Report Overview

Organic Peroxide Market - Highlights

Organic Peroxide Market Size:

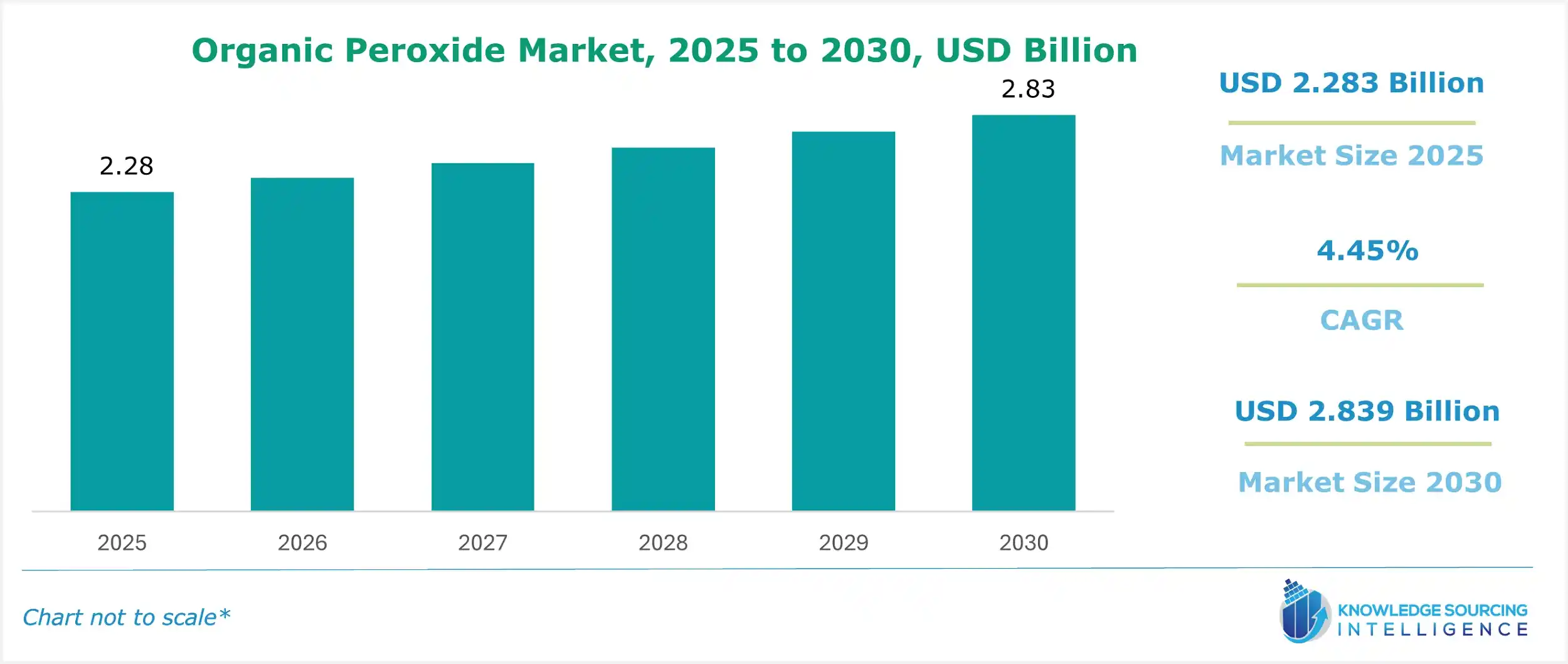

The organic peroxide market is estimated to attain a market size of USD 2.839 billion by 2030, growing at a 4.45% CAGR from a valuation of USD 2.283 billion in 2025.

Organic Peroxide Market Introduction:

The expanding use of organic peroxides in the rubber and plastics sectors is one of the major factors propelling the global market for organic peroxides. These organic peroxide compounds offer unique features that make them perfect for use in a variety of end-user applications, including coatings and adhesives, paper and textiles, detergents, polymers and rubber, personal care, and other applications. As a result of its employment as a free radical activator in the production of PVC and vinyl monomer, "diacyl peroxide" is the type segment with the fastest growth rate. Plastics and other polymeric materials are produced in large quantities using organic peroxides.

