Report Overview

Network Forensics Market Report Highlights

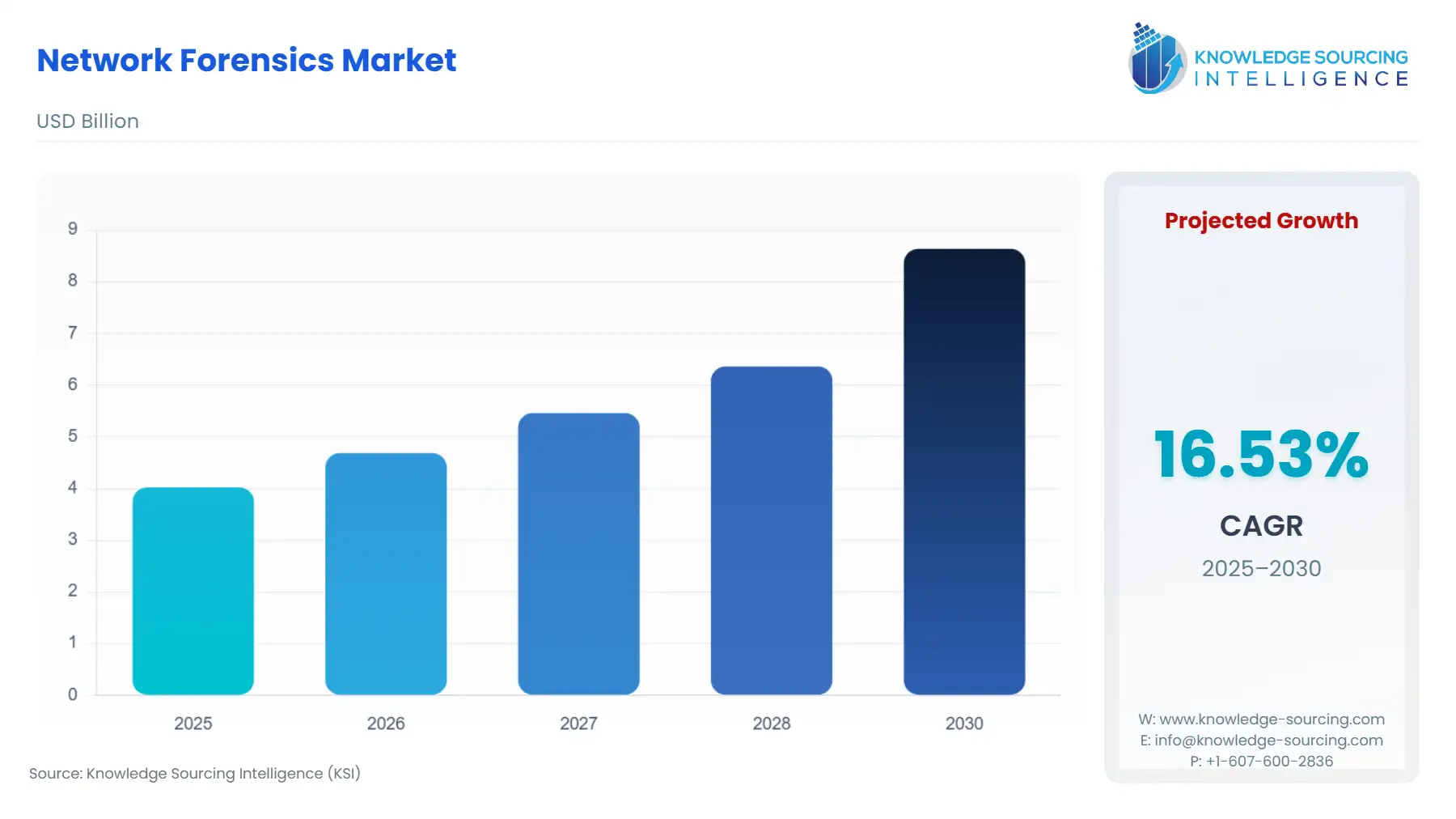

Network Forensics Market Size:

The Network Forensics Market will climb from USD 4.021 billion in 2025 to USD 8.640 billion by 2030, registering a 16.53% CAGR.

Introduction to the Network Forensics Market:

The network forensics market has emerged as a critical component of cybersecurity, driven by the escalating complexity and frequency of cyber threats in an increasingly interconnected digital ecosystem. Network forensics involves the monitoring, capturing, and analysis of network traffic to detect, investigate, and mitigate security incidents, such as data breaches, malware infections, and insider threats. This discipline enables organizations to reconstruct cyberattack timelines, identify vulnerabilities, and comply with regulatory requirements. As businesses and governments rely heavily on digital infrastructure, the demand for robust network forensics solutions has surged, positioning this market as a cornerstone of modern cybersecurity strategies.

