Report Overview

North America Advanced Ceramics Highlights

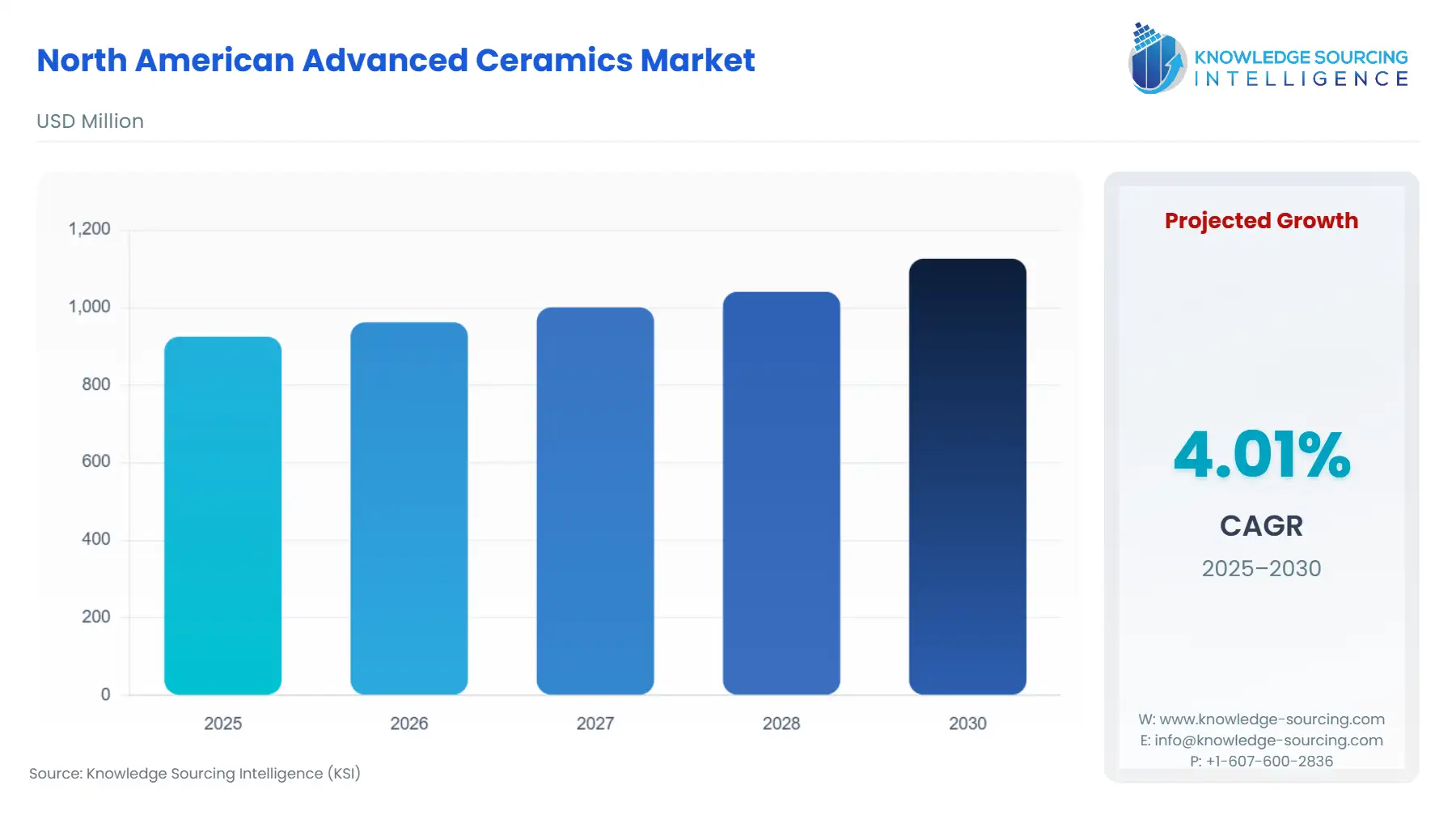

North American Advanced Ceramics Market Size:

The North American Advanced Ceramics Market will reach US$1,126.226 million in 2030 from US$925.145 million in 2025 at a CAGR of 4.01% during the forecast period.

The North American advanced ceramics market is a dynamic and rapidly evolving sector within the global materials industry, driven by the increasing demand for high-performance materials in applications spanning aerospace, defense, electronics, healthcare, and energy. Advanced ceramics, including materials like alumina, zirconia, silicon carbide, and ceramic matrix composites (CMCs), are valued for their exceptional properties such as high-temperature resistance, corrosion resistance, and mechanical strength. These characteristics make them critical for industries requiring durability and precision under extreme conditions. The United States, Canada, and Mexico are key contributors to the market, with the U.S. leading due to its robust industrial base and significant R&D investment in ceramics.

The North American advanced ceramics market is propelled by several key drivers. First, substantial R&D investment in ceramics fuels innovation, particularly in the U.S., where government and private sector funding support the development of next-generation materials. A 2025 report highlights increased funding for ceramic research in aerospace and electronics applications. Second, the aerospace and defense sectors drive demand for high-performance materials like CMCs for lightweight, heat-resistant components in jet engines and missile systems. Third, the growing adoption of materials substitution, replacing metals and plastics with ceramics in electronics and medical devices, enhances performance and sustainability.

