Report Overview

Nurse Call Systems Market Highlights

Nurse Call Systems Market Size:

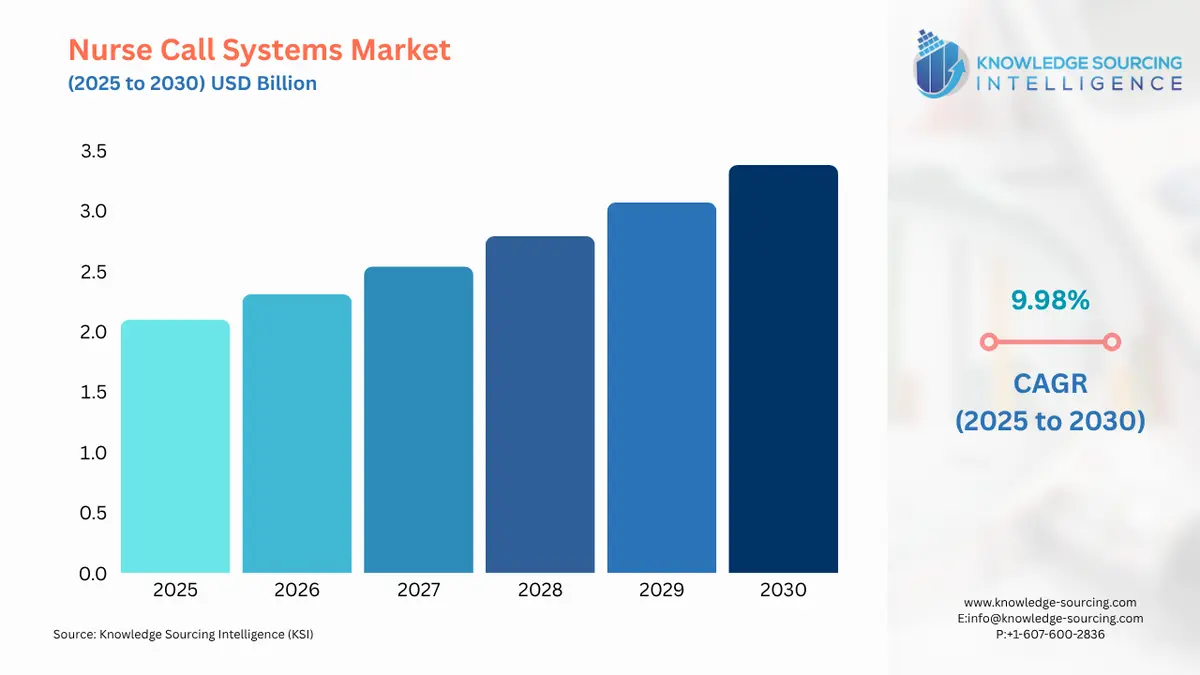

The nurse call systems market is projected to expand at a 9.68% CAGR, attaining USD 3.652 billion in 2031 from USD 2.098 billion in 2025.

Nurse Call Systems Market Trends:

With the help of nurse call systems, patients and residents receive the voice communication and assurance they require, and the hospital team has the resources to access and act on alarms, messages, and clinical data. Various benefits associated with nurse call systems encourage the demand thereby boosting the nurse call systems market. Moreover, the growing healthcare infrastructure enabled by advanced technology and huge hospitalization rate negatively impacting the nurse-to-patient ratio further propels the nurse call systems market.

Nurse Call Systems Market Growth Drivers:

Diversified Application and Multiple Assistance

A nurse call system gathers crucial data, spots areas for care improvement, and provides carers and patients with useful insight. Additionally, the wireless nurse call system sends out rapid alerts and messages. By automating workflow procedures, integrating staff finding and nurse call systems significantly minimizes wasted time and enhances efficiency. It allows a patient who is bedridden and unable to communicate with carers to notify a nurse when they require any form of help. Many settings, including hospital wards, nursing homes, hydrotherapy units, operating theatres, day clinics, private patient rooms, consulting rooms, accessible restrooms, X-ray departments, and temporary buildings, use nurse call systems. All these benefits and application encourages the implementation of nurse call systems thereby boosting the nurse call systems market.

