Report Overview

Multimeter Market - Strategic Highlights

Multimeter Market Size:

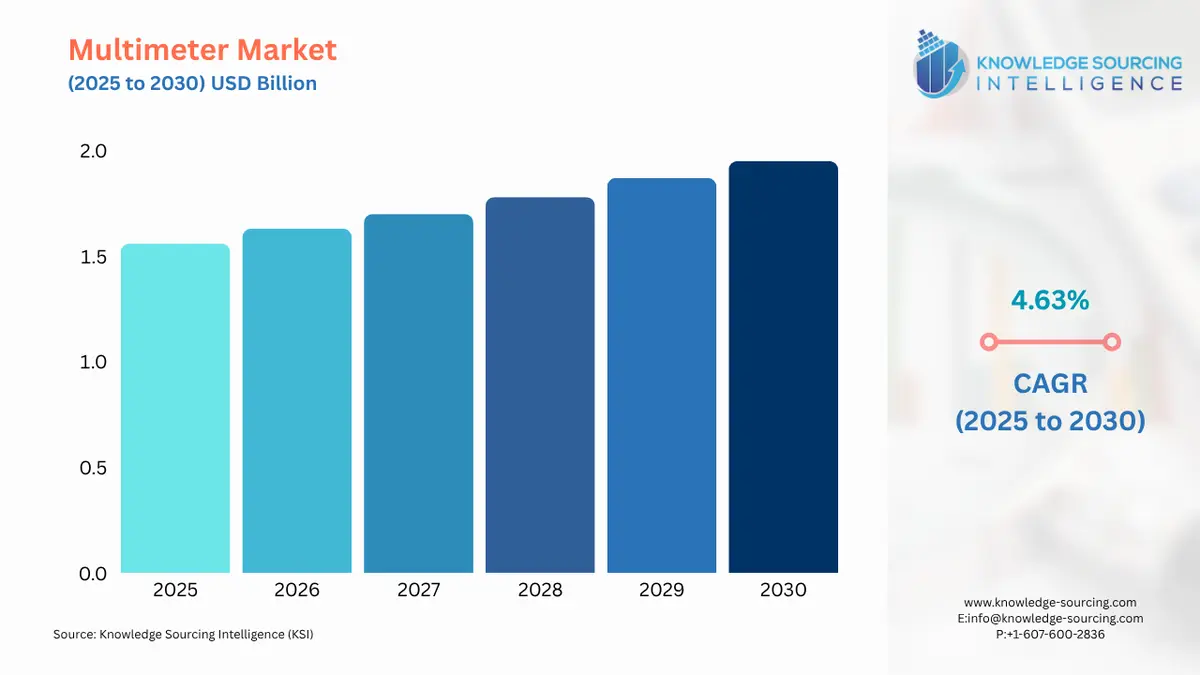

The multimeter market, at a 4.49% CAGR, is expected to grow from USD 1.557 billion in 2025 to USD 2.027 billion in 2031.

Multimeter Market Trends:

A multimeter is an electronic tool used to measure electric properties such as voltage, current, and resistance when a failure develops in an electrical device. Additionally, it is used to check the continuity of two points in an electrical circuit. Multimeters offer accurate & reliable measurements owing to which they hold high industrial applicability. The multifunctionality features of the multimeter coupled with the growing number of end-users are the main growth drivers for the multimeter industry.

Multimeter Market Growth Drivers:

Rising use of multimeters in aircraft

Multimeters play a crucial role in aircraft maintenance, troubleshooting, and system diagnostics, allowing technicians to measure voltage, current, resistance, continuity, and other electrical parameters. The aerospace sector is experiencing significant growth due to increasing air travel demand, the development of new aircraft models, and technological advancements. Such growth has propelled multimeter demand. For instance, in April 2022, VIAVI Solutions Inc. launched the ALT-9000, a versatile flight line test set for universal radio altimeters (RADALTS). With the ability to test all types of RADALTS, including those with advanced waveforms.

Rising technological development with industrialization

Rapid industrialization and a booming electronics industry are majorly driving the global market. The demand for these gadgets among electrical professionals has increased as consumers all over the world use more electronic devices. In addition, as a result of improvements in product manufacturing technology, multimeters can be used in conjunction with other measurement tools, including insulation testers and infrared thermometers. Additionally, these devices add properties like polarization index, dielectric absorption, and earth-bond resistance. The increased efficiency and user-friendliness that these features offer lead to an increase in demand for the product.