However, the market faces notable restraints. High production costs, driven by complex manufacturing processes and expensive raw materials, limit adoption, particularly for small enterprises. A 2025 article notes that the energy-intensive sintering process for ceramics increases costs. Additionally, technical challenges, such as the inherent brittleness of ceramics, require continuous innovation to improve toughness.

Role of Advanced Ceramics in North America

Advanced ceramics are engineered materials designed to meet stringent performance requirements in extreme environments. Their unique properties—high hardness, low thermal expansion, and chemical inertness—enable applications in diverse industries. In advanced manufacturing, ceramics like silicon carbide and zirconia are used in cutting tools and wear-resistant components, enhancing production efficiency in automotive and aerospace sectors. A 2024 report emphasizes ceramics’ role in precision machining.

In electronics, alumina ceramics serve as substrates for high-power chips, supporting the U.S.’s booming semiconductor industry. In healthcare, bioceramics like zirconia are critical for dental implants and orthopedic devices due to their biocompatibility. The energy sector leverages ceramics in solar panels and fuel cells, driven by sustainability goals. These applications underscore the market’s reliance on R&D investment in ceramics to develop tailored solutions.

How Advanced Ceramics Are Produced and Applied

The production of advanced ceramics involves high-purity raw materials, such as oxides or carbides, processed through techniques like pressing, injection molding, or 3D printing ceramics. These are sintered at high temperatures (often above 1,600°C) to achieve densification, ensuring structural integrity. For instance, CoorsTek’s launch of 3D-printed silicon carbide components for aerospace applications demonstrates the impact of advanced manufacturing. Post-processing, such as ceramic coatings, enhances durability, as seen in GE Aviation’s use of ceramic coatings for turbine blades.

Applications vary by industry. In aerospace, ceramic matrix composites (CMCs) reduce weight in engine components, improving fuel efficiency. In defense, silicon carbide is used in lightweight armor, while in electronics, alumina substrates ensure thermal management. The materials substitution trend is evident in automotive, where ceramics replace metals in engine parts for better performance.

The North American advanced ceramics market is poised for growth, driven by technological advancements and strategic initiatives. The U.S.’s CHIPS and Science Act boosts R&D investment in ceramics for semiconductors. Canada’s focus on sustainable energy drives ceramic use in renewables, while Mexico’s automotive sector adopts high-performance materials for electric vehicle components.

Emerging trends include 3D printing ceramics, enabling complex geometries, as seen in 3M’s ceramic additive manufacturing solutions. Sustainability drives materials substitution, with bio-based ceramics gaining traction in healthcare. The integration of nanotechnology enhances ceramic properties. These trends align with North America’s focus on innovation and environmental responsibility.

North America Advanced Ceramics Market Trends

The North American advanced ceramics market is thriving, propelled by technological advancements and growing demand across aerospace, electronics, and healthcare. Key trends shaping the industry include 3D printing ceramics, CMCs, ultra-high temperature ceramics (UHTCs), nano-ceramics, monolithic ceramics, and ceramic coatings, each enhancing performance and sustainability.

3D printing ceramics is revolutionizing manufacturing, enabling complex geometries for aerospace and medical applications. CoorsTek’s 2024 launch of 3D-printed silicon carbide components exemplifies this trend. CMCs are critical in aerospace for lightweight, heat-resistant jet engine parts. Ultra-high temperature ceramics (UHTCs), like zirconium diboride, support hypersonic applications in defense.

Nano-ceramics enhance electronics with superior thermal and electrical properties. Monolithic ceramics, such as alumina, dominate industrial applications for durability. Ceramic coatings improve wear resistance in automotive components. These trends drive innovation, aligning with North America’s focus on high-performance, sustainable solutions.

North America Advanced Ceramics Market Dynamics

Drivers:

- Significant R&D Investment in Ceramics: The North American advanced ceramics market is propelled by substantial R&D investment in ceramics, particularly in the U.S., where government and private sector funding drives innovation. Programs like the CHIPS and Science Act support research into high-performance materials for semiconductors and aerospace. This investment fuels advancements in 3D printing ceramics and nano-ceramics, enabling applications in electronics and medical devices. For instance, CoorsTek’s development of 3D-printed silicon carbide components showcases how R&D enhances manufacturing precision. In Canada, funding for sustainable energy research promotes ceramics in solar and fuel cell technologies. This driver accelerates market growth by fostering cutting-edge solutions tailored to industry needs.

- Aerospace and Defense Sector Demand: The aerospace and defense sectors significantly drive demand for CMCs and UHTCs due to their lightweight and heat-resistant properties. In the U.S., ceramics are critical for jet engine components and missile systems, improving fuel efficiency and performance under extreme conditions. The Department of Defense’s focus on hypersonic technologies boosts UHTCs like zirconium diboride. In Mexico, aerospace manufacturing growth leverages ceramics for precision parts. This driver strengthens the market by aligning with North America’s strategic priorities for advanced technology and national security.