The organic peroxides industry is a vital segment of the specialty chemicals organic peroxide market, driving innovation in polymer processing. The peroxide initiators market fuels polymerization, while the cross-linking agents’ market and curing agents market enhance material durability in plastics and rubber production. Polymer additives, including chemical initiators, improve product performance across industries like automotive, construction, and packaging. Organic peroxides offer precise control over reaction processes, ensuring high-quality outputs. As demand for advanced materials grows, this market delivers tailored, high-performance solutions, addressing technical and sustainability challenges for industry experts in diverse manufacturing applications.

The market is also growing moderately, fueled by the growing need for coatings and adhesives and the polymer industry. The synthesis of coating resins and the use of organic peroxides as curing agents for coatings are major attributes for its increasing demand. Additionally, companies are launching new products and expanding their global reach through manufacturing facility construction, fuelling market growth. For instance, in November 2024, Nouryon completed its capacity expansion for organic peroxides at its Chinese manufacturing facility. It involved doubling production capacity to 6,000 tons each of Perkadox 14 and Trigonox 101 organic peroxide products, which will support the growing polymer industry.

Additionally, the rise in the manufacture of different polymers will increase the requirement for organic peroxide during the polymerization process. Throughout the forecast period, it is anticipated that the rise in demand for ready-made garments, along with their use in diverse industrial sectors, will promote market growth. Moreover, these organic peroxide compounds offer unique features that make them ideal for utilization in various end-user applications, including personal care, paper & pulp, and other industries.

Organic Peroxide Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

The growing demand from various end-use sectors, including plastics, chemicals, coatings, and personal care, is propelling the market for organic peroxide. Organic peroxides are crucial for the synthesis of polymers, resins, and elastomers because they are frequently employed as cross-linking, curing, and polymerization initiators. These are essential in the production of polymers; therefore, the growing use of plastics in the electronics, construction, automotive, and packaging industries greatly fuels market growth.

The need for composite materials and coatings, of which organic peroxides are essential components, is also increasing due to the expanding global construction industry, especially in emerging economies. Wider use of organic peroxide formulations has been encouraged by technological developments and advances that have improved thermal stability and created safer handling properties. Furthermore, the personal care and cosmetics sector is showing great promise, utilizing organic peroxides in bleaching and other cosmetic formulations.

The market has grown because of manufacturers investing in safer, more effective product varieties due to strict regulatory guidelines regulating the handling, storage, and transportation of organic peroxides. However, market participants face substantial obstacles due to the inherent dangers of organic peroxides, such as their sensitivity to heat and propensity for explosiveness, necessitating strict safety precautions across the supply chain.

A bifunctional peroxide by Nouryon called Perkadox® 14-40B-PD is used to crosslink polyolefins and both natural and synthetic rubbers. Excellent scorch safety is provided by rubber compounds containing Perkadox® 14-40B-PD, which can be mixed in one step under specific circumstances. Temperature for safe processing: 135°C (rheometer ts2 > 20 min). 175°C is the typical crosslinking temperature (rheometer t90, approximately 12 min).

The steady demand from various industries, rapid industrialization, and growing emphasis on strong, lightweight materials that require organic peroxides for synthesis and processing are all factors driving the market's expansion despite these obstacles. In the upcoming years, the shift toward bio-based and sustainable organic peroxides, along with increased R&D expenditures, will create new opportunities for market players.

Organic Peroxide Market Trends:

The organic peroxide market is evolving rapidly, driven by innovations in sustainable organic peroxides and eco-friendly formulations. A key trend is the shift toward bio-based peroxides, which align with green chemistry principles and reduce environmental impact. These peroxides, derived from renewable sources, cater to the growing demand for sustainability in industries like plastics, coatings, and composites. VOC-free formulations are also gaining traction, minimizing harmful emissions and meeting stringent regulatory standards.

