Report Overview

Oncology Information Systems Market Highlights

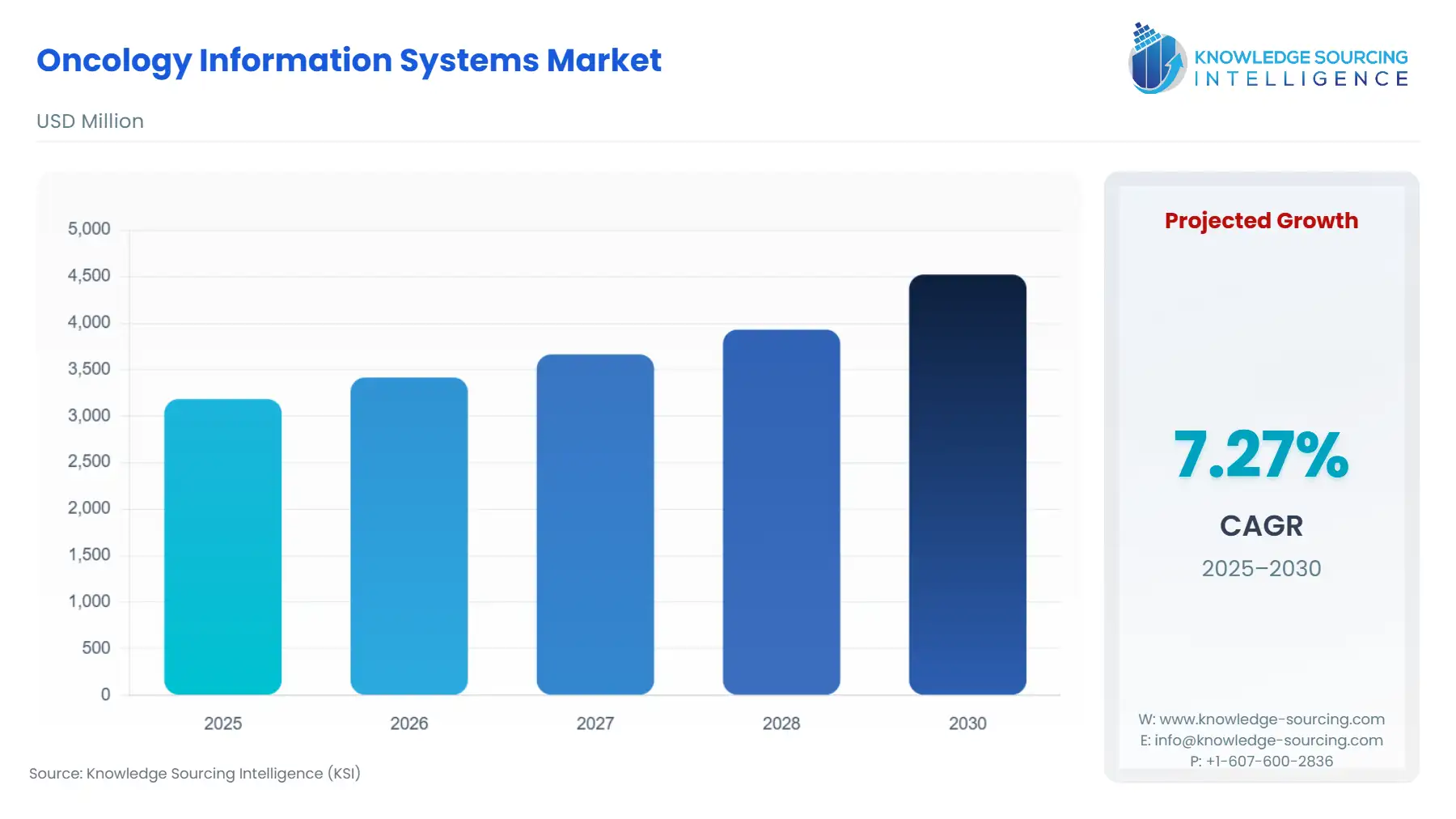

Oncology Information Systems Market Size:

Oncology Information Systems Market is expected to grow at a 7.06% CAGR, increasing from USD 3.184 billion in 2025 to USD 4.795 billion in 2031.

The oncology information systems market is anticipated to grow at a steady pace throughout the forecast period. Oncology Information Systems (OIS) are specialized software solutions designed to support healthcare providers, particularly oncologists and oncology teams, in managing and streamlining the care of cancer patients. Rising cancer cases along with technological advancements are major growth drivers of the oncology information systems market. Moreover, the increasing focus on clinical trials and government initiatives are further stimulating the oncology information systems market growth.

Oncology Information Systems Market Growth Drivers:

Rising Cancer Prevalence

The incidence of cancer has been increasing globally, placing a higher demand on oncology services. OIS assists healthcare providers in efficiently managing the growing number of cancer patients and handling their complex treatment plans. Therefore, the rising prevalence is contemplated to augment the oncology information systems market growth. For instance, approximately 20 million cancer cases worldwide were reported in 2020 according to Cancer Research UK. Moreover, around 13.9 new cases emerge every year as per the ICMR. Additionally, the number of breast cancer cases reported in the UK every year is 56,000 and the prevalence rate has doubled in the past 50 years in England according to Breast Cancer UK.