- Materials Substitution Trends: The trend of materials substitution, replacing metals and plastics with ceramics, drives market growth by enhancing performance and sustainability. In electronics, alumina ceramics replace traditional substrates for better thermal management, supporting the U.S. semiconductor boom. In automotive, ceramics like silicon carbide are used in electric vehicle components for durability. In healthcare, bioceramics like zirconia substitute metals in implants, offering biocompatibility. This driver promotes advanced manufacturing by leveraging ceramics’ superior properties, reducing environmental impact, and meeting stringent industry standards across North America.

Challenges:

- High Production Costs: The high cost of producing advanced ceramics is a significant restraint, limiting adoption in cost-sensitive applications. Manufacturing processes like high-temperature sintering and raw material purification for monolithic ceramics and ceramic coatings are energy-intensive and expensive. Small and medium-sized enterprises, particularly in Mexico’s developing industrial sector, face financial barriers to adopting ceramics. The complexity of 3D printing ceramics further increases costs due to specialized equipment needs. This restraint challenges market expansion, requiring cost-effective production innovations to broaden accessibility.

- Technical Challenges in Material Properties: The inherent brittleness of ceramics poses a technical restraint, limiting their use in high-stress applications. While CMCs and nano-ceramics offer improved toughness, achieving consistent fracture resistance remains challenging. In advanced manufacturing, such as automotive and aerospace, brittleness can lead to component failure under mechanical stress. Overcoming this requires ongoing R&D investment in ceramics to develop toughened ceramics, increasing costs and delaying commercialization. This restraint hinders widespread adoption, particularly in industries requiring reliable, high-impact materials, necessitating advancements in material science to enhance performance.

North America Advanced Ceramics Market Segmentation Analysis

- By Material: Alumina: Alumina dominates the North American advanced ceramics market due to its cost-effectiveness, high hardness, and thermal stability, making it ideal for diverse applications. In the electrical & electronics sector, alumina ceramics are used as substrates and insulators in high-power semiconductors and circuit carriers, supporting the U.S.’s booming chip industry. In advanced manufacturing, alumina’s wear resistance enhances cutting tools and industrial components. Its corrosion resistance also supports energy applications, such as solar panel components. CoorsTek’s expansion of alumina production in the U.S. underscores its market leadership, driven by demand for high-performance materials.

- By End-User Industry: Electrical & Electronics: The electrical & electronics sector leads the market, fueled by the region’s semiconductor boom and demand for high-performance materials. Alumina ceramics and silicon carbide are critical for substrates, capacitors, and thermal management in 5G infrastructure and consumer electronics. The U.S.’s CHIPS and Science Act drives investments in ceramic-based components for chip manufacturing, while Canada’s telecommunications sector adopts ceramics for high-frequency circuits. In Mexico, electronics manufacturing growth leverages nano-ceramics for miniaturized components. The sector’s reliance on materials substitution and 3D printing ceramics ensures continued growth, enhancing performance and sustainability in high-tech applications.

North America Advanced Ceramics Market Geographical Outlook

- By Country: United States: The United States is the largest market, driven by robust R&D investment in ceramics and a strong industrial base. The aerospace and defense sectors demand ceramic matrix composites (CMCs) and ultra-high temperature ceramics (UHTCs) for jet engines and hypersonic systems. The U.S. semiconductor industry, bolstered by the CHIPS Act, uses alumina and silicon carbide for chip substrates. Healthcare applications, such as bioceramics for implants, are growing. Innovations like 3M’s ceramic coatings for automotive components further drive the market. The U.S.’s focus on advanced manufacturing and sustainability cements its dominance in the region.

North America Advanced Ceramics Market Competitive Landscape

Some of the major players covered in this report include CoorsTek, Inc., Kyocera Corporation, Morgan Advanced Materials, CeramTec GmbH, and Saint-Gobain Ceramic Materials, among others.

List of key companies profiled:

- CoorsTek Inc.

- Kyocera Corporation

- CeramTec GmbH

- Saint-Gobain Ceramic Materials

- Morgan Advanced Materials plc

- 3M

- Corning Incorporated

North America Advanced Ceramics Market Key Developments:

- In September 2024, Kyocera, a major global player in advanced ceramics, launched the KVF-I Corporate Venture Capital Fund in the U.S. While not a product or direct acquisition of a company, this is a significant strategic move that shows Kyocera's intent to invest in and partner with startups. By establishing this fund, Kyocera is looking to foster innovation, gain access to emerging technologies, and collaborate with new ventures in the North American market, particularly in areas like AI, 5G, and other advanced tech where ceramics play a vital role. This is a form of indirect acquisition of future technology and market influence.

North America Advanced Ceramics Market Segmentation:

- By Material:

- Alumina

- Zirconate

- Titanate

- Ferrite

- Others

- By Product:

- Monolithic

- Ceramic Coatings

- Ceramic Matrix Composites

- Others

- By End-User Industry:

- Electrical & Electronics

- Automotive

- Machinery

- Environmental

- Medical

- Others

- By Country:

- United States

- Canada

- Mexico

- Others