Low-temperature curing peroxides are another significant advancement, enhancing energy efficiency in manufacturing processes. By reducing the energy required for curing, these peroxides lower operational costs and carbon footprints. Additionally, safer organic peroxides and encapsulated peroxides are improving handling and storage stability, addressing safety concerns in industrial applications. Controlled-release peroxides further optimize reaction precision, particularly in polymer processing, ensuring consistent performance and quality.

The integration of AI in chemical formulation is transforming the market by accelerating the development of high-performance peroxides. AI-driven tools analyze data to optimize formulations, improving efficiency and reducing time-to-market. Similarly, Industry 4.0 chemical manufacturing leverages automation and smart technologies to streamline production, enhance quality control, and minimize waste. These advancements align with global sustainability goals and regulatory pressures, driving adoption across diverse sectors.

The organic peroxide market is also benefiting from increased demand in composites and coatings, where high-performance, eco-friendly solutions are critical. As industries prioritize environmental responsibility and operational efficiency, these trends—bio-based peroxides, low-temperature curing, VOC-free formulations, and AI-driven innovation—are reshaping the market. They deliver sustainable, safe, and efficient solutions to meet modern manufacturing challenges, positioning organic peroxides as vital components in green industrial applications

Organic Peroxide Market Drivers:

- Rising demand for ketone peroxide

The growing need for coatings and adhesives is one of the main factors driving the growth of the organic peroxide industry. One of the most common applications for organic peroxides is coating. The synthesis of coating resins and the use of organic peroxides as curing agents for coatings make good use of their advantages, such as the production of more polymer chains with lower molecular weight. A greater degree of control over molecular weight and viscosity is possible due to the more selective nature of the generated radicals, which also leads to less hydrogen abstraction, which will increase the organic peroxide market share.

- Increasing use of benzoyl peroxide

Due to its antibacterial, irritating, keratolytic, comedolytic, and anti-inflammatory properties, benzoyl peroxide is one of the most popular and commonly used organic peroxides. It is frequently used in cosmetics and personal care products for the treatment of acne, hair bleaching, and teeth whitening. It is made up of two benzoyl groups joined by a peroxide bond. Benzoyl peroxide breaks down into benzoic acid and oxygen when it comes into contact with the skin. Because of this oxygen release, it works well as a disinfectant for burns and as a dermatological medication to cure acne, increasing the organic peroxide market share.

- Rising demand for coatings and adhesives

Rubber hoses, tires, tubes, and gaskets are made in the automotive industry using zinc oxide. Because of the expanding applications, zinc oxide will continue to dominate the global market for organic peroxide over the forecast period. Due to the rising demand for zinc compounds in paints and varnishes, the organic peroxide market size is expanding. The increasing automotive industry is also helping the market grow favourably because it has raised the need for organic peroxide used in belts, radial tires, paints, and coatings.

- High demand for polymer production

The organic peroxide market is rising due to the increase in the manufacture of different polymers, which will increase the need for the product during the polymerization process. Over the course of the forecast period, it is anticipated that the demand for ready-made garments will increase along with the use in a growing number of industrial sectors. Additionally, there is a growing need for organic peroxide in this application because of rising garment spending and rising sales of pulp and paper. The use of organic peroxides has increased due to the automobile industry's growing use of rubber.

- Increasing use in the packaging industry

The demand for packaging films has increased recently for a variety of products, including bakery goods, dairy products, snacks and candy, frozen food bags, and poultry packing. According to a PMMI survey, which was conducted by the Association for Packaging and Processing Technologies, the global packaging market would grow from USD 36.8 billion in 2016 to USD 42.2 billion by 2021. Additionally, there is a growing demand for flexible packaging, which is made of plastics like polypropylene. The Flexible Packaging Association (FPA) (US) claims that flexible packaging reduces content waste by 50–90%, saving ten times as much money as other types of packaging and enabling higher product yields. As a result, it is predicted that the market will grow throughout the forecast period.