Growing applicability in EV

Digital multimeters are essential for the manufacturing and upkeep of EV charging infrastructure since they guarantee the effective and secure operation of both EVs and the infrastructure. Further, the demand for multimeters will significantly increase as governments launch initiatives to increase EV charging networks and create charging standards. For instance, on January 14, 2022, the Ministry of Power released updated, streamlined guidelines and Standards for EV charging infrastructure. Numerous initiatives have been started by the Indian government to promote the manufacture and use of electric automobiles in the country.

High demand for analog multimeters

To diagnose electrical and electronic issues, analog multimeters are utilized. The measurement of resistivity in ohms, current in amps, and potential in volts are fundamental functions. Advanced analog multimeters have capabilities such as modes for checking capacitors, diodes, and integrated circuits. The measurement of DC and AC voltage are a few of the precise measurements carried out with the assistance of analog multimeters. The two main types of analog multimeters are benchtop and hand-held. The design of handheld analog multimeters makes it possible to use them while holding them in one hand. Wheels and handles can be used to move benchtop analog multimeters around.

Multimeter Market Geographical Outlook:

Asia Pacific is projected to dominate the multimeter market

During the projected period, the Asia Pacific is anticipated to account for a considerable market share due to its well-established electronic manufacturing and growing EV applications. Additionally, government initiatives aimed at promoting electric vehicle (EV) adoption and developing EV charging infrastructure have further propelled the demand for multimeters. For instance, in December 2022, under the second phase of the FAME-India Scheme, a budget allocation of Rs. 1000 Cr. was dedicated to the development of charging infrastructure by the Ministry of Heavy Industries. Also, the ministry further approved the establishment of 2,877 electric vehicle charging stations in 68 cities across 25 states/union territories.

Multimeter Market Challenge:

Low battery and voltage limitation

An external power source or a battery is required to power the LCD. The display will be dark and difficult to read when the battery is low. Further, as the voltage limitation exists. The meter won’t function if the amount is increased past the safe level. Further, the multimeters cost more than the analog model, and they should be used within the measurement range and category rating recommended by the manufacturer. Failure to do so will result in both equipment damage and physical injury, which will pose a challenge to the multimeter market growth.

Multimeter Market Company Products:

Digital Multimeter – 101: The Fluke 101 digital multimeter, provided by the Fluke Corporation, is a purpose-built tool for conducting fundamental electrical tests. It is specifically designed to cater to the needs of residential and commercial electricians, as well as heating and air conditioning technicians. Despite its compact and lightweight form factor, this multimeter is highly durable and can withstand rigorous daily use over an extended period.

34460A: Keysight Technologies provides the 34460A, a basic digital multimeter that offers additional features such as a histogram and bar chart. This versatile instrument allows users to gain deeper insights, especially when working with low current resolutions. With a remarkable basic DC voltage (DCV) accuracy of 75 ppm, it ensures precise measurements. Moreover, it can measure DC accurately even in the 100 µA range.

Multimeter Market Key Developments:

August 2025: Fluke Corporation launched a new Null Meter option for the Fluke 8588A Reference Multimeter, designed to make traditional analog null detectors obsolete.

June 2025: Rohde & Schwarz launched the R&S UDS digital multimeter series, offering 5½ and 6½-digit resolution instruments with advanced measurement and remote control functions.

May 2025: GW Instek launched the GDM-9052 5½-digit dual measurement multimeter, featuring AI-powered auto identification and versatile connectivity for manufacturing and QA workflows.

April 2025: Bosch launched a specialized range of professional electrical testing equipment, featuring new digital multimeters and non-contact voltage testers for trade professionals.

Multimeter Companies:

Fluke Corporation

Mastech Group (MGL International Group Limited)

Keysight Technologies

Yokogawa Test & Measurement Corporation (Yokogawa Electric Corporation)

GMC-Instruments

Multimeter Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Multimeter Market Size in 2025 | USD 1.557 billion |

Multimeter Market Size in 2030 | USD 1.952 billion |

Growth Rate | CAGR of 4.63% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Multimeter Market |

|

Customization Scope | Free report customization with purchase |

Multimeter Market Segmentation

By Product Type

Digital

Analog

By Probe Type

Pointed Probes

Crocodile Clips

Retractable Hook Clips

By End-User

Automotive

Aerospace

Defense & Government

Power & Energy

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others