Network forensics plays a pivotal role in safeguarding organizational assets by providing actionable insights into cyber incidents. Unlike traditional forensics, which focuses on physical devices, network forensics analyzes data packets traversing networks to uncover malicious activities. It encompasses real-time monitoring, post-incident analysis, and predictive threat intelligence, enabling organizations to respond swiftly to attacks. The rise of remote work, cloud computing, and Internet of Things (IoT) devices has expanded network perimeters, making comprehensive visibility into network traffic essential. According to a 2024 report by the Cybersecurity and Infrastructure Security Agency (CISA), over 60% of critical infrastructure organizations experienced network-based attacks, underscoring the need for advanced forensics capabilities.

Network forensics tools integrate with Security Information and Event Management (SIEM) systems, Intrusion Detection Systems (IDS), and artificial intelligence (AI)-driven analytics to enhance threat detection accuracy. These tools capture packet-level data, log network activities, and generate detailed reports for incident response teams. For industry experts, understanding the market’s growth trajectory and technological advancements is crucial for strategic decision-making, particularly as cyber threats evolve in sophistication.

Network Forensics Market Drivers:

- Rising Sophistication of Cyberattacks

The increasing complexity and frequency of cyberattacks, such as advanced persistent threats (APTs), ransomware, and zero-day exploits, are major catalysts for the network forensics market. These attacks target critical infrastructure, financial systems, and sensitive data, necessitating detailed network traffic analysis to trace attack origins and prevent future incidents. For instance, a 2025 report by the World Economic Forum highlighted a 30% surge in ransomware attacks globally, with attackers leveraging encrypted channels to evade detection. Network forensics tools enable organizations to capture and analyze encrypted traffic, reconstruct attack timelines, and identify vulnerabilities. The rise of state-sponsored cyberattacks, such as those targeting government networks, further underscores the need for forensic capabilities to attribute attacks accurately. In 2024, the CISA reported that 60% of critical infrastructure organizations faced network-based attacks, driving investments in forensic solutions.

- Stringent Regulatory Compliance Requirements

Global data protection regulations, such as the European Union’s General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the Health Insurance Portability and Accountability Act (HIPAA), mandate comprehensive incident response and audit mechanisms. Non-compliance can lead to substantial fines and reputational damage, prompting organizations to adopt network forensics tools to maintain detailed logs and conduct breach investigations. In 2024, the European Commission noted a 25% increase in GDPR-related penalties, with fines exceeding €2 billion, emphasizing the financial risks of non-compliance. Network forensics solutions provide organizations with the ability to generate forensic reports, ensuring compliance with regulatory requirements for data breach disclosures and audits. The growing adoption of frameworks like the NIST Cybersecurity Framework also encourages proactive network monitoring, further fueling market demand.

- Adoption of Cloud Computing and IoT Technologies

The rapid shift to cloud-based infrastructures and the proliferation of Internet of Things (IoT) devices have significantly expanded organizational attack surfaces. Cloud environments, such as Amazon Web Services (AWS) and Microsoft Azure, and IoT ecosystems, including smart devices and industrial sensors, generate vast amounts of network traffic that require monitoring. Network forensics tools are essential for detecting anomalies across distributed networks and ensuring security in hybrid environments. A 2025 study by the International Data Corporation (IDC) projected that global IoT spending will reach $1.1 trillion by 2026, with a corresponding increase in demand for network security solutions. The complexity of securing cloud-native applications and IoT devices drives organizations to invest in forensics tools capable of analyzing diverse traffic patterns and identifying threats in real time.

- Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into network forensics tools has revolutionized threat detection and incident response. AI-driven solutions analyze vast datasets, identify patterns, and reduce false positives, enabling faster and more accurate investigations. In 2024, Palo Alto Networks launched its AI-powered Cortex XDR platform, which enhances network traffic analysis with predictive analytics, demonstrating the market’s shift toward intelligent forensics. These advancements allow organizations to proactively detect threats, such as insider attacks or malware, before they escalate. The adoption of AI also supports automated incident response, reducing the burden on cybersecurity teams and driving market growth as organizations seek scalable solutions.

Network Forensics Market Restraints:

- High Implementation and Maintenance Costs

Deploying network forensics solutions involves significant costs, including hardware, software licenses, and ongoing maintenance. For small and medium-sized enterprises (SMEs), these expenses can be prohibitive, limiting market penetration. Additionally, the need for specialized infrastructure, such as high-capacity storage for packet captures, adds to the financial burden. A 2024 survey by the Ponemon Institute found that 45% of SMEs cited cost as a primary barrier to adopting advanced cybersecurity technologies, including network forensics. Large enterprises also face challenges in scaling solutions across complex networks, further increasing operational costs. These financial constraints hinder widespread adoption, particularly in cost-sensitive regions.