Increasing Number of Hospitals and Nursing Homes

There is an increasing need for faster patient response times as well as reduced nurse fatigue due to the rising number of hospitals, nursing homes, and home healthcare institutions. According to American Hospital Association, there were 6,129 hospitals in the country with 84% being community hospitals in 2021 as compared to 6,093 hospitals in 2020. Moreover, the rising healthcare expenditure by numerous nations is rapidly developing the healthcare infrastructure thereby propelling the nurse call systems market. For instance, the Ministry of Health and Family Welfare (MoHFW) received 89,155 crore rupees (10.76 billion dollars) from the Indian government in the Union Budget 2023–24 as compared to $860 billion in 2022-23.

Higher Number of Hospital Admissions

The higher rate of hospital admissions due to the increasing number of diseases in humans is expected to boost the nurse call systems market. For instance, there were around 11.6 million hospitalizations in 2021-22 with a rate of 405 hospitalizations per 1,000 population as per the AIHW NHMD (Australia). Moreover, the waiting days for elective admission were 77 days in 2020-21 which was 17 days longer than the average waiting days in 2019-2020, this shows the rise in hospital admissions for treatment. This huge number of hospitalizations increases the nurse-to-patient ratio which in turn increases the need for the nurse call systems market. The likelihood of death, the length of hospital stays, and the possibility of being readmitted to the hospital within 30 days all rise with each additional patient per nurse.

Aging Population and their Associated Illness

The aging population is growing rapidly. For instance, one in six persons on the planet will be 60 years of age or older by the year 2030 and at this point, there will be 1.4 billion people, up from 1 billion in 2020, who are 60 years of age or older according to the WHO estimates. As people get older, several complex health conditions known as geriatric syndromes start to arise. Frailty, urine incontinence, falls, delirium, and pressure ulcers are a few of the underlying causes that frequently lead to them. The older population accounts for more hospitalizations for instance, people aged 65 years or above accounted for 43% of total Australian hospitalization in 2021-22 as per the AIHW. Therefore, the growing aging population is a major growth factor in the nurse call systems market.

Nurse Call Systems Market Restraints:

Apart from all the growth factors, higher implementation, and operational cost is expected to limit the nurse call systems market growth. For instance, the cost of nurse call systems ranges from $2500 for a standard room with basic software and hardware to $10,000 for a fully integrated room. Moreover, the healthcare facilities which have installed nurse call systems further need to pay the software maintenance fee from time to time which further increases the burden of this nurse call systems.

Nurse Call Systems Market Geographical Outlook:

North America is expected to grow Significantly

The North American region is projected to hold a significant share of the nurse call systems market during the forecast period. Various factors attributed to such a share are the rise in healthcare expenditure, the growing geriatric population, and the adoption of advanced technology. According to the CDC, the total amount spent on various types of health consumption expenditures (HCE) by individuals, health insurers, and federal, state, and local governments in 2021 was approximately $4.0 trillion, or 17.4% of the country's gross domestic product. Moreover, the US population aged 65 years or above is estimated to increase from 47 million in 2020 to 65 million in 2040 as per the U.S. Census Bureau which is expected to increase the hospitalization rate thereby propelling the nurse call systems market in the region to maintain the nurse-to-patient ratio.

List of Top Nurse Call Systems Companies:

Ascom is a German healthcare company that offers healthcare ICT and mobile workflow solutions. TeleCARE IP offered by the company is a unique combination of products for long-term and acute care settings. It provides an accurate location function and an easy-to-use push button, and it is available as a pendant or wristband.

Jeron Electronics System Inc. is a US multinational focused on the design and manufacturing of internal communications and alerting systems. Provider® 790, Provider® 680, Pro-Alert™ 570, and Provider® 700 are nurse call systems offered by the company to streamline workflow and increase patient satisfaction.

Nurse Call Systems Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Nurse Call Systems Market Size in 2025 | USD 2.098 billion |

Nurse Call Systems Market Size in 2030 | USD 3.376 billion |

Growth Rate | CAGR of 9.98% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Nurse Call Systems Market |

|

Customization Scope | Free report customization with purchase |

Nurse Call Systems Market Segmentation

By Type

Intercom Systems

Button-Based Systems

Integrated Communication Systems

Digital And Mobile Nurse Call Systems

Basic Audio/Visual Nurse Call Systems

Others

By Application

Alarms & Communications

Workflow Optimization

Wanderer Control

Fall Detection & Prevention

Visitor Management

By End-User

Hospitals

Ambulatory Surgery Centers

Long-Term Care Facilities

Physician Offices

Medical Assisted Living Centers

Nursing Homes

Out Patient Departments

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others

Our Best-Performing Industry Reports:

Navigation

Page last updated on: September 29, 2025