Technological Advancements

OIS continually evolves with technological advancements such as improved imaging capabilities, treatment planning algorithms, and data analytics. These developments enhance the efficiency and accuracy of cancer diagnosis and stimulate the oncology information systems market growth. Advances in biotechnology have led to breakthroughs in genomics, personalized medicine, gene editing (e.g., CRISPR), and regenerative medicine offering new possibilities for healthcare and improving human health. For example, the two coronavirus vaccines with the highest level of efficacy are based on messenger RNA, a technique that has been in development for 20 years.

Increasing Focus on Research and Clinical Trials

OIS offers features that support oncology research, clinical trials, and outcomes analysis. As cancer research and clinical trial activity increases, OIS becomes a valuable tool for managing and analyzing the resulting data. Researchers at the Memorial Sloan Kettering Cancer Centre, the American Cancer Society, and Seattle's Fred Hutchinson Cancer Centre are working together on the Quit2Heal trial. In this study, two smartphone apps for cancer patients who want to stop smoking are compared. Moreover, a collection of precision medicine cancer clinical studies called ComboMATCH (Combination Therapy Platform study with Molecular Analysis for Therapy Choice) includes a registration study and multiple treatment clinical trials supported by NCI.

Remote and Telemedicine Capabilities and Expansion

The COVID-19 pandemic accelerated the adoption of telemedicine and remote care in healthcare. For example, a San Francisco internal care doctor claims that throughout 2020, the number of virtual visits to her practice increased, and today, around one-third of her patient encounters are still in person. OIS with telemedicine capabilities allows oncologists to provide consultations and monitor patients remotely, improving access to care and thereby boosting the oncology information systems market. Moreover, telemedicine visits witnessed a remarkable surge with a 154% rise in telemedicine consultations during the last week of March 2020 in comparison to the corresponding timeframe in 2019 according to the CDC.

Government and Institutional Support

Governments and healthcare regulatory bodies in many countries have been advocating for the adoption of electronic health records and advanced healthcare technologies, including OIS thereby propelling the oncology information systems market. For instance, in August 2022, the National Cancer Grid (NCG) founded the Koita Centre for Digital Oncology (KCDO) with the aim of advancing the adoption of digital technologies and tools to enhance cancer care throughout India. Moreover, the growing adoption of OIS is further boosting market expansion. For instance, Icon Group adopted the ARIA oncology information system (OIS) with additional multi-disciplinary features in August 2021, making it the first company in the world to implement it.

Oncology Information Systems Market Restraints:

The oncology information systems market has experienced growth and development however some restraints or challenges can impact its expansion. For example, OIS implementation may be more challenging in resource-constrained or rural areas, where access to advanced technology, internet connectivity, and skilled personnel could be limited. Moreover, integrating OIS with other healthcare information systems, such as Electronic Health Records (EHRs), Radiology Information Systems (RIS), and Picture Archiving and Communication Systems (PACS), can be complex and time-consuming.

Oncology Information Systems Market Geographical Outlook:

North America is Expected to Grow Considerably

During the forecast period, North America is projected to maintain a substantial portion of the oncology information systems market. The factors attributed to such a share are the rising cancer cases, technological advancements, increasing investments, and government support. For instance, the National Cancer Institute's budget was approved by the US Congress as part of the yearly federal budgeting process in 2022. The total amount was $6.9 billion which was an increase of $353 million from 2021. Moreover, there were around 1.9 million cancer cases in 2021 according to the American Cancer Society.

List of Top Oncology Information Systems Companies:

RaySearch Laboratories is a Swedish medical technology company specializing in the development of advanced software solutions for radiation therapy, oncology, and radiology. It offers a RayStation treatment planning system which is designed to assist radiation oncologists in creating highly accurate and personalized treatment plans for cancer patients undergoing radiation therapy.

Elekta offers brachytherapy systems for various cancer types, delivering radiation directly to the tumor site to achieve highly localized treatment. The Mosaiq Oncology Information System facilitates seamless workflow management, patient data, and treatment documentation.

McKesson Corporation is an American healthcare services and information technology company headquartered in Irving, Texas. McKesson offers a variety of healthcare information technology solutions designed to enhance clinical workflows, improve patient care, and optimize healthcare operations.

Oncology Information Systems Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Oncology Information Systems Market Size in 2025 | USD 3.184 billion |

Oncology Information Systems Market Size in 2030 | USD 4.523 billion |

Growth Rate | CAGR of 7.28% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Oncology Information Systems Market |

|

Customization Scope | Free report customization with purchase |

Oncology Information Systems Market Segmentation:

By Product

Solutions

Professional Services

By Application

Medical Oncology

Radiation Oncology

Surgical Oncology

By End-User

Hospitals & Diagnostic Imaging Centers

Government Institutions

Research Facilities

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

Japan

China

India

South Korea

Indonesia

Thailand

Others