- Growing demand from the plastics and polymer industry

One of the main factors propelling the global organic peroxide market growth is the increasing demand from the polymer and plastics industries, since these peroxides are crucial for the polymerization and processing of different plastic materials as initiators and cross-linking agents. Organic peroxides are essential for manufacturing common polymers such as elastomers, polyethylene, polypropylene, polyvinyl chloride, and polystyrene. These polymers are the foundation of many sectors, including consumer products, electronics, packaging, automotive, and construction.

The rising global population, urbanization, shifting consumer habits, and growing need for lightweight, strong, and affordable materials have all contributed to the plastics industry's recent explosive rise. In particular, the expanding e-commerce and food delivery industries have led to a surge in demand for flexible packaging solutions, raising the consumption of plastics and, in turn, the demand for organic peroxides in the production of polymers. The automotive industry's drive to produce lightweight vehicles for improved fuel efficiency and reduced greenhouse gas emissions is increasing the demand for plastic composites and advanced polymers, which rely on organic peroxides for their cross-linking and curing processes.

In the absence of more robust regulations, it is anticipated that the production and consumption of plastics will rise by 70%, from 435 million tonnes (Mt) in 2020 to 736 Mt in 2040, with only 6% of plastics originating from recycled sources as per the Organisation for Economic Co-operation and Development.

This expansion is partly a result of the growing usage of plastic-based components in the construction industry, such as pipes, insulation, and coatings, which provide cost and durability benefits. Furthermore, the emergence of extensive plastic manufacturing hubs owing to the rapid industrialization of rising economies such as China, India, Brazil, and Southeast Asian nations has increased demand for organic peroxides. Improved efficiency, thermal stability, and safety profiles due to technological developments in organic peroxide formulations have prompted broader use in high-speed and energy-efficient polymerization processes.

Organic Peroxide Market Restraints:

- The storage, travel, or handling of organic peroxides is difficult.

Fire and explosion are the main restraints of the organic peroxide market. Organic peroxides are highly corrosive and poisonous. Additionally, potent oxidizers are organic peroxides. When contaminated with the majority of organic peroxides, combustible materials can deflagrate, or quickly catch fire and burn ferociously. For typical organic peroxide compositions, the NFPA developed a risk classification system. The standard transportation and storage containers for these formulations, which have been approved by Transport Canada or the US Department of Transportation (DOT), are classified according to the NFPA classification system, which describes the threats of fire and explosion.

Organic Peroxide Market Segmentation Analysis

- The market is segmented based on major key bases such as type, form, end-user, and geography.

By type, the organic peroxide market is divided into diacyl peroxides, ketone peroxides, percarbonates, dialkyl peroxides, hydroperoxides, peroxyesters, and others. Diacyl peroxides hold the largest market share, due to their widespread use as free radical initiators in polymerization processes for plastics and rubber production. Their versatility extends to applications in coatings, adhesives, and healthcare sectors.

Based on form, the market is segmented into solid and liquid. The liquid form will hold a significant market share, as liquid organic peroxides such as Arkema’s Luperox brand Luperox Q2 are highly versatile and utilized in a diverse range of applications, including polymerization, crosslinking, and curing processes.

By end-user, the organic peroxide market is divided into plastic, paper & pulp, cosmetics, healthcare, textiles, and others. The plastic sector will hold a substantial share, driven by the rise in urbanization coupled with infrastructure development. Furthermore, plastics and other polymeric materials are produced in large quantities using organic peroxides, which are utilized in diverse applications.

Geographically, the organic peroxide market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific regions. The Asia-Pacific region holds a significant market share due to increasing demand for plastic goods and the rise of China and India as major regions for the manufacturing of consumer goods. The booming personal care and healthcare sector is also creating opportunities for organic peroxide solutions. Additionally, the increase in infrastructure development in the region is raising demand for paints and coatings, promoting the regional market to grow in the coming years.