- Data Privacy and Compliance Concerns

Network forensics involves capturing and analyzing sensitive network traffic, which can include personal data, raising significant privacy concerns. In jurisdictions with stringent data protection laws, such as the EU and Asia-Pacific regions, organizations must navigate complex regulations to avoid violations. For example, analyzing encrypted traffic may require decryption, which can conflict with privacy regulations like GDPR. In 2025, the Asia-Pacific Economic Cooperation (APEC) highlighted privacy compliance as a key challenge for network security vendors, noting that 40% of organizations faced legal uncertainties in deploying forensics tools. Balancing forensic investigations with user privacy requires robust data governance frameworks, which can complicate and delay implementation.

- Shortage of Skilled Cybersecurity Professionals

The complexity of network forensics demands specialized expertise in cybersecurity, data analysis, and network protocols. However, the global cybersecurity workforce gap poses a significant challenge. A 2024 report by (ISC)² revealed a shortage of 4 million cybersecurity professionals worldwide, with network forensics expertise being particularly scarce. This shortage limits organizations’ ability to effectively deploy and manage forensics tools, leading to underutilization or misconfiguration. The lack of skilled personnel also increases reliance on third-party vendors, further elevating costs and complicating implementation.

Network Forensics Market Segmentation Analysis:

- By Component, the Solutions segment will experience significant growth

Within the component segmentation, Solutions dominate the network forensics market due to their critical role in providing the core software and hardware tools required for network traffic analysis, threat detection, and incident response. Solutions include packet capture tools, network monitoring platforms, and forensic analysis software, which are essential for real-time and post-incident investigations. These tools integrate advanced technologies like artificial intelligence (AI) and machine learning (ML) to enhance threat detection accuracy and scalability.

Solutions are the backbone of network forensics, enabling organizations to monitor, capture, and analyze network traffic at scale. The demand for AI-driven forensic platforms has surged, as they reduce false positives and accelerate incident response. For instance, in 2024, Palo Alto Networks enhanced its Cortex XDR platform with AI-powered network forensics capabilities, allowing enterprises to detect sophisticated threats like ransomware and APTs. The rise of open-source solutions, such as Zeek 6.0, released in 2024, has also expanded access to cost-effective forensic tools, further driving market growth.

The integration of AI and ML into forensic solutions is a key trend, enabling predictive analytics and automated threat hunting. Additionally, the adoption of solutions supporting encrypted traffic analysis is growing, as attackers increasingly use encryption to evade detection. A 2025 report by the World Economic Forum noted a 30% increase in encrypted ransomware attacks, underscoring the need for advanced forensic solutions. Vendors are also focusing on user-friendly interfaces and cloud-native architectures to cater to diverse enterprise needs.

- By Deployment Model, the cloud segment is expected to lead market growth

The Cloud deployment model is the leading segment in the network forensics market, driven by the widespread adoption of cloud-based infrastructures and the need for scalable, flexible forensic solutions. Cloud-based network forensics solutions offer centralized management, real-time monitoring, and seamless integration with cloud environments like AWS, Microsoft Azure, and Google Cloud.

Cloud deployments are preferred for their cost-effectiveness, scalability, and ability to handle distributed networks, particularly in hybrid and multi-cloud environments. The shift to remote work and cloud-native applications has amplified the need for cloud-based forensics to monitor dispersed network traffic. In 2025, the IDC projected that global cloud spending will exceed $1.5 trillion by 2026, driving demand for cloud-compatible security solutions. Companies like CrowdStrike have integrated cloud-native network forensics into their Falcon platform, enhancing visibility into cloud workloads.

Cloud-based forensics solutions are increasingly incorporating AI-driven analytics and automated incident response to address the dynamic nature of cloud environments. The adoption of zero-trust architectures, which rely on continuous network monitoring, is also boosting this segment. A 2024 initiative by the U.S. Department of Homeland Security (DHS) emphasized cloud security, allocating $50 million for research into cloud-based forensic tools.

- By Enterprise Size, large enterprises are gaining notable growth

Large Enterprises dominate the enterprise size segmentation due to their extensive network infrastructures, significant cybersecurity budgets, and exposure to sophisticated cyber threats. These organizations require comprehensive network forensics solutions to protect critical assets and comply with regulatory mandates.

Large enterprises, particularly in sectors like finance, healthcare, and technology, face a higher volume of cyberattacks, necessitating robust forensic capabilities. The CISA noted in 2024 that 70% of large enterprises experienced network-based attacks, compared to 40% of SMEs. These organizations invest heavily in integrated forensic platforms that combine packet analysis, threat intelligence, and SIEM systems. For example, IBM’s QRadar suite, updated in 2024, caters to large enterprises with advanced network forensics features.

Large enterprises are adopting hybrid forensic solutions that combine on-premises and cloud capabilities to address complex network environments. The focus on regulatory compliance, such as GDPR and CCPA, drives investments in forensic tools for audit trails and breach investigations. In 2024, the European Commission reported a 25% increase in GDPR fines, prompting large enterprises to prioritize compliance-driven forensics.

- By Application, the network security segment is expanding considerably

Network Security is the leading application segment, as it addresses the core need to protect network infrastructure from unauthorized access, malware, and data breaches. Network forensics tools in this segment focus on monitoring traffic, detecting anomalies, and investigating security incidents.

Network security is the primary use case for network forensics, driven by the rising incidence of network-based attacks. A 2025 report by the World Economic Forum highlighted that 60% of global cyberattacks target network infrastructure, emphasizing the need for forensic analysis. Tools like Wireshark and commercial platforms like Splunk Enterprise Security, enhanced in 2024, are widely used for network security forensics. These tools enable organizations to identify attack vectors and mitigate risks.

The integration of AI-driven threat detection and automated response mechanisms is transforming network security forensics. The adoption of 5G networks and IoT devices is also increasing the demand for real-time network monitoring. In 2024, Nokia launched a network forensics module for its 5G security portfolio, targeting network security applications.

- By End-User, the Banking, Financial Services, and Insurance (BFSI) sector is growing significantly

The BFSI sector is the dominant end-user segment, driven by its high exposure to cyber threats, stringent regulatory requirements, and reliance on secure network transactions. Network forensics tools are critical for detecting fraud, securing online banking systems, and ensuring compliance.

The BFSI industry faces frequent cyberattacks, including phishing, ransomware, and data breaches, due to its handling of sensitive financial data. A 2024 report by the Financial Stability Board noted a 35% increase in cyberattacks targeting financial institutions. Network forensics solutions help BFSI organizations investigate incidents, trace fraudulent activities, and comply with regulations like PCI DSS. For instance, Visa’s 2024 cybersecurity initiative emphasized network forensics for payment system security.

The BFSI sector is adopting AI-driven forensics to combat real-time threats like account takeovers. Blockchain-based forensic tools are also emerging to secure digital transactions. In 2025, the Asia-Pacific Economic Cooperation (APEC) highlighted the BFSI sector’s leadership in adopting advanced cybersecurity solutions.

Network Forensics Market Geographical Outlook:

- The North American market is rising notably

North America is the leading regional segment, driven by its advanced technological infrastructure, high cybersecurity investments, and stringent regulatory landscape. The U.S. and Canada are key contributors, with significant demand from the government, BFSI, and technology sectors.

North America’s dominance is attributed to its early adoption of network forensics, fueled by frequent cyberattacks and regulatory mandates like the CCPA and CISA guidelines. In 2024, CISA reported that 65% of U.S. enterprises adopted network forensics tools to counter network-based threats. The region’s robust vendor ecosystem, including companies like Cisco and FireEye, supports market growth. The U.S. Department of Homeland Security’s $50 million investment in network forensics research in 2024 further strengthens this segment.

North America is witnessing increased adoption of cloud-based forensics and AI-driven solutions. Government initiatives, such as the U.S. National Cybersecurity Strategy, are driving public-private partnerships to enhance forensic capabilities. In 2024, Canada’s cybersecurity agency launched a network forensics training program for enterprises.

Network Forensics Market Key Developments:

- CrowdStrike’s Acquisition of FlowSecurity for Cloud-Native Network Forensics (2025): CrowdStrike acquired FlowSecurity, a startup specializing in cloud-native network forensics, to bolster its Falcon platform. The acquisition integrated advanced packet-level analysis and cloud traffic monitoring capabilities, enhancing visibility into hybrid and multi-cloud environments.

- Launch of Palo Alto Networks’ Cortex XDR with Enhanced Network Forensics (2024):

Palo Alto Networks upgraded its Cortex XDR platform to include advanced network forensics capabilities, integrating artificial intelligence (AI) and machine learning (ML) for real-time threat detection and encrypted traffic analysis. The platform enhances network visibility by correlating network data with endpoint and cloud telemetry, enabling comprehensive incident investigations.

Network Forensics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Network Forensics Market Size in 2025 | US$2.005 billion |

| Network Forensics Market Size in 2030 | US$3.850 billion |

| Growth Rate | CAGR of 13.94% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Network Forensics Market |

|

| Customization Scope | Free report customization with purchase |

Network Forensics Market Segmentation:

- By Component

- Hardware

- Software

- Services

- By Deployment

- On-Premise

- Cloud

- By Enterprise Size

- Small

- Medium

- Large

- By Application

- Network Security

- Data Center Security

- Endpoint Security

- Application Security

- By End-User

- BFSI

- Retail

- Government

- IT & Telecommunication

- Healthcare

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

- North America