experienced growth and development however some restraints or challenges can impact its expansion. For example, Osmotic power systems especially pressure retarded osmosis (PRO) has relatively low conversion efficiencies. Moreover, osmotic power generation is limited by the energy density of osmotic gradients, which can be relatively low compared to other renewable sources. As a result, large-scale energy production may require significant infrastructure and large plant footprints. Further, osmotic power faces stiff competition from well-established and more efficient renewable energy sources like solar, wind, hydro, and geothermal power. These alternatives have been widely adopted and have a more established supply chain and infrastructure which slows the osmotic power market expansion.

Osmotic Power Market Geographical Outlook:

Europe is Expected to Grow Significantly

Europe is expected to hold a significant share of the osmotic power market during the forecast period. The factors attributed to such a share are the zero-emission commitments by the regional countries, government support and initiatives, installation of osmotic power plants, increasing electricity demand, and growing population. For instance, a hybrid event was organized at the European Parliament in July 2022 to discuss the potential of osmotic power to produce clean permanent electricity and green hydrogen. Moreover, the European Union funded the SaltPower project which developed osmotic power units that can be delivered in containerized modules.

Osmotic Power Market Major Players:

Statkraft is a Norwegian state-owned renewable energy company and one of the largest producers of renewable energy in Europe. The world's first osmotic power or salinity gradient power production facility was developed by Statkraft in Tofte (Norway).

IDE Technologies is a global leader in desalination and water treatment solutions. IDE offers modular and small to large-scale desalination systems. The innovative, highly pre-engineered, and pre-assembled IDE MPD modular design reduces the time and cost of very expensive on-site installation.

Osmotic Power Market Key Developments:

In June 2023, Sweetech Energy announced the joint venture with Compagnie Nationale du Rhone (CNR) for the deployment of Sweetech’s INOD® technology in France. This technology enables industrial-scale production of electricity from osmotic energy which is generated naturally.

In February 2023, Toyobo’s hollow-fiber FO membrane was used at the world’s first osmotic power plant by Danish venture firm SaltPower. Toyobo’s FO membrane is semipermeable and includes cross-winding which enables fresh water to flow uniformly.

In June 2021, the McGill team developed a hybrid membrane made from exotic nanomaterials that can enable osmotic energy systems by generating a higher amount of power.

List of Top Osmotic Power Companies:

Kyowa-KK

Sweetech Energy

Ocean Energy Systems

Singapore Polytechnic

Toyobo Japan

Osmotic Power Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Osmotic Power Market Size in 2025 | USD 872.264 million |

Osmotic Power Market Size in 2030 | USD 1,881.020 million |

Growth Rate | CAGR of 16.61% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Million |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Osmotic Power Market |

|

Customization Scope | Free report customization with purchase |

Osmotic Power Market Segmentation

By Type

Pressure-retarded osmosis

Reversed Electrolysis

Others

By Application

Shipping & Harbor Industries

Military Ships & Aircraft Carriers

Oil & Natural Gas Industries

By Source

Sea Water

SWRO Brine

Salt Dome

Green Salt Lake

Dead Sea

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others