Organic Peroxide Market Geographical Outlook:

- Asia Pacific is projected to dominate the organic peroxide market

During the projected period, the Asia Pacific region is anticipated to lead the organic peroxide market. The strong demand for plastic goods in the Asia Pacific is projected to make the region a promising growth market for the organic peroxide sector. Over the anticipated timeframe, it is anticipated that the rise of China and India as important locations for the manufacturing of consumer goods will fuel demand for organic peroxides. The booming personal care sector is boosting the revenue of the organic peroxide business, which is supported by expanding disposable income and living standards. Additionally, the region's expanding construction industry has raised demand for paints and coatings, which has helped the local market expand.

- The US is also anticipated to lead the market expansion

The industrial productivity of the United States has experienced progression fueled by government-backed polices and schemes to bolster overall productivity, followed by investments in innovations, especially in the development of high-performance polymers. Organic peroxide is mainly applied in the polymerization of polymers to advance their modification.

Likewise, major sectors in the country, such as the manufacturing sector, demand parts & components that can offer performance enhancement during operations. Oxygen peroxide fulfils such a requirement, and with the improved manufacturing output, the demand is expected to show growth. According to the National Association of Manufacturers, in Q4, the manufacturing value-added output reached USD 2.937 trillion, marking a positive growth of USD 2.925 trillion.

Moreover, the synthesized polymers also find applicability in the automotive and aerospace sectors for gasket and seal applications. Hence, with the growing demand for fuel-efficient vehicles, followed by ongoing innovations in aircraft manufacturing to improve the overall aesthetic appeal, the scope of usage will expand swiftly. According to the data provided by the International Organization of Motor Vehicle Manufacturers, in 2024, the automotive production was valued at 10.56 million units, representing a 5.07% growth compared to 2022’s production volume.

Furthermore, the well-established presence of major market players, namely Arkema and Nouryon, which offer an extensive portfolio of organic peroxide in both solid and liquid forms, serving major sectors, including polymers, oil & gas, and chemicals, is an additional driving factor for the overall market growth.

Organic Peroxide Market Product Launches:

- In May 2023, Nouryon announced plans to "significantly" increase organic peroxide manufacturing at its Ningbo, China, facility. The Dutch manufacturer of specialized chemicals will boost its capacity by the middle of 2024.

- In October 2022, Weber & Schaer GmbH & Co. KG began distributing ARKEMA's Luperox® and ReHc® organic peroxide products in select northern, central, and eastern European nations.

- In July 2022, the new TBHP-TBA factory in Huaibei, Anhui Province, China, with a capacity of 25 tons/a, was finished by United Initiators. The new plant is the organization's first move towards producing organic peroxides for use downstream. Through expansion, the company has improved both its product offering and its presence.

Organic Peroxide Market Scope:

| Report Metric | Details |

| Organic Peroxide Market Size in 2025 | USD 2.283 billion |

| Organic Peroxide Market Size in 2030 | USD 2.839 billion |

| Growth Rate | CAGR of 4.45% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Organic Peroxide Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Type

- Diacyl Peroxides

- Ketone Peroxides

- Percarbonates

- Dialkyl Peroxides

- Hydro-Peroxides

- Peroxyesters

- Others

- By Form

- Solid

- Liquid

- By End-User

- Plastic

- Paper & Pulp

- Cosmetics

- Healthcare

- Textiles

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Organic Peroxide Market Size:

- Organic Peroxide Market Highlights:

- Organic Peroxide Market Introduction:

- Organic Peroxide Market Overview:

- Organic Peroxide Market Trends:

- Organic Peroxide Market Drivers:

- Organic Peroxide Market Restraints:

- Organic Peroxide Market Segmentation Analysis

- Organic Peroxide Market Geographical Outlook:

- Organic Peroxide Market Product Launches:

- Organic Peroxide Market Scope:

Page last updated on: September 